Report Overview

Content Delivery Network Market Highlights

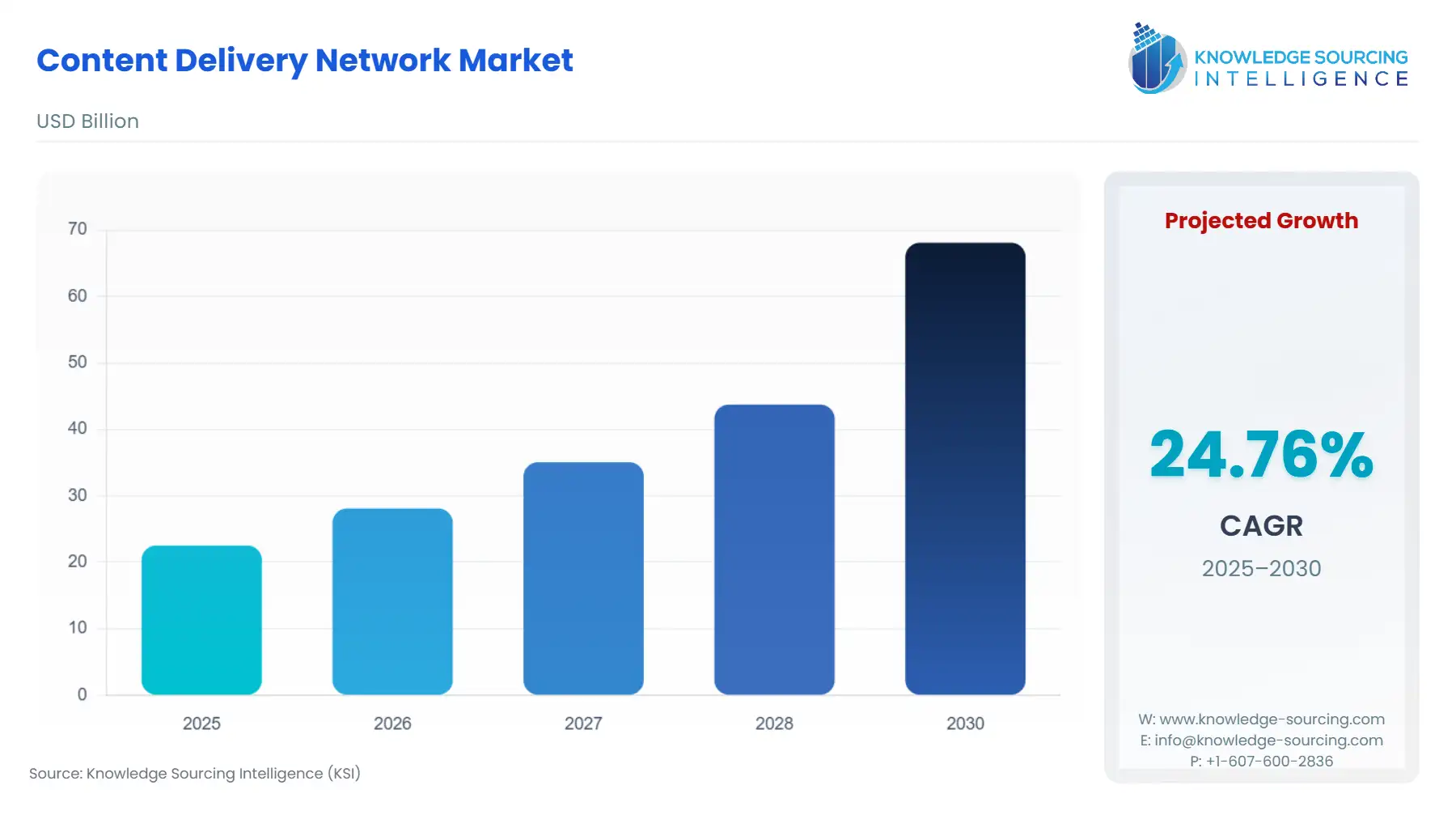

Content Delivery Network Market Size:

The Content Delivery Network Market is expected to grow from US$22.533 billion in 2025 to US$68.102 billion in 2030, at a CAGR of 24.76%.

The Content Delivery Network (CDN) Market serves as the foundational layer for accelerated, secured, and distributed delivery of all digital content across the modern internet ecosystem. Defined by a globally dispersed network of servers, a CDN's core function is to optimize latency and minimize data transfer bottlenecks between the origin server and the end-user.

The market's current trajectory is moving beyond simple static caching to encompass comprehensive Edge Computing and sophisticated Cloud Security platforms, effectively transforming the CDN from a cost-optimization utility into a core strategic component of enterprise IT and digital business strategy. This shift is non-negotiable for sectors like Media & Entertainment and E-commerce, where user experience, performance, and security are inextricably linked to competitive advantage and revenue retention.

