Report Overview

Crop Monitoring Technology Market Highlights

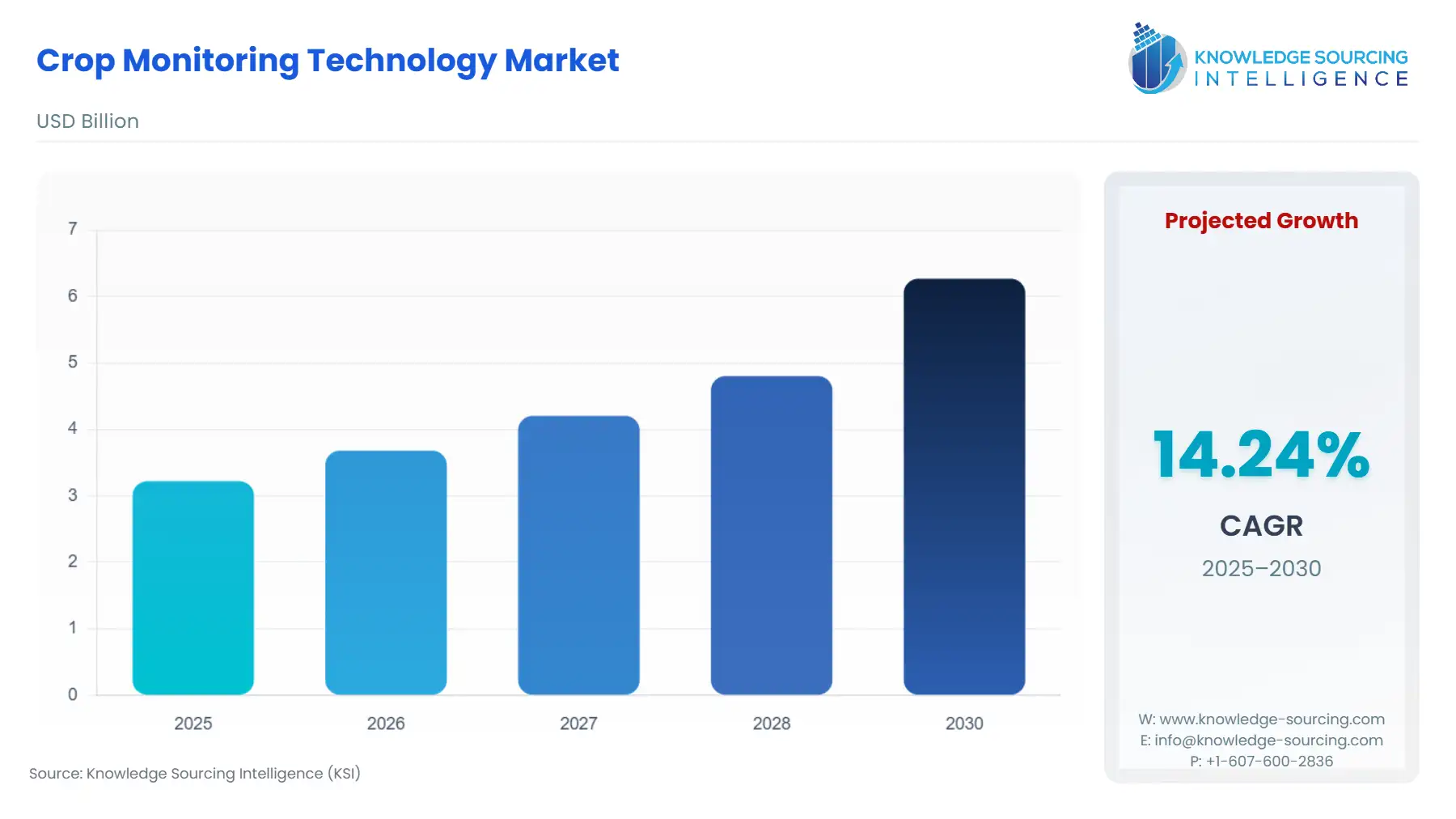

Crop Monitoring Technology Market Size:

The crop monitoring technology market is expected to grow from USD 3.222 billion in 2025 to USD 6.269 billion in 2030, at a CAGR of 14.24%.

The Crop Monitoring Technology Market comprises a suite of interconnected solutions, spanning field-installed hardware, airborne remote sensing, and sophisticated data analytics platforms. This market addresses the global imperative for increasing agricultural productivity amidst climate volatility, finite resource availability, and escalating demand for food. Technologies like advanced sensor arrays, GPS-enabled guidance, and variable rate systems enable farmers to transition from traditional, blanket-application farming to site-specific management, driving measurable improvements in yield and resource utilization.

Crop Monitoring Technology Market Analysis

- Growth Drivers

The market's expansion is fundamentally propelled by the necessity for greater resource-use efficiency and yield enhancement. Increasing adoption of Artificial Intelligence (AI) and Internet of Things (IoT)-based devices, driven by advancements in sensor affordability, directly creates demand for precision Software and Service solutions capable of processing real-time farm data. Furthermore, governmental financial assistance programs—such as those managed by the USDA, which subsidize conservation practices—explicitly increase the economic viability for farmers to invest in costly technologies like Variable Rate Technology (VRT), which requires detailed crop monitoring data to operate effectively and justify the initial acquisition cost.

- Challenges and Opportunities

A significant market challenge is the high up-front acquisition cost for sophisticated hardware and the prevailing digital divide in developing regions, which constrains demand among smallholder farmers. The lack of standardized data protocols also hampers the interoperability of mixed-fleet systems, reducing the perceived value of multi-vendor solutions. Conversely, a primary opportunity lies in the further boost of digitization initiatives across the agriculture sector. The development of robust, farmer-centric data governance frameworks and analytical tools that translate complex farm data into simplified, actionable, and profitable decisions directly enhances farmer confidence, stimulating long-term demand for data-centric monitoring services.

- Raw Material and Pricing Analysis

The hardware segment of Crop Monitoring Technology, including sensors, ground-based IoT devices, and guidance systems, is highly dependent on the global semiconductor value chain. This chain is geographically concentrated, particularly in East Asia, which introduces significant vulnerability to supply shocks and logistical delays. Disruptions in the semiconductor supply since 2020 have caused price increases across downstream sectors, including agricultural electronics. This inflationary transmission directly elevates the acquisition costs for essential crop monitoring components, such as high-performance microprocessors for edge computing and Micro-Electro-Mechanical Systems (MEMS) used in soil and environmental sensors, placing upward pressure on the final product pricing for farmers.

- Supply Chain Analysis

The global supply chain for Crop Monitoring Technology exhibits a complex segmentation defined by specialized production hubs. The design and high-end fabrication of critical semiconductor chips are concentrated in regions like Taiwan and South Korea. Conversely, the final assembly of major agricultural machinery and integrated precision components—like guidance systems and on-board monitors—is often conducted by OEMs in North America and Europe. Logistical complexities stem from the large physical size of machinery and the high dependency on a global network of specialized component manufacturers for sensors and embedded systems, making the entire chain vulnerable to geopolitical and infrastructure disruptions, particularly for the hardware and integrated Guidance System segments.

Crop Monitoring Technology Market Government Regulations

Key global regulations focus on two primary areas: financial incentivization for conservation and the establishment of clear operational guidelines for new technologies like drones, directly impacting demand structures.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Advancing IoT for Precision Agriculture Act of 2021 (part of the CHIPS and Science Act of 2022) / USDA Financial Assistance Programs |

USDA programs provide financial support for implementing conservation practices, increasing demand for VRT and Yield Monitoring tools required for quantification. The Act promotes R&D, which encourages innovation and market entry for new sensing hardware and software platforms. |

|

India |

Kisan Drone Scheme under Sub-Mission on Agricultural Mechanization (SMAM) / Directorate General of Civil Aviation (DGCA) Regulations |

The Kisan Drone Scheme offers substantial financial subsidies to farmers and custom hiring centers for drone adoption, creating immediate, subsidized demand for drone-based Remote Sensing services and data analysis platforms. DGCA rules establish necessary legal clarity for operations. |

|

European Union |

Common Agricultural Policy (CAP) / Environmental Regulations |

CAP promotes farming methods that adhere to strict environmental standards. Compliance necessitates granular data, directly driving demand for advanced soil monitoring sensors and Field Mapping software that documents and validates efficient resource use, such as nitrogen. |

Crop Monitoring Technology Market Segment Analysis

- By Application: Yield Monitoring

The Yield Monitoring segment, which uses sensors integrated into harvesting equipment to measure crop flow and moisture content in real-time, is driven primarily by the farmer’s profitability and data-driven decision-making imperative. Accurate, geo-referenced yield data is the foundational dataset for all other precision agriculture applications, including Field Mapping and Variable Rate Application (VRA). The need for Yield Monitoring solutions directly increases because this data allows farmers to create as-applied maps, which quantify the efficacy of previous input applications (seed, fertilizer, chemicals). This data provides the rationale necessary for farmers to invest in costly VRA equipment, as it substantiates the financial returns on precision agriculture investments. Furthermore, yield data is increasingly required by government and insurance programs for crop risk assessment, which provides a non-negotiable compliance-driven demand component for the technology.

- By Technology: Remote Sensing

Remote Sensing, encompassing satellite and drone-based imagery, is driven by the need for non-invasive, high-frequency, wide-area crop health surveillance. The need for Remote Sensing platforms, especially for high-resolution drone imagery services, is increasing due to their ability to conduct precise Crop Scouting and plant-level anomaly detection earlier than ground-based inspections. This technology serves as a proactive measure, enabling early detection of water stress, pest infestations, and nutrient deficiencies, which drives immediate demand for remedial action (e.g., Variable Rate Application of targeted inputs). The decreasing cost and increasing operational simplicity of high-resolution drone platforms, coupled with favorable government regulations that clarify flight rules, have made this data acquisition method more accessible and cost-effective, directly catalyzing demand across all farm sizes for real-time field intelligence.

Crop Monitoring Technology Market Geographical Analysis

- US Market Analysis

The US market is characterized by large-scale farms and established infrastructure, which creates an environment where the high fixed costs of integrated Guidance Systems and VRT equipment are economically justified through economies of scale. This growth is consistently driven by robust federal support; the USDA, through its financial assistance and loan programs, subsidizes the adoption of precision agriculture practices, directly lowering the financial barrier for farmers to acquire Crop Monitoring Technology. Moreover, the Advancing IoT for Precision Agriculture Act encourages R&D, which spurs a sustained demand for novel, interconnected hardware and software solutions that improve data interoperability and reduce field operating time. The US market mandates interoperability and data transparency to maintain a competitive advantage.

- Brazil Market Analysis

The Brazilian market is strongly correlated with the country’s position as a global agricultural powerhouse, particularly in soybean and corn production. The sheer scale of production necessitates sophisticated monitoring systems. Growth drivers include the pressure to manage massive fields efficiently and the need to optimize fertilizer and pesticide use due to rising input costs. While high adoption is seen in large cooperative farms, the market faces a constraint in rural internet connectivity, which depresses demand for continuous, cloud-based data services. Therefore, the Brazilian market shows a preference for rugged, on-board hardware and systems with edge computing capabilities that can process data locally before transmission.

- Germany Market Analysis

The German market for Crop Monitoring Technology is fundamentally shaped by strict European Union environmental regulations mandated by the Common Agricultural Policy (CAP). These regulations compel farmers to demonstrate reduced environmental impact, especially concerning nutrient leaching and pesticide application. This creates an intense, compliance-driven demand for highly accurate Soil Monitoring sensors and Variable Rate Technology, which can document and prove site-specific, optimized input use. Furthermore, Germany's established research sector and high digital literacy drive continuous demand for advanced, integrated software platforms that facilitate detailed regulatory reporting and advanced predictive analytics.

- Israel Market Analysis

The Israeli market exhibits uniquely high demand for technology due to the extreme necessity for water conservation in an arid environment. The scarcity of water elevates the value of precise monitoring, making systems like sophisticated soil moisture sensors and hyperspectral Remote Sensing platforms for irrigation scheduling a non-negotiable operational necessity. Its growth is driven by a culture of technological innovation and academic-industry collaboration, resulting in a high uptake of cutting-edge, data-intensive Services and Software. This highly efficient, technology-dense environment focuses demand on solutions that deliver the highest possible resource-use efficiency, often pioneered by homegrown AgTech firms like Semios and Prospera Technologies.

- China Market Analysis

China’s market is defined by a dichotomy: large state-run farms and vast numbers of small, fragmented landholdings. Government-led initiatives, such as the aggressive promotion of the Kisan Drone Scheme (referencing similar Asian programs), are the primary growth catalyst, particularly for Remote Sensing and Field Mapping services via drones, which overcome the challenge of monitoring numerous small plots. The drive for food security and the need to centralize crop production data fuel public sector demand for monitoring systems like CropWatch. However, the small and fragmented nature of most farms limits the commercial adoption of large-scale, capital-intensive equipment like advanced integrated VRT systems, favoring low-cost, portable hardware and localized service models.

Crop Monitoring Technology Market Competitive Environment and Analysis

The competitive landscape of the Crop Monitoring Technology Market is characterized by a mix of established global Original Equipment Manufacturers (OEMs) specializing in machinery and pure-play AgTech firms focused on software and data analytics. OEMs are strategically integrating precision technology to create closed-loop, proprietary digital ecosystems, while specialized firms push innovation in data acquisition and analysis. The core battleground is data ownership, interoperability, and the ability to provide a complete, trusted digital solution across mixed-fleet operations.

- Deere & Company

Deere & Company is strategically positioned as a dominant force through its integration of hardware, machinery, and proprietary digital platforms. The company’s John Deere Operations Center acts as the central hub for all farmer data, integrating inputs from various sensors, guidance systems, and planters. The strategic aim is to create a seamless, end-to-end proprietary ecosystem where the company’s equipment and data services reinforce each other. A key product is the Generation 4 CommandCenter display, which provides a unified interface for guidance, VRT, and documentation, ensuring a high barrier to entry for third-party software providers and driving demand for Deere's integrated hardware-software solution bundle.

- Trimble Inc.

Trimble Inc. maintains a strong position as a technology-neutral provider, specifically focusing on positioning, modeling, and data analytics. Its core strength lies in its Guidance System segment, where it provides high-accuracy GNSS hardware and auto-steer solutions that are compatible with mixed-fleet equipment, directly addressing the interoperability challenge faced by many farmers. Key products include the Trimble Ag Software suite, which aggregates farm data from various sources for Field Mapping, VRT prescription, and fleet management. This strategic positioning as a non-OEM, multi-brand enabler creates demand by offering flexible, high-precision solutions that integrate into any farm operation.

- AGCO Corporation

AGCO Corporation is rapidly transforming its competitive profile through its strategic focus on precision agriculture under the PTx brand, which integrates the former Precision Planting and newly acquired Trimble assets. This structure positions AGCO to offer a full-line, mixed-fleet approach. A key product is the PTx Trimble portfolio, which includes advanced steering and guidance technologies. By forming PTx, AGCO signals a direct challenge to the proprietary ecosystems of competitors, aiming to drive demand by offering high-tech, integrated solutions that remain compatible across diverse machinery brands.

Crop Monitoring Technology Market Developments

- September 2025: AGCO Corporation announced the completion of the sale of its interest in Tractors and Farm Equipment Limited (TAFE), a strategic move to focus its capital and resources more heavily on its high-growth precision agriculture technology segment, as embodied by its PTx brand strategy. This divestiture simplifies AGCO's structure and accelerates its digital transformation.

- June 2025: AGCO’s PTx Trimble received the Fast Company World Changing Ideas Award for its OutRun™ Autonomous Grain Cart Solution. This product is a retrofit platform that demonstrates the company's commitment to advancing autonomous capabilities and reducing labor requirements across farming operations, thereby driving future demand for integrated autonomous technology.

- January 2025: Solutions from AGCO Parts, Fendt, Precision Planting, and PTx Trimble were recognized with five AE50 Awards for innovation and engineering excellence. The awards acknowledge new farmer-focused solutions, highlighting a focus on continued product launch and refinement across its various precision technology and machinery brands.

Crop Monitoring Technology Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.222 billion |

| Total Market Size in 2031 | USD 6.269 billion |

| Growth Rate | 14.24% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, Solution, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Crop Monitoring Technology Market Segmentation:

- By Application

- Field Mapping

- Soil Monitoring

- Crop Scouting

- Yield Monitoring

- Variable Rate Application

- Others

- By Technology

- Guidance System

- Remote Sensing

- Variable Rate Technology

- By Solution

- Hardware

- Software

- Service

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East And Africa

- Saudi Arabia

- Israel

- Other

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America