Report Overview

Oil Storage Tanks Market Highlights

Oil Storage Tanks Market Size:

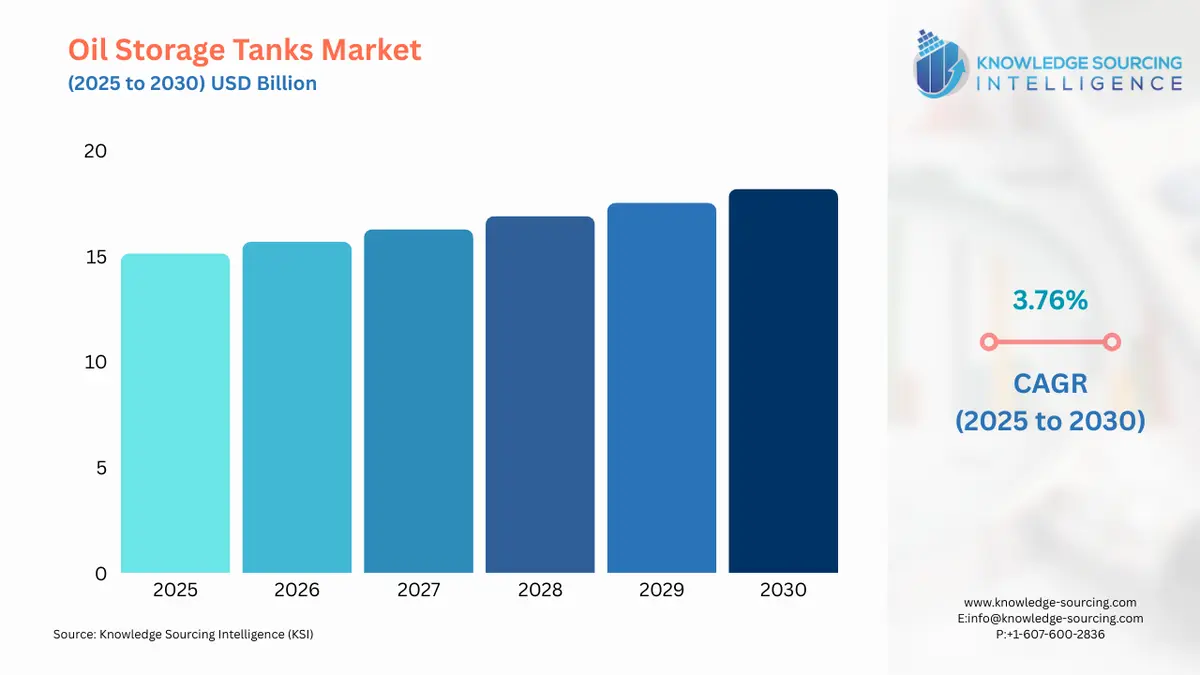

The oil storage tanks market is projected to expand at a 3.65% CAGR, achieving USD 18.752 billion in 2031 from USD 15.125 billion in 2025.

Oil Storage Tanks Market Trends:

An oil storage tank is a type of large-scale reservoir designed to store and hold oil. Oil storage tanks offer multiple key advantages in the global market, as they help prevent product loss and improve oil safety. They are also used for storing oils at different levels of production or refinery processes.

The increasing global demand and production of edible oil are also among the key factors propelling the global oil storage tanks market expansion during the forecasted timeline. The production of edible oil witnessed a significant increase, majorly in developing countries and regions with growing populations. The US Department of Agriculture, in its report, stated that the total production of edible oil in the nation grew significantly in India. The agency stated that in 2022-23, the total production of oil was recorded at 9,230 thousand MT, which increased to 9,487 thousand MT in 2023-24. In 2024-25, the total production of oil in India is expected at 9,773 thousand MT.

Oil storage tanks serve as large-scale container that holds fluids at various stages of the refinery process. They are commonly classified into three types: floating roof oil tanks, fixed roof oil tanks, and bunder oil tanks. Additionally, they come in three storage capacities such as up to 200 gallons, 200 to 500 gallons, and above 500 gallons. The rise in demand for oil and the expansion of oil refineries are the prominent drivers expanding the oil storage tanks market size.

Some of the major companies include Artson Engineering Ltd (TATA Projects Ltd.), T Bailey Inc., and Fox Tank Company.

Artson Engineering Ltd is among the leading structural fabrication and equipment manufacturers, which is a part of TATA Projects Ltd. The company offers storage tanks, heat exchangers, pressure vessels, skid units, and distillation columns, among others.

