Report Overview

Corrugated Board Market Size, Highlights

Corrugated Board Market Size:

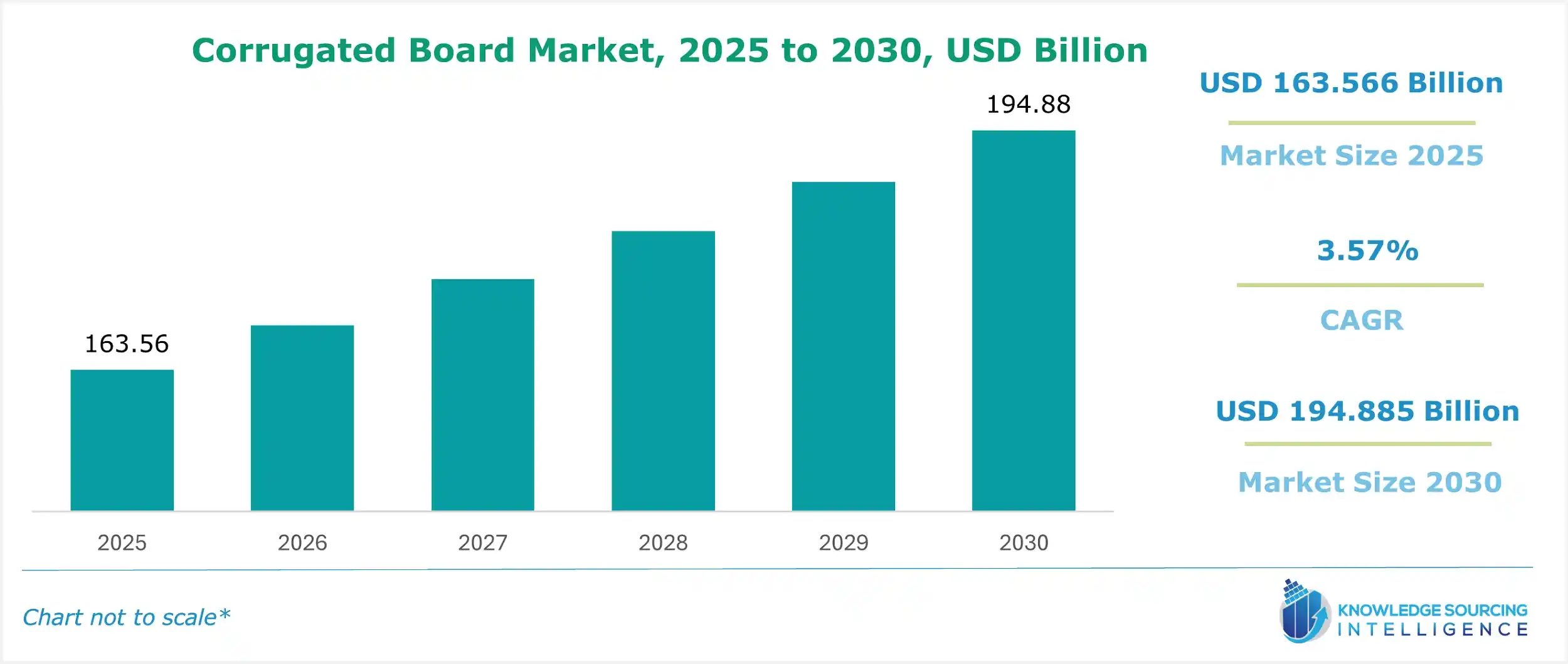

The Corrugated Board Market is expected to grow from US$163.566 billion in 2025 to US$194.885 billion in 2030, at a CAGR of 3.57%.

The corrugated board market, a cornerstone of the corrugated packaging industry, drives innovation in the containerboard market and paperboard packaging. As a versatile and sustainable solution, the cardboard box market supports diverse applications in industrial packaging and retail packaging. Corrugated boards offer durability, lightweight design, and recyclability, making them ideal for packaging solutions across e-commerce, food, and manufacturing sectors. Advanced manufacturing techniques enhance strength and customization, meeting evolving industry demands.

The market is primarily driven by the growth of the e-commerce industry and the rising demand for environmentally friendly packaging. However, it is anticipated that the absence of sturdiness in corrugated boards may restrict market expansion. One of the most popular materials for packaging in a variety of industries, including food & beverage, healthcare, and consumer goods, is plastic. But the increasing use of plastic is having a negative effect on the environment. The UN estimates that over 300 million tonnes of plastic garbage are produced yearly on a global level, which is nearly equal to the weight of all people on earth. The idea of eco-friendly packaging is increasingly being embraced in order to prevent the production of this much plastic waste. To meet the growing consumer demand for sustainable packaging, the end-user sectors are transitioning from plastic to corrugated board packaging. With growing emphasis on eco-friendly materials, the corrugated board market empowers businesses with cost-effective, scalable packaging solutions, addressing global supply chain and sustainability challenges.

Corrugated Board Market Drivers:

- Food and beverage to hold lucrative market opportunities

Companies are increasingly using corrugated board packaging to provide better customer results because it keeps moisture from items and can endure lengthy transportation times, particularly for secondary or tertiary packaging. The demand for these packaging materials is fueled by processed meals like meat products, bread, and other food products that require these materials to be used only once. Thus, corrugated board packaging is emerging as a potential substitute for plastic packaging for a variety of food products. Recycled materials make it easier to make corrugated boxes. Additionally, consumers, particularly Gen-Z and millennials, have grown more conscious of the environmental effects of food manufacturing, packaging, and wastage. Millennials are ready to shell out an additional 10% to 25% for sustainable goods and services, according to the World Economic Forum. Due to this raised knowledge, a growing number of consumers demand and select solutions that are much healthier, more environmentally friendly, and more sustainable. As a result of increasing demand, this aspect is anticipated to fuel market growth for corrugated boxes. Additionally, packaged food and beverage manufacturers are using more corrugated cardboard cartons, according to the Japanese Ministry of Economy and Industry.

Corrugated Board Market Trends:

The corrugated board market is advancing with digital printing corrugated, enabling vibrant, customized designs. AI packaging design optimizes material efficiency, while smart packaging corrugated integrates IoT in packaging for real-time tracking and traceability. Anti-counterfeiting packaging enhances security through advanced printing techniques like flexography, corrugated, and lithography. Die-cut corrugated supports precise, tailored packaging solutions. Automated packaging systems streamline production, reducing costs and waste. These innovations align with sustainability and e-commerce demands, offering scalable, eco-friendly solutions. These trends are driving efficiency, security, and customization, reshaping the corrugated packaging landscape for industrial and retail applications.

Corrugated Board Market Geographical Outlook:

Corrugated boards are predicted to have a sizable market in the Asia Pacific. The existence of highly populated nations like China and India, rising urbanisation, and rising per capita income in these nations all point to the packaging sector in the Asia Pacific region expanding, in turn, the market for corrugated boards. The region's increasing environmental consciousness and desire for green packaging options are expected to fuel market expansion. The rising per capita income, as well as the shifting social climate and demography, have a significant impact on the Chinese corrugated board packaging industry. This change necessitates the use of innovative packaging materials and procedures. For instance, it is anticipated that expanding e-commerce businesses like Alibaba will propel the corrugated packaging market. Additionally, e-commerce companies like Alibaba and JD.com claim that Chinese consumers spent almost USD 139 billion during the Singles' Day festival, which increased inventories and storage needs for various commodities and increased demand for corrugated packaging.

Moreover, it is projected that the US would be a significant market for corrugated boards. There are many packaged food businesses in the nation, including those that provide convenience foods, ready-to-eat meals, and ready-to-make meals. One of the main development drivers is the high demand for out-of-home food due to hectic work and personal schedules and the convenience that these food items offer is a major driver.

Corrugated Board Market Segmentations:

Corrugated Board Market Segmentation by Board Type

The market is analyzed by board type into the following:

- Single Face Board

- Single Wall Board

- Double Wall Board

- Triple Wall Board

Corrugated Board Market Segmentation by Flute Type

The report analyzes the market by flute type as below:

- A-Flute

- B-Flute

- C-Flute

- E-Flute

- F-Flute

- Combination Flutes

Corrugated Board Market Segmentation by End-User Industry

The market is analyzed by end-user industry into the following:

Corrugated Board Market Segmentation by Regions:

The study also analyzed the Corrugated Board Market into the following regions, with country-level forecasts and analysis as below:

- North America (USA, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others)

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Corrugated Board Market Competitive Landscape:

The cork stopper market features key players such as International Paper Company, Smurfit Kappa, Mondi Group, DS Smith, WestRock Company, Packaging Corporation of America, Stora Enso, Oji Holdings Corporation, and Georgia-Pacific LLC, among others.

Corrugated Board Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Corrugated board market size, forecasts, and trends by different board types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Corrugated board market size, forecasts, and trends by flute type, with historical revenue data and analysis.

- Corrugated board market size, forecasts, and trends by end-user industry, with historical revenue data and analysis across various segments.

- Corrugated board market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts, further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the corrugated board market to the decision-makers, analysts and other stakeholders in the easy to read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Corrugated Board Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Corrugated Board Market Size in 2025 | US$163.566 billion |

| Corrugated Board Market Size in 2030 | US$194.885 billion |

| Growth Rate | CAGR of 3.57% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Corrugated Board Market |

|

| Customization Scope | Free report customization with purchase |

Navigation

- Corrugated Board Market Size:

- Corrugated Board Market Key Highlights:

- Corrugated Board Market Drivers:

- Corrugated Board Market Trends:

- Corrugated Board Market Geographical Outlook:

- Corrugated Board Market Segmentations:

- Corrugated Board Market Competitive Landscape:

- Corrugated Board Market Report Coverage:

- Corrugated Board Market Scope: