Report Overview

Cosmetic Pigments Market Size, Highlights

Cosmetic Pigments Market Size

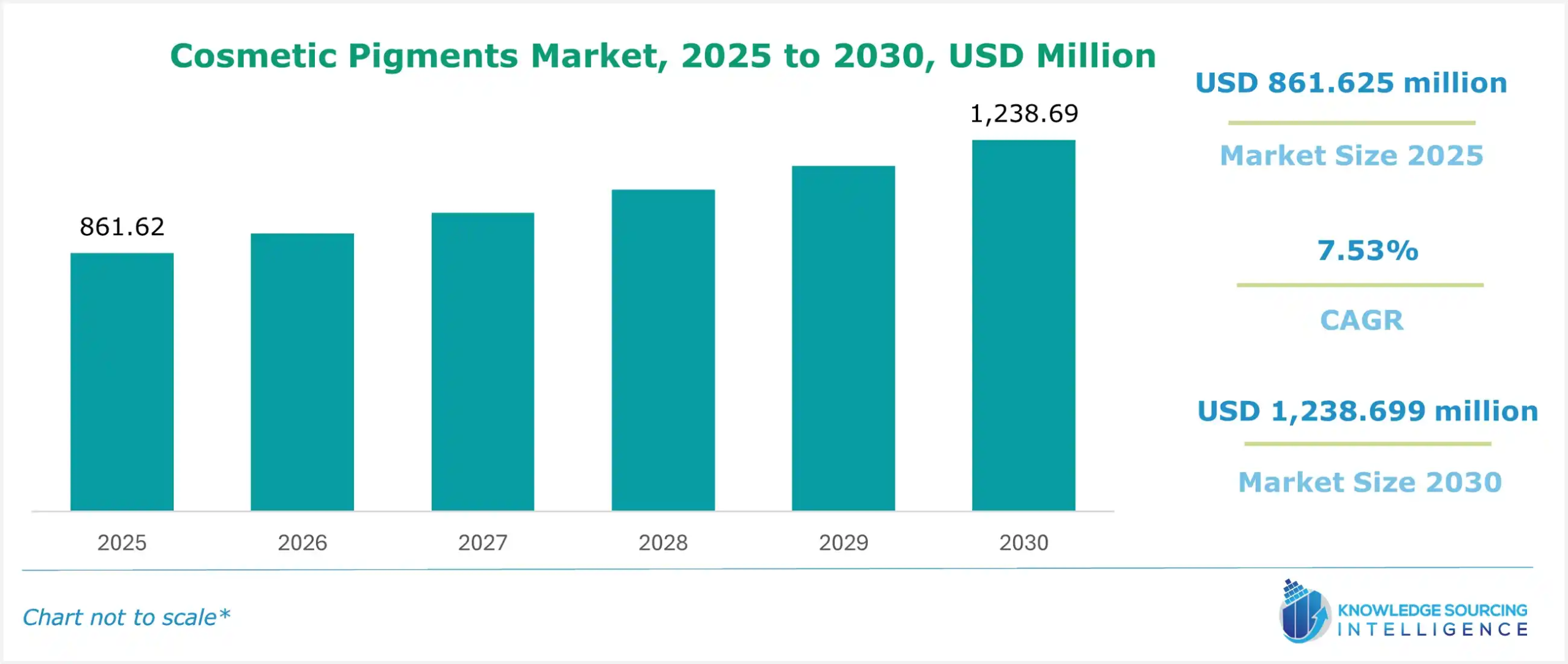

The cosmetic pigments market is expected to grow at a CAGR of 7.53%, reaching a market size of US$1,238.699 million in 2030 from US$861.625 million in 2025.

The cosmetic pigments market is regarded as a dynamic segment within the cosmetics industry, which focuses imperatively on colorants that enhance the aesthetic appeal of multiple beauty products. These pigments are added while creating lipstick, foundation, eye shadows, and many other cosmetic items. They provide various colors and effects for consumer choice. Two types of pigments are considered to be the most used, mainly organic and inorganic. Organic pigments are made from carbon, presenting diverse colors, whereas inorganic ones are made from minerals and provide stability and opacity.

Market trends for cosmetic pigments include a growing demand for environmentally-friendly products, highlighted by the increasing interest in natural and sustainably sourced cosmetic pigments. Additionally, the consumers' interest in health and the environment has led them to prefer natural pigments derived from botanical sources instead of certain synthetic pigments. As a result, the increasing pressure has forced manufacturers to invest heavily in R&D to bring about a safer alternative, considering the stringent requirements posed by regulatory agencies such as the FDA and the EU. The use of natural colorants addresses the health concern of synthetic dyes and hence aligns with the movement of being environment-friendly.

Another market driver is the improved pigment technology, enabling resultant products to improve performance. For example, surface treatments can improve the application properties of the pigments themselves, resulting in a strong adhesion of the pigments to the skin and a long wear time. Color can also be another area whereby social media trends influence the production and sale of cosmetics. Perhaps the most apt example is the specific shade associated with the phenomenon known as "Barbiecore" fashion.

What are the cosmetic pigment market drivers?

- Rising benefits of Pigments

One additional benefit of using pigments in cosmetics, rather than dyes, is that they are insoluble, so they do not settle down and sink to the bottom of any formulations without affecting the texture or stability of the product. This results in good color retention, resistance to fading, and minimal skin migration. For example, the opacity and enhancing ability of titanium dioxide are the reasons this ingredient is quite commonly used in various products while making them more opaque. Thus, it is a classic in foundations and concealers. Iron oxides are also used for safe color options in various cosmetic applications because they are non-toxic.

- Increasing growth in the cosmetics industry in various countries

According to Cosmetics Europe, The Personal Care Association, in 2023, reported that over 259,244 individuals were employed directly in the cosmetics chain, where an additional 2.68 million were employed indirectly. Furthermore, the European economy was valued at Euro 96 billion in 2023, making it the global flagship market for cosmetics and personal care.

Additionally, the largest national markets for cosmetics and personal care products within Europe are Germany, with a valuation of Euro 15.9 billion, and France, with a valuation of Euro 13.7 billion. It is followed by Italy (Euro 12.5 billion), the UK (Euro 11 billion), Spain (Euro 10.4 billion), Poland with Euro 5.2 billion, and other countries accounting for a total of Euro 27 billion. This growth in the cosmetics industry is directly related to the cosmetic pigments market expansion.

Major restraints of the cosmetic pigment market:

- One of the most significant restraining factors in the cosmetic pigment market growth is the increased vigilance over safety and compliance with regulations in the case of synthetic pigments. Due to increased awareness regarding adverse health effects related to a particular chemical composition, regulatory agencies are imposing tougher regulations for using specific pigments in cosmetics worldwide. This may also raise the cost of production for manufacturers since they would have to invest in research, testing, and reformulation to meet safety requirements.

The long approval processes for new pigments delay product launches and innovation and give companies less opportunity to react quickly to market trends. As a result, manufacturers may face the challenge of finding a strike balance between consumers' color demands and evolving regulations that also keep changing. As a result, such an effect would negatively impact market growth and profitability.

Segment analysis of the cosmetic pigment market

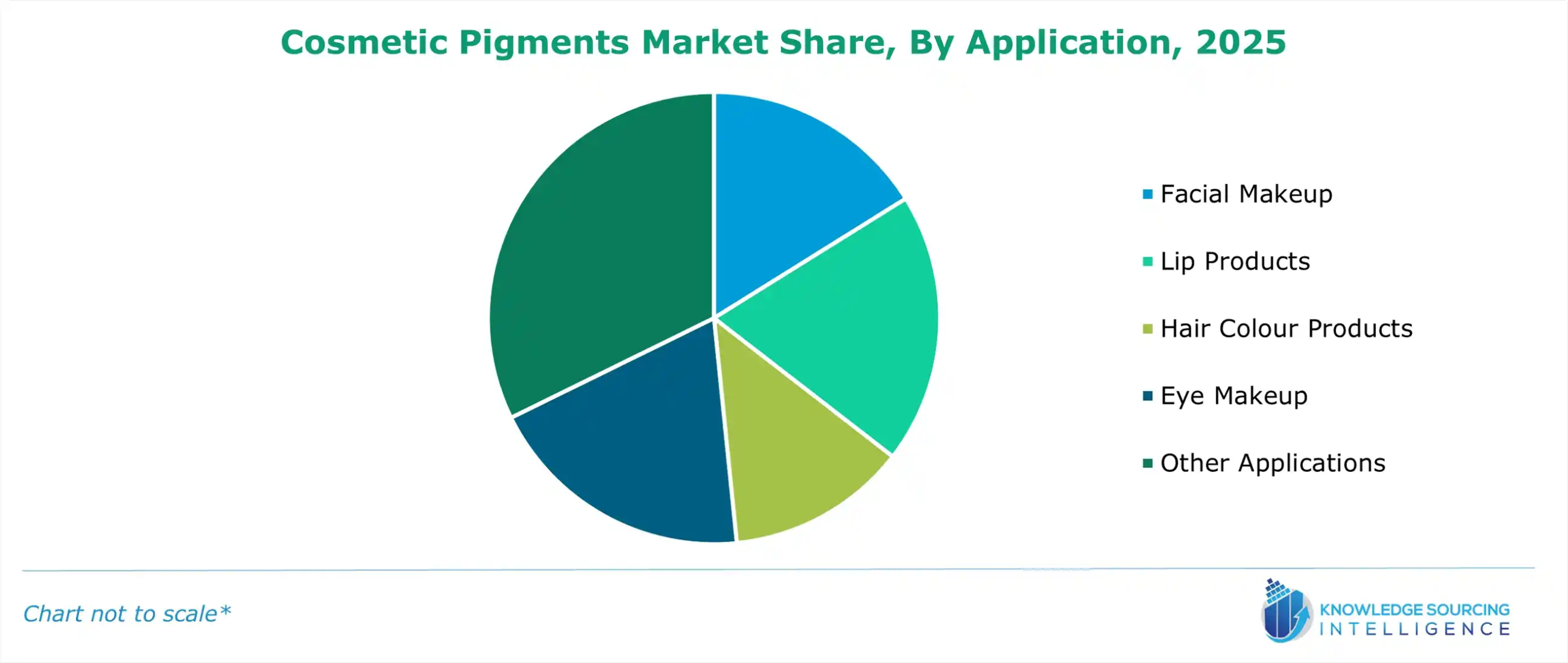

- The cosmetic pigments market by application is segmented into facial makeup, lip products, hair color products, eye makeup, and other applications.

Cosmetic pigments are utilized in different application areas, such as facial makeup, lip products, and others. With the growing economies of Asia and Africa, the demand for cosmetic pigments in hair color and eye makeup products is increasing.

Key developments in the cosmetic pigment market:

- In March 2023, Sun Chemical, during the in-cosmetics Global 2023, under the “Beauty is colorful. We are all color experts” campaign, introduced new effect pigments with the highlight being on its natural colorants and ingredients. This further emphasized the importance of providing colorful and sustainable solutions to the beauty industry.

- In November 2022, P2 Science, Incorporation, a green chemistry company, launched their new range of biobased and patented pigment dispersions under the tradename Citrosperse.

- In August 2021, DIC Corporation launched two new color travel effect pigments, Reflecks MD Midnight Cherry and Reflecks MD Midnight Sapphoite, with its wholly-owned subsidiary Sun Chemical.

Cosmetic pigments market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cosmetic Pigments Market Size in 2025 | US$861.625 million |

| Cosmetic Pigments Market Size in 2030 | US$1,238.699 million |

| Growth Rate | CAGR of 7.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

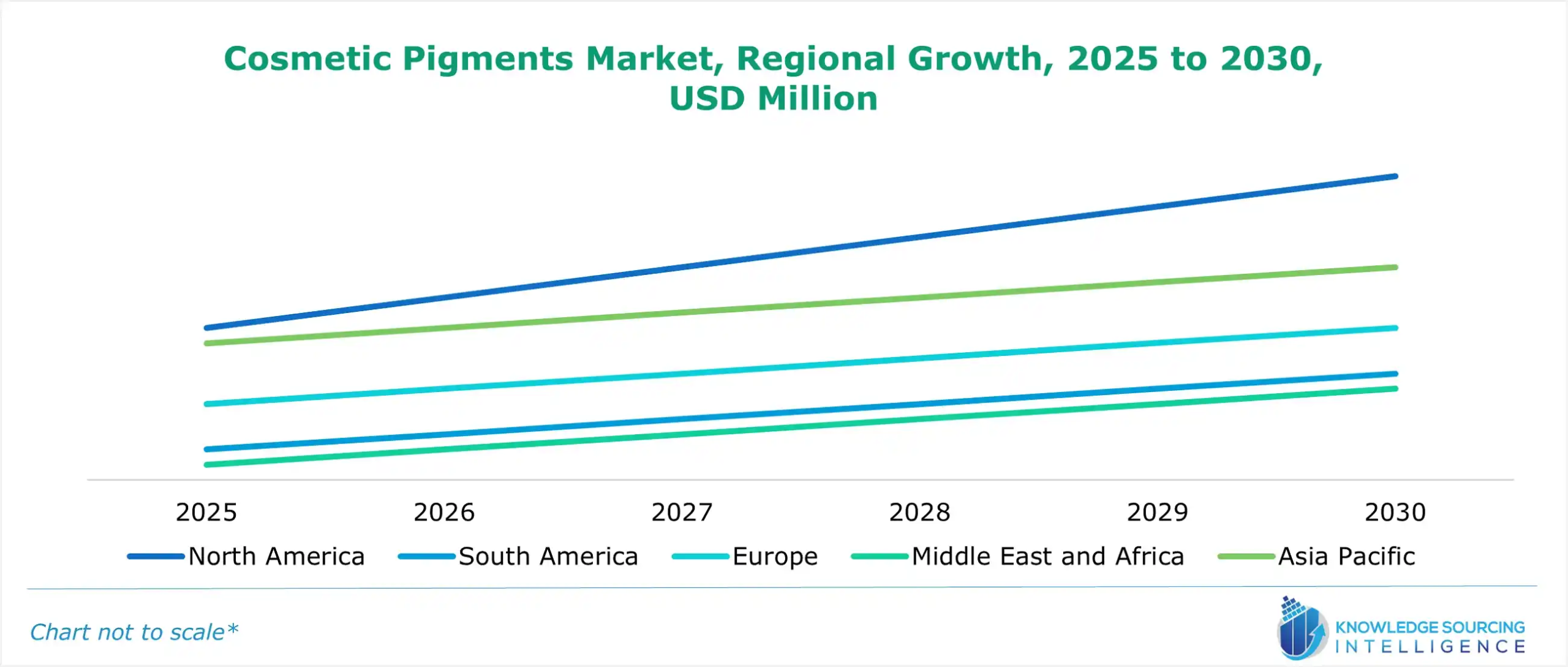

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cosmetic Pigments Market | |

| Customization Scope | Free report customization with purchase |

The cosmetic pigments market is segmented and analyzed as follows:

- By Application

- Facial Makeup

- Lip Products

- Hair Colour Products

- Eye Makeup

- Other Applications

- By Composition

- Inorganic

- Organic

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America