T BAILEY is a global leader in the fabrication market, offering products and solutions for multiple industries, including marine, transportation, water, wastewater, and pulp & paper, among others.

Fox Tank Co. is a global manufacturer of a wide range of products and solutions, including gas separators, heater treaters, crane & delivery, oil & water storage, and stairways & walkways, among others.

Oil Storage Tanks Market Growth Drivers:

Rising oil demand bolsters the oil storage tank market growth.

As global energy consumption continues to increase due to population growth, urbanization, and industrialization, there is a corresponding surge in the need for oil and petroleum products. Hence, to meet this rising demand, significant quantities of oil need to be stored safely and efficiently, necessitating the construction and expansion of oil storage tank facilities, which is contributing to the growth of the oil storage tank market. According to the International Energy Agency, world oil demand is predicted to rise by 2.2 mb/d in 2023 to an average of 102 mb/d. China's demand recovery has surpassed expectations, reaching a record high of 16 mb/d in March.

Increasing demand for crude oil

The growing global demand for crude oil is propelling the oil storage tanks market expansion during the forecasted timeline. With the increasing global demand for crude oil, production will increase, boosting the need for oil storage tanks during the forecasted timeline. The global production of crude oil increased by 1% in 2023. Enerdata, in its report, stated that in 2023, the USA witnessed a growth of about 8.5% in its oil production. The report further stated that in 2021, the total production of crude oil in the USA was recorded at 712 MT, which increased to 756 MT in 2022. In 2023, the USA’s total production of crude oil was recorded at 820 MT.

Government initiatives drive the oil storage tanks industry expansion.

Oil refineries expand their operations to meet increasing energy demands, there is a heightened need for additional storage capacity with increasing energy demands and a focus on energy security, governments worldwide are actively supporting the expansion of storage infrastructure, through policies, funding, strategic initiatives, and government incentivize. For instance, as per the Indian Brand Equity Foundation, the Union Ministry of Petroleum & Natural Gas approved in October 2021 to increase the refining capacity of the Numaligarh Refinery Expansion Project from 3 to 9 MMTPA, with a revised project cost of US$3.8 billion (Rs. 28,026 crores).

Rising oil trade drives the oil storage tank market growth.

Oil storage tanks play a crucial role in storing and managing vast quantities of oil during transit, thereby ensuring a steady and secure supply. The growing engagement of countries in global oil trade has propelled the demand for storage infrastructure to accommodate larger volumes of oil traded. For instance, according to the report of the Census and Economic Information Center (CEIC), in December 2021, India witnessed a reported increase in crude oil imports, reaching 4,243.758 barrels/Day. This marks a growth compared to the previous 4,033.050 Barrels/Day recorded in December 2020. Additionally, according to the Census and Economic Information Centre, in February 2023, the United Arab Emirates recorded a crude oil production of 3,042,000 barrels per day.

Oil Storage Tanks Market Restraints:

Shift towards renewable energy restrains the oil storage tanks industry.

The ongoing global transition towards renewable energy sources, such as solar and wind power, is expected to have a significant impact on the demand for traditional fossil fuels. As renewable energy gains momentum, there is a growing consensus that the need for storage capacity for fossil fuels, primarily facilitated by oil storage tanks, will experience a decline. This shift towards renewables not only reflects a broader environmental consciousness but also signifies a potential transformation in the market dynamics of the oil storage tanks industry.

Oil Storage Tanks Market Segmentation Analysis:

Floating roof tanks are gaining traction in the market

The oil storage tanks market is segmented by type into floating roof tanks, fixed roof tanks, bunder oil tanks, and others. Floating roof tanks are cylindrical steel storage containers designed with a floating roof that rests on the liquid surface. The roof is usually lightweight and supported by buoys for maintaining buoyancy. This roof can respond vertically to alterations in the volume of liquid. The types of floating roofs include external floating roofs and internal floating roofs. External floating roofs were used mainly for hazardous chemicals and volatile liquids, while internal floating roofs were meant for storing large volumes of crude oil and petroleum products. The floating roof tanks are very important to the oil and gas industry in holding large amounts of liquids.

External roof tanks are fitted based on environmental or economic factors for limiting product loss and the emission of volatile organic compounds and other airborne pollutants. Internal floating roof tanks provide environmental safety, as venting gases that explode in nature are released safely into the atmosphere. Deha Tech is a leading supplier of both categories with emission control solutions in design, manufacture, assembly, and after-sales support for chemical and petroleum tanks manufactured to industry standards.

Floating roof tanks will contribute a major value to the oil storage tank market because of reduced emissions, enhanced safety, and product quality. Further, these tanks minimize environmental concerns, fire, and explosion risks associated with oil storage and protect from product losses and contamination concerning sustainability regulation and safety standards.

