Report Overview

Crude Oil Flow Improvers Market Size

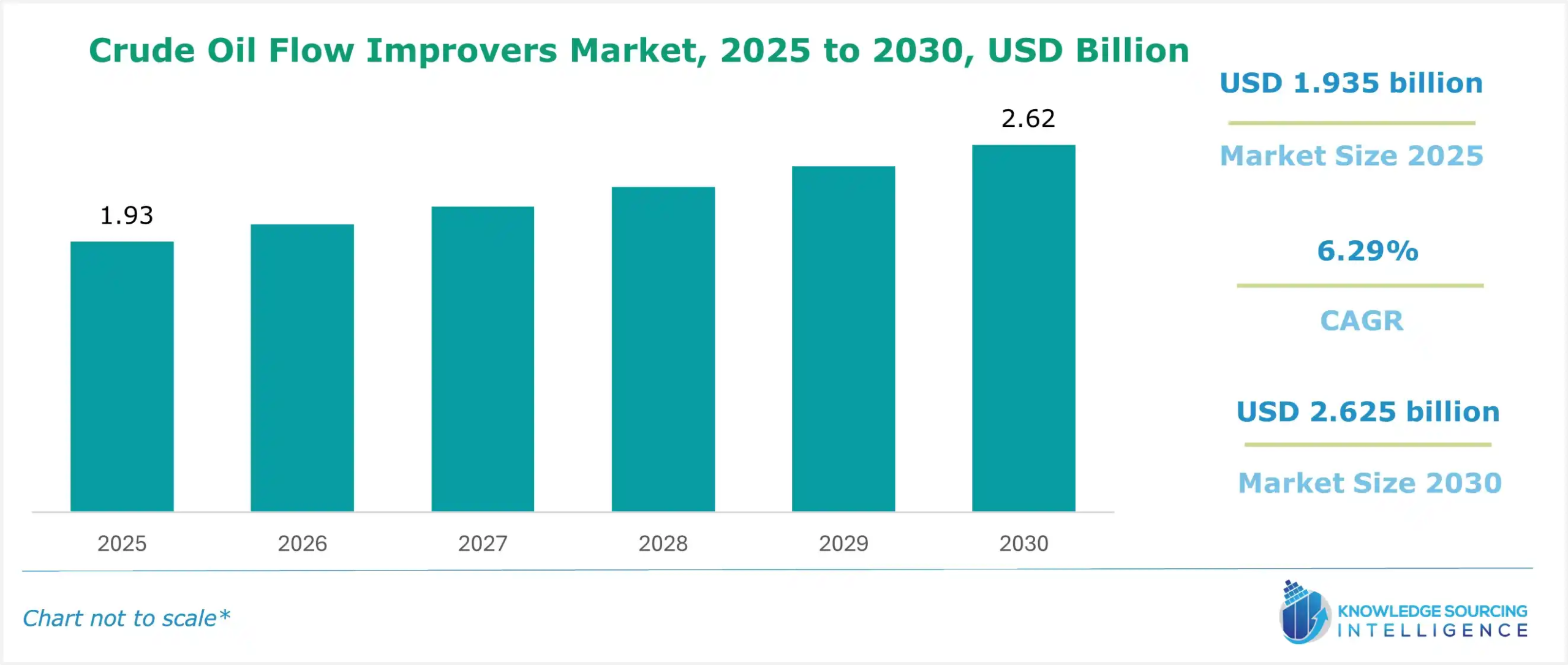

The crude oil flow improvers market is expected to grow at a CAGR of 6.29%, reaching a market size of US$2.625 billion in 2030 from US$1.935 billion in 2025.

Crude Oil Flow Improvers, abbreviated as COFIs, is the chemical term for additives applied in oil and gas production to improve the flow characteristics of crude oil while being produced, transported, and stored. Crude oil, particularly heavy and waxy types, becomes thixotropic and thus becomes difficult to transport through pipelines when cold. COFIs mitigate the above challenges by improving the fluidity of the oil, enabling smoother transportation, reducing operational costs, and preventing blockages.

The pipeline infrastructure is expanding rapidly in developed and developing countries, fuelling the market for crude oil flow improvers in the projected period. COFIs are used to bring a smoother flow of heavy and waxy crude oils and serve long-distance transportation in in-depth regions, especially in colder areas. It resists blockages, reduces viscosity, and reduces additional heating or diluent requirements. Therefore, the requirement for operational efficiency is optimized and cost-saving.

Several ongoing projects related to pipeline development are anticipated to positively influence market growth in the coming years. For instance, Hindustan Petroleum Corporation Limited, India (HPCL), announced that the Bathinda Sangrur Pipeline (BSPL Project), which originated from HMEL’s Guru Gobind Singh Refinery, is being extended up to 90kms till Sangrur Depot, and this project will be completed in 2024. Similarly, HPCL’s Haldia Panagarh LPG Pipeline Project (HPPL), a project from Haldia to HPCL LPG Bottling Plant, is expected to be completed by 2025. Hence, such major projects in developing countries are expected to increase the demand for crude oil flow improvers in the coming years.

What are the crude oil flow improvers market drivers?

- The rising crude oil processing and production is expected to influence the market for crude oil flow improvers in the coming years. These crude oils tend to solidify in cold weather, increasing the demand for COFIs in the projected period. For instance, according to the Government of India Ministry of Petroleum and Natural Gas Economic & Statistics Division, the cumulative crude oil production from April 2023 to February 2024 was 26,852.78 TMT, 0.48% higher than the previous year. Additionally, in February 2024, the total production of crude oil was 2,331.68 TMT, which was 7.88% higher than in February 2023, when the monthly production was 2,161.37 TMT. Similarly, according to the United States Energy Information Administration, the U.S. field production of crude oil was 4,00,994 thousand barrels in July 2023, which increased to 4,09,344 thousand barrels in July 2024. Hence, the increasing production and processing of crude oil is expected to positively influence market growth in the coming years.

- Moreover, COFIs prevent the formation of wax and buildup in viscosity, ensuring the smooth flow of crude in exposed high-pressure pipelines undergoing extreme temperatures. The various transportation, which involves carrying crude from the rigs to processing units without interruption, ensures reduced downtime for less strain on expensive heating systems. The growing offshore oil and gas production is anticipated to fuel the market for crude oil flow improvers in the coming years.

For instance, according to the International Energy Agency (IEA), offshore oil production is expected to increase from 26.4 mboe/d in 2016 to 27.4 mboe/d in 2040. Similarly, the offshore gas production is expected to increase from 17.5 mboe/d in 2016 to 26.9 mboe/d in 2040. Hence, the increasing offshore oil and natural gas production is expected to fuel the market for COFIs in the coming years.

- Oil companies have been facing a growing threat of emission rates, pipeline leakage, and other energy consumption issues from regulatory bodies, investors, and environmental groups. With such positive effects on oil transportation and storage efficiency, COFIs are gradually capturing their share of those sustainability goals. Several regulations, such as the Environmental Impact Assessment (EIA) Act and the Environmental, Health, and Safety (EHS) Guidelines, provide guidelines to oil and gas companies to consider all potential impacts before starting a project. Hence, such regulations are anticipated to fuel the market growth for crude oil flow improvers in the forecasted period.

Segment analysis of the crude oil flow improvers market:

