Report Overview

Community Cloud Market Size, Highlights

Community Cloud Market Size:

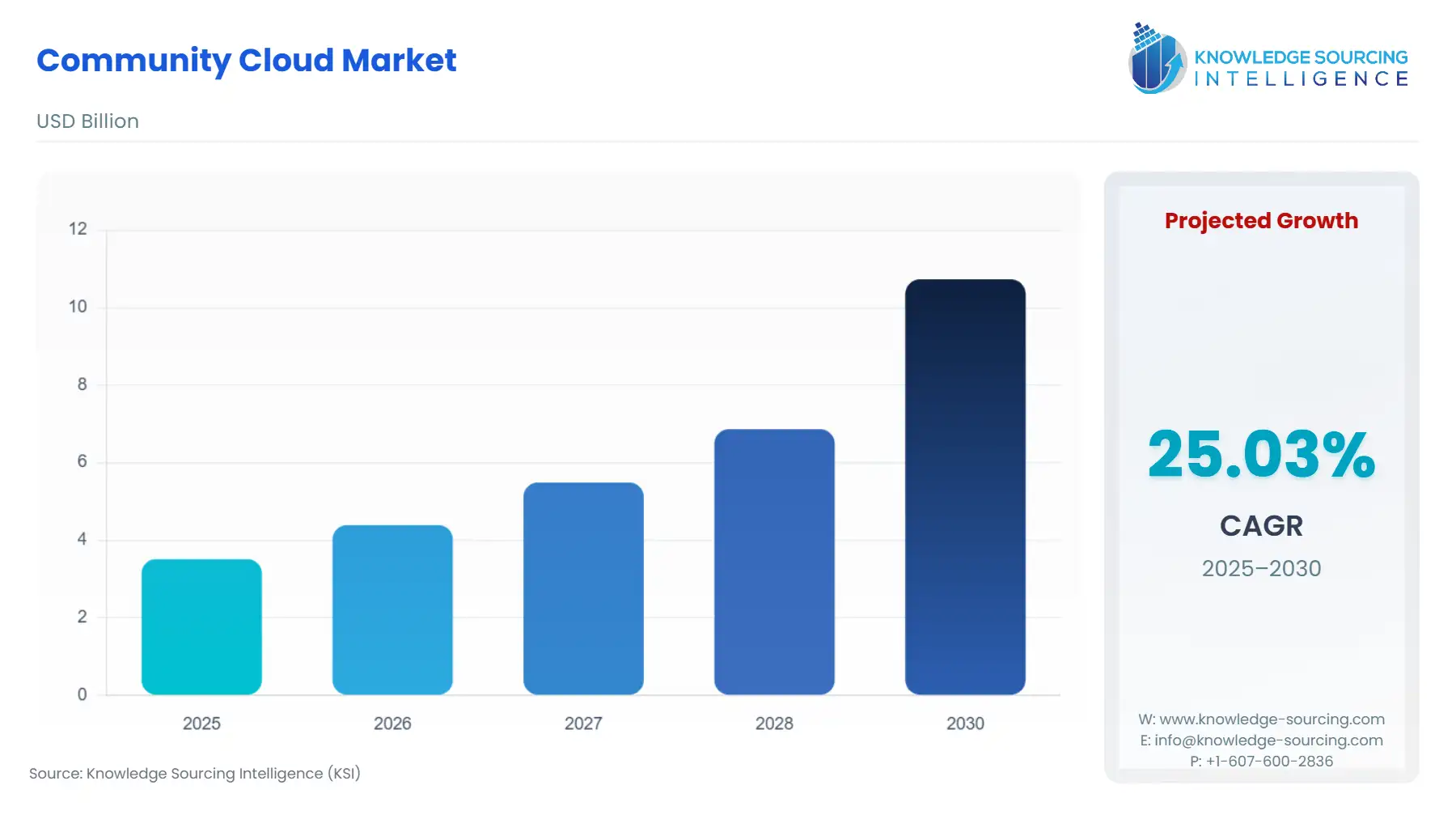

Community Cloud Market is projected to grow at a CAGR of 25.03% to be valued at US$10.731 billion in 2030 from US$3.512 billion in 2025.