The emissions standards for volatile organic liquid (VOL) storage tanks were revised in November 2024 by the EPA under 40 CFR 60 Subpart Kc. The 20,000 gallons comprise the storage capacity used for the VOL stored with a true vapor pressure of at least 0.25 psi when applied under Subpart Kc. It is proposed that the updates will affect approximately 1,500 new and modified storage vessels in industries such as Petroleum and Coal Products Manufacturing, Chemical Manufacturing, and Petroleum and Bulk Stations and Terminals. Floating roof tanks falling under Subpart Kc will thereby have much stricter requirements on rim seals and roof fittings. This stricter requirement will lead to a rise in demand for more advanced floating roof tank technologies, which will positively contribute to market expansion in the coming years.

Middle East & Africa is anticipated to dominate the oil storage tanks market

The Middle East and Africa region is a major global contributor to oil production owing to the abundant reserves and a strong presence of oil-producing nations such as Saudi Arabia, Iran, Iraq, and the United Arab Emirates. The need for storage infrastructure to accommodate the large-scale production of oil has increased. According to the International Trade Administration, the UAE ranks in the top ten oil producers globally, with Abu Dhabi holding 96% of its 100 billion barrels of proven reserves. It produces around 3.2 million barrels of petroleum and liquids daily. Additionally, according to the Census and Economic Information Centre, crude oil production for Saudi Arabia experienced growth from 10,215.000 barrels in March 2022 to 10,361.000 barrels in February 2023.

The US will also hold a large market share

The USA oil storage tank market is a significant global segment, given that the US is equipped with a major oil and gas industry, which in turn demands dedicated storage for primarily crude oil, refined products, and natural gas liquids. The US has been the largest producer of crude oil for six consecutive years, as per the International Energy Statistics. In 2023, the US broke its average crude oil production record of 12.9 million barrels a day, overtaking its previous record of 12.3 million barrels per day in 2019. The average monthly production peaked at over 13.3 million barrels per day in December 2023, the highest ever recorded monthly.

In addition, according to EIA (U.S. Energy Information Administration), the field production of crude oil in the U.S. recorded an increase from 12,554 thousand barrels per day in January 2024, which had climbed to 13,204 thousand barrels at the end of September 2024.

Additionally, the rising geopolitical risks and uncertainties in the global oil market have strengthened the case for strategic petroleum reserves, which will, in turn, drive oil storage tank demand in the country during the forecast period. The US government places a high priority on the establishment of strategic petroleum reserves to safeguard energy security and mitigate instances of supply disruptions, which will increase demand for oil storage tanks. For instance, in September 2024, in September 2024, the Biden-Harris Administration closed out emergency revenues from 2022's sales, securing 200 million barrels of the Strategic Petroleum Reserve at a favorable price. The purchase of 2.4 million barrels secured reliable fuel supplies for American businesses and consumers while calming much of the global supply markets.

Oil Storage Tanks Market Company Products:

800 BBL Storage Tanks: The Viro fluid storage tanks are innovative horizontal tanks with dual compartments. Each compartment features separate desanding piping, enabling efficient removal of produced sand using a vac-truck. The tanks' user-friendly hook-up system facilitates a streamlined process, resulting in time and cost savings.

VITRIUM Glass-Fused-to-Steel: CST Industries' VITRIUM Glass-Fused-to-Steel product is specifically designed for liquid and gas applications. It boasts a high-specification 3-coat glass coating, ensuring excellent performance and durability. With its low maintenance requirements, VITRIUM™ offers a practical and long-lasting solution for various industrial needs in the gas zone.

Condensate Tanks: TBailey Inc. offers bulk storage condensate tanks that are specifically designed for natural gas liquids, condensates, and liquid waste products generated during oil production. These tanks serve as efficient storage solutions for these substances, allowing for safe and reliable containment.

Oil Storage Tanks Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Oil Storage Tanks Market Size in 2025 | USD 15.125 billion |

Oil Storage Tanks Market Size in 2030 | USD 18.193 billion |

Growth Rate | CAGR of 3.76% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Oil Storage Tanks Market |

|

Customization Scope | Free report customization with purchase |

Key Segment:

By Type

Floating Roof Tanks

Fixed Roof Tanks

Bunder Oil Tanks

Others

By Material

Plastic

Steel

Carbon Steel

Stainless Steel

Reinforced Concrete

By Storage Capacity

Upto 200 gallons

200 to 500 gallons

Above 500 gallons

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: October 03, 2025