Report Overview

Cholangioscopy Market Size, Share, Highlights

Cholangioscopy Market Size:

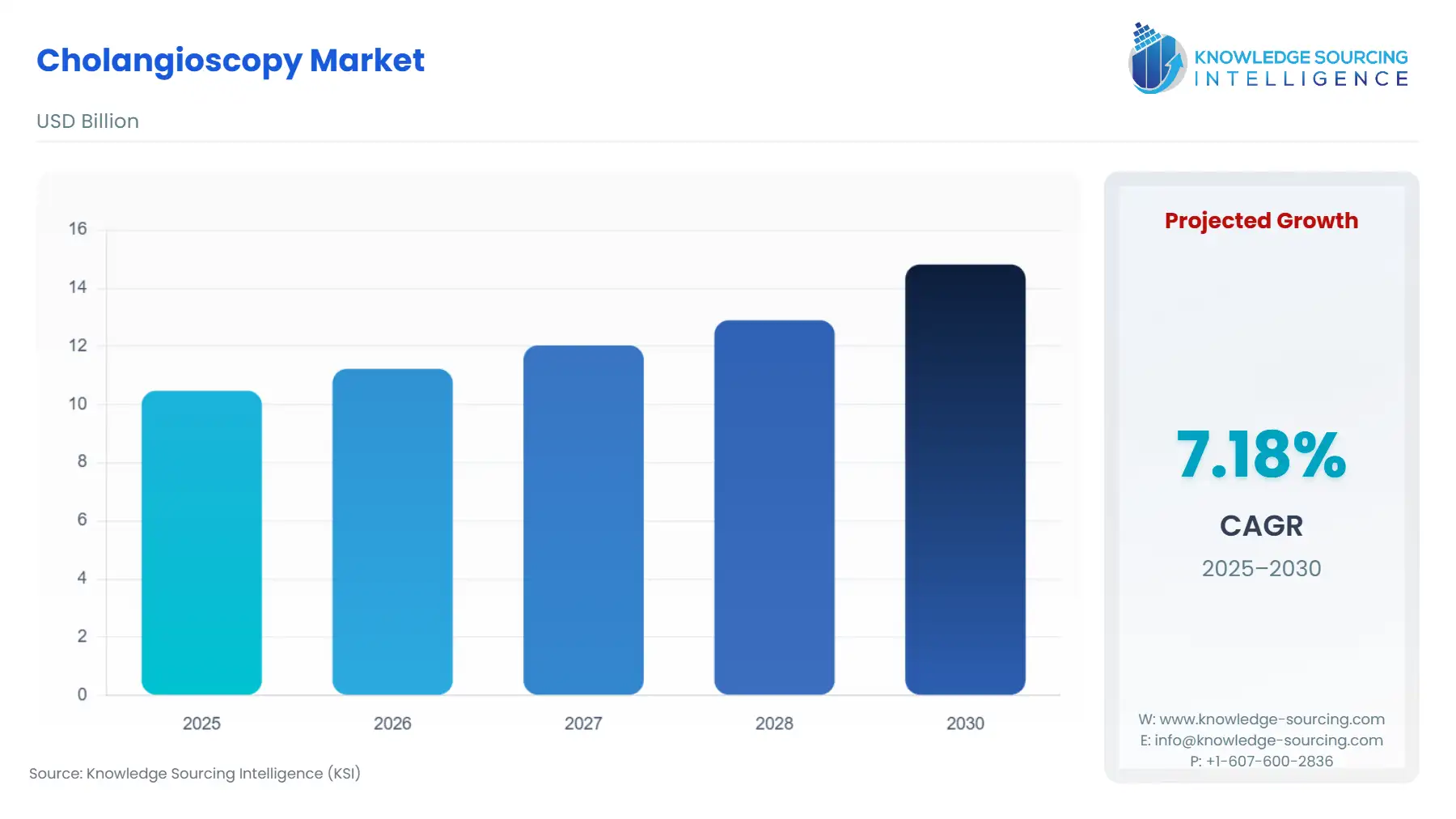

The cholangioscopy market is estimated to grow at a CAGR of 7.19%, attaining US$14.820 billion by 2030, from US$10.476 billion in 2025.

Key Market Highlights:

Cholangioscopy or peroral cholangioscopy (POC) is a type of low or minimal-invasive procedure that is commonly used to evaluate or diagnose the bile ducts of patients. The cholangioscopy procedure is majorly used for direct visual diagnostic evaluation of the bile ducts or for simultaneous therapeutic intervention. The process offers multiple benefits to the healthcare sector, which include identifying and addressing blockages in the liver, pancreatic, and biliary parts of the body, and is also used to spot or identify cancer in the ducts.

The global cholangioscopy market is expected to witness significant growth mainly due to the increasing global cases of bile duct cancer during the forecasted timeline. The cholangioscopy plays a critical role in detecting and monitoring bile duct cancer. Similarly, the increasing global older population is also expected to boost the growth of the global cholangioscopy market. The risk of side effects and the expensive procedure of cholangioscopy are among the key factors challenging the growth of the market.

Key players working in the market include Boston Scientific Corporation, Micro-Tech Endoscopy, Japan Lifeline Co., Ltd., Ottomed, Olympus Corporation, Penlon, Fujifilm Group, Medtronic, Johnson & Johnson, Cook Medical, Inc., B. Braun Melsungen AG, Arthrex, Inc., and HOYA Corporation.

Cholangioscopy Market Trends

- Increasing Global Cases of Bile Duct Cancer

The major factor propelling the growth of the global cholangioscopy market is the increasing global cases of bile duct cancer. Bile duct cancer or cholangiocarcinoma is a type of rare and more aggressive form of cancer, which is more common in the older population. Cholangioscopy plays a critical role in detecting and assessing the details of malignant spots, which helps in monitoring and locating the precise location of the cancer cell. The cholangioscopy procedure can also help collect specimens of the cancer cells, which can help enhance the process of therapy.

The global cases of bile duct cancer witnessed significant growth during the past few years. The American Cancer Society, in its report, stated that in the USA, about 8,000 new cases of bile duct cancer are diagnosed annually. Similarly, the Christie NHS Foundation Trust of the UK stated that in the nation, about 1,000 cases of bile duct cancer are recorded annually.

Cholangioscopy Market Drivers

- Increasing Global Older Population

The increasing population of the older population across the globe is also among the key factors propelling the growth of the cholangioscopy market during the forecasted timeline. With the increasing age of an individual, the cases of various types of cholangioscopy diseases, like bile duct blockage, cholangitis, duct strictures, and pancreatic duct stones, increase. Various medical research institutes across the globe stated that in the older population, cases of cholangioscopy or bile duct cancer are most common.

The older global population witnessed a significant surge during the past few years. The World Bank, in its report, stated that in 2021, the population above the age of 65 years recorded at 754.681 million, which surged to 778.122 million in 2022. In 2023, the total population above the age of 65 years was recorded at 805.475 million. In 2022, the total population of males above the age of 65 years was recorded at 345.650 million, whereas the population of females was recorded at 432.471 million. Similarly, in 2023, the total population of males above the age of 65 years was recorded at 357.583 million, whereas the female population was recorded at 446.891 million.

Market Restraints

- High Cost of Cholangioscopy Equipment and Procedures

The Cost of Cholangioscopic Equipment and Procedures – Cost is one of the most important limitations on the growth of the insulin delivery device market. The cholangioscopy system itself, like a digital single-operator cholangioscope, is a highly sophisticated system that carries a significant investment not only for the purchase and installation of the system, but also for the ongoing and regular maintenance of the system. In addition to the cost of the system, most procedures also utilize costly disposable accessories and consumables such as guidewires, catheters, and biopsy instruments, which also drive up the cost of the procedure. For healthcare facilities, particularly those in limited resource settings, the high capital cost incurred in purchasing a system like cholangioscopy can be difficult to justify when the cost of conventional imaging procedures, like MRCP and ultrasound, is far less expensive and widely available.

From a patient perspective, the high per-procedure cost combined with limited and variable reimbursement in many regions of the world also contributes to overall affordability and either participation in or uptake of cholangioscopy procedures. The cost question here presents an even more serious issue in emerging markets, where the out-of-pocket costs of healthcare are significantly higher, creating two tracks in providing healthcare for advanced hospitals in developed countries and poorly funded healthcare institutions in developing economies, and separating the two markets even further. Ultimately, the high costs of cholangioscopy equipment and procedures limit access to cholangioscopy, even though technology offers clear, if not highly sophisticated, clinical value.

- Risk of Side Effects to the Procedure

The major challenging factor to the growth of the global cholangioscopy market is the increasing risk of side effects related to preoral cholangioscopy. The procedure of cholangioscopy involves various types of side effects to the patients, which include stomach upset, vomiting, drowsiness, and sore throat, among others. Preoral cholangioscopy can also lead to intestinal gas and bloating or cramping of the stomach, as the procedure traps a small amount of air in the stomach.

