Report Overview

Kids’ Smartwatch Market - Highlights

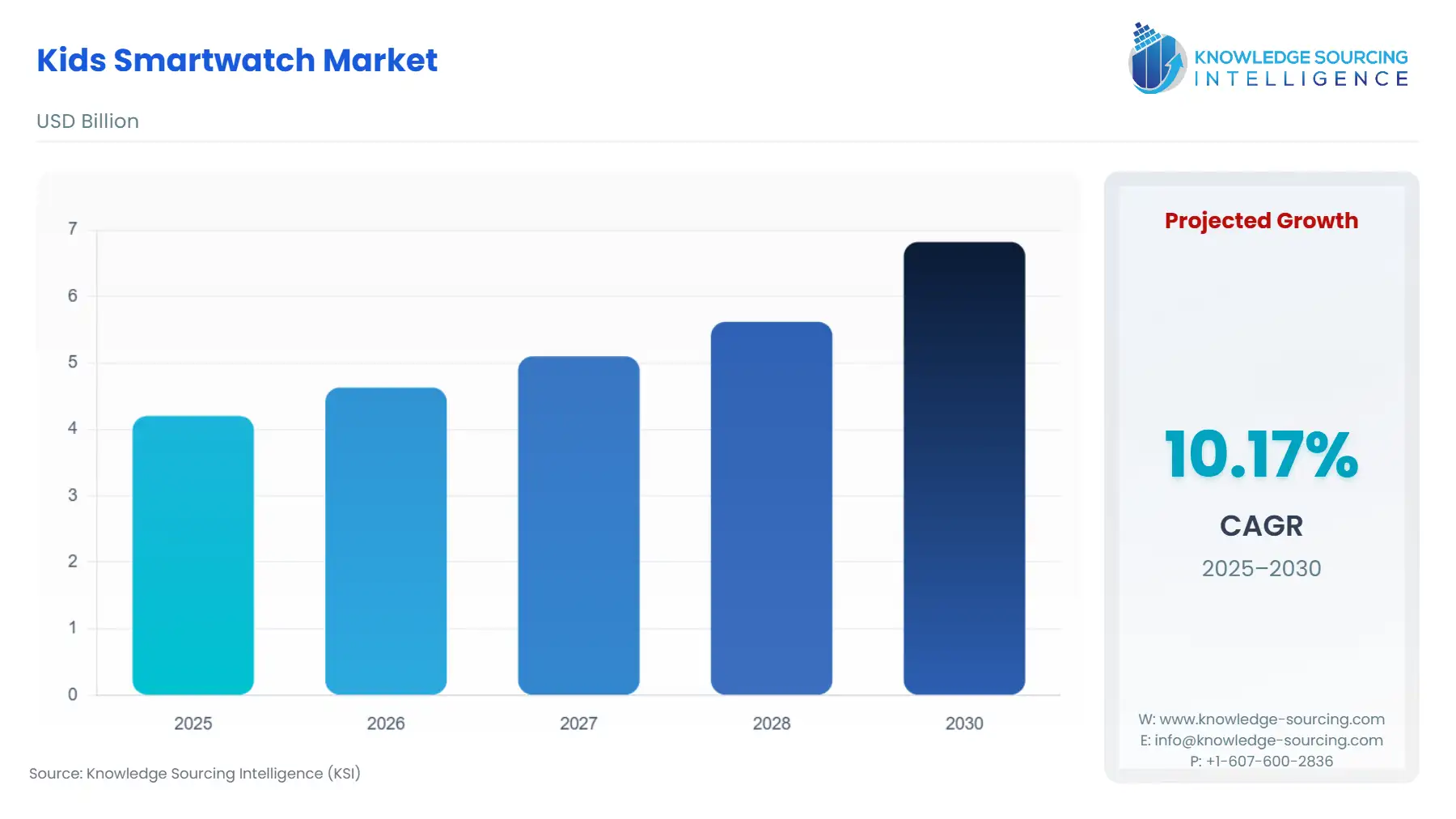

Kids Smartwatch Market Size:

The Kids Smartwatch Market is expected to grow at a CAGR of 8.0%, reaching a market size of USD 6,822.3 million in 2031 from USD 4,639.8 million in 2026.

The kids smartwatch market centers on wearable devices tailored for children, combining basic timekeeping with safety-oriented functions such as location monitoring and limited communication. These products target parents seeking alternatives to full smartphones, emphasizing protection over entertainment. As families integrate technology into daily routines, demand hinges on devices that balance accessibility with robust controls to prevent exposure to broader digital risks.

