Report Overview

China Data Center Market Highlights

China Data Center Market Size:

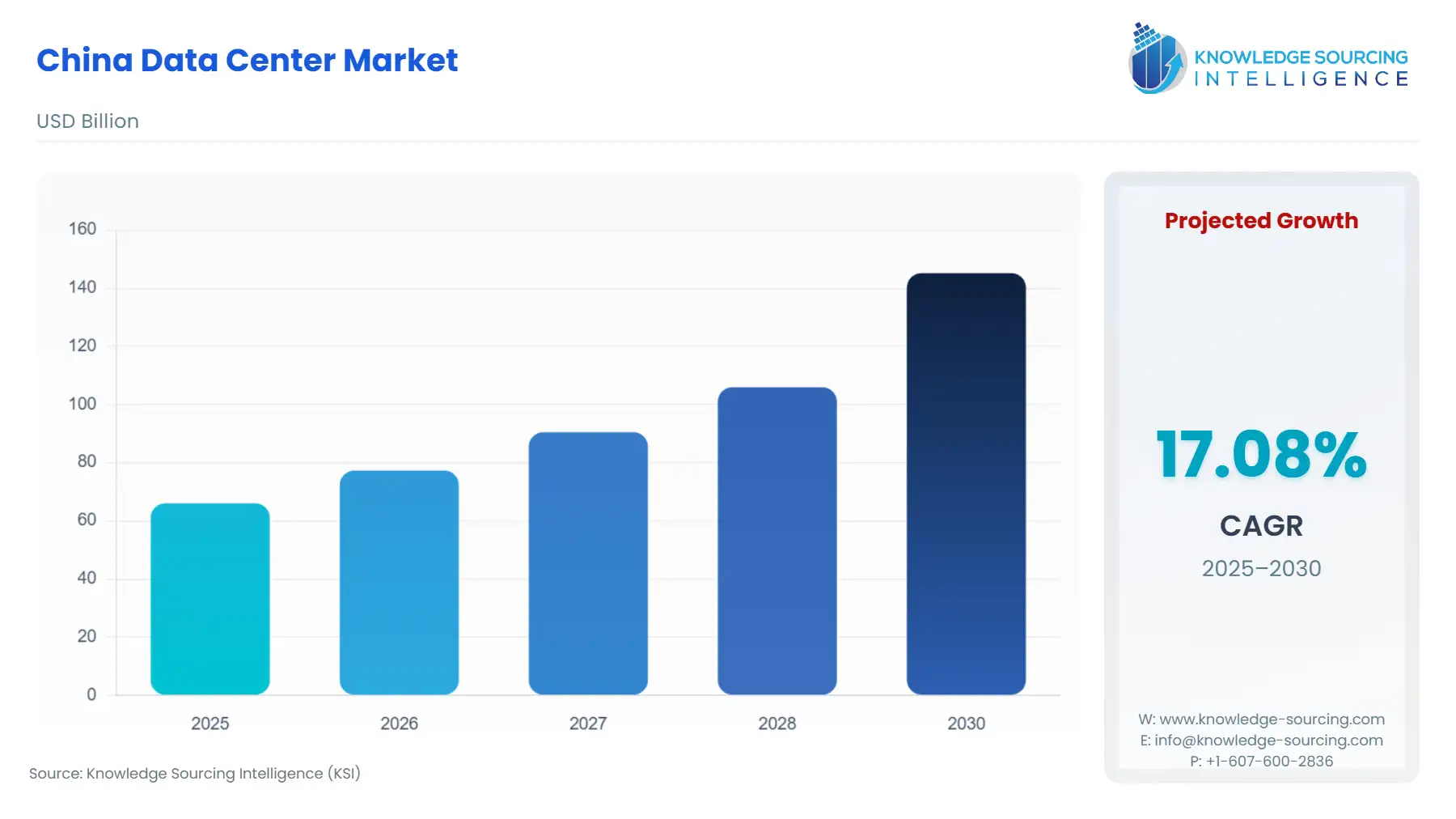

The China Data Center Market is projected to expand at a CAGR of 17.08%, reaching USD 145.223 billion in 2030 from USD 66.010 billion in 2025.

The China data center market is undergoing a period of intense transformation, driven by both rapid technological advancement and strategic national policy. As the world's largest data consumer, China's digital economy generates unprecedented volumes of data, creating an imperative for a robust and scalable data center infrastructure. The market's evolution is directly influenced by the strategic priorities of major technology companies and the overarching national economic development agenda, which emphasizes digital transformation and self-sufficiency.

China Data Center Market Analysis

- Growth Drivers

The surge in demand for data centers is directly tied to the escalating data generation from various sectors. The proliferation of 5G networks, the Internet of Things (IoT), and the burgeoning artificial intelligence (AI) and machine learning (ML) industries are creating a direct need for enhanced data storage and processing capabilities. This data-intensive environment compels enterprises and cloud service providers to expand their infrastructure to support real-time analytics, complex AI model training, and a growing user base. The government's "New Infrastructure" stimulus, which includes cloud computing build-outs, further accelerates this demand by providing policy support and investment. This is particularly evident as hyperscalers plan to deploy massive AI compute capacity, directly increasing their consumption of data center power and space.

- Challenges and Opportunities

The Chinese data center market faces significant challenges, including high upfront capital expenditure for advanced infrastructure and constraints on grid power in Tier-1 cities. The government’s export controls on advanced chips present a risk to hyperscalers, as a lack of supply could stifle their ability to build out necessary AI infrastructure, thereby reducing their demand for new data center capacity.

However, these challenges create distinct opportunities. The "Eastern Data and Western Computing" project presents a clear opportunity for operators to develop new facilities in western regions where land and energy are abundant and often cheaper. Furthermore, the tightening of energy efficiency and sustainability regulations compels the market to innovate. Operators who invest in sustainable power and efficient cooling technologies gain a competitive advantage, as they can meet new compliance mandates, lower long-term operational costs, and align with China’s carbon neutrality goals. This regulatory environment creates a clear demand for high-efficiency UPS systems, liquid cooling solutions, and renewable energy procurement strategies.

- Supply Chain Analysis

The global data center supply chain for China is characterized by both domestic reliance and international dependencies. Key production hubs for hardware components, such as servers, networking devices, and cooling systems, are located globally, but China's push for technological self-sufficiency has increased the role of domestic suppliers. The "Eastern Data and Western Computing" initiative introduces logistical complexities, as data centers are now being built far from the population and business centers in the East. This requires a robust and high-performing network infrastructure to ensure low-latency data transmission and efficient resource scheduling. The supply chain for advanced AI chips remains a critical dependency, with US trade restrictions on high-processing AI chips creating a significant risk for new data center development. This has, however, created an impetus for domestic chip developers to fill the supply gap, as seen in government-mandated procurement policies.

China Data Center Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

China (National) |

"Eastern Data and Western Computing" Initiative |

The initiative redirects demand for data center construction from land- and energy-constrained eastern cities to western regions with abundant resources. This directly influences investment and development strategies, decentralizing the market. |

|

China (National) |

Green Electricity Certificate (GEC) System / Ministry of Industry and Information Technology (MIIT) |

New mandates require national hub data centers to source at least 80% of their electricity from renewable sources by 2030. This creates demand for renewable energy procurement and a shift towards energy-efficient hardware to achieve lower PUE ratios. |

|

China (National) |

Cybersecurity Law (CSL) / Data Security Law (DSL) |

These laws mandate that certain types of data be stored within China's borders. This imperative directly drives the demand for local data center capacity from both domestic and international companies seeking to comply with data residency requirements. |

China Data Center Market Segment Analysis:

- By End User: IT & Telecommunications

The IT and telecommunications sector is a primary growth driver for the Chinese data center market. The rapid rollout of 5G networks across the country necessitates a massive build-out of supporting infrastructure. 5G technology enables low-latency applications, such as real-time analytics for connected vehicles and industrial internet operations. These applications demand a distributed network of micro data centers and edge facilities closer to the end-user to minimize latency. Consequently, telecommunications operators are actively investing in new data centers to support enhanced connectivity and processing requirements. The sector's growth is further fueled by the explosive growth of cloud computing services, as providers expand their hyperscale data centers to accommodate increasing workloads from enterprise customers and the general public. This segment's growth is a direct function of the continuous digitalization of the Chinese economy.

- By Data Center Type: Hyperscale Data Center

Hyperscale data centers are the fastest-growing segment in the Chinese data center market, driven by the intense computational demands of major cloud service providers and internet companies. These facilities are designed for massive scale and efficiency, providing the foundational infrastructure for big data analytics, AI, and cloud services. The demand for hyperscale facilities is a direct result of the "AI race" among Chinese tech giants who need to rapidly deploy AI compute resources to train and run large language models and other AI applications. The economies of scale offered by hyperscale facilities, including their ability to source bulk clean electricity and adopt advanced cooling technologies, make them an attractive investment. Operators in this segment are also benefiting from the "Eastern Data and Western Computing" initiative, as they are well-positioned to build the large-scale, resource-intensive facilities in the western hubs.

China Data Center Market Competitive Analysis

The Chinese data center market is dominated by a mix of state-owned telecommunications companies and major internet and cloud service providers. The competitive landscape is becoming increasingly concentrated at the top, with leading players commanding significant market share. The ability to secure large-scale land, energy resources, and regulatory approval is a key determinant of competitive advantage.

- China Unicom: As a state-owned telecommunications operator, China Unicom leverages its extensive network infrastructure to offer data center services. The company's strategic positioning is evident in its commitment to national policies. In September 2025, China Unicom inaugurated an AI data center in Xining, Qinghai, powered entirely by domestically manufactured processors. This move not only expands its computing capacity but also aligns with the government's push for technological self-sufficiency in the face of international trade restrictions.

- GDS Holdings Ltd. (GDS): GDS is a leading developer and operator of high-performance data centers. The company’s strategic focus is on serving hyperscale cloud service providers and large enterprises with mission-critical IT infrastructure. GDS has a high pre-commitment rate for its new capacity, indicating its strong relationships with major clients and its ability to secure future demand. Its focus on building Tier III and Tier IV facilities positions it to capture demand for high-reliability services.

- Chindata Group: Chindata Group specializes in building and operating hyperscale data centers in emerging regions of China and other parts of Asia. The company's business model is explicitly aligned with the "Eastern Data and Western Computing" initiative, focusing on developing new hubs in resource-rich but less-developed areas. Its ability to manage large-scale, capital-intensive projects and its pre-committed capacity with anchor tenants underscore its strategic positioning to capitalize on the market's geographical shift.

China Data Center Market Developments:

- September 2025: China Unicom launched a US$390 million AI data center in Xining, Qinghai province, which is powered by domestically manufactured processors. The facility currently operates 23,000 AI processors and has a computing power of 3,579 petaflops, with plans for expansion to 20,000 petaflops.

China Data Center Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 66.010 billion |

| Total Market Size in 2031 | USD 145.223 billion |

| Growth Rate | 17.08% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Data Center Type, Tier Level, Region |

| Geographical Segmentation | Shanghai, Yangtze River Delta, Beijing, Other |

| Companies |

|

China Data Center Market Segmentation

- BY COMPONENT

- Hardware

- Servers

- Network Infrastructure

- Cabling Infrastructure

- Power Infrastructure

- Cooling Infrastructure

- Physical Security

- Storage Infrastructure

- Software and Services

- Hardware

- BY DATA CENTER TYPE

- Colocation Data Center

- Enterprise Data Center

- Hyperscale Data Center

- Edge Data Center

- Micro Data Center

- BY TIER LEVEL

- Tier I

- Tier II

- Tier III

- Tier IV

- BY ENTERPRISE SIZE

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- BY END USER

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Government & Public Sector

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Other

- BY REGION

- Shanghai

- Yangtze River Delta

- Beijing

- Other