- Expensive Process of Cholangioscopy

The cholangioscopy procedure involves integrations of various medical procedures, which include anesthesiology and endoscopy, among others. The first step of the cholangioscopy procedure is anesthesia, which can cause drowsiness in the patients, followed by placing a mouth guard and carefully guiding the endoscope or duodenoscope through the throat. The process of cholangioscopy requires well-trained endoscopists, making the procedure expensive.

Market Opportunities

- Increasing Investment in the Medical Technology and Devices Sector

The increasing investment and introduction of key governmental policies to boost the medical equipment technology across the globe are also expected to propel the growth of the market during the forecasted period. Various countries, like the USA, Canada, India, and Japan, have introduced key policies and investment opportunities to boost the advancement of medical device technologies. For instance, the Department of Pharmaceuticals of the Indian Government, in April 2023, announced the introduction of the National Medical Device Policy, which is designed to accelerate the development of the patient-centric medical device technology approach. The policy also aims to boost innovation and competitiveness in the global medical device technology market.

Cholangioscopy Market Segmentation Analysis

- By Equipment Type

Based on equipment type, the market is classified into endoscopes, duodenoscopes, and others.

Duodenoscopes are the fastest-growing category of products within the cholangioscopy space, mostly due to their constant utility in endoscopic retrograde cholangiopancreatography (ERCP) and emerging use alongside modern cholangioscopy equipment. Duodenoscopes provide the access point needed to the bile and pancreatic ducts, making them necessary in diagnostic and therapeutic use cases such as stone extraction, specimen collection, and stricture management. Recent innovation has facilitated the creation of single-use and partially single-use duodenoscopes, which have substantially increased demand due to the reduced risk of infection spread that is associated with reusable scopes for contaminated use cases, which often need to be reprocessed.

As patient safety and infection control have emerged as regulatory focal points in endoscopy practices, and because the introduced disposable models of duodenoscopes have begun to see widespread approval by the industry leaders, use of interactive videoscopes is growing quickly in all regions, especially developed regions. Simultaneously, the rise in global incidence of biliary and pancreatic disease, combined with the unique increase in the number of ERCP procedures completed around the world, increased demand for performance duodenoscopes. Corporations and specialized endoscopic centers are making very large investments into duodenoscope platforms that allow for greater combination with the newest digital cholangioscopy systems, leveraging better visualization and achieving greater efficiencies in procedure completion.

As acute care systems place more emphasis on novel endoscopic devices to improve the efficiency of procedure completion and enhance infection control policies that utilize advanced endoscopic devices, duodenoscopes will remain the most rapidly growing equipment type in the cholangioscopy market.

Cholangioscopy Market Regional Analysis

- By region, the market is segmented into North America, South America, the Middle East and Africa, and Asia-Pacific.

North America

The North American region is also among the leading markets in the research and development of enhanced technologies, which is expected to boost the performance of the cholangioscopic equipment. Similarly, countries like the USA and Canada in the region have also introduced key policies and investment opportunities to enhance the reach of advanced technologies in the pharmaceutical sector.

Europe

The continent of Europe is one more major market for the cholangioscopy, with the top four countries being Germany, France, the UK, and Italy, which are leading the way in the adoption. The area enjoys a good and effective healthcare system, an aging population that is at high risk of the formation of stones in the gall bladder and other biliary disorders, and a rising popularity of minimally invasive diagnostic procedures. The European hospitals are turning to the use of digital cholangioscopy in combination with ERCP as a method of achieving better diagnostic accuracy and treatment outcomes. Nevertheless, the differences in reimbursement systems between various European countries and the limited funding of public healthcare budgets still impose hurdles. Anyway, the high regulatory standards, technological partnerships, and the continuous training of the gastroenterologists are predicted to result in a positive trend all over the area.

Asia-Pacific

The cholangioscopy market will see the fastest growth in the Asia-Pacific region. Such a trend will be driven by a large patient population with gastrointestinal and biliary diseases in the region, increasing healthcare spending, and better accessibility of endoscopy technologies. These three countries are China, India, and Japan. The latter country is an early riser of advanced imaging systems, while China and India are the two markets that are awakening from the slumber due to the increasing demand for medical services of the middle-class population and the hospital infrastructure ramping up. There are some obstacles, such as the high cost of the equipment, uneven distribution, and reimbursement, that are still hindering the adoption of these technologies in emerging economies. Despite having to surmount these hurdles, the market prognosis is still extremely positive with multinationals throwing significant dollars into regional expansion and training programs.

