Report Overview

Denmark Smartwatch Market Size, Highlights

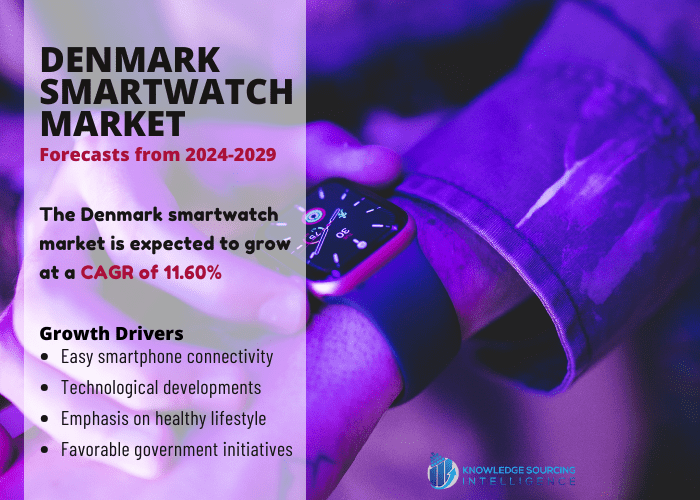

The Denmark smartwatch market is expected to experience a CAGR of 11.60% throughout the forecast period, reaching a market size of US$162.298 million by 2029. This represents a substantial increase from US$75.267 million recorded in 2022.

Technological developments, health-conscious consumers looking for sophisticated monitoring functions, and easy smartphone connectivity are driving the Danish smartwatch market. In addition, the nation's smartwatch industry is growing faster because of partnerships with healthcare providers and the expansion of e-commerce. The best digital accessory for supporting and motivating people throughout their training or exercise routines is a smartwatch. Since lifestyle illnesses such as diabetes are more common, people are more conscious of their health, which has raised the need and demand for electronic medical equipment. For instance, as per the IDF Diabetes Atlas in Demark 309.4 thousand people had diabetes in the year 2021.

Danish smartwatch manufacturers prioritize ongoing technical innovation, including cutting-edge health functions and stylish designs to maintain their competitive edge. To increase market reach, strategic alliances with fitness and fashion companies are utilized. In the dynamic wristwatch industry, the emphasis is still on developing state-of-the-art, customizable devices to satisfy changing consumer tastes. For thirty years, Skagen, a Danish lifestyle brand, has been producing watches. Despite being a part of the Fossil Group of watch companies, the brand has its distinct look. Skagen's watches are known for their simplicity, style, and functionality. In addition, the newest model of the watch offered by the business is made in collaboration with luxury lifestyle audio company X by KYGO. This edition's matte black watch body and wrist strap are exclusive. The third edition of the Falster has a more polished overall appearance, but it still has the same essential features as the previous version, including a flat, spherical watch body with floating lug ends.

Furthermore, the smartwatch market may benefit from government programs that foster technical innovation or digital health, as well as from laws that encourage the use of wearable technology. The goal of the Danish digital health plan is to increase citizen collaboration in digital healthcare and for patients to view the healthcare system as a reliable and cohesive network of services. The plan helps the healthcare players assume accountability for linking the patient pathways among their various encounters with the industry. To further propel the healthcare system's digital transformation, the Digital Health Strategy 2018–2022 has been extended until 2024.

Growth in e-commerce and digitalization propel the Denmark smartwatch market.

The Denmark smartwatches market is greatly impacted by the expansion of e-commerce as it increases accessibility and customer reach. Online retailers give customers a quick and easy way to browse and buy smartwatches, which boosts sales. E-commerce also makes a wide variety of items more accessible, enabling customers to evaluate features and costs and make better-informed purchases. To increase demand and promote market expansion, smartwatch manufacturers may also use targeted marketing campaigns and promotions owing to the digital marketplace. As per the International Trade Administration, local online shops in Denmark generated approximately DKK 130 billion (about USD 20 billion) in sales through e-commerce in 2021. In contrast, the sales made by overseas shops were around DKK 50 billion, or USD 7.5 billion. In addition, nearly 70% of Danish internet consumers bought apparel and sporting goods in 2021, demonstrating the growing popularity of fashion e-commerce in the country. The worth of internet fashion sales, however, changes with the seasons. Danes tend to spend more on clothing and accessories in the months of the main national holidays, which fall in the second and fourth quarters of the year.

Furthermore, the smartwatch market in Denmark benefits from growing digitization since it promotes more functionality and connection. Smartwatch use increases as digital ecosystems grow and provide more advanced capabilities, smoother interactions, and wider compatibility. Denmark is among the most digitally advanced nations in the world. Almost all interactions with Danish authorities occur online, and the majority of transactions are cashless. The Danish government has promised to utilize paper only in extreme cases and to go "digital by default." Digital-only services are feasible and available in Denmark due to the country's high internet penetration rate. Denmark places a great premium on data security and privacy. "Two-factor" authentication is necessary for the completion of financial transactions and other crucial services.

In the Digital Economy and Society Index (DESI) of the European Commission, Denmark topped in the 2021 edition. The four benchmark areas used in the DESI surveys to gauge the degree of digitalization in EU member states are human capital, connectivity, digital technology integration, and digital public services. According to the 2021 study, Denmark has a plethora of digital projects, many of which have helped with the COVID-19 pandemic management.

Top executives and specialists from the Danish corporate world, the research community, labour unions, civil society, Local Government Denmark, and Danish Regions formed a Digitization Partnership in 2021, which was established by the Danish government. The partnership's goal was to talk about and advise the government on how Denmark could take advantage of upcoming technology prospects.

After considering the suggestions made by the Digitization Partnership, the Danish government unveiled a 2022–2026 national policy. The government is introducing a plan that addresses the public and private sectors for the first time. Using new technology to further enhance Danish welfare and healthcare, supporting businesses' digital transformation, encouraging the green transition, and encouraging the responsible and ethical use of data and emerging technologies like artificial intelligence in the public sector are some of the strategy's central themes.

Denmark Smartwatch Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2022 | US$75.267 million |

| Market Size Value in 2029 | US$162.298 million |

| Growth Rate | CAGR of 11.60% from 2022 to 2029 |

| Base Year | 2022 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Million |

| Segments Covered |

|

| Companies Covered | |

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Product Type:

- Extension

- Standalone

- Classical

- By Application:

- Personal Assistance

- Healthcare

- Sports

- Others

- By Operating Type:

- Watch OS

- Wear OS

- Tizen

- Others