Report Overview

Conveyor Systems Market - Highlights

Conveyor Systems Market Size:

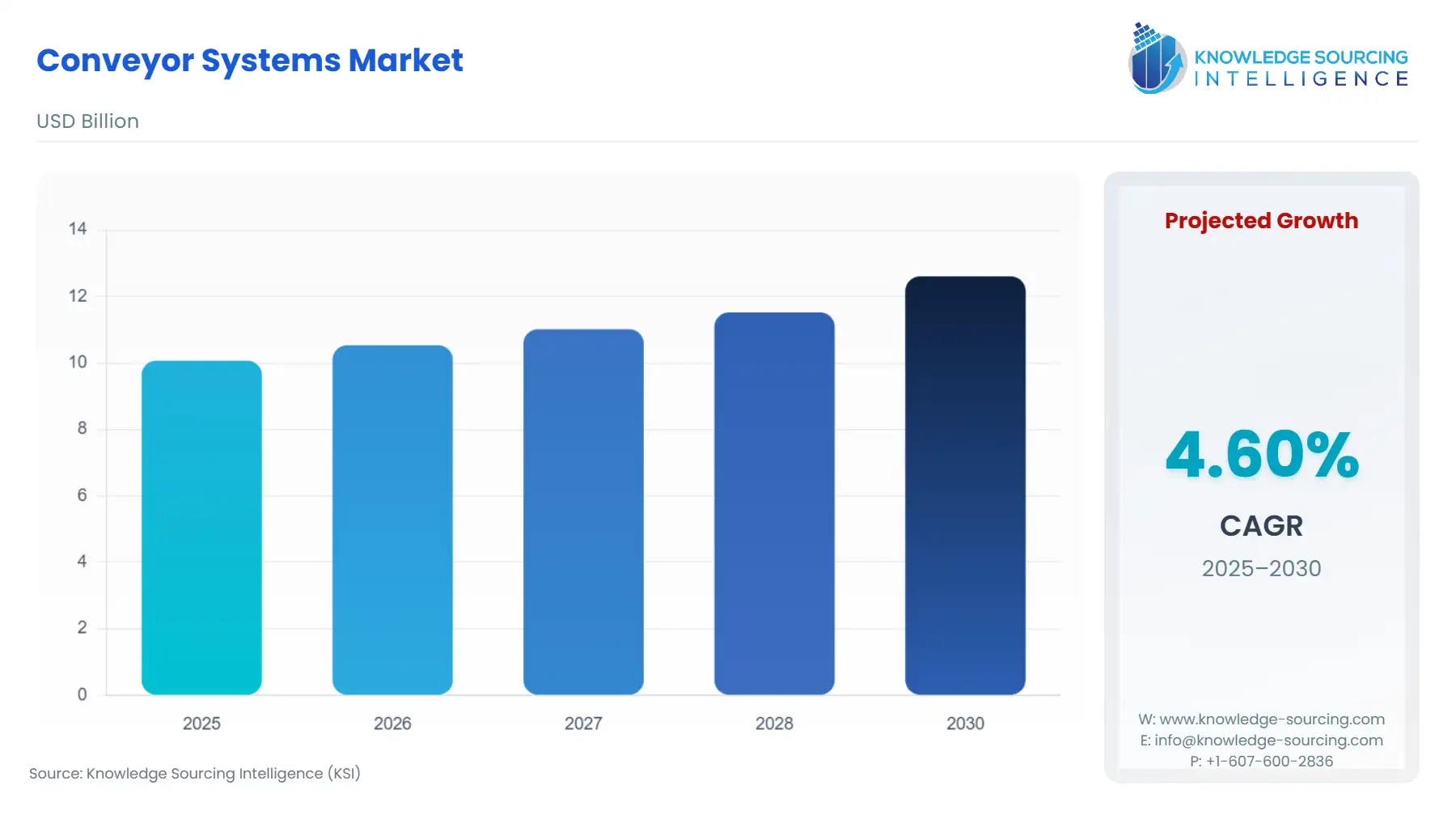

The Conveyor Systems Market will grow at a CAGR of 4.60% to be valued at US$12.608 billion in 2030 from US$10.071 billion in 2025.

A conveyor system is known as a systematic and rapid mechanical handling equipment for transferring goods and materials within a specific enclosed area. The key advantage of conveyor systems is that they reduce human error, minimize workplace risks and accidents, and help in the reduction of labor costs. The conveyor systems are also widely used in the movement of heavy, bulk goods and materials from one place to another. It is classified and used as wheels, belts, chains, or rollers to transfer goods and loads. Major firms and corporations have been investing a considerable sum of capital to develop novel, safer, and advanced conveyor systems for their customers. The Asia Pacific region is expected to play a major role in the market growth, due to the high and stronger manufacturing sector and other related factors. The increasing regulations and standards by various organizations, countries, and others, intending to enhance the workplace safety standards, are expected to play a major role in the development of advanced conveyor systems worldwide.

The conveyor systems market is a cornerstone of modern material handling systems, enabling efficient movement of goods across industries such as manufacturing, logistics, retail, and e-commerce. Conveyor systems, ranging from belt and roller to overhead and pallet conveyors, form the backbone of logistics automation and warehouse automation, streamlining operations in warehouses, distribution centers, and production facilities. These systems integrate advanced technologies like smart conveyors, powered by IoT, AI, and supply chain automation, to optimize throughput, reduce labor costs, and enhance operational flexibility. The rise of intralogistics, which focuses on internal material flow and logistics optimization, underscores the market’s importance in meeting the demands of Industry 4.0 and e-commerce-driven supply chains.

Further, the conveyor systems market encompasses a range of automated and semi-automated solutions designed to transport materials efficiently within facilities, supporting intralogistics and supply chain automation. Industrial conveyors, such as belt, roller, and pallet systems, are critical in industries like automotive, food and beverage, and retail, where they facilitate seamless movement of goods from raw materials to finished products. Smart conveyors, equipped with IoT sensors and AI-driven analytics, enable real-time monitoring and predictive maintenance, enhancing warehouse automation. The market is driven by the need for operational efficiency, scalability, and adaptability in dynamic environments like e-commerce fulfillment centers and smart factories. Logistics automation integrates conveyor systems with warehouse management systems (WMS) and automated guided vehicles (AGVs), creating interconnected material handling systems that optimize workflows.

Key players working in the market include Siemens AG, Dematic Corp. (KION Group), Honeywell Intelligrated, Daifuku Co., Ltd., Interroll Holding AG, SSI SCHAFER Group, BEUMER Group GmbH & Co. KG, FlexLink AB (Coesia Group), Dorner Manufacturing Corporation, Kardex Group, Murata Machinery, Ltd., and Taikisha Ltd.

Conveyor Systems Market Trends

- Integration of Multi-Modal Natural Language Processing

The conveyor systems market is transforming through technological advancements, enhancing material handling systems and logistics automation. IoT sensors enable real-time monitoring, with predictive maintenance reducing downtime by detecting faults early. In 2024, Walmart integrated Swisslog’s IoT sensors into modular conveyor systems, optimizing warehouse automation. AI and machine learning enhance routing and efficiency, as seen in HAI Robotics’ January 2024 integration with Honeywell, using AI-driven conveyors for intralogistics. Robotics integration with modular conveyor systems streamlines e-commerce fulfillment, enabling flexible configurations. Digital twins simulate conveyor performance, improving design and maintenance, as demonstrated in Swisslog’s 2023 CarryPick upgrade, which boosted logistics automation. Sustainable conveyor belts, made from recyclable materials, align with environmental goals. These trends, driven by AI and machine learning and IoT sensors, position the market for growth in supply chain automation, particularly in the Asia-Pacific and North America.

Conveyor Systems Market Drivers

- Surge in E-commerce and Warehouse Automation

The conveyor systems market is propelled by the booming e-commerce sector, driving demand for warehouse automation to handle high order volumes efficiently. Material handling systems, particularly industrial conveyors, streamline order fulfillment in distribution centers, supporting rapid delivery expectations. For example, Walmart partnered with Swisslog to deploy advanced conveyor systems in a Texas facility, integrating IoT sensors to optimize intralogistics for e-commerce operations. Logistics automation enables faster sorting, packing, and shipping, which is critical in regions like North America and Asia-Pacific, where online retail is expanding rapidly. Modular conveyor systems offer flexibility to adapt to fluctuating demands, enhancing scalability. This driver fuels market growth as businesses invest in supply chain automation to meet consumer expectations for speed and accuracy in e-commerce fulfillment.

Market Restraints

- High Initial Investment Costs

The conveyor systems market faces challenges due to the high initial costs of implementing advanced material handling systems, particularly smart conveyors with IoT sensors and AI and machine learning capabilities. These systems require significant capital for installation, integration, and customization, limiting adoption by small and medium-sized enterprises (SMEs). For instance, Walmart’s deployment of Swisslog’s conveyor systems involved substantial investment in warehouse automation, a barrier for smaller players. This restraint is pronounced in emerging markets like South America and parts of the Asia-Pacific, where budget constraints favor manual or less advanced systems, slowing the growth of logistics automation and intralogistics solutions in cost-sensitive regions.

Further, integrating conveyor systems into existing legacy infrastructure poses a significant restraint, complicating logistics automation for industries with outdated facilities. Retrofitting smart conveyors and robotics integration requires compatibility with legacy warehouse management systems (WMS), increasing costs and deployment timelines. A 2024 report noted that legacy system integration challenges hinder supply chain automation, particularly in Europe, where older manufacturing facilities dominate. This restraint affects warehouse automation projects, as businesses face technical complexities and retraining needs to adopt digital twins and IoT sensors, limiting market expansion for advanced material handling systems in traditional industrial settings.

Market Opportunities

- The Rise of Industry 4.0

Further, the rise of Industry 4.0 is a key driver, with smart conveyors integrating AI and machine learning and IoT sensors to enhance logistics automation. These technologies enable predictive maintenance, reducing downtime by detecting equipment issues in real time. For instance, HAI Robotics collaborated with Honeywell to integrate smart conveyors with automated storage systems, optimizing material handling systems in distribution centers. Digital twins simulate conveyor performance, improving design and operational efficiency. This trend is prominent in the Asia-Pacific, where manufacturing hubs like China and Japan prioritize industrial automation. Smart conveyors support data-driven decision-making, driving market expansion by enhancing throughput and reliability in intralogistics and supply chain automation, particularly for automotive and retail sectors.

In addition, conveyor systems address labor shortages and rising costs by automating repetitive tasks in material handling systems, driving market growth. Industrial conveyors reduce reliance on manual labor in warehouse automation, improving efficiency in sorting, transporting, and packaging. For instance, Swisslog’s upgraded CarryPick system, featuring modular conveyor systems and robotics integration, minimized labor dependency in retail intralogistics. Supply chain automation mitigates workforce challenges in North America and Europe, where labor costs are high. Sustainable conveyor belts further reduce operational costs through energy-efficient designs. This driver strengthens market demand as industries seek cost-effective, automated solutions to maintain competitiveness in logistics automation.

Conveyor Systems Market Segmentation Analysis

- By Type

Based on type, the market is classified into belt conveyors, roller conveyors, chain conveyors, pallet conveyors, overhead conveyors, modular belt conveyors, screw conveyors, and vibrating conveyors.

In the Conveyor Systems Market, belt conveyors constitute the largest share of all types based primarily on their ease of use, making them versatile in their application across industries such as manufacturing, airports, logistics, and food processing companies. The maximum growth rate, however, will be in the vibrating conveyors industry, due to an increase in several applications in food & beverage, pharmaceuticals, mining, and the chemical industries, where critical or precise handling, proper hygienic design, as well as conveying and handling fragile, granular, or bulk materials, is required. In contrast to conventional conveying systems, vibrating conveyers offer several advantages, such as low maintenance, reduced spillage, smooth handling of materials, and the ability to convey materials at a specified speed and angle. The demand for vibrating conveyors is being driven by an increased propensity toward automation, energy-efficient equipment, and advanced process control across processing industries. In addition, with increased food consumption, increased standards for hygiene, and the need for continuous transport, or transport free of contamination, vibrating conveyors are beginning to emerge as the fastest-growing type of conveyor, radically changing the competitive dynamics in the market.

Conveyor Systems Market Regional Analysis

- By region, the market is segmented into North America, South America, the Middle East and Africa, and Asia-Pacific.

North America

North America is still a key market with significant uptake of intelligent and automated conveyor systems, particularly in the U.S. The e-commerce boom, together with the emergence of mega distribution centers, has created solid demand for conveyors that are fast, flexible, and entirely software-based in North America. Additionally, automotive manufacturing, pharmaceutical manufacturing, and the need for warehouse management solutions contribute to a more positive market outlook in the region.

Europe

The European market is the most technically advanced, emphasizing energy-efficient and automated solutions. Industry 4.0 initiatives and robotics and IoT integration are prevalent, as well as a growing emphasis on workplace safety and sustainability, driving the adoption of conveyor systems. Germany, the UK, France, and Italy are the leading countries in terms of conveyor demand. Europe has a strong manufacturing base, along with established automotive, aerospace, and food processing industries, which have continued to perform due to demand for conveyor systems. The industry overall will continue to focus on using sustainable materials, particularly recycled materials, because of the EU sustainability goals.

Asia-Pacific

Asia Pacific is the dominant region in the conveyor systems market, propelled by rapid industrialization, e-commerce growth, and manufacturing expansion in countries like China, India, and Japan. The region’s robust logistics automation and warehouse automation initiatives drive demand for industrial conveyors, particularly belt conveyors, in e-commerce & retail and automotive & manufacturing. For example, HAI Robotics integrated smart conveyors with Honeywell’s software, enhancing material handling systems in Asia-Pacific distribution centers. Supportive government policies and investments in supply chain automation further strengthen the region’s leadership, making Asia-Pacific the largest market for conveyor systems due to its scale and technological adoption.

South America

The South American market is slowly expanding, primarily driven by Brazil, Argentina, and Chile, where increased capital spending in mining, manufacturing, and infrastructure projects is creating demand for conveyor systems. The growth of the retail segment, coupled with efforts to modernize warehouses and logistics capabilities, is also driving demand for conveyor systems.

The Middle East and Africa

At the same time, the Middle East & Africa region, while rather small, is showing hopeful potential with large-scale investments in infrastructure development, expanding retail and food processing sectors, and the rising trend of automation in the Gulf Cooperation Council (GCC) region.

Conveyor Systems Market Competitive Landscape

- Key Industry Players

The Conveyor System Market is very competitive and consists of a combination of leading global players and local solution providers. The major players include Siemens AG, Dematic Corp. (KION Group), Honeywell Intelligrated, Daifuku Co., Ltd., Interroll Holding AG, SSI SCHÄFER Group, BEUMER Group GmbH & Co. KG, FlexLink AB (Coesia Group), Dorner Manufacturing Corporation, Kardex Group, Murata Machinery, Ltd., Taikisha Ltd., all of whom strive to offer innovative, automated, and energy-efficient conveyor solutions. Market participants compete on technology, and some operate globally, while others only operate in their local marketplace, but still have a niche market. Many participants are focused on IoT integration and specifications related to robotics and sustainability to meet the needs of the rapidly changing demands of the e-commerce, automotive, food & beverage, and manufacturing industries.

List of Key Company Profiles

- Swisslog Holding AG

- HAI Robotics Co., Ltd.

- Siemens AG

- SSI Schaefer Group

- Daifuku Co., Ltd.

- Dematic

- Interroll Holding AG

- BEUMER Group GmbH & Co. KG

- Vanderlande Industries B.V.

- TGW Logistics Group GmbH

Conveyor Systems Market Key Developments

- Acquisition: In July 2025, Siemens AG completed the acquisition of the industrial drive technology business of ebm-papst. This acquisition was aimed at strengthening Siemens' presence in the industrial automation market. The deal included a range of drive systems and components that are a strong complement to Siemens' existing portfolio, especially enhancing its offerings for efficient and innovative conveyor system solutions. This acquisition allows Siemens to provide more comprehensive and integrated automation systems.

- Product Launch: In April 2025, an African mine will be one of the first users of patented rail-running conveyor (RRC) technology, which was commercialized by the full flowsheet provider FLS in partnership with the University of Newcastle, Australia.

- Product Launch: In April 2025, at Bauma, the ground-breaking Tru-Trac intelligent belt scale was introduced. Tru-Trac Rollers' most recent innovation is a revolutionary intelligent belt scale system that monitors the condition of the entire conveyor system in addition to basic weighing.

- Collaboration: In April 2024, in a major collaboration, Walmart in the U.S. partnered with Swisslog Holding AG to implement Swisslog's state-of-the-art storage automation technology at a Texas facility. This included a sophisticated conveyor system as a core component. The partnership's goal is to improve operational efficiency and streamline logistics processes within the facility, showcasing a trend towards major retailers investing in advanced, integrated automation solutions to meet the demands of e-commerce.

Conveyor Systems Market Segmentation:

- By type

- Belt Conveyors

- Roller Conveyors

- Chain Conveyors

- Pallet Conveyors

- Overhead Conveyors

- Modular Belt Conveyors

- Screw Conveyors

- Vibrating Conveyors

- By application

- Material Handling

- Food & Beverage

- Automotive & Manufacturing

- Mining & Construction

- Pharmaceutical & Healthcare

- E-commerce & Retail

- Airport & Postal Services

- By end-user

- Manufacturing & Industrial

- Retail & E-commerce

- Mining & Metals

- Food Processing

- Pharmaceutical & Chemical

- Airports & Transportation

- By regions

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

- North America