Report Overview

Chocolate Wrapping Film Market Highlights

Chocolate Wrapping Film Market Size:

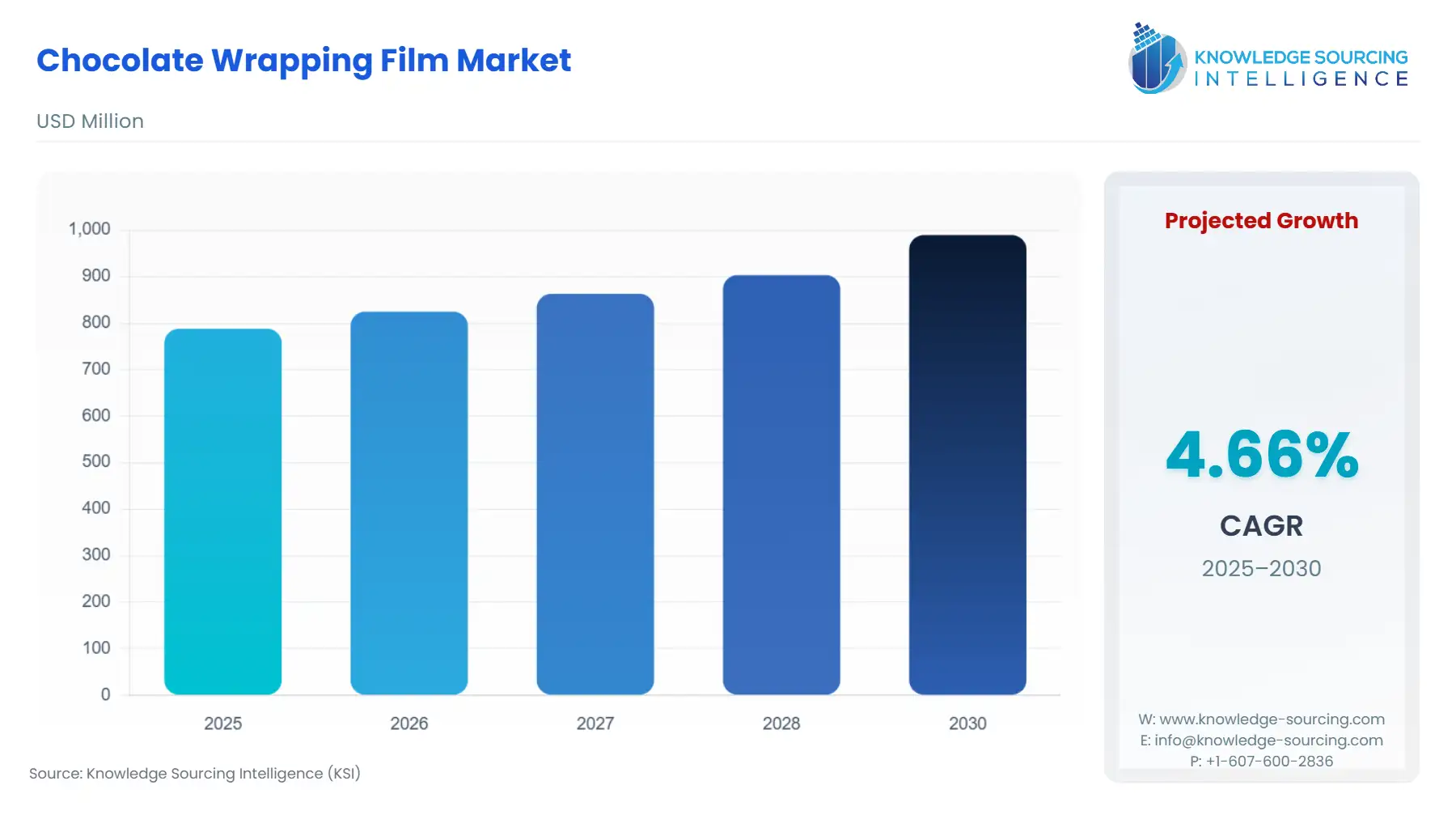

The chocolate wrapping film market is set to rise at a 4.52% CAGR, growing from USD 788.004 million in 2025 to USD 1027.377 million in 2031.

