Report Overview

Global Color Cosmetics Market Highlights

Color Cosmetics Market Size:

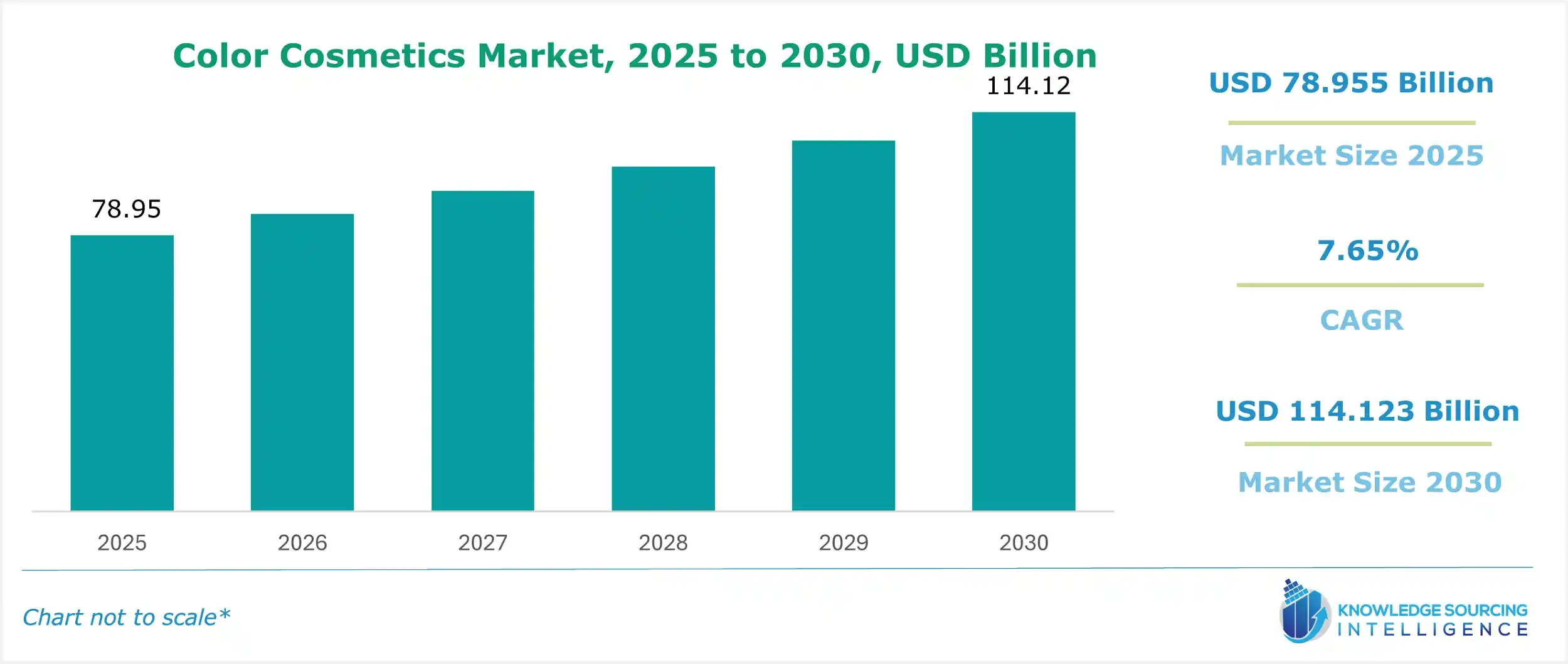

The global color cosmetics market, valued at US$114.123 billion in 2030 from US$78.955 billion in 2025, is projected to grow at a CAGR of 7.65% through 2030.

Color Cosmetics Market Overview:

The global color cosmetics market is rising due to increasing consciousness among people about their appearance and the improving quality of life. Color cosmetics help in enhancing one’s beauty and providing them with confidence. The major driving factor for the growing color cosmetics market is the increase in people's disposable income, changing lifestyles, and increasing consciousness about their appearance.

The growing number of working women is improving their lifestyle, demanding stylish and designer clothes due to their high fashion sense. The increasing presence of fashion-conscious consumers and high disposable income are the major reasons for the growing demand for color cosmetics.

Color Cosmetics Market Overview & Scope:

The global color cosmetics market is segmented by:

- Target Market: By target, the market is segmented into premium products and mass products. The demand for mass products in the target market segment is expected to grow, mainly with the increasing awareness of cosmetic products in the global market.

- Application: By application, the market is segmented into nail products, lip products, eye make-up, facial make-up, hair color products, special effect products, and others.

- Region: The Asia-Pacific region is expected to be the fastest-growing regional market for color cosmetics during the forecast period. The increasing disposable income of people and the rising working women’s population are augmenting the demand for color cosmetics. Urbanization and growing economies have provided more income for people to buy their desired products. This growth is further supported by many online make-up and other cosmetics, both international and domestic brands, selling platforms in countries like India, China, and South Korea.

Top Trends Shaping the Global Color Cosmetics Market:

1. Growth of e-commerce platform

- The increasing global utilization of e-commerce platforms is also among the key factors pushing the market’s growth. The increasing utilization of e-commerce platforms offers users convenience and a wide range of product choices.

2. Development of a hybrid product

- The increasing innovation and development of the cosmetic sector, and the introduction of hybrid cosmetics, offer cosmetic applications and skincare benefits.

Color Cosmetics Market Growth Drivers vs. Challenges:

Opportunities:

- Increase in Internet and smartphone penetration: A rapid increase in Internet and smartphone penetration has given rise to a new platform for retailers to sell cosmetics directly to end users. The increasing visibility and ease of accessibility of the online platform have raised the market for e-commerce companies. The color cosmetics market is increasing its online presence by providing customers with a convenient and wide range of products while investing little in advertising.

- Growing disposable income: Developing countries are seeing a rise in their disposable income due to urbanization and growing industries. This allows people to spend more of their income on their desired products. The rise in the number of women working in multinational companies is forming new markets to fulfill their demands. This is encouraging global cosmetics companies to invest more in developing new products while diversifying their product lines.

Challenges:

- Increasing demand for organic ingredients: The increasing utilization of organic and natural ingredients in the cosmetic sector is among the key factors challenging market growth.

Color Cosmetics Market Regional Analysis:

- Europe: Europe is expected to have a significant share in the color cosmetic market due to the presence of major cosmetics companies and the region's high demand for color cosmetics. The emerging popularity of organic/natural color cosmetics due to rising concerns over the harmful effects of synthetic cosmetics is further driving the regional color cosmetics market growth.

Color Cosmetics Market Competitive Landscape:

The market is fragmented, with many notable players, including L'Oréal S.A., Estée Lauder Companies Inc., Avon Products, Inc., Coty Inc., Revlon Consumer Products Corporation, Kryolan Professional Make-Up, Shiseido Company Limited, Chantecaille Beaute Inc., Ciaté London, Global Cosmetics (HK) Company Limited, Schwan Cosmetics International GmbH, and MPLUS COSMETICS SRL, among others.

- Technology Launch: In June 2024, L'Oreal Paris, a global leader in the cosmetics sector, launched Colorsonic, a breakthrough device, which is designed to enhance the hair coloring experience of the consumer.

Color Cosmetics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Color Cosmetics Market Size in 2025 | US$78.955 billion |

| Color Cosmetics Market Size in 2030 | US$114.123 billion |

| Growth Rate | CAGR of 7.65% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Color Cosmetics Market | |

| Customization Scope | Free report customization with purchase |

Color Cosmetics Market is analyzed into the following segments:

By Target Market

- Premium Products

- Mass Products

By Application

- Nail products

- Lip products

- Eye Make-up

- Facial Make-up

- Hair Color Products

- Special Effects Products

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa