Report Overview

Cardiac Marker Analyzer Market Highlights

Cardiac Marker Analyzer Market Size:

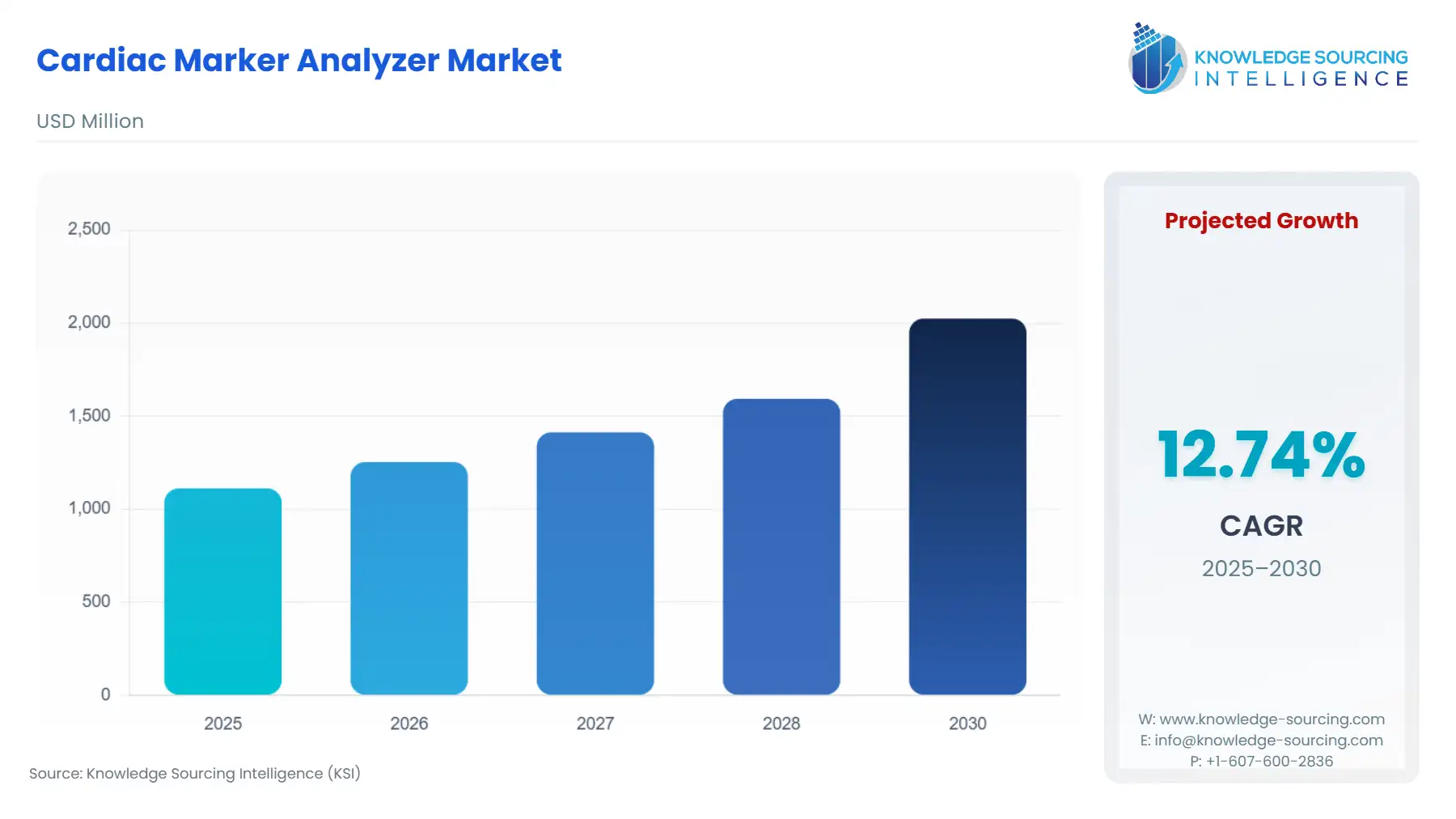

The cardiac marker analyzer market is expected to grow from USD 1.112 billion in 2025 to USD 2.025 billion in 2030, at a CAGR of 12.74%.

The Cardiac Marker Analyzer Market encompasses the specialized in vitro diagnostic instruments used to quantify biomarkers—primarily proteins and hormones—released into the bloodstream due to myocardial injury or stress. These analyzers are mission-critical tools in the clinical setting, serving the dual function of rapid triage for acute coronary syndromes (ACS) and long-term risk stratification for conditions like heart failure. The market's foundational drivers are the persistent, high global prevalence of cardiovascular diseases and the continuous innovation in immunoassay technology, which mandates faster, more sensitive, and highly reproducible diagnostic results. The shift from traditional laboratory-based testing toward decentralized, near-patient analysis is fundamentally reshaping the product landscape, favoring compact, automated systems that can deliver actionable data within the critical "door-to-decision" window in acute care environments.

Cardiac Marker Analyzer Market Analysis

Growth Drivers

The escalating global prevalence of cardiovascular diseases (CVDs) and the expanding geriatric population, which exhibits a higher incidence of cardiac events, create a fundamental and inelastic demand for diagnostic tools. The clinical adoption of sophisticated high-sensitivity troponin assays directly fuels demand for analyzer platforms capable of meeting their enhanced precision and lower limit of detection requirements, compelling labs to upgrade equipment. Moreover, contemporary clinical guidelines increasingly promote rapid triage protocols (e.g., the 0/1-hour algorithm), which mandates the deployment of point-of-care (POC) analyzers in acute care settings to deliver results within minutes, dramatically increasing the installed base demand.

Challenges and Opportunities

A principal challenge is the high capital expenditure required for sophisticated, centralized immunoassay analyzers, coupled with the need for highly skilled technical staff, which constrains adoption in low-resource settings and smaller clinics. This pricing barrier suppresses demand outside major hospital networks. The most compelling opportunity lies in expanding the analyzer's utility beyond acute care to chronic disease management. Integrating analyzers with digital health solutions and electronic medical records allows for the longitudinal monitoring of heart failure biomarkers (e.g., NT-proBNP) in ambulatory and decentralized settings, opening new demand pathways in preventive and post-acute care markets.

Raw Material and Pricing Analysis

The analyzers themselves are complex physical products that depend on critical components, including specialized optics, microfluidic systems, and high-precision electronic sensors. The companion reagents, such as monoclonal antibodies and chemiluminescent substrates used in the assays, constitute a continuous revenue stream and are the primary cost-of-use variable. Supply chain volatility for key electronic components (semiconductors, microprocessors) can increase manufacturing costs of the analyzer hardware. Pricing strategies often follow a razor-and-blade model: the analyzer unit is sold or leased at a competitive price to secure the long-term, high-margin revenue from the proprietary, single-use reagent cartridges and assay kits.

Supply Chain Analysis

The supply chain is vertically integrated and globally dispersed, with key production hubs for sophisticated immunoassay and clinical chemistry analyzers centered in North America and Western Europe, where major industry players are domiciled. The critical dependency for the consumable reagents, including the specialized antibodies and immunoassay components, often originates from highly specialized biotech clusters globally. Logistical complexities arise from the necessity of cold-chain management for sensitive biological reagents and cartridges. Geopolitical concentration in Asian manufacturing hubs for certain electronic sub-components also presents a vulnerability, requiring strategic dual-sourcing to ensure consistent global analyzer supply.

Cardiac Marker Analyzer Market Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | Food and Drug Administration (FDA) Premarket Approval (PMA) / 510(k) Clearance | Rigorous clearance process, particularly for high-sensitivity cardiac troponin assays, drives standardization and enhances clinical confidence, directly increasing the credibility and, thus, the demand for FDA-cleared analyzer systems. |

European Union | In Vitro Diagnostic Regulation (IVDR) | IVDR imposes stricter performance, safety, and clinical evidence requirements for in vitro diagnostic devices. This significantly increases compliance and development costs for manufacturers, potentially leading to the withdrawal of some older/less validated assays and funneling demand toward newly certified, high-standard analyzers. |

