Report Overview

Synthetic Gloves Market Report, Highlights

Synthetic Gloves Market Size:

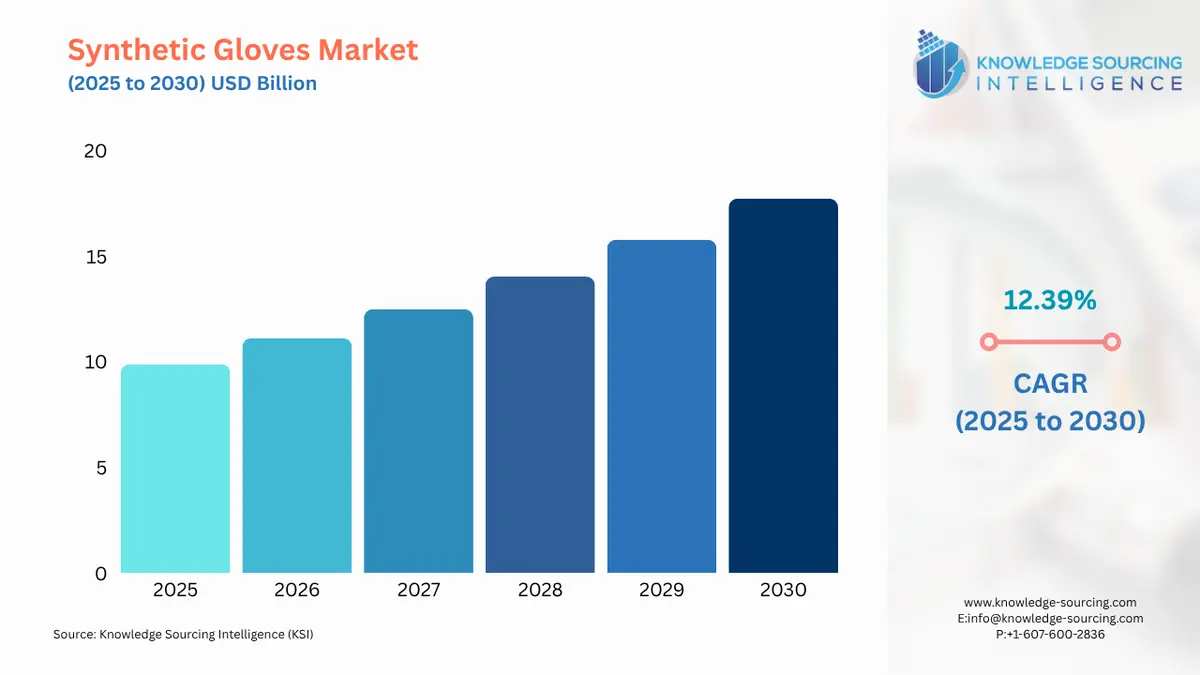

The Synthetic Gloves Market is expected to grow from USD 9.882 billion in 2025 to USD 17.719 billion in 2030, at a CAGR of 12.39%.

The synthetic gloves market is a specialized yet vital component of the broader personal protective equipment (PPE) industry. Synthetic gloves, primarily made from materials such as nitrile, vinyl, and neoprene, serve as a critical barrier against chemical, biological, and physical hazards. Their widespread adoption is driven by the need for a non-allergenic alternative to natural rubber latex gloves and the superior barrier protection they offer in a variety of high-risk applications. The market's trajectory is deeply intertwined with global health and safety imperatives, including the prevention of healthcare-associated infections and the adherence to strict occupational safety standards.

Synthetic Gloves Market Segment Analysis

- By Material: Nitrile

The nitrile segment is a dominant force in the synthetic gloves market, and its growth is driven by its functional superiority and the market's shift away from natural rubber latex. Nitrile gloves are made from a synthetic rubber that offers a compelling combination of properties: they are highly resistant to punctures, chemicals, and tears, and they do not contain the proteins found in natural latex that cause allergic reactions. This non-allergenic characteristic is a significant growth driver, particularly in the healthcare and food processing industries, where the risk of allergic reactions to latex has led to institutional policies mandating the use of alternatives. The demand for nitrile gloves is further propelled by their versatility; they are available in a variety of thicknesses and grades, suitable for applications ranging from delicate surgical procedures to heavy-duty industrial tasks involving hazardous chemicals. The continuous improvement in manufacturing processes has also led to thinner, more flexible nitrile gloves that offer a level of tactile sensitivity that was once exclusive to latex, thereby solidifying their position as the preferred choice for a wide range of end-users. - By End-User Industry: Healthcare

The healthcare industry is the single largest consumer and most influential growth driver for synthetic gloves. The market expansion is a direct result of several critical factors. First, the continuous need for infection control and patient safety in hospitals, clinics, and laboratories necessitates the use of disposable gloves for every patient interaction, procedure, and handling of contaminated materials. This practice is a cornerstone of modern medical hygiene and is enforced by stringent protocols. Second, the aforementioned allergic reactions to natural rubber latex have spurred a near-complete transition to synthetic gloves. Hospitals have adopted latex-free policies to protect both patients and healthcare workers, creating a sustained and non-negotiable demand for nitrile, vinyl, and synthetic polyisoprene gloves. Finally, the aging global population and the expansion of healthcare services in developing economies contribute to a growing volume of medical procedures and patient care, each requiring the use of protective gloves. This demographic shift and expansion of services ensure a consistent and increasing demand for synthetic gloves, making the healthcare segment the most critical in the market.

Synthetic Gloves Market Growth Drivers vs. Challenges

- Drivers:

The synthetic gloves market is propelled by a confluence of public health and regulatory factors that create a sustained and non-cyclical demand. The most significant driver is the widespread prevalence of Type I latex allergies. In the past, natural rubber latex gloves were the industry standard; however, the protein content in natural latex was found to trigger severe allergic reactions in both healthcare workers and patients. This documented health risk has resulted in a large-scale, mandated transition away from latex gloves in clinical settings and food handling environments. This shift directly increases the demand for synthetic alternatives, with nitrile gloves, in particular, becoming the preferred choice due to their superior barrier protection, puncture resistance, and non-allergenic properties.

A second major catalyst is the global focus on infection control and hygiene. The imperative to prevent healthcare-associated infections (HAIs) and the heightened public awareness of infectious disease transmission have amplified the demand for single-use, disposable gloves. Healthcare providers, laboratories, and food service establishments now have a greater commitment to using disposable gloves to prevent cross-contamination. This practice is supported by government bodies and public health organizations. The U.S. Centers for Disease Control and Prevention (CDC), for example, provides guidelines on hand hygiene and PPE use, reinforcing the importance of single-use gloves in clinical practice. The move to single-use products creates a consistent, high-volume demand for synthetic gloves as they are a low-cost, effective solution for preventing the spread of pathogens.

- Challenges:

The synthetic gloves market faces a dual set of challenges and opportunities. A primary challenge is the significant volatility of raw material prices. The key raw material for nitrile gloves is acrylonitrile-butadiene rubber (NBR) latex, a derivative of crude oil. Fluctuations in crude oil prices and the supply-demand dynamics of petrochemicals directly impact the cost of NBR latex, thereby affecting the manufacturing cost and, consequently, the final price of synthetic gloves. This price volatility can compress profit margins for manufacturers and create pricing instability for end-users, potentially leading to inventory hoarding or deferred purchasing.

Despite this challenge, the market presents notable opportunities. The necessity for higher-performance gloves is a key opportunity. End-users in specialized fields, such as chemical manufacturing, pharmaceuticals, and semiconductor fabrication, require gloves that offer specific characteristics, including enhanced chemical resistance, improved tactile sensitivity, and antistatic properties. Manufacturers who invest in research and development to create advanced glove formulations and designs can capture a premium segment of the market. Another significant opportunity lies in the development of more sustainable products. As global environmental concerns mount, there is a growing demand for synthetic gloves that are biodegradable or manufactured using more sustainable processes. Companies that can innovate in this area can differentiate their products and appeal to environmentally conscious customers, creating a new and profitable demand channel.

Synthetic Gloves Market Raw Material and Pricing Analysis

The synthetic gloves market's pricing is directly tied to the cost and availability of key raw materials. For nitrile gloves, the dominant segment, the primary raw material is nitrile butadiene rubber (NBR) latex. NBR is a synthetic polymer produced from acrylonitrile and butadiene monomers, both of which are petrochemical products. Therefore, the price of NBR latex is highly sensitive to the global price of crude oil. When oil prices rise, the cost of NBR latex typically follows, putting upward pressure on the manufacturing costs for nitrile gloves. Similarly, vinyl gloves are produced from polyvinyl chloride (PVC), and their pricing is influenced by the market for ethylene, a key feedstock.

This dependency on petrochemicals exposes manufacturers to significant market risk. They must navigate a complex landscape of commodity pricing, foreign exchange fluctuations, and global supply chain logistics. To mitigate these risks, manufacturers often engage in long-term raw material contracts, but this does not eliminate the inherent volatility. The cost of these raw materials directly affects the final pricing of the gloves, and any significant increase can be a constraint on demand, particularly for price-sensitive bulk buyers in industries like food service and general healthcare.

Synthetic Gloves Market Supply Chain Analysis

The global synthetic gloves supply chain is characterized by a high degree of geographical concentration, logistical complexity, and reliance on a few key production hubs. The vast majority of the world's synthetic gloves, particularly nitrile, are manufactured in Southeast Asia, with Malaysia and Thailand being the dominant producers. This concentration creates a logistical challenge, as a large volume of finished goods must be shipped globally to meet demand in North America, Europe, and other regions.

The supply chain begins with the procurement of raw materials, such as NBR latex, from various suppliers, often located in different countries. These materials are then transported to large-scale, highly automated manufacturing plants in Southeast Asia. From there, the finished gloves are packaged and shipped via sea freight to major distribution centers and ports in destination markets. The complexities and dependencies of this supply chain were exposed during recent global events, where logistical bottlenecks and port congestion led to significant delays and cost increases. Manufacturers must manage these complexities, including the potential for unforeseen disruptions and the need for a robust and resilient distribution network to ensure a consistent supply of products to their global customer base.

Synthetic Gloves Market Government Regulations:

Government regulations and standards are not passive observers; they are active growth drivers and shape the competitive landscape of the synthetic gloves market. These regulations enforce a baseline for product safety, quality, and performance, compelling manufacturers to adhere to strict guidelines.

- Jurisdiction: United States

Key Regulation / Agency: U.S. Food and Drug Administration (FDA) & OSHA

Market Impact Analysis: The FDA's ban on powdered surgeon's gloves and patient examination gloves, effective since January 2017, directly eliminated a segment of the market and created a mandatory shift to powder-free alternatives, including synthetic options. This ban was based on the documented health risks of cornstarch powder, which can lead to allergic reactions and respiratory issues. Additionally, OSHA's Personal Protective Equipment (PPE) standards, such as 29 CFR 1910.138, require employers to select and provide appropriate hand protection for workers exposed to hazards. This regulation creates a continuous and non-negotiable demand for gloves that meet specific safety criteria, a requirement often fulfilled by synthetic gloves. - Jurisdiction: European Union

Key Regulation / Agency: Medical Device Regulation (MDR) & Personal Protective Equipment (PPE) Regulation (EU) 2016/425

Market Impact Analysis: The EU's MDR, which came into full effect in May 2021, and the PPE Regulation represent a comprehensive overhaul of safety and quality standards. These regulations impose stricter requirements on medical devices and PPE, respectively, from manufacturing to post-market surveillance. They compel manufacturers to provide more extensive clinical and performance data, which directly increases the cost and complexity of product certification. This raises the barrier to entry for new players and drives demand for gloves from established manufacturers who can demonstrate compliance with these rigorous standards, ensuring a high-quality product for the EU market. - Jurisdiction: United Kingdom

Key Regulation / Agency: Personal Protective Equipment (Enforcement) Regulations 2018

Market Impact Analysis: Following its departure from the EU, the UK implemented its own regulations, assimilating the EU's PPE Regulation (EU) 2016/425 into UK law. This means that all PPE, including synthetic gloves, placed on the UK market must meet the essential health and safety requirements of this regulation. The UKCA marking is now required for certain products, in addition to or in place of the CE mark. This regulatory bifurcation creates a need for manufacturers to certify their products for both the EU and UK markets, increasing compliance costs and compelling them to maintain separate but equally rigorous standards, a dynamic that directly impacts the logistics and demand for compliant products.

Synthetic Gloves Market Regional Analysis

- US Market Analysis: The US market is a leading consumer of synthetic gloves, driven by a highly developed healthcare system, a strong emphasis on occupational safety, and a robust regulatory environment. The market is propelled by the widespread adoption of single-use nitrile gloves in hospitals and clinics to prevent the spread of infections. It benefits from a proactive approach to safety, with regulations from OSHA and the FDA compelling industries to use certified PPE. This creates a predictable and consistent demand. The growth of the food processing and manufacturing sectors, particularly in states with high industrial activity, also contributes to the market, as these industries require gloves for both hygiene and chemical protection. The US is a key destination for gloves from major manufacturers in Southeast Asia, and its market dynamics are often a bellwether for global trends.

- Brazil Market Analysis: Brazil's synthetic gloves market is a function of its developing healthcare infrastructure and growing industrial sectors. This market is primarily driven by the modernization of hospitals and clinics, coupled with increasing awareness of hygiene and safety standards. While the market is highly price-sensitive, the local regulatory framework, including the Brazilian Health Regulatory Agency (ANVISA), is increasingly aligned with international standards, which drives demand for higher-quality, certified products. The country's expanding food and beverage industry and its large manufacturing base also contribute significantly to the market. The demand for synthetic gloves in Brazil is expected to continue to grow as the country’s economy diversifies and its safety standards evolve.

- Germany Market Analysis: Germany's market for synthetic gloves is mature, sophisticated, and defined by a strong emphasis on quality, performance, and sustainability. The market is driven by a highly advanced healthcare system, a robust pharmaceutical industry, and precision-driven manufacturing sectors, particularly automotive and chemical. German companies have a strong preference for high-quality products that comply with stringent European regulations like the MDR and PPE Regulation. This creates a market that values product integrity and technical specifications over price alone. The market's expansion is also influenced by a growing focus on environmental responsibility, with a preference for manufacturers who can demonstrate sustainable production practices.

- Saudi Arabia Market Analysis: The synthetic gloves market in Saudi Arabia is a high-growth segment, fueled by significant government investment in healthcare, construction, and petrochemicals as part of the Vision 2030 economic diversification plan. The demand for synthetic gloves is a direct result of the construction of new hospitals, industrial facilities, and large-scale infrastructure projects. These new developments require a large volume of PPE that adheres to international safety standards, often from European or American certifiers. The market's growth is tied to the pace of these mega-projects and the country's commitment to modernizing its industrial base and improving public health standards.

- Japan Market Analysis: Japan's synthetic gloves market is characterized by a need for premium, high-quality, and highly specialized products. The market is dominated by its advanced manufacturing industries, particularly electronics and automotive, where cleanroom and high-precision applications are common. In the healthcare sector, a strong culture of hygiene and a dense network of medical facilities drive consistent demand for high-quality examination and surgical gloves. The market has a high adoption rate for advanced materials, such as synthetic polyisoprene, which offers a feel and performance similar to natural latex without the allergenic risks. The demand for synthetic gloves is also supported by Japan’s aging population and the associated expansion of geriatric care services.

Synthetic Gloves Market Competitive Landscape

The synthetic gloves market is highly competitive, with a few large, integrated manufacturers and numerous smaller regional players. Competition is based on scale, manufacturing efficiency, product quality, regulatory compliance, and a strong global distribution network.

- Ansell Limited: Ansell is a global leader in protection solutions and a major player in the synthetic gloves market. Its strategic positioning is based on a broad and diversified product portfolio that serves both healthcare and industrial sectors. Ansell's competitive advantage is its strong brand recognition, deep technical expertise, and a history of innovation. The company's key product lines, such as the Microflex® and TouchNTuff® series, are well-regarded for their performance and reliability. Ansell’s focus on high-performance gloves, including those with enhanced chemical resistance and tactile sensitivity, allows it to capture a premium segment of the market.

- Top Glove Corporation Bhd.: Top Glove is the world's largest manufacturer of gloves by volume and a dominant force in the synthetic gloves market. Its strategic positioning is to be a cost-efficient, high-volume producer. The company's competitive advantage lies in its massive production capacity and economies of scale, which allow it to offer a wide range of gloves at competitive prices. Top Glove focuses on continuous quality improvement and automation to maintain its cost leadership. Its global reach and extensive distribution network allow it to serve a vast customer base, from large healthcare systems to industrial distributors.

- Hartalega Holdings Berhad: Hartalega is a major glove manufacturer, renowned for its pioneering role in the development and production of nitrile gloves. The company's strategic positioning is focused on technological innovation and manufacturing excellence. Hartalega’s key competitive advantage is its proprietary manufacturing processes and its Next Generation Integrated Glove Manufacturing Complex (NGC), which is designed for high efficiency and automation. This allows the company to produce a high volume of high-quality nitrile gloves at a competitive cost. Hartalega's continuous investment in R&D and process optimization solidifies its position as a leading innovator in the nitrile glove segment.

- Recent Development: In July 2025, Top Glove Corporation Bhd. unveiled its next-generation chemotherapy nitrile glove, which is designed to provide enhanced protection against chemotherapy drugs and other hazardous substances. This new product launch represents a strategic move to penetrate the specialized and high-value medical market segment, demonstrating the company’s focus on product innovation and addressing specific end-user needs.

- Recent Development: In June 2025, Ansell announced the launch of its KIMTECH™ product line in Japan, as part of a broader expansion into the Asia-Pacific region. This development is a strategic move to grow the company's footprint in a key market and introduce its specialized product portfolio, which includes advanced synthetic gloves for cleanroom and laboratory applications, to a new customer base.

- Recent Development: In July 2024, Ansell announced a successful acquisition of the Kimberly-Clark Personal Protection Equipment (KBU) business. This acquisition strengthens Ansell’s position in the industrial and scientific sectors, adding a complementary portfolio of gloves and protective apparel and expanding its geographic reach. The integration of the KBU business enhances Ansell’s offering and strengthens its competitive position in a variety of end-user industries.

Synthetic Gloves Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 9.882 billion |

| Total Market Size in 2031 | USD 17.719 billion |

| Growth Rate | 12.39% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Material, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Synthetic Gloves Market Segmentation:

- By Material

- Vinyl

- Nitrile

- Neoprene

- Synthetic Polyisoprene

- Nylon

- Others

- By End-User Industry

- Healthcare

- Food and Beverages

- Automotive

- Chemical

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America