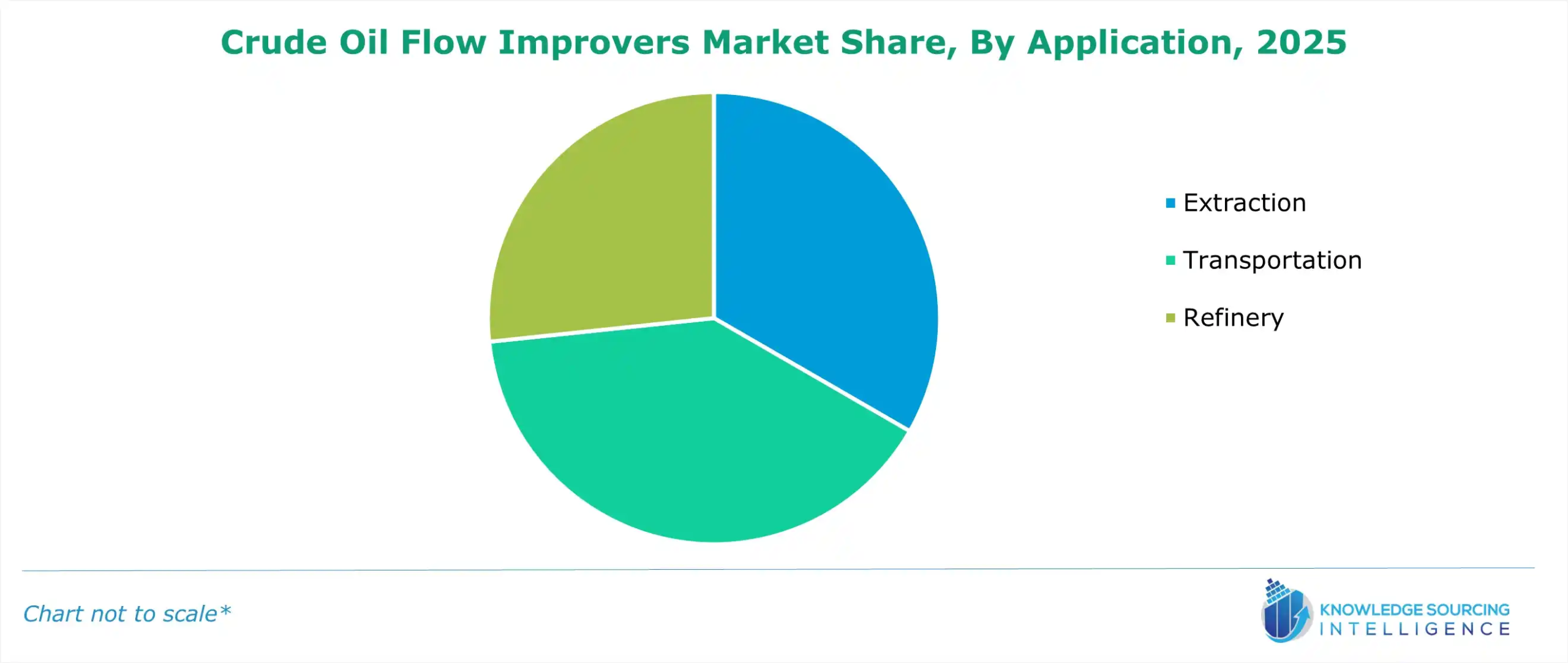

- The refinery segment is expected to hold a substantial market share in the projected period.

In the coming years, refineries will account for the majority share of the crude oil flow improvers (COFI) market. The additives ensure that all processes run efficiently. These include smooth flow through storage tanks, processing units, and pipelines without irregularities due to flow resistance. These waxy, heavy, and blended crude oils often plague refineries as they solidify or thicken in storage, processing, and transit in response to temperature fluctuations. If not properly controlled, such wax and asphaltene depositions lead to clogged equipment, increasing the amount of energy consumed and being time-consuming.

With optimized fluidity, COFIs ensure that operations occur without hindrance, reduce efforts in maintenance, and save on operational costs. As refineries move toward processing more crude grades, which include heavy, heavy to light, unconventional, and blended crudes, the demand for COFIs will likely increase as there will be a demand for higher efficiency, higher throughput, and actual production. The expansion of refinery infrastructure capacity and the modernization of state-of-the-art technology to achieve improved oil refining processes are additional contributors to this trend.

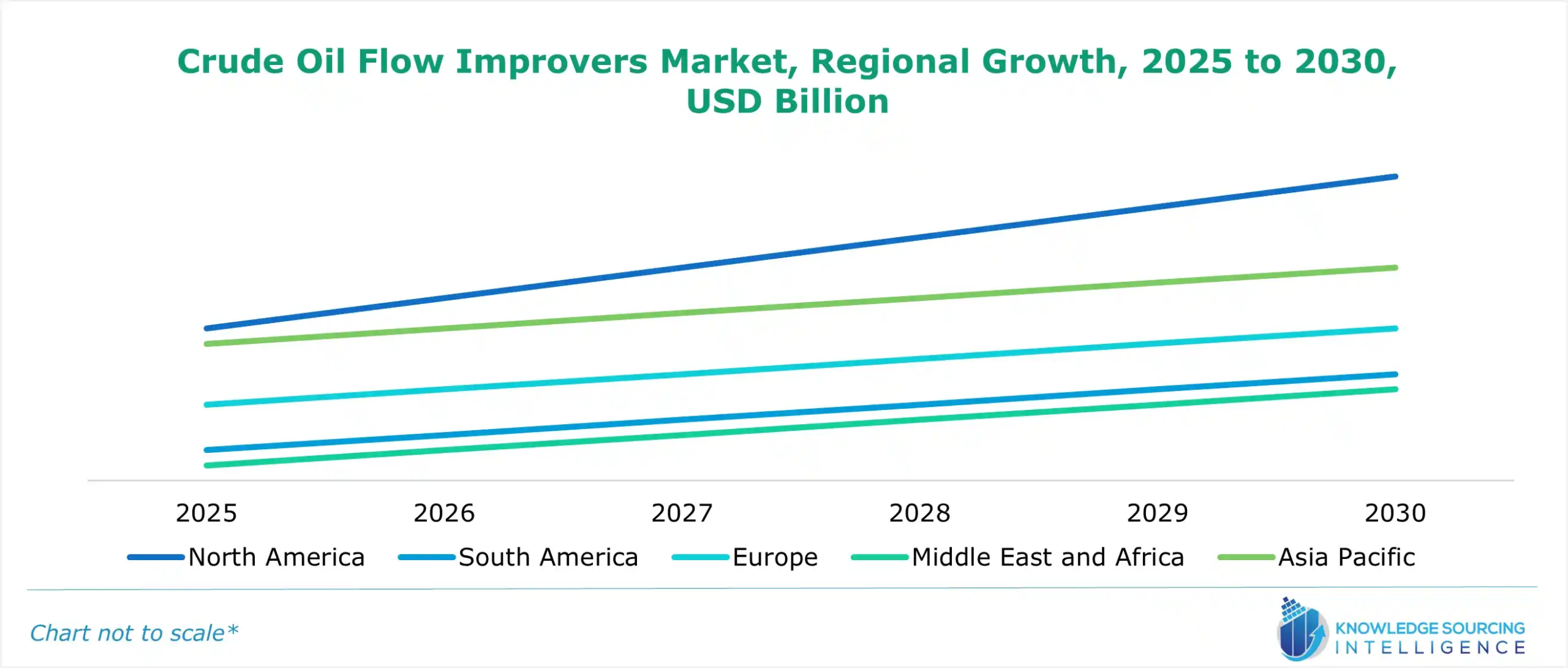

- The Asia Pacific region is anticipated to hold a significant share in the coming years.

The Asia Pacific region is expected to hold a major market share in the forecasted period, as COFIs are highly used in increasing exploration activities. There have been various upcoming projects coupled with increasing production and processing of crude oil in countries such as India and China are expected to fuel the demand for COFIs in the projected period.

Demand for crude oil flow improvers is driven by the large volumes of oil produced in the Middle East, challenging reservoir conditions, and an imperative to optimize transport through pipelines. Flow improvers, through additives, allow for flow by thinning viscosity within the crude oil, preventing the deposition of wax and asphaltene, and avoiding blockages, especially at lower temperatures or in deepwater applications. Thus, these are important to sustain operations efficiency as infrastructural expansion with EOR projects gaining speed and momentum in upstream and downstream sectors.

Crude Oil Flow Improvers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Crude Oil Flow Improvers Market Size in 2025 | US$1.935 billion |

| Crude Oil Flow Improvers Market Size in 2030 | US$2.625 billion |

| Growth Rate | CAGR of 6.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Crude Oil Flow Improvers Market |

|

| Customization Scope | Free report customization with purchase |

The Crude Oil Flow Improvers market is analyzed into the following segments:

- By Product:

- Paraffin Inhibitors

- Asphaltene Inhibitors

- Scale Inhibitors

- Others

- By Application:

- Extraction

- Transportation

- Refinery

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America