Report Overview

Computer-Aided Drug Discovery Market Highlights

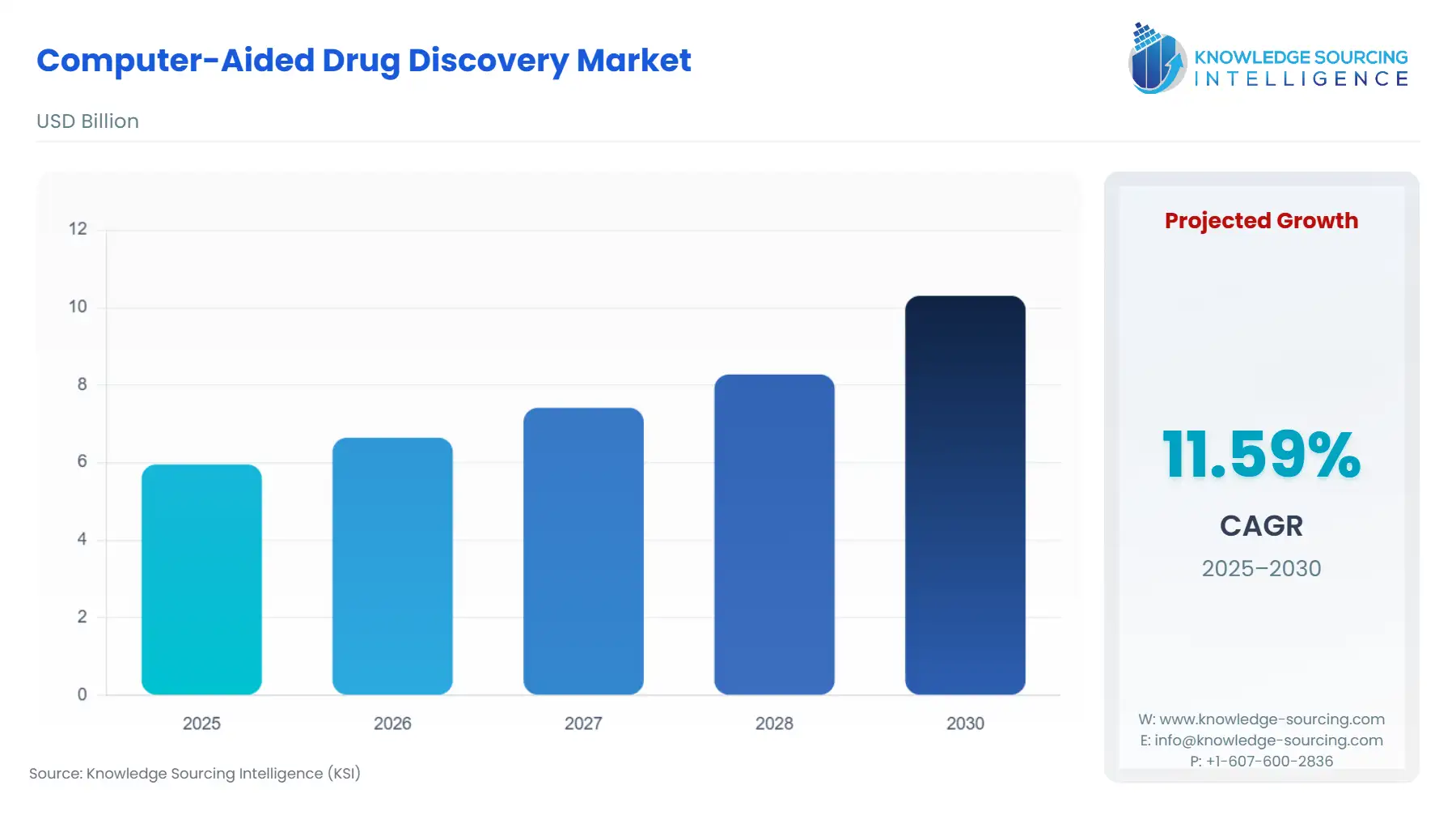

The computer-aided drug discovery market is projected to grow at a CAGR of 11.59% over the forecast period, increasing from US$5.955 billion in 2025 to US$10.306 billion by 2030.

Drug discovery is a time-consuming process, but digital transformation is paving the way for improved efficiency and efficacy in the pharmaceutical industry. Computer-aided drug discovery, automation, and digitization have become key in the industry. It is used to improve the quality, decrease the cost, and reduce the time limit. With the changing scenarios and shortage of resource dexterities, automation and digitization have become key drivers for business growth.

Further, the application theory of quantum mechanics to computer-aided drug discovery enabled the in-silico modeling of biological and chemical systems with high accuracy and, therefore, has the potential to help identify novel drug candidates.

Increased cases of chronic diseases have propelled the need for rapid drug development, boosting the computer-aided drug discovery market growth in the forecast period. According to the National Center for Health Statistics, 1,958,310 new cancer cases and 609,820 cancer deaths are projected in the United States In 2023. These numbers indicate the severity of the situation.

What are the drivers of the Computer-aided Drug Discovery Market?

- Expanding use of artificial intelligence applications in the drug discovery process

The discovery of new drugs is an immensely complex and time-consuming process. Identifying the right compound that can bind to specific disease-related targets requires screening large numbers of molecules. AI is revolutionizing the way potential compounds are being discovered. Using technologies such as knowledge graphs, in-silico target identification, and target ranking can bring treatments to patients at faster and higher precision.

In December 2023, Merck launched its AIDDISON drug discovery software, the first software-as-a-service platform that bridges the gap between virtual molecule design and real-world manufacturability through SynthiaTM retrosynthesis software application programming interface (API) integration. It combined generative AI, machine learning, and computer-aided drug design to increase the success rate of new drugs.

Trained on more than two decades of validated datasets from pharmaceutical R&D, AIDDISON software identifies compounds from over 60 billion possibilities. The identification is based on the key properties of a successful drug, such as non-toxicity, solubility, and stability in the body.

Artificial Intelligence and machine learning models like AIDDISON software increase the success rate of delivering new patient therapies. AI can potentially cut huge amounts of costs for the drug discovery process and can save up to 70% of the time and costs for drug discovery in pharmaceutical companies.

- Increased incidences of NCDs (non-communicable diseases) and undiagnosed diseases are driving the market

According to the WHO, noncommunicable diseases (NCDs) kill over 41 million people each year, equivalent to 74% of all deaths globally. Most deaths are accounted for in low- and middle-income countries. There were multiple factors rapidly causing the rise of these diseases, like rapid unplanned urbanization, globalization of unhealthy lifestyles, and population aging.

Unhealthy diets and a lack of physical activity cause increased blood pressure, blood glucose, elevated blood lipids, and obesity. These are called metabolic risk factors and can lead to NCD, resulting in premature deaths. Government and private organizations are coming together to develop different drugs and treatments.

For instance, Aragen Life Sciences and FAR Biotech collaborated to advance preclinical programs in neurodegeneration in May 2023. As part of the collaboration, Aragen would deploy its experimental discovery platform to help FAR advance its small molecule program toward developing neurodegeneration drugs. The computational approach in this collaboration can deliver novel molecules that can give treatment for overcoming Alzheimer’s, Parkinson’s, and other related diseases.

What are the key geographical trends shaping the Computer-aided Drug Discovery Market?

By geography, the computer-aided drug discovery market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth due to the growing population and rapid increase in chronic diseases. For example, it was estimated that about 4,824,700 new cancer cases and 2,574,200 new cancer deaths occurred in China in 2022. This made the development of personalized medicine crucial. The advancement of personalized medicine can be possible with computer-aided drug discovery technology.

North America is expected to have a significant share of the computer-aided drug discovery market, as the leading players such as Bioduro-Sundia, BOC Sciences, Aris Pharmaceuticals, Inc., and Schrödinger, Inc., among others, are based in the United States.

Key developments in the Computer-aided Drug Discovery Market:

The market leaders for computer-aided drug discovery are Aragen Life Sciences Pvt. Ltd., Bioduro-Sundia, BOC Sciences, Aris Pharmaceuticals, Inc., AstraZeneca, Schrödinger, Inc., Bayer AG, Charles River Laboratories, Albany Molecular Research Inc. and Insilico Medicine. The key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

Computer-aided Drug Discovery Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Computer-Aided Drug Discovery Market Size in 2025 | US$5.955 billion |

| Computer-Aided Drug Discovery Market Size in 2030 | US$10.306 billion |

| Growth Rate | CAGR of 11.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Computer-Aided Drug Discovery Market |

|

| Customization Scope | Free report customization with purchase |

Computer-Aided Drug Discovery Market is analyzed into the following segments:

- By Type

- Structure-Based Drug Design

- Ligand-Based Drug Design

- Sequence-Based Approaches

- By Therapeutic Area

- Oncology

- Neurology

- Cardiovascular Disease

- Respiratory Disease

- Others

- By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Research Laboratories

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America