Report Overview

Coagulation Analyzer Market Size, Highlights

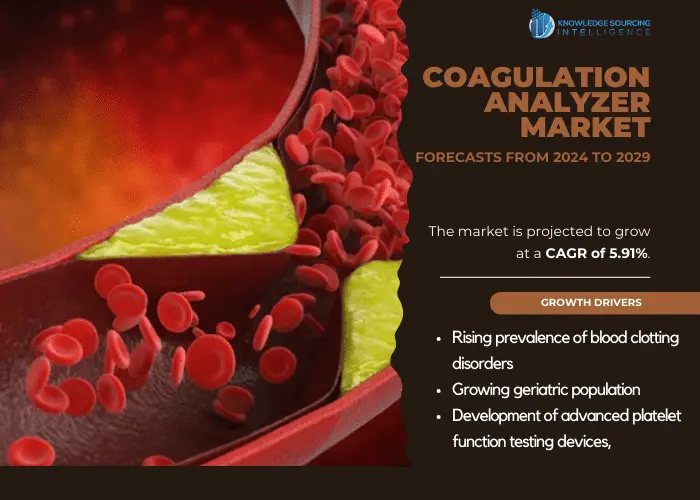

The coagulation analyzer market is projected to grow at a CAGR of 5.91% to reach US$5.144 billion in 2029 from US$3.441 billion in 2022.

The coagulation analyzer market refers to the global market for medical devices used to analyse the coagulation process, which is the body's natural ability to form blood clots. These devices are primarily used to diagnose and monitor conditions related to blood clotting disorders such as thrombophilia, hemophilia, and von Willebrand disease. Coagulation analyzers utilize various technologies, such as optical, mechanical, and electrochemical methods, to measure the coagulation parameters of a blood sample. The measured parameters include clotting time, prothrombin time, activated partial thromboplastin time, and international normalized ratio, among others.

The increasing prevalence of blood clotting disorders and the rising demand for coagulation analyzers for diagnostic purposes are the key factors driving the need for these solutions. Moreover, adopting automated coagulation analyzers and developing advanced coagulation assays are also contributing to the market growth. The coagulation analyzer market is highly competitive, with several large and small players catering to the wide demand. These players offer various coagulation analyzers and related products, such as reagents, controls, and consumables. Further, the development of advanced coagulation assays and the adoption of automated coagulation analyzers are expected to drive the growth of the coagulation analyzer market. Automated coagulation analyzers offer advantages over traditional manual methods, such as increased accuracy, efficiency, and speed. Moreover, developing advanced coagulation assays enables clinicians to accurately and efficiently diagnose and monitor blood clotting disorders.

Market Drivers

- The rising prevalence of blood clotting disorders is propelling the market growth.

The increasing prevalence of blood clotting disorders such as thrombophilia, hemophilia, and von Willebrand disease is a major driver of the coagulation analyzer market. According to the World Federation of Hemophilia, approximately 400,000 people worldwide have hemophilia, while von Willebrand disease affects around 1% of the global population. The rising incidence of these disorders is expected to drive the demand for coagulation analyzers for diagnostic purposes.

- The growing geriatric population has propelled the market expansion.

The aging population is another major driver of the coagulation analyzer market. As people age, their risk of developing blood clotting disorders increases. According to the United Nations, the global population aged 65 years and above is expected to reach 1.5 billion by 2050, up from 703 million in 2019, and the same source states, that the population aged 65years and above accounted for 10% of the global population, which signified a 2% increase over 2015’s percent share. This increase in the aging population is expected to drive the demand for coagulation analyzers during the projected period.

- Based on the test, the coagulation analyzer demand is expected to show significant growth

The global coagulation analyzer market for platelet function tests reveals significant growth prospects due to the increasing prevalence of bleeding disorders, the rising geriatric population, and the growing demand for point-of-care testing. Platelet function tests are used to evaluate the ability of platelets to form blood clots, making them an important diagnostic tool in identifying and managing various bleeding disorders. The market is expected to grow significantly due to the development of advanced platelet function testing devices, increasing healthcare expenditure, and the growing demand for early disease diagnosis. Using platelet function tests in research activities and clinical trials will also drive market growth.

North America accounted for a significant share of the global coagulation analyzer market.

Based on geography, the coagulation analyzer market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The North American coagulation analyzer market is expected to grow significantly during the projected period due to the increasing prevalence of coagulation disorders, rising healthcare expenditure, and growing demand for advanced coagulation testing. The United States is expected to be a significant market in this region due to major market players, well-established healthcare infrastructure, and favourable government initiatives.

Key Developments:

- In July 2021, Sysmex Europe launched two new automated blood coagulation analyzers, the CN-3500 and CN-6500, for medium- to large-scale hospitals and commercial labs in select countries in the EMEA region. These devices use the chemiluminescence enzyme immunoassay (CLEIA) methodology to measure various thrombosis and hemostasis-related parameters with a single device. They can measure molecular markers for blood coagulation, offering early-stage diagnosis and appropriate treatment for thrombotic diseases. The CN-3500 and CN-6500 aim to improve productivity, reliability, operability, and serviceability for healthcare settings by using an integrated approach to hemostasis testing that is less complex and time-consuming than the traditional method, which uses multiple instruments with different measurement principles.

- In October 2021, Trivitron Healthcare, a leading firm in medical devices, partnered with Diagon-Vanguard Diagnostics India to introduce a new series of Coagulation Analyzer products for the Indian diagnostics sector. The COAG Line comprises automated, semi-automated, and POC systems produced by Diagon Hungary to decrease bleeding risks during surgeries, determine the efficacy of hemostatic therapies and anticoagulant medicines, and improve patient management. These coagulation analyzers are widely known for their ability to test with high throughput and reagents, thereby increasing laboratory efficiency and turnaround time.

Coagulation Analyzer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2022 | US$3.441 billion |

| Market Size Value in 2029 | US$5.144 billion |

| Growth Rate | CAGR of 5.91% from 2022 to 2029 |

| Study Period |

2019 to 2029 |

| Historical Data |

2019 to 2022 |

| Base Year | 2023 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered | |

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Type

- Semi-Auto Coagulation Analyzer

- Fully-Auto Coagulation Analyzer

- Other

- By Test

- Fibrinogen Testing

- D-Dimer Testing

- Platelet Function Test

- Others

- By Technology

- Optical Technology

- Mechanical Technology

- Electrochemical Technology

- Others

- By End User

- Hospitals

- Diagnostic Centers

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America