Report Overview

Generative AI Market Size, Highlights

Generative AI Market Size:

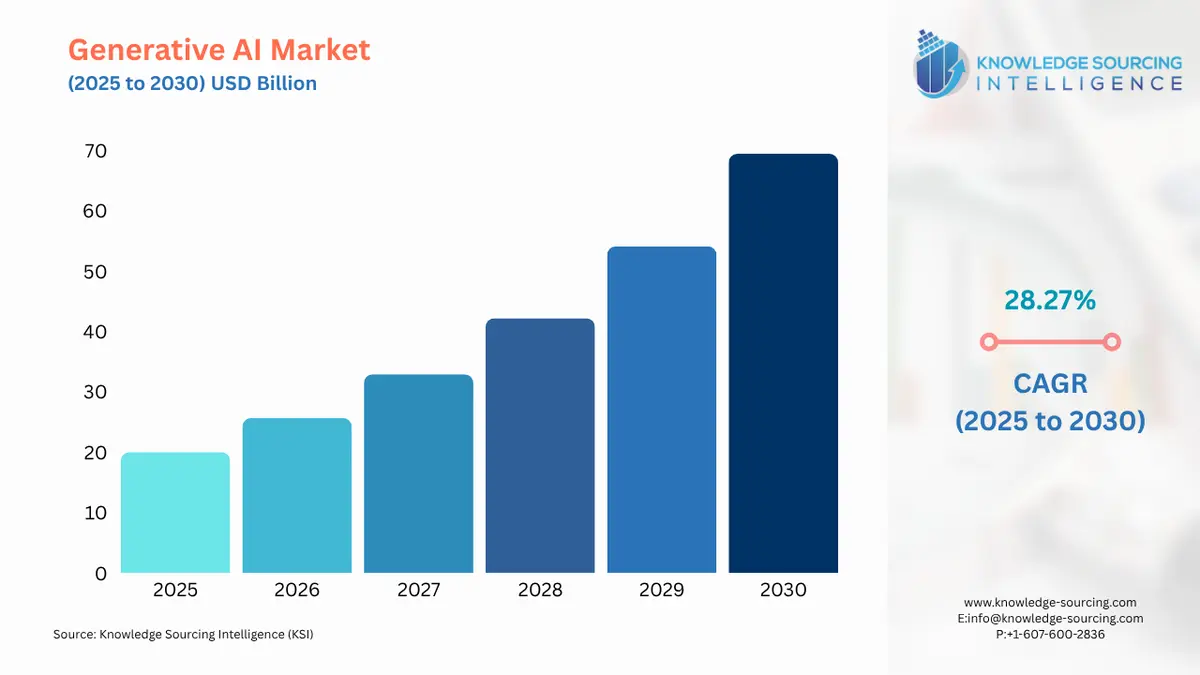

The Generative AI Market is evaluated at US$20.00 billion for the year 2025 growing at a CAGR of 28.27% reaching the market size of US$69.460 billion by the year 2030.

Generative AI Market Trends:

Increasing advances in deep learning and artificial intelligence (AI) have fostered an environment that fosters creativity. Moreover, the increase in content creation efforts and the growing need for creative applications are both contributing considerably to the growth of the Large Language Model market, which is boosting the generative AI sector. To support the trajectory of growing, cloud-based systems that make data easily accessible have been made easily accessible for this purpose.

In addition, factors including but not limited to the use of escalating super-resolution tools, text-to-image conversion tools, or text-to-video transcription apparatus, as well as a rise in automation requirements across various industries, have led to the rising need for generative AI software applications.

Furthermore, AI can tailor content depending on user preferences, making it more interesting and relevant. In addition, advances in deep learning and the aim to give users and customers more customized, engaging, and relevant information and experiences are propelling the industry. Generative AI enables models to become multimodal, which means they can interpret many modalities at the same time, such as images and text, widening their application areas and enhancing their adaptability. Generative AI improves the link to the world by allowing humans to speak with computers using natural language rather than programming languages.

Generative AI Market Growth Drivers:

- Growing applications in various industries

The adaptability and potential of generative AI in several industries have fueled its adoption and contributed to market development. The media and entertainment industries have heavily utilized generative artificial intelligence. It is used to produce lifelike computer-generated graphics and special effects in motion pictures and video games.

Furthermore, generative AI has altered advertising and marketing techniques by letting firms create personalized and tailored material, allowing them to adjust their messaging and offerings to particular customers. It is also employed in the healthcare industry for activities including medical picture analysis, medication discovery, illness diagnosis, and treatment planning. Generative AI models can create synthetic medical visuals, imitate physiological systems, and aid in precision medicine efforts.

- Generative aids in efficiently managing big data and hence is widely used by companies.

The rapid growth of digital gadgets, social media, and the internet has resulted in an explosion of data. To learn and produce fresh content, generative AI systems require massive volumes of data. Furthermore, greater data helps generative AI models capture a larger spectrum of patterns and variances found in the actual world. This can lead to more realistic and accurate content development. The growing amount of generated data may be used for data augmentation and synthesis. To increase generality and flexibility, generative AI models may be trained on augmented datasets by merging actual and generated data. This technique addresses issues such as limited real-world training data and allows generative AI models to handle a broader range of scenarios.

- Rising interest in conversational AI

Conventional AI-based conversational interfaces are limited to predetermined instructions and fail to grasp the intent of inquiries, resulting in poor results. Conversational AI addresses this issue by learning, comprehending, and preparing chat replies depending on context and purpose. Many companies develop applications using OpenAI's UserChatGPT or chatbots that can take pictures or text while returning only text. They solve typical problems, support automation of regular clients' issues, as well as give one-on-one assistance to improve retail consumers’ satisfaction.

Customer data analysis avails itself with the use of conversational bots, provided they are driven by general intelligence, thereby ensuring that businesses can improve their operational efficiency. For instance, Salesforce introduced two generative artificial intelligence (AI) tools for the commerce experience: Commerce GPT and Marketing GPT in June 2023. The Marketing GPT model uses real-time data from Salesforce's data cloud platform to create creative audience segmentation, tailored mailings, and marketing campaigns.

- The rising trend of developing a virtual world in the metaverse

Generative AI is commonly used by AI developers to generate gaming settings and new virtual worlds. It allows virtual reality (VR) developers to construct an infinite number of unique and immersive gaming worlds. As a result, application use cases such as VR gaming and VR training simulations are highly efficient. As a result, the earliest AI deployments in business will most likely concentrate on enhancing human AI with a workforce (human employees collaborating with intelligent virtual assistants or cobots). This will considerably boost market expansion throughout the world. For example, NVIDIA has announced a substantial update to its NVIDIA OmniverseTM platform, which includes new foundation apps and services for developers and industrial companies to optimize and enhance their 3D processes using the OpenUSD framework and generative AI in August 2023.

- High demand from the service industry

The service sector had a significant growth rate and is poised to dominate the market over the forecast period. The segment's expansion can be linked to growing concerns about data security, fraud detection, business prediction, and risk factor modeling. In June 2023, Accenture and Microsoft agreed to transform the industries by utilizing generative AI, which is improved by the cloud, hence leading to the prediction of growth in demand for service provision through these systems due to their adaptability, scale-up features, and low cost. It assists clients in determining the best strategy to establish and enhance technology in their business. Both these companies have already worked with a wide range of clients in various sectors. For example, they collaborated with Radisson Hotel Group to develop an intelligent, automated system that manages guest cancellations and generates draft responses to guest reviews, addressing feedback with a full understanding of specific positive and negative elements. Each contact teaches the algorithm something new, making each answer smarter than the last.

Generative AI Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North America accounts for a sizable portion of the global market and is expected to hold the top spot throughout the forecast period due to several things, including an increase in banking fraud and pseudo-imaging and medical care. Regional market growth is also expected to be fueled by the presence of well-known players in the industry, including Microsoft, Google LLC, and Meta, a U.S.-based company, technology organizations, and experts. The growing need for AI-generated content in media & entertainment, medical care, and other industries, as well as the abundance of data available for generative model training, are other factors that impetus the regional market.

Generative AI Market Key Developments:

- In April 2023, Microsoft Corp. and American healthcare software provider Epic Systems partnered to integrate AI and extensive language model tools into Epic's electronic health record software. Through this partnership, healthcare providers will be able to decrease administrative burden and increase productivity by utilizing generative AI.

List of Top Generative AI Companies:

- Nvidia Corporation

- Google, Inc.

- Microsoft Corporation

- Amazon Web Services

- IBM Corporation

Generative AI Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Generative AI Market Size in 2025 | US$20.00 billion |

| Generative AI Market Size in 2030 | US$69.460 billion |

| Growth Rate | CAGR of 28.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Generative AI Market |

|

| Customization Scope | Free report customization with purchase |

Generative AI Market Segmentation:

- By Offering

- Software

- Services

- By Application

- Language

- Audio and Speech

- Visual

- Others

- By Model

- Generative Adversarial Networks (GANs)

- Transformer-based models

- Others

- By End-User Industry

- Automotive

- Healthcare/Drug Discovery

- Media and Entertainment

- BFSI

- Education

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America