The Community Cloud Market occupies a distinct and strategically critical position within the broader cloud ecosystem, defined by its specialized infrastructure design and strict adherence to sector-specific requirements. Unlike the generic scalability of Public Clouds or the exclusive control of Private Clouds, the Community Cloud model is fundamentally a shared infrastructure provisioned for a specific, exclusive community of organizations—such as government agencies, financial institutions, or healthcare providers—that share common compliance objectives, security requirements, and operational concerns. This highly segmented market's valuation is driven not by general IT expenditure but by non-discretionary regulatory and mission-critical imperatives. The demand trajectory is propelled by the necessity for secure, cost-effective digital collaboration and the secure deployment of advanced technologies like Artificial Intelligence (AI) and High-Performance Computing (HPC) within validated, compliant environments.

Cloud technology has grown in prominence over recent years, leading to a significant increase in its adoption across various business sectors. For optimal performance and services, industries manage and depend on vast amounts of data. The community cloud concept is an emerging trend that many businesses are embracing. Additionally, several government agencies worldwide are investing heavily in implementing these technologies. For instance, organizations such as the Australian Taxation Office (ATO) and the General Services Administration (GSA) have already begun investing in and utilizing community cloud technology. As a result, the adoption of community cloud technology is expected to rise in the coming years.

Cloud computing technologies form the foundation of community cloud systems. The rising global demand for unified regulatory and network security standards is a key driver of this market’s growth. Because the community cloud technology model is built on a shared cost structure, it offers significant potential for small and medium-sized enterprises (SMEs), such as those in healthcare and clinical sectors. To achieve profitability and economies of scale quickly, SMEs often prefer the community cloud model over traditional cloud approaches.

The market for community cloud technology is propelled by a global need for high-performance, low-latency infrastructure. Additional drivers include achieving economies of scale through a shared cost model, addressing shared concerns for data redundancy, security, and compliance, and a push for green computing to reduce server numbers. However, security concerns over business data in a shared environment pose a challenge to market expansion. Government initiatives promoting community cloud adoption in commercial and public sectors, along with investments in cloud technology by research and education sectors, are expected to drive the market forward in the coming years.

Community Cloud Market Growth Drivers:

- Cost-effectiveness associated with adoption is to drive market growth.

The rising demand for cloud-based services and the need to reduce infrastructure costs in industries such as finance, government, education, gaming, and healthcare have spurred the adoption of this deployment model. Community cloud not only lowers the total cost of ownership (TCO) by sharing infrastructure and service costs but also enhances productivity.

- Favorable government initiatives to contribute to market expansion.

Governments worldwide are investing in community cloud solutions that meet regulatory requirements, fueling market growth in the coming years. The processing systems of government agencies that conduct transactions with one another can leverage shared infrastructure. This setup reduces costs for tenants and minimizes data traffic. In the United States, federal agencies benefit from these advantages, particularly those with similar security, audit, and privacy needs. The community-based nature of this platform instills confidence in users to invest in it for their projects.

- Logical segmentation and its growing need to contribute to market development.

Multiple organizations may require a system or application hosted on cloud services. A cloud provider can enable several users to access the same environment while logically segmenting their sessions. This eliminates the need for separate servers for each client with identical objectives. Instead of relying on public cloud services, agencies can use this method to test applications with stringent security requirements. Given the regulatory framework of community clouds, this presents an opportunity to explore some features of public cloud services.

- The flexibility and scalability parameters to increase the market size.

Community cloud ensures compatibility among its users, allowing them to adjust attributes to meet their specific needs. It also enables businesses to connect with remote workers and supports the use of various devices, such as smartphones and tablets. Consequently, this type of cloud service is highly adaptable to user requirements. Comprising a community of users, it is scalable in terms of physical resources, services, and personnel. It accommodates demand growth by simply expanding the user base.

Community Cloud Market Key Restraints:

- Security considerations are to restrain market growth.

In a community cloud, multiple organizations share access to and management of the infrastructure, necessitating specific security configurations. Data is accessible to all authorized community members, requiring businesses to ensure confidential information remains protected. Compliance rules and regulations within a community cloud can be complex, as one organization’s systems may need to align with the standards of others in the community.

- Supply Chain Analysis

The supply chain for the Community Cloud Market is dominated by the hyper-scale Cloud Service Providers (CSPs) who act as the core infrastructure and service providers. Production is centered in major data center hubs—Northern Virginia (US), Frankfurt (Germany), and Singapore—but is geographically segmented by data sovereignty laws. Logistical complexities revolve around establishing separate, physically isolated or cryptographically segregated cloud regions (e.g., AWS GovCloud or Azure Government) to meet residency and security mandates. Key dependencies include hardware manufacturers (e.g., specialized server and networking components) and the crucial partnerships with independent security auditors (e.g., FedRAMP Third-Party Assessment Organizations) who provide the non-discretionary accreditation necessary for market entry.

Community Cloud Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FedRAMP (Federal Risk and Authorization Management Program) |

Serves as the mandatory baseline security standard for all cloud services utilized by US Federal agencies. This requirement explicitly creates demand for Community Clouds (like Azure Government) that have achieved the necessary high-impact authorization levels, effectively partitioning the market. |

|

United States |

HIPAA (Health Insurance Portability and Accountability Act) |

Mandates strict security and privacy standards for Protected Health Information (PHI). This drives the entire Healthcare & Life Sciences segment to demand Community Cloud solutions that offer Business Associate Agreements (BAA) and technical controls compliant with the HIPAA Security Rule. |

|

European Union (EU) |

GDPR (General Data Protection Regulation) |

Enforces strict data sovereignty and residency rules for personal data of EU citizens. This regulation forces CSPs to build and certify data centers within EU borders, creating market demand for localized, EU-based Community Cloud offerings that guarantee data residency. |

Community Cloud Market Segment Analysis

- By Deployment Model: Private Community Cloud

The Private Community Cloud segment is primarily driven by organizations within the Defense & Security and Finance & Banking sectors that require the benefits of shared, specialized infrastructure while maintaining dedicated, isolated compute and storage environments. The core growth driver is the need for maximum security assurance and granular control over the underlying infrastructure, exceeding what is typically offered by public-shared models. By establishing a cloud exclusively for a defined group (e.g., a consortium of banks or defense contractors), entities can jointly fund and operate infrastructure built to the most stringent security benchmarks (e.g., DoD Impact Level 5), directly addressing high-stakes data integrity and national security requirements. This model satisfies the imperative for shared standards without sacrificing the autonomy of a private network.

- By Industry Vertical: Government & Public Sector

The Government & Public Sector vertical is the foundational pillar of the Community Cloud Market, fundamentally driven by the national security imperative and legal mandates for data separation and compliance. Federal agencies require platforms that have achieved rigorous security authorizations, such as FedRAMP High and Department of Defense (DoD) Impact Levels 4, 5, and 6. This non-discretionary compliance need compels agencies to procure services from certified Community Clouds (e.g., AWS GovCloud, Azure Government). Furthermore, the need to securely leverage cutting-edge capabilities like AI for mission-critical tasks (e.g., intelligence processing, citizen services) escalates the demand for Specialized Community Solutions that embed these advanced tools within a validated, secure perimeter.

Community Cloud Market Geographical Analysis

- US Market Analysis

The US market is the global leader, defined by the immense and non-negotiable demand from federal and state agencies under the Government & Public Sector vertical. This growth is meticulously structured by the FedRAMP framework and DoD Impact Level requirements, which compel hyperscale providers to invest heavily in physically and logically segregated Community Clouds. The market’s demand for Private Community Cloud is further supported by the Healthcare & Life Sciences sector, where HIPAA compliance dictates the use of secure environments for patient data, creating a massive, regulated market for compliant cloud services.

- Brazil Market Analysis

The Brazilian Community Cloud market is nascent but accelerating, driven primarily by the need for data residency and enhanced security within the Finance & Banking sector. Local regulations governing data protection and cross-border data transfer (similar to GDPR principles) create a powerful driver for localized Community Cloud solutions. The demand is further fueled by the need for secure, reliable infrastructure to support public sector digitalization initiatives, although adoption rates are generally slower than in North America due to investment prioritization.

- Germany Market Analysis

The German market exhibits strong demand for Community Cloud, driven by the rigorous implementation of GDPR and a national focus on data sovereignty, particularly in the Finance & Banking and Manufacturing & Supply Chain verticals. German businesses mandate that cloud operations and data storage remain within EU boundaries, driving demand for locally-operated Private Community Cloud offerings that address the digital sovereignty concerns. Cloud providers must demonstrate clear separation from non-EU jurisdictions and adhere to BSI (Federal Office for Information Security) guidelines to secure local demand.

- UAE Market Analysis

The UAE Community Cloud market is institutionally driven, fueled by large-scale smart government initiatives and national digital transformation mandates (e.g., UAE Vision 2021). Government & Public Sector entities, along with the burgeoning Finance & Banking sector in free zones, require highly secure, locally hosted cloud infrastructure to meet data localization laws and ensure business continuity. The demand is specifically for Hybrid Community Cloud models that allow sensitive data to reside locally while utilizing global public cloud capacity for non-critical workloads.

- Japan Market Analysis

The Japanese market is dominated by the Finance & Banking and Healthcare & Life Sciences sectors, characterized by a preference for exceptionally high service reliability and data quality assurance. Financial regulators impose strict security and auditability requirements for IT systems, creating a stable demand for Private Community Cloud environments tailored to banking standards. The need for collaborative research, particularly in the Education & Research sector, also drives demand for secure, shared infrastructure that enables joint projects while maintaining the non-public nature of the data.

Community Cloud Market Competitive Environment and Analysis

The Community Cloud Market is a high-stakes arena dominated by a few global hyper-scale CSPs who have the requisite capital and technical depth to achieve and maintain stringent regulatory accreditations. Competition centers on three core vectors: the breadth of regulatory compliance (e.g., meeting all DoD impact levels simultaneously), the integration of advanced technologies (e.g., AI/ML services within the compliant perimeter), and the depth of the partner ecosystem. The high barrier to entry ensures that smaller, specialized providers often partner with the larger players to deliver niche Customizable Community Frameworks. Success hinges on becoming the certified, trusted foundation for mission-critical government and industry workloads.

- Microsoft Corporation

Microsoft's strategy in the Community Cloud market is anchored by Microsoft Azure Government, which operates dedicated, physically isolated cloud environments designed to meet the rigorous standards of US government agencies. Microsoft drives demand by continuously expanding the security authorization of its key services: a pivotal development was the Azure OpenAI Service authorization for U.S. Government data classification levels in September 2024, enabling federal agencies to securely adopt generative AI within their compliant environment. This proactive alignment of cutting-edge technology with high-level security clearances reinforces Microsoft’s competitive position as a leading provider of Public-Shared Community Cloud for the public sector.

- Amazon Web Services (AWS)

AWS strategically commands a significant share of the Community Cloud market with AWS GovCloud (US), which offers isolated regions for sensitive data and regulated workloads. AWS's competitive advantage lies in its deep history of public sector accreditations, being the first cloud provider to launch infrastructure specifically for government security requirements. A key strategic move was the November 2025 announcement of an investment up to $50 billion to expand AI and supercomputing capacity across its GovCloud and classified regions, directly addressing the massive, increasing AI and HPC demand from the Defense & Security segment and reinforcing their foundational capacity.

- Salesforce, Inc.

Salesforce focuses on providing Software-as-a-Service (SaaS) on community cloud infrastructure, primarily targeting the Government & Public Sector with its Government Cloud Plus and Government Cloud Premium offerings. Salesforce’s strategy centers on mission enablement via its low-code/no-code application development platform within a highly secure, compliant environment. A major product launch was the rollout of Government Cloud Premium with Top Secret accreditation in October 2024. This capability allows intelligence agencies to quickly build secure, user-friendly applications for mission-critical operations, driving demand for Specialized Community Solutions that require a certified SaaS layer.

Community Cloud Market Developments

- November 2025: Amazon announced an investment of up to $50 billion to expand AI and supercomputing capacity across AWS GovCloud and classified regions starting in 2026. This capacity addition aims to meet the escalating, mission-critical AI and HPC demands from U.S. government agencies.

- October 2024: Salesforce rolled out Government Cloud Premium, its new cloud environment with Top Secret accreditation, hosted on AWS’s classified infrastructure. This product launch directly addresses the highest security needs of the U.S. intelligence community.

- September 2024: Microsoft announced that Azure OpenAI Service received authorization for use across U.S. Government data classification levels, including DoD IL4 and IL5. This product launch expands the use of Generative AI within the secure Public-Shared Community Cloud environment.

Community Cloud Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Community Cloud Market Size in 2025 | US$3.512 billion |

| Community Cloud Market Size in 2030 | US$10.731 billion |

| Growth Rate | CAGR of 25.03% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Community Cloud Market |

|

| Customization Scope | Free report customization with purchase |

Community Cloud Market Segmentation

BY PRODUCT TYPE

- General Community Platforms

- Specialized Community Solutions

- Customizable Community Frameworks

BY DEPLOYMENT MODEL

- Private Community Cloud

- Hybrid Community Cloud

- Public-Shared Community Cloud

BY INDUSTRY VERTICAL

- Government & Public Sector

- Healthcare & Life Sciences

- Education & Research

- Finance & Banking

- Defense & Security

- Manufacturing & Supply Chain

- Others

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others