South America

The cholangioscopy market in South America is undergoing gradual growth, with Brazil being the main driver of the market along with Argentina, Chile, and Colombia as the following countries. The demand for endoscopic procedures of a high degree of precision is rising in the area, which is a direct result of the escalation of gastrointestinal and hepatobiliary diseases that comprise the likes of gallstones, bile duct strictures, and pancreatic disorders. The relatively well-developed private healthcare sector and the growing investments in cutting-edge medical technologies make Brazil the largest source of income for the South American cholangioscopy market. Nevertheless, the market is confronted with some obstacles, like the issue of unequal access to healthcare between urban and rural areas, the scarcity of reimbursement structures, and the high reliance on imported cholangioscopy systems that not only make the equipment more expensive but also limit its use in public hospitals.

The Middle East and Africa

The MEA region is an area with a smaller market that is developing for cholangioscopy. The main growth of this procedure has been in the countries of the Gulf Cooperation Council (GCC), such as Saudi Arabia, the UAE, and Qatar. What these countries do is that they put a lot of money into the healthcare infrastructure and are very willing to take on advanced medical technologies as a way of achieving better patient outcomes. Still, the majority of Africa is struggling with many issues that include insufficient healthcare infrastructure, less accessibility to advanced endoscopic devices, and the lack of a sufficient number of skilled professionals. But on the bright side, the increasing government healthcare spending, going for medical tourism in the Middle East, and the rising number of collaborations with international medical device companies will probably have an impact on the use of cholangioscopy in the region, which will be a gradual boost.

Cholangioscopy Market Competitive Landscape

- Key Industry Players

The major contributors to the cholangioscopy market are the major global and regional companies, including Boston Scientific Corporation, Micro-Tech Endoscopy, Japan Lifeline Co., Ltd., Ottomed, Olympus Corporation, Penlon, Fujifilm Group, Medtronic, Johnson & Johnson, Cook Medical, Inc., B. Braun Melsungen AG, Arthrex, Inc., and HOYA Corporation. These companies are directing the resources towards product innovation, partnership strategies, and broadening their portfolios of endoscopic devices to not only maintain their market position but also to have a better reach of the increasing global demand for advanced cholangioscopy solutions.

List of Key Company Profiled

- Boston Scientific Corporation

- Micro-Tech Endoscopy

- Japan Lifeline Co., Ltd.

- Ottomed

- Olympus Corporation

- Penlon

- Fujifilm Group

- Medtronic

- Johnson & Johnson

- Cook Medical, Inc.

- B. Braun Melsungen AG

- Arthrex, Inc.

- HOYA Corporation

Cholangioscopy Market Key Developments

- Product Launch: In April 2025, At the 22nd MUMBAI LIVE Endoscopy event, FUJIFILM India, a major player in the healthcare technology sector, launched its innovative ELUXEO 8000 therapeutic endoscopy solution. The improved endoscopic technology, which was only available in Japan and Europe, has made its debut in India with the aim of raising the quality of images, increasing the use of treatment, and facilitating the work of healthcare providers.

- Product Launch: In April 2025, IKEDA unveiled an entirely new portfolio of endoscopy innovations at CMEF 2025. There was the introduction of the Dual-Endoscopy System Solution, 4K ICG Fluorescence Endoscopic Camera System, 3CMOS 4K Endoscope Camera System, Irrigation Pump, CO? Insufflator, Auto-Clavable Camera, and 4K Digital Electronic Colposcope, among others.

- Collaboration: In April 2025, Medtronic healthcare technology declared an agreement with the aim of distributing the new advanced system Dragonfly pancreaticobiliary from the company Dragonfly Endoscopy, Inc. in America. The new Dragonfly system is designed to help with the main clinical limitations that are the critical points in the traditional cholangioscopy.

Cholangioscopy Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cholangioscopy Market Size in 2025 | US$10.476 billion |

| Cholangioscopy Market Size in 2030 | US$14.820 billion |

| Growth Rate | CAGR of 7.19% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Cholangioscopy Market |

|

| Customization Scope | Free report customization with purchase |

The Cholangioscopy Market is analyzed into the following segments:

- By Type

- Peroral Videocholangioscopy (POCS)

- Direct Peroral Videocholangioscopy (D-POCS)

- SpyGlass™ Direct Visualization System (SGDVS)

- Others

- By Equipment Type

- Endoscope

- Duodenoscope

- Others

- By Application

- Diagnostics

- Post–liver transplant

- Choledocholithiasis

- Intraductal tumor mapping

- Others

- Therapeutics

- Lithotripsy

- Biliary tumor ablative therapy

- Selective biliary duct wire cannulation

- Diagnostics

- By Technology

- High Definition Systems

- Digital Imaging Technologies

- By End User

- Hospitals

- Surgical Centers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific Region

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America