The Chocolate Wrapping Film Market operates at the convergence of consumer premiumization and unprecedented regulatory pressure for environmental sustainability. This critical packaging sector, which assures product integrity and drives brand differentiation, is fundamentally altering its material and structural composition. Film producers must navigate a complex landscape defined by the increasing technical requirements of mono-material structures designed for recycling, even as demand for confectionery—a non-essential consumer good—remains subject to global economic and inflationary headwinds. The current market dynamic requires an immediate pivot from commodity-grade, multi-layer solutions toward high-performance, compliant, and demonstrably sustainable film substrates to maintain long-term competitive viability and market access, particularly in heavily regulated Western economies.

Chocolate Wrapping Film Market Analysis:

Growth Drivers

The global shift to mono-material packaging is the primary growth catalyst. Regulations from jurisdictions like the European Union incentivize recycling by targeting non-recyclable multi-material structures, directly propelling the demand for mono-polymer films such as BOPP or specialized PET that fit into established waste streams. This regulatory imperative translates directly into film manufacturer investment in new lines capable of producing high-barrier, single-polymer films. Concurrently, the premiumization of confectionery dictates that packaging must serve a dual purpose: product protection and brand storytelling. Customization—vibrant printing, metallic effects, and specialized finishes—is increasingly critical for consumer engagement, consequently driving demand for films with superior print receptivity, gloss, and optical properties beyond basic barrier function.

Challenges and Opportunities

The primary challenge is raw material price volatility combined with the increasing cost of regulatory compliance. Geopolitical instability and logistics disruptions directly impact feedstock prices for polymers like BOPP and PET, creating cost-push inflation for film converters and constraining price stability for chocolate manufacturers. This pressure forces a strategic move toward material optimization. The most significant opportunity lies in the accelerated development of compostable and bio-based films. While conventional film demand is challenged by legislative scrutiny on plastic waste, the verifiable launch of high-barrier, food-contact compliant compostable alternatives will capture market share and unlock demand from global confectionery brands committed to public-facing sustainability targets and regional plastic tax mitigation strategies.

Raw Material and Pricing Analysis

The Chocolate Wrapping Film market, a physical product category, is profoundly exposed to the global petrochemical and logistics complex. Polypropylene (PP), the core feedstock for BOPP film, saw price surges in Q1 2024 in Europe, driven by shipping disruptions in the Red Sea, which constrained resin and film supply chains. This forced a significant 12% jump in the price of 20-micron BOPP film in the quarter. Simultaneously, 12-micron PET film also experienced price appreciation, demonstrating a synchronized inflationary trend across key flexible packaging substrates. These price increases were primarily logistics-driven and necessitated converters to pass cost increases to downstream chocolate producers, thereby forcing constant re-evaluation of optimal film gauge and material substitution to maintain packaging cost neutrality against fluctuating polymer spot markets.

Supply Chain Analysis

The global chocolate wrapping film supply chain is a high-precision, capital-intensive structure anchored by production hubs in Asia-Pacific (notably China and India) and Europe. Asia-Pacific dominates primary film extrusion due to scale and lower operating costs, serving as a critical supplier of base BOPP and PET films. The key logistical complexity involves the intercontinental transport of these base films to regional converting operations in Europe and North America, where specialized printing, metallization, and lamination occur closer to the final chocolate manufacturers. The supply chain maintains a crucial dependency on petrochemical feedstock availability, which ties the industry's stability directly to global oil and gas market conditions and regional geopolitical risks, a vulnerability highlighted by the impact of shipping route disruptions on European film prices.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | Regulation (EU) No 10/2011 on plastic materials and articles / EFSA | Mandates specific migration limits (SMLs) and an Overall Migration Limit (OML) for substances in plastic food contact materials. This regulation significantly limits the range of permissible additives and ink chemistries, directly increasing the cost and lead time for film qualification, and focusing film demand on EU-approved resin grades. |

United States | Federal Food, Drug, and Cosmetic Act (FFDCA) / FDA | Regulates food contact substances, requiring films to be proven safe under the intended conditions of use. Compliance is often achieved via the Food Contact Substance Notification Program, which drives demand toward films utilizing Effective Food Contact Substances and limits the use of non-approved or novel film compositions until rigorous safety data is generated. |

European Union | Framework Regulation (EC) No 1935/2004 | Establishes general safety and inertness principles for all food contact materials (FCMs), requiring they do not transfer constituents to food in harmful amounts or change its organoleptic properties. This necessitates detailed Declaration of Compliance (DoC) documentation from film suppliers to chocolate manufacturers, making regulatory compliance a prerequisite for market participation. |

Chocolate Wrapping Film Market Segment Analysis:

By Application: Dark Chocolate Wrapping Film

The need for dark chocolate wrapping film is driven by the intrinsic fragility and high value of the product, requiring superior protective packaging. Dark chocolate possesses a low melting point and a composition sensitive to light, oxygen, and moisture, which accelerates the development of "bloom"—a white surface layer indicating fat or sugar crystallization that ruins consumer appeal. This chemical sensitivity propels specific demand for high-barrier films, often utilizing metallized PET or specialized, high-density BOPP structures to offer maximum oxygen and light blockage. Furthermore, the dark chocolate segment is closely linked to the premium and artisanal market. Consequently, film selection is driven by both performance and aesthetics; superior clarity, high-definition printing capability, and matte finishes are required to reinforce the high-end brand identity and justify the product’s elevated price point at retail. The focus on extended shelf life in the export market further solidifies the demand for films engineered with maximum barrier properties.

By Material: BOPP (Biaxially Oriented Polypropylene) Film

BOPP film commands a significant share of the chocolate wrapping film market, with over 52% of global BOPP demand originating from the food and beverage sector, including confectionery. The necessity for BOPP is fundamentally driven by its optimal balance of cost-efficiency, technical performance, and inherent recyclability. It is a low-density, lightweight material that offers superior clarity, tensile strength, and excellent moisture barrier properties, making it highly effective for standard chocolate bars and twist-wrap applications (with ultra-light films below 15 micron). Furthermore, its excellent surface energy and printability make it the substrate of choice for high-graphic packaging demanded by marketing teams. Critically, the growing imperative for mono-material packaging, driven by recycling legislation, is pivoting demand toward BOPP and its derivatives. Film producers are actively developing high-barrier mono-BOPP structures to replace non-recyclable PET/PE or foil/paper laminates, ensuring their continued dominance as the material that best satisfies the competing demands of performance, cost, and circular economy compliance.

Chocolate Wrapping Film Market Geographical Analysis

US Market Analysis (North America)

The need for chocolate wrapping film in the US market is highly influenced by two major factors: the pervasive convenience culture and the rising market penetration of shareable, resealable packaging formats. While the FDA regulates the safety of food contact materials, state-level initiatives and major CPG brand commitments drive the demand for sustainable films. The US market’s preference for large, multi-serving confectionery bags and snack packs over traditional individual bars necessitates a higher volume demand for BOPP and PET films optimized for form-fill-seal (FFS) machinery, demanding films with high puncture resistance and excellent hot-tack properties for high-speed line efficiency. The need for clear, anti-fog films is also significant for refrigerated and impulse-buy chocolate displays, a specific technical requirement for film converters supplying this region.

Brazil Market Analysis (South America)

The Brazilian market is characterized by significant domestic confectionery consumption and a strong focus on cost-efficient packaging solutions. Economic factors and lower disposable income levels compared to North America or Europe place a higher premium on material cost, driving demand toward commodity-grade, cost-effective BOPP and PVC film variants. The dominant requirement is for high-volume wrapping of mass-market chocolate tablets and seasonal Easter eggs. The high ambient temperatures and humidity across the region necessitate robust film barriers to mitigate product spoilage, directly increasing demand for films with verifiable moisture-resistance performance. Local market factors, including a less developed municipal recycling infrastructure, indicate the immediate demand for highly specialized, certified compostable or recyclable mono-materials is lower than in the EU, though this trend is gradually emerging.

Germany Market Analysis (Europe)

The German market, an influential European economy, imposes the highest degree of sustainability-driven demand on film manufacturers. Germany’s strong legislative framework, including the Packaging Act (VerpackG) and its ambitious recycling quotas, directly accelerates the demand for films certified as ‘designed for recycling.’ This has created an acute market shift away from multi-layer films that contaminate the recycling stream and toward high-performance mono-materials like BOPP or specialized mono-PET structures. Furthermore, the German consumer base exhibits a high awareness of premium and organic chocolate, sustaining demand for sophisticated printing techniques and packaging aesthetics, which reinforces the need for highly printable film substrates and specialized finishing processes. Compliance with EU-wide food contact material regulations is non-negotiable.