Content Delivery Network Market Analysis

- Growth Drivers

The relentless surge in high-resolution Video Streaming and online Gaming Content consumption is the primary growth catalyst. Services offering 4K/8K resolution and ultra-low-latency competitive gaming require a geographically distributed network to mitigate the delay inherent in long-distance data transmission, directly increasing demand for CDN Media Delivery services. Concurrently, the exponential growth of E-commerce and financial transactions necessitates instantaneous page loads and zero-downtime application environments. This need for guaranteed Web Performance Optimization translates directly into heightened enterprise demand for specialized CDN services capable of handling complex, personalized, and highly transactional Dynamic Content.

- Challenges and Opportunities

A central challenge confronting the CDN market is the high upfront capital expenditure and ongoing operational costs required for extensive global infrastructure build-out, particularly for new Edge Computing deployments necessary to support 5G-driven applications. This cost structure can decelerate adoption among smaller enterprises. The dominant opportunity lies in the convergence of security and performance within a single platform. The rising frequency of sophisticated cyberattacks creates high-value demand for integrated CDN-as-a-Service offerings that natively embed Cloud Security functions, such as WAF, DDoS mitigation, and bot management, positioning CDNs as indispensable security outposts rather than mere delivery systems.

- Supply Chain Analysis

The CDN is a digitally dependent service whose supply chain is predominantly architectural and technological. It relies on a network of key dependencies: upstream connectivity providers (telecom companies providing backbone networks), hardware manufacturers (for high-density edge servers and specialized networking gear), and data center operators (for co-location and interconnection points). The supply chain's complexity stems from the critical dependency on securing peering agreements with Tier 1 and Tier 2 ISPs globally to ensure optimal last-mile delivery. The critical production "hubs" are the strategic metropolitan locations where high-traffic exchange points are situated, making logistical capability for rapid hardware deployment and software-defined capacity crucial for global service coverage.

Content Delivery Network Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union (EU) |

General Data Protection Regulation (GDPR) |

Mandates that personal data of EU citizens must be processed with specific protections, compelling CDNs to offer Data Localization services. This directly drives demand for regional PoPs and granular control over data caching, significantly increasing demand for CDN solutions that guarantee compliance for EU-based customers. |

|

India |

Digital Personal Data Protection Act (DPDP) and Telecom Regulations |

Imposes data localization and specific content blocking requirements. This mandates CDN providers operating in India to expand their physical infrastructure footprint and incorporate localized content filtration tools, increasing demand for in-country node deployment. |

|

Global |

Payment Card Industry Data Security Standard (PCI DSS) |

A non-governmental, mandatory standard for entities handling credit card information. For E-commerce CDNs that process transactions or manage payment pages, compliance with PCI DSS encryption and security protocols is mandatory, directly increasing demand for certified Cloud Security and managed WAF services. |

Content Delivery Network Market Segment Analysis

- By Content Type: Video Streaming

The Video Streaming segment is the most substantial growth driver in the CDN market, characterized by the shift to high-definition (HD, 4K, and 8K) and the rise of live, interactive video services. High bandwidth requirements for Ultra-HD content place an immense strain on traditional network architecture. Consequently, Over-the-Top (OTT) platforms and broadcasters are forced to rely on CDN Media Delivery solutions to cache content closer to users, thereby reducing buffering and mitigating last-mile latency. This is further amplified by live event streaming (e.g., sports, concerts), where even millisecond delays are unacceptable, creating non-negotiable demand for CDNs that offer real-time stream optimization, adaptive bitrate switching, and dynamic content packaging to ensure Quality of Experience (QoE) across diverse device ecosystems.

- By End-User: Media & Entertainment

The Media & Entertainment sector, encompassing OTT providers, major film studios, and gaming publishers, drives complex and high-volume CDN demand. Their business model is inherently dependent on maximizing content accessibility and minimizing time-to-market globally. The proliferation of digital rights and global licensing agreements increases the demand for sophisticated CDN features like Digital Rights Management (DRM) enforcement and geo-fencing capabilities, which ensure content is only accessible in licensed territories. Furthermore, the imperative to deliver a personalized, multi-device viewing experience pushes demand towards CDNs that offer integrated Transcoding services at the edge, allowing content to be efficiently formatted for various screens and bandwidths without requiring multiple upstream origin versions.

Content Delivery Network Market Geographical Analysis

- US Market Analysis

The US market is characterized by a mature digital infrastructure and the presence of the world's largest content providers, including major OTT and E-commerce entities. Growth is highly sophisticated, concentrating on low-latency Edge Computing for serverless functions and advanced Cloud Security platforms, driven by the need to protect high-value intellectual property and massive consumer datasets. Regulatory compliance, notably the California Consumer Privacy Act (CCPA), compels major corporations to utilize CDNs capable of granular user data handling and disclosure management, thereby accelerating the adoption of compliance-focused CDN services.

- Brazil Market Analysis

The Brazilian CDN market is rapidly expanding, fueled by rising internet penetration and explosive growth in mobile data consumption. While cost-sensitivity remains a factor for smaller content providers, the large-scale investment by major international and domestic Media & Entertainment companies drives significant demand for localized Media Delivery PoPs. The relatively higher complexity and occasional lower reliability of regional networks place a high premium on CDNs that offer superior network optimization and intelligent routing capabilities to reliably serve content to the growing base of mobile-first users.

- Germany Market Analysis

The German market, highly influenced by stringent EU regulations, exhibits a dominant demand for compliance-driven CDN solutions. GDPR mandates and a deeply ingrained preference for data privacy mean enterprises prioritize CDNs that verifiably guarantee data sovereignty and offer EU-based caching. This creates specific, high-value demand for CDN providers who can demonstrate robust legal frameworks and offer premium, locally compliant Cloud Security services, particularly for the large, traditional manufacturing and BFSI sectors undergoing digital transformation.

- United Arab Emirates (UAE) Market Analysis

The UAE market is strongly correlated with massive government-backed digital initiatives and the country’s status as a major regional finance and media hub. The focus is on ultra-high performance and security to support a premium digital experience, particularly in the E-commerce and financial services sectors. The market requires advanced DDoS mitigation and WAF services to protect high-profile digital assets, while a strong emphasis on international connectivity drives demand for CDNs that act as a low-latency gateway to the broader Middle East and Asia regions.

- China Market Analysis

The Chinese CDN market is unique, characterized by stringent government control over cross-border data traffic and the mandatory need for local licensing (ICP). International companies seeking to serve the Chinese consumer base must partner with domestic CDN providers or navigate the complex regulatory environment. This environment creates high demand for specialized local solutions focusing on intra-China delivery, where the ability to manage massive Gaming Content and Video Streaming loads within the highly segmented domestic network architecture is a key capability.

Content Delivery Network Market Competitive Environment and Analysis

The competitive landscape is defined by three distinct groups: legacy pure-play CDNs, cloud hyperscalers offering integrated CDN services, and emerging Edge Computing specialists. Competition centers less on price for bandwidth and more on feature differentiation, such as integrated security, serverless compute functions (Edge Computing), and developer tools. The presence of hyperscalers like Amazon and Google introduces a powerful challenge, leveraging massive cloud ecosystems to offer "free-tier" or bundled CDN services, forcing pure-play vendors to innovate rapidly at the application layer.

- Akamai Technologies, Inc.

Akamai maintains its position as a dominant pure-play CDN, strategically pivoting to offer a comprehensive, integrated security and delivery platform. Its key positioning revolves around delivering the scale and resilience required by the world's largest enterprises and financial institutions. A core verified product is the Akamai Connected Cloud, which represents a significant capacity addition to its distributed edge and core infrastructure, supporting the growing demand for Edge Computing and sophisticated application performance features like Ion for Web Performance Optimization.

- Cloudflare, Inc.

Cloudflare leverages a developer-first, network-as-a-service model, disrupting the market by bundling security and performance into its offering. Its strategic focus is on the Cloud Security and Edge Computing segments. Key verified products include Cloudflare Workers, a serverless execution environment that runs code directly at the edge, and the Cloudflare One Zero Trust platform, which directly increases demand for their integrated DDoS and WAF solutions across the IT & Telecom and BFSI sectors.

- Fastly, Inc.

Fastly differentiates itself through a focus on developer empowerment and delivering ultra-low-latency, customizable edge cloud services. Its strategic positioning targets companies with highly Dynamic Content and real-time data needs, such as high-volume E-commerce and streaming platforms. A major verifiable product is Compute@Edge, a serverless compute environment that allows for maximum application logic to be executed at the edge, enabling complex personalization and security functions closer to the end-user.

Content Delivery Network Market Developments

- April 2025: Cloudflare launched Workers VPC and VPC Private Link, allowing developers to build secure, cross-cloud applications. This expansion of their edge compute services directly addresses enterprise demand for secure, hybrid cloud architectures and improves functionality for Dynamic Content delivery.

- April 2025: Fastly unveiled new DDoS Attack Insights for customers, providing enhanced visibility and intelligence for better Cloud Security protection. This feature addition directly supports customers in the E-commerce segment by improving transparency and defense against web-scale volumetric attacks.

- October 2024: Cloudflare acquired Kivera to deliver simple, preventative cloud security capabilities. This move strengthens their Cloud Security component, adding deeper Zero Trust infrastructure access controls to the Cloudflare One platform, increasing their competitive posture against cyber threats.

Content Delivery Network Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Content Delivery Network Market Size in 2025 | US$22.533 billion |

| Content Delivery Network Market Size in 2030 | US$68.102 billion |

| Growth Rate | CAGR of 24.76% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Content Delivery Network Market |

|

| Customization Scope | Free report customization with purchase |

Content Delivery Network Market Segmentation

BY COMPONENT

- Web Performance Optimization

- Media Delivery

- Cloud Security

- Transcoding & Digital Rights Management

- Support & Maintenance Services

BY CONTENT TYPE

- Static Content

- Dynamic Content

- Video Streaming

- Gaming Content

- Software Downloads

BY END-USER

- Media & Entertainment

- E-commerce

- Healthcare

- BFSI

- IT & Telecom

- Government & Education

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others