China | National Medical Products Administration (NMPA) Device Registration | NMPA requires domestic clinical trials and manufacturing registration. This often favors local manufacturers due to simplified processes, creating market entry barriers for foreign analyzer vendors but simultaneously driving localized manufacturing and increasing domestic product supply. |

Cardiac Marker Analyzer Market Segment Analysis

By Cardiac Marker: Troponin

The Troponin segment, encompassing both Troponin I (TnI) and Troponin T (TnT), commands the largest market share due to its established status as the gold standard biomarker for diagnosing myocardial injury. The key growth driver is its unmatched clinical specificity and sensitivity, particularly with the advent of high-sensitivity assays, which can detect minute changes in troponin concentration much earlier than older generations. This technological leap has revolutionized emergency department triage by enabling rapid rule-out protocols (e.g., the 0/1-hour or 0/2-hour algorithms), which directly translates to a non-negotiable demand for high-performance analyzers capable of accurately quantifying levels in the picogram per milliliter (pg/mL) range. Furthermore, guidelines-driven necessity for serial sampling over hours ensures sustained, high-volume reagent consumption for analyzer systems in high-acuity care settings.

By End-User: Hospitals and Clinics

The Hospitals and Clinics segment represents the single largest consumer of cardiac marker analyzers, driven by the volume of patients presenting with acute chest pain and suspected cardiac events in Emergency Departments (EDs) and Critical Care Units. The core growth driver is the legal and clinical imperative for immediate, high-stakes decision-making. Hospitals require a blend of large, highly automated central lab analyzers (for high throughput and comprehensive testing) and compact, rapid POC analyzers (for immediate bedside triage). The demand is fundamentally linked to hospital budgets and infrastructure investment cycles, focusing on analyzer systems that offer seamless integration with Laboratory Information Systems (LIS) and Electronic Health Records (EHRs), streamlining workflow and minimizing the potential for human error in urgent care protocols.

Cardiac Marker Analyzer Market Geographical Analysis

US Market Analysis

The US market is distinguished by high technology adoption, robust reimbursement structures, and the early and extensive penetration of high-sensitivity cardiac troponin assays. Demand is fundamentally driven by clinical guidelines promoting rapid and accurate diagnosis to mitigate substantial institutional liability risks associated with missed or delayed heart attack diagnoses. The shift to value-based care also drives demand for POC analyzers, as hospitals seek to reduce ED overcrowding and lower the length of stay for low-risk patients by implementing rapid rule-out protocols, increasing the total installed base across hospitals and satellite clinics.

Brazil Market Analysis

The Brazilian market exhibits latent demand propelled by the high burden of cardiovascular disease and growing access to private healthcare. Local demand is concentrated in major urban centers and is sensitive to the procurement budgets of both public and private hospital groups. The primary growth driver is the need for cost-effective, durable analyzer platforms. Adoption is currently focused on established immunoassay technologies, with a slower, cautious transition to advanced high-sensitivity assays, often due to stringent import taxes and complex local regulatory approvals for new medical devices and reagents.

German Market Analysis

Germany operates a sophisticated and highly decentralized healthcare system, driving strong demand for advanced analyzer technology in both central laboratories and decentralized hospital units. Demand is accelerated by high standards for quality assurance and an emphasis on clinical efficiency. The key local factor is the country's supportive regulatory environment and the willingness of public health insurers to cover advanced diagnostic tests, ensuring that the latest generation of high-sensitivity assays and their corresponding analyzer platforms are rapidly adopted across the system.

Saudi Arabia Market Analysis

The market in Saudi Arabia is characterized by significant, centrally-funded investment in modernizing healthcare infrastructure as part of the Vision 2030 economic diversification plan. Local demand is driven by the construction of new specialized cardiac centers and a high prevalence of metabolic syndrome and CVD. The government's purchasing power favors the acquisition of the latest generation of fully automated, high-throughput analyzers from global market leaders, prioritizing speed, standardization, and data integration capability across newly established hospital networks.

China Market Analysis

China is a massive, high-growth market where demand is rapidly expanding due to explosive urbanization, lifestyle changes leading to increased CVD incidence, and the expansion of national health coverage. The key growth driver is the government's ambitious plan to build out and standardize tertiary and secondary healthcare facilities nationwide. This creates high-volume demand, especially for cost-effective, locally manufactured analyzer systems. Foreign companies often form joint ventures or localize production to navigate NMPA regulations, ensuring a large-scale supply of both sophisticated and basic analyzer units.

Cardiac Marker Analyzer Market Competitive Environment and Analysis

The Cardiac Marker Analyzer market features high barriers to entry, characterized by intense intellectual property protection for proprietary assays, extensive regulatory requirements for clinical validation, and the necessity of massive, established sales and service networks. Competition centers on the analytical performance of the assays (e.g., sensitivity, time-to-result), the automation capabilities of the analyzer platform (throughput, connectivity), and the total cost of ownership (TCO) for hospitals. Major players leverage their installed base of central laboratory systems to secure long-term reagent supply contracts. The competitive edge is increasingly found in the development of multi-marker panels and comprehensive digital solutions that integrate diagnostic results into clinical decision support systems.

F. Hoffman–La Roche Ltd.

F. Hoffman–La Roche Ltd. maintains a dominant market position, particularly in the Troponin T segment, leveraging its legacy as an innovation pioneer. The company's strategic positioning revolves around its integrated Cobas family of immunoassay analyzers and its gold-standard Elecsys Troponin T high-sensitivity assays. Roche's commitment to advancing diagnostic accuracy is highlighted by the development of the Elecsys Troponin T hs Gen 6 test, which delivers improved sensitivity and accuracy, compelling existing and new laboratory customers to upgrade their Cobas platforms to run the latest, most clinically relevant assays, thereby sustaining the analyzer demand.

Abbott

Abbott is a critical competitor, strategically positioned with a comprehensive cardiac diagnostic portfolio that spans both central laboratory and point-of-care (POC) testing. The company's core laboratory offering includes the high-throughput ARCHITECT ci-series analyzers paired with their STAT High Sensitive Troponin-I assay, ensuring rapid, reliable results for high-volume central labs. Concurrently, Abbott leads the POC segment with its i-STAT 1 System and the recently FDA-cleared i-STAT hs-TnI cartridge, which directly drives demand in Emergency Departments and remote settings by providing lab-quality results in approximately 15 minutes, enabling streamlined patient management.

Siemens Healthcare Private Limited

Siemens Healthineers is strategically focused on automation and system integration within the central laboratory environment. The company's key product is the Atellica CI Analyzer for immunoassay and clinical chemistry testing, which is designed to integrate automation and significantly reduce manual workflow steps in high-volume laboratory settings. Siemens Healthineers utilizes its established customer base for its Stratus systems in the POC segment, while the Atellica platform drives demand in larger, sophisticated laboratories by offering superior throughput and integration capabilities for a wide menu of cardiac markers, including proprietary high-sensitivity Troponin I assays.

Cardiac Marker Analyzer Market Developments

September 2025: Roche announced the primary results of the TSIX Study Program, evaluating its sixth-generation high-sensitivity Troponin T test. This launch and subsequent CE Mark approval drive demand for its Cobas analyzers capable of running this next-generation, high-accuracy assay.

March 2025: Radiometer expanded its clinical intelligence software suite with an AI-enabled tool to improve triage in overcrowded Emergency Departments. This launch enhances the utility of their ABL blood gas and AQT90 FLEX analyzers by integrating diagnostics with decision support.

January 2025: The FDA cleared the i-STAT hs-TnI cartridge for use with the i-STAT 1 System. This expansion of the i-STAT menu to include a high-sensitivity troponin I assay directly increases the market utility and demand for Abbott's compact, rapid POC analyzer platform in US hospitals.

Cardiac Market Analyzer Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.112 billion |

| Total Market Size in 2030 | USD 2.025 billion |

| Forecast Unit | Billion |

| Growth Rate | 12.74% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Cardiac Marker, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cardiac Market Analyzer Market Segments:

By Cardiac Marker

Troponin

Creatine Kinase

Myoglobin

Others

By End-User

Hospitals and Clinics

Laboratories

Ambulatory Surgical Centers

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others