UAE Market Analysis (Middle East & Africa)

The UAE market is characterized by a high volume of imported luxury and international chocolate brands and significant challenges posed by extreme climatic conditions. The hot climate necessitates films with the absolute highest barrier properties against moisture and heat to prevent rapid melting and blooming during transport, storage, and retail display. This environmental imperative drives specific demand for metalized films and aluminum foil/film laminates that offer superior thermal and light protection, often overshadowing sustainability as the primary selection criterion. The UAE’s status as a major trade and logistics hub in the region also creates an elevated demand for robust, tamper-evident packaging suitable for cross-border and export distribution.

China Market Analysis (Asia-Pacific)

The Chinese market is a dual driver for the chocolate wrapping film sector: it is both a rapidly expanding consumer market and a dominant global manufacturing hub. Consumer demand is surging, particularly in urban areas, driven by rising disposable incomes and the increasing penetration of Western-style confectionery. This translates to high volume demand for films suitable for mass-market chocolate production. Concurrently, as a major film production hub, China exports enormous volumes of BOPP and PET base films. The local market trend is increasingly influenced by the government's push for a circular economy, which is beginning to stimulate demand for domestically produced, recyclable films, though the overall adoption rate for certified sustainable materials still trails Europe. The sheer scale of domestic production maintains strong downward pressure on global pricing.

Chocolate Wrapping Film Market Competitive Environment and Analysis

The Chocolate Wrapping Film market is highly competitive and moderately concentrated, dominated by a few multinational packaging giants with extensive global manufacturing and converting capabilities. Competition centers on film innovation, specifically the successful commercialization of high-barrier, mono-material structures, and global supply chain reliability to mitigate geopolitical and raw material price volatility. The key strategic differentiator is the ability to provide consistent quality and a verifiable Declaration of Compliance (DoC) across all major international jurisdictions.

Amcor Plc

Amcor is a global leader in responsible packaging, holding a strategically diversified position across flexible and rigid packaging sectors. Their core strategy revolves around sustainability-driven innovation, aiming to deliver packaging that is increasingly lighter weight, recyclable, and reusable. In the chocolate wrapping film sector, Amcor’s competitive advantage lies in its extensive global footprint and its proprietary film technologies, such as their high-barrier, mono-material films engineered for recyclability. Their customer engagement program, Catalyst™, exemplifies their focus on collaborative innovation with major confectionery brand owners to develop customized, sustainable film solutions that directly address the demand for high-performance, compliant packaging solutions across diverse global markets.

Mondi Group

Mondi Group operates as a major international paper and packaging company with a strong commitment to its MAP2030 sustainability agenda. Mondi's strategy in the flexible packaging sector, including films for confectionery, emphasizes the principle of "sustainable by design." Their competitive edge is their broad material portfolio, which includes both film and paper-based solutions, positioning them as a partner for brand owners seeking a complete transition to sustainable packaging. Mondi focuses on developing recyclable mono-material films and innovative paper-based alternatives for multipack confectionery. This dual approach addresses the demand for both protective, high-speed-machinable film wraps and certified recyclable outer packaging components, a strategy that directly aligns with European packaging mandates.

Chocolate Wrapping Film Market Developments

September 2024: Pakka, a sustainable packaging producer, introduced a new line of flexible compostable packaging films. This development targets the food and beverage sector, including chocolate, providing manufacturers with a certified, eco-friendly alternative to conventional multi-layer films, supporting the industry's shift away from non-recyclable plastic wraps.

June 2024: Saica Group and Mondelz International announced a partnership to pilot a new paper-based solution aimed at replacing plastic multipack wrapping for confectionery and chocolate. This joint venture directly addresses sustainability goals by developing a wrapper intended to be fully recyclable within the existing paper waste stream infrastructure.

Chocolate Wrapping Film Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 788.004 million |

| Total Market Size in 2030 | USD 989.555 million |

| Forecast Unit | Million |

| Growth Rate | 4.66% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Chocolate Wrapping Film Market Segmentation:

By Material

PET

PVC

BOPP

By Application

Dark

Milk

White

By Packaging Type

Sheets

Rolls

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others