Report Overview

Cleanroom Glove Market - Highlights

Cleanroom Glove Market Size:

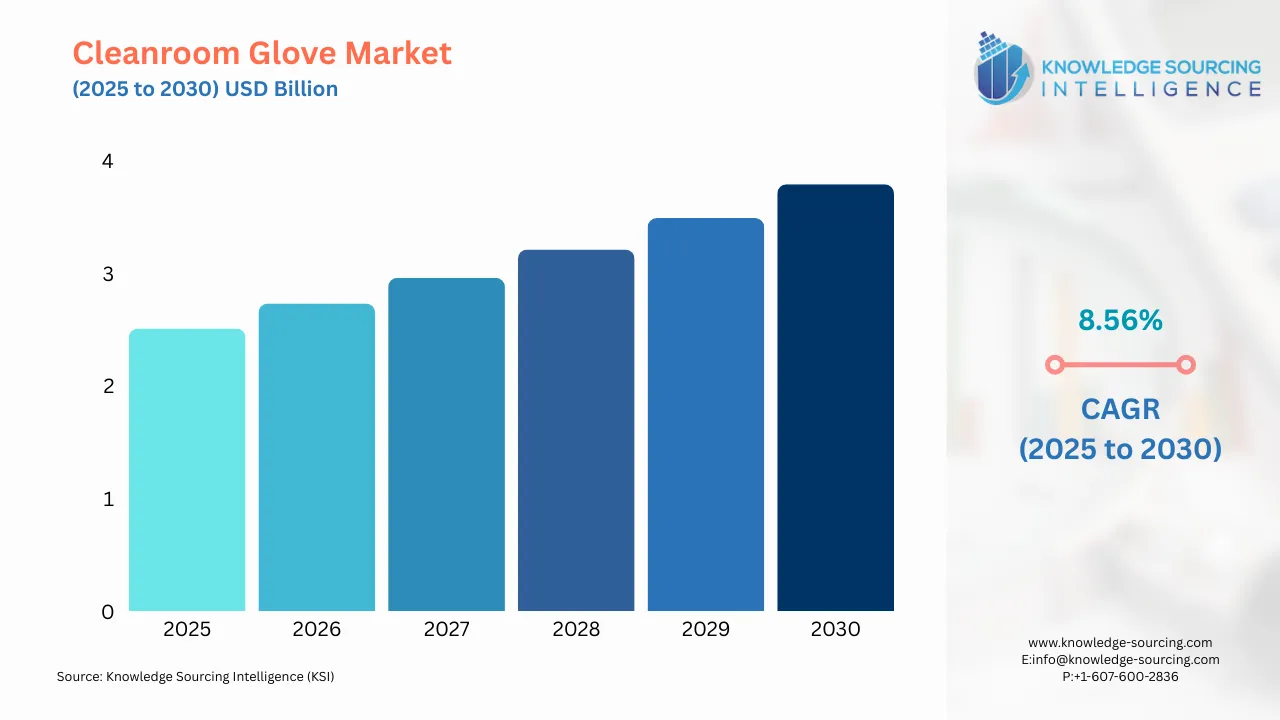

The Cleanroom Glove Market is projected to grow from USD 2.512 billion in 2025 to USD 3.788 billion in 2030, at a CAGR of 8.56%.

The cleanroom glove market plays a pivotal role in industries where contamination control is paramount, such as pharmaceuticals, biotechnology, electronics, and healthcare. Cleanroom gloves are specialized protective equipment designed to maintain sterile environments by preventing contamination from human contact, particulate matter, or chemical exposure. These gloves, typically made from materials like nitrile, latex, neoprene, or vinyl, are engineered to meet stringent cleanliness standards, ensuring product integrity and worker safety in controlled environments. As global industries increasingly prioritize precision, hygiene, and regulatory compliance, the cleanroom glove market has become a critical component of the broader cleanroom technology ecosystem.

Cleanroom gloves are essential for maintaining aseptic conditions in environments where even microscopic contaminants can compromise product quality or safety. In pharmaceuticals, they prevent microbial contamination during drug formulation and packaging, while in electronics, they protect sensitive components like semiconductors from electrostatic discharge (ESD) and particulate matter. The market encompasses various glove types, including disposable and reusable options, with nitrile gloves gaining prominence due to their chemical resistance and low allergenicity compared to latex. The demand for cleanroom gloves is closely tied to the expansion of cleanroom facilities, driven by advancements in high-tech manufacturing and healthcare. As industries adopt cutting-edge technologies like biologics, microelectronics, and advanced medical devices, the need for high-quality cleanroom gloves continues to grow, positioning the market as a vital enabler of innovation.

The cleanroom glove market is experiencing robust growth, propelled by the global expansion of industries requiring controlled environments. The pharmaceutical and biotechnology sectors are key contributors, driven by increased research and development (R&D) activities and stringent regulatory standards. Similarly, the electronics industry, particularly semiconductor manufacturing, is a major demand driver.

Technological advancements in glove materials and manufacturing processes are reshaping the market. Innovations such as biodegradable nitrile gloves and automated donning systems enhance sustainability and sterility, addressing both environmental concerns and operational efficiency. In 2024, Ansell Ltd. launched a new line of biodegradable cleanroom gloves made with eco-friendly materials, targeting sustainability-focused industries like pharmaceuticals and electronics. These developments align with growing regulatory and consumer emphasis on environmentally responsible practices, further expanding the market’s appeal.

The healthcare sector also plays a significant role, with cleanroom gloves used in surgical procedures, medical device manufacturing, and laboratory settings to prevent healthcare-associated infections (HAIs). The Centers for Disease Control and Prevention (CDC) reported that HAIs affect approximately 1.5 million patients annually in the U.S., underscoring the need for high-quality protective equipment like cleanroom gloves. Additionally, the rise of advanced manufacturing in aerospace and food processing industries contributes to market growth, as these sectors adopt cleanroom protocols to meet stringent quality standards.

Recent advancements highlight the market’s dynamic evolution. Additionally, in January 2025, Top Glove Corporation introduced a new range of sterile nitrile gloves with improved tactile sensitivity for semiconductor manufacturing, addressing the industry’s need for precision and contamination control. These innovations reflect the industry’s focus on meeting diverse application needs while addressing sustainability and performance demands.

Cleanroom Glove Market Overview:

Cleanrooms are specialized facilities for industrial and scientific research, as well as manufacturing. They provide a closed environment for testing and manufacturing products, as small components in the environment can easily contaminate them. The demand for cleanroom gloves is expected to increase in tandem with the demand for cleanrooms, driven by the global rise in pharmaceutical and micro-electronic component production.

Additionally, demand is projected to grow with increasing investments in life sciences, biotechnology, and semiconductor research and development. Moreover, the safety guidelines and regulations in the pharmaceutical and food industries, coupled with the growth in these industries, are expected to further boost the cleanroom gloves market’s growth.

The growing need for microelectronics, especially within the smartphone and consumer electronics sectors, is set to fuel the expansion of the cleanroom glove market. As demand for mobile devices rises, so does a requirement for cleanroom gloves, driven by the miniaturization of electronic components enabled by technological progress.

PUREZERO* HG5 cleanroom gloves made of nitrile provide extensive protection against the risk of chemical exposure. Staff members must be shielded from potentially dangerous chemicals and chemotherapy medications. PUREZERO* HG5 Cleanroom Gloves are tested against 21 chemicals and two chemotherapy drugs in addition to offering protection against chemical splash, microbes, and viruses. PUREZERO* HG5 Blue SGX* Nitrile Gloves 12" and PUREZERO* HG5 White Nitrile Gloves 12" against Carmustine (BCNU) (3.3) have 117.7 and 119 minutes of the minimum breakthrough time, respectively.

Safety Standards and Regulations in Pharmaceutical and Food Industries ensure product safety and quality; the pharmaceutical and food industries must adhere to strict regulations, necessitating the use of cleanroom gloves. In the European Union, compliance with EU Good Manufacturing Practices (GMPs) is mandatory for pharmaceutical manufacturers, with regular inspections of production sites reinforcing the widespread use of cleanroom gloves across the sector. Additionally, various countries enforce sanitation and hygiene GMPs, requiring pharmaceutical firms to maintain stringent cleanliness standards for personnel, facilities, equipment, materials, containers, and cleaning products at every stage of production. The global growth of these industries further amplifies the demand for cleanroom gloves, propelling market expansion.

The Asia Pacific region is poised to command a substantial market share and exhibit the fastest growth during the forecast period, driven by rapid industrialization. As a global manufacturing powerhouse, particularly in China, the region is witnessing significant growth in its industrial sector. This industrialization boom and the rising manufacturing sector are increasing the adoption of cleanroom gloves, a pattern expected to persist in the years ahead.

Some of the major players covered in this report include Cardinal Health, Inc., Ansell Limited, Medline Industries, Inc., Top Glove Corporation Bhd, Kossan Rubber Industries Bhd, Kimberly-Clark Corporation, among others.

Cleanroom Glove Market Growth Drivers:

Stringent Regulatory Standards: Stringent regulatory frameworks governing cleanroom operations in pharmaceuticals, biotechnology, and medical device manufacturing are a primary driver for the cleanroom glove market. Regulations such as the European Union’s Good Manufacturing Practices (GMP) and the U.S. Food and Drug Administration’s (FDA) Current Good Manufacturing Practice (cGMP) guidelines mandate the use of high-quality cleanroom gloves to prevent contamination during production processes.

Growth in Pharmaceutical and Biotechnology Sectors: The rapid expansion of the pharmaceutical and biotechnology industries, fueled by increased R&D for biologics, vaccines, and personalized medicine, significantly boosts demand for cleanroom gloves. These sectors rely on sterile environments to prevent microbial or particulate contamination during drug formulation, testing, and packaging.

Expansion of Electronics and Semiconductor Industries: The cleanroom gloves market is significantly driven by the growth of electronics and semiconductor manufacturing. High-end particle-free environments are necessary in semiconductor fabs and electronics assembly to avoid the presence of particles that lead to yield losses or device failures. As a result, disposable cleanroom gloves have become one of the most important contamination control consumables in several processes like wafer fabrication, packaging, MEMS, LED, and the assembly of precision components.

The adoption of chip fabrication technologies has led to a decrease in the mobile telecommunication sector's tolerance to impurity, leading to a rise in glove usage with increased change-out frequency, a demand for higher-performance materials like nitrile, coated synthetics, and a rise in interest in specialized gloves with attributes like low-particulate, low-ion-content, and antistatic.

The output of the electronics sector increased almost six times from Rs 1.9 lakh crore in 2014–15 to Rs 11.3 lakh crore in 2024–25 in India, according to the Press Information Bureau. Furthermore, mobile phone exports surged 127 times from Rs 1,500 crore in 2014–15 to Rs 2 lakh crore in 2024–25. The country is the second-largest manufacturer of mobile phones in the world.

Moreover, cleanrooms of the ISO class are required in areas such as semiconductor fabrication, including wafer processing and electronics assembly, to prevent contamination of ions that could jeopardize the entire production yield. Gloves like nitrile for low shedding and dexterity, and neoprene, which is the fastest growing for chemical resistance, are critical and witnessing a rise in demand among these sectors. As devices shrink, such as 5nm chips, precision handling demands escalate, which is also boosting the overall market.

Cleanroom Glove Market Segmentation Analysis:

Cleanroom Glove Market Segmentation Analysis by Material:

Nitrile: Nitrile gloves dominate the cleanroom glove market due to their superior chemical resistance, low allergenicity, and versatility across high-demand industries like semiconductors, pharmaceuticals, and healthcare.

Natural Rubber: Natural rubber (latex) gloves are used in some cleanroom applications but are less common due to allergenicity concerns, particularly in healthcare and pharmaceutical settings.

Synthetic Rubber: Synthetic rubber gloves offer an alternative to latex, providing similar elasticity with reduced allergenic potential, used in specific cleanroom applications.

Vinyl: Vinyl gloves are cost-effective and used in less stringent cleanroom environments, particularly for non-sterile applications in electronics and food industries.

Neoprene: Neoprene gloves provide excellent chemical resistance and durability, suitable for handling harsh chemicals in pharmaceutical and biotechnology cleanrooms.

Others: Other materials, such as polyurethane or blended polymers, are emerging for specialized cleanroom applications, offering unique properties like enhanced flexibility or sustainability.

Cleanroom Glove Market Segmentation Analysis by Sterility:

Sterile Gloves: Sterile gloves are critical for pharmaceutical, biotechnology, and medical device manufacturing, where aseptic conditions are mandatory to prevent microbial contamination.

Non-Sterile Gloves: Non-sterile gloves are used in less stringent cleanroom environments, such as certain electronics manufacturing processes, where particulate control is prioritized over sterility.

Cleanroom Glove Market Segmentation Analysis by End-Use Functionality:

Chemical-resistant gloves: Chemical-resistant gloves, often made from nitrile or neoprene, are designed for handling hazardous substances in pharmaceutical and biotechnology cleanrooms.

ESD-safe gloves: ESD-safe gloves, typically nitrile or vinyl, are essential for semiconductor and electronics manufacturing to prevent electrostatic discharge damage.

Extended cuff gloves: Extended cuff gloves provide additional protection for wrist and forearm areas, used in applications requiring enhanced contamination control.

Cleanroom Glove Market Segmentation Analysis by End-Use Industry:

Semiconductors: The semiconductor industry is the largest end-use segment for cleanroom gloves, driven by the global surge in demand for microelectronics, driven by technologies like 5G, AI, and the IoT.

Pharmaceuticals: The demand for cleanroom gloves in the pharmaceutical sector is witnessing a positive expansion due to an increase in the production of vaccines and biologics. This growth highlights the need for a stringent sterile-manufacturing environment and compliance with contamination-control regulations, such as GMP and ISO. Along with this, the rise in contract manufacturing activities and clinical production demands an aseptic process that requires higher-specification cleanroom gloves.

Moreover, the rise in clinical trials in research and development (R&D) in the pharmaceutical industry is also boosting the requirement for cleanroom gloves. These gloves offer aseptic conditions and protect sensitive materials from contamination in pharmaceutical research laboratories.

According to the European Federation of Pharmaceutical Industries and Associations (EFPIA) report titled ‘The Pharmaceutical Industry in Figures’ of 2024, the R&D expenditure for the pharmaceutical industry in Europe was valued at a positive growth to €50,000 million in 2023 from € 47,010 million in 2022. From this R&D expenditure investment, the highest share was accounted for by clinical trials, which was 48.4 percent.

Similarly, as per the IQVIA report-named ‘Global Trends in R&D 2024’ of 2024, the total number of clinical trials globally in 2024 was 4,873. From this, approximately 1,900 were phase I clinical trials, while 1,972 and 1,001 clinical trials were phase II and phase III clinical trials. Additionally, the share of small molecule clinical trials in phase III trials was 53% in 2024, while in phase II and phase I trials was 47% and 61%, respectively, as per the same source. These clinical trials often involve sensitive or hazardous molecules and substances such as cytotoxic drugs or biologics, or any infectious agents, which demand maintaining an aseptic environment, which will promote the demand for cleanroom gloves in the segment in the coming years.

Medical & Healthcare: Cleanroom gloves are used in surgical procedures, medical device manufacturing, and laboratories to prevent healthcare-associated infections.

Food and Beverage: The food and beverage industry uses cleanroom gloves to meet hygiene standards in processing and packaging environments.

Others: Other industries, such as aerospace and optics, adopt cleanroom gloves for precision manufacturing and contamination control.

Cleanroom Glove Market Geographical Outlook:

The cleanroom glove market report analyzes growth factors across the following regions:

Asia-Pacific: Asia-Pacific is the leading regional segment in the cleanroom glove market, driven by its status as a global hub for electronics manufacturing, pharmaceutical production, and cleanroom technology adoption.

North America: North America is a significant market, driven by stringent regulatory standards and advanced pharmaceutical and semiconductor industries, particularly in the USA.

Cleanroom gloves assist in maintaining a contamination-free environment by minimizing the transfer of dust, particles, and microorganisms. The regulatory shift towards establishing a sterile and dust-free environment for industrial applications has provided a benchmark for the use of contamination-control products in the United States. Furthermore, following FDA guidelines, the US industrial sectors are also emphasising following international standards such as “ISO 14644”.

Moreover, the ongoing investments in new production and research plants by various biotech and pharmaceutical companies are expected to positively impact demand for cleanroom gloves in the US market. For instance, in June 2025, GSK plc announced investments of USD 30 billion to bolster its research & development and supply chain infrastructure across the United States. The investments include funding of USD 1.2 billion for advanced manufacturing facilities.

Likewise, in August 2025, AbbVie announced investments of USD 195 million in its Illinois manufacturing plant to expand the company’s domestic active pharmaceutical ingredients production. The investments form part of the company’s strategic maneuver to expand its critical manufacturing capability in the United States. Additionally, the US government is emphasising bolstering its electronics & semiconductor production capacity, for which it has established various schemes and policies such as “CHIPS and Science ACT”.

Such polices are expected to drive demand for contamination control products in the country’s semiconductor sector, which is experiencing strong growth. According to the Semiconductor Industry Association’s “State of the U.S Semiconductor Industry” report, as of July 2025, private sector investments to revitalize US chip manufacturing have reached nearly half a trillion dollars. The same report also stated that, in 2024, the US semiconductor industry invested 17.7% of its revenue, i.e., USD 62.7 billion in research & development operations, marking a 5.7% growth over the preceding year’s investments.

Besides growing industrial output, the ongoing innovation & advancement in glove materials like nitryl, followed by the growing workers’ safety and hygiene concern, is further acting as an additional driving factor for the cleanroom gloves market expansion in the United States.

Europe, Middle East & Africa: Europe’s market is propelled by strict GMP regulations and pharmaceutical manufacturing, while the Middle East and Africa show slower growth due to limited cleanroom infrastructure.

Cleanroom Glove Market Competitive Landscape:

Ansell Ltd.: Ansell Ltd. is a leading player, offering innovative cleanroom gloves, including biodegradable nitrile options for pharmaceutical and electronics applications.

Top Glove Corporation Bhd: Top Glove is a major manufacturer, providing sterile nitrile gloves with ESD compliance for semiconductor and pharmaceutical industries.

Kimberly-Clark Corporation: Kimberly-Clark offers high-performance cleanroom gloves, focusing on chemical resistance and sterility for pharmaceutical and healthcare applications.

These companies are among the global leaders in cleanroom glove manufacturing, driving innovation through advanced materials and sustainability initiatives.

Cleanroom Glove Market Latest Developments:

August 2025: Unigloves UK introduced the BioTouch™ Biodegradable Nitrile Gloves, a sustainable solution for cleanroom environments, offering 81% biodegradation within 490 days and full decomposition in under five years.

January 2025: Top Glove Corporation introduced a new range of sterile nitrile cleanroom gloves with enhanced tactile sensitivity and ESD compliance, targeting semiconductor and pharmaceutical applications.

2024: Ansell Ltd. launched a new line of biodegradable nitrile cleanroom gloves, targeting the pharmaceutical and electronics industries in Asia-Pacific and Europe.

Cleanroom Glove Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 2.512 billion |

| Total Market Size in 2030 | USD 3.788 billion |

| Forecast Unit | Billion |

| Growth Rate | 8.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Material, Sterility, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cleanroom Glove Market Segmentation:

By Type

Chemical Resistant

Electrostatic Discharge-Safe (ESD) Gloves

Extended-Cut Gloves

By Material

Latex

Synthetic

Nitrile

Vinyl

Others

By Sterility

Sterile

Non-Sterile

By End-User

Food & Beverage

Medical & Healthcare

Pharmaceuticals

Electronics & Semiconductor

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others