Manufacturers position kids smartwatches as entry-level tech tools, often featuring simplified interfaces and parental oversight apps. This niche has evolved from novelty gadgets to essential safety aids, driven by heightened awareness of child vulnerabilities in urban environments. Key to market traction remains the ability to deliver verifiable security without overwhelming young users. Trade dynamics further shape this space, with production concentrated in Asia yet increasingly diversified amid geopolitical tensions.

Government interventions underscore the imperative for data protection, ensuring products align with evolving standards for minor users. Subsequent sections dissect these elements, revealing how they collectively influence procurement decisions. At its core, the market reflects broader societal shifts toward proactive child monitoring. Parents weigh features against compliance, favoring watches that integrate seamlessly into family ecosystems. This foundation informs the analytical breakdown ahead, highlighting demand catalysts rooted in real-world imperatives.

Kids Smartwatch Market Analysis:

Growth Drivers

Parental safety imperatives propel demand for kids smartwatches by enabling real-time oversight without constant supervision. for instance, Noise “Scout Kids Smartwatch” incorporates GPS and SOS buttons that allow immediate alerts to guardians, addressing urban mobility concerns where children navigate independently. This functionality directly correlates with uptake, as parents prioritize tools that mitigate abduction risks or location uncertainties, targeting tracking precision. Such features transform passive worry into actionable control, spurring purchases among risk-averse households.

Technological advancements in LTE connectivity further catalyze expansion by offering standalone operation, decoupling watches from parental phones. Garmin's Bounce 2, launched in September 2025, exemplifies this with two-way calling and messaging over cellular networks, appealing to families delaying smartphone access for children. This independence fosters demand in active lifestyles, where kids engage in sports or after-school activities; the device's geofencing alerts notify parents of boundary breaches, directly increasing appeal for children in extracurricular settings. By eliminating Bluetooth limitations, these innovations expand usability, drawing in demographics previously sidelined by tethering requirements.

Regulatory compliance emerges as a demand multiplier, as mandates for child data privacy force iterative product upgrades that enhance market confidence. The EU's Digital Services Act (DSA), effective since February 2024, requires platforms accessible to minors—including connected wearables—to implement high privacy standards, such as default secure settings and age verification. This compels manufacturers to embed GDPR-aligned protections, like encrypted location data in Xplora's X6Play, which launched in November 2024 with C Spire. Parents, attuned to breach risks, favor these fortified devices, boosting sales in regulated regions where non-compliant alternatives face scrutiny. The DSA's risk-based approach specifically elevates watches with built-in safeguards, creating a premium segment that outpaces basic models.

Educational integration via activity tracking drives adoption among health-conscious families, embedding watches into routine development. Garmin's Bounce lineup includes step counters and sports apps that gamify movement, aligning with pediatric guidelines for daily minutes of activity. This positions devices as behavioral nudges, increasing demand in households combating sedentary habits; the 2025 Bounce 2 software update from 4.28 to 5.10 adds interactive challenges, directly appealing to parents monitoring fitness remotely. By linking play to rewards, these tools extend beyond safety, capturing segments focused on holistic child rearing.

Challenges and Opportunities

Privacy vulnerabilities constrain demand by eroding trust in connected devices, as breaches expose sensitive child data like locations. EU guidelines under the DSA highlight risks in wearables, mandating privacy-by-design to avert profiling or unauthorized sharing; non-adherent models, such as those lacking end-to-end encryption, face parental backlash and reduced sales. This headwind particularly hampers entry-level imports, where cost-cutting skips robust safeguards, directly diminishing uptake among cautious demographics in regulated markets like Europe.

Battery limitations pose another barrier, curtailing usability in extended scenarios and deterring prolonged adoption. Kids smartwatches often rely on compact lithium-ion cells, yielding 1-2 days of life under GPS strain, as noted in VTech's DX3 manual emphasizing micro-USB charging. Parents balk at frequent recharges disrupting safety monitoring, especially during school hours, which suppresses demand for active-use segments and favors wired alternatives in high-mobility families.

Opportunities arise from cybersecurity enhancements, as compliance becomes a differentiator that elevates demand. Establishment of regulations such as European Union’s “Cyber Resilience Act” mandates secure-by-default features for wireless devices like smartwatches, including fraud prevention and network resilience. Firms like Garmin, updating Bounce in 2025 with LTE-secured messaging, capitalize by positioning products as trustworthy guardians, attracting premium payers who value data integrity over price. This shift directly expands the market toward fortified, subscription-tied ecosystems.

LTE proliferation opens avenues for seamless integration, countering tethering frustrations and broadening appeal. Garmin's Bounce 2 introduction in September 2025 with built-in calling bypasses phone dependency, targeting 7+ year-olds in extracurriculars; paired with carrier plans, it reduces setup friction, spurring demand in connectivity-poor areas. Parents gain reliable access, transforming watches from novelties to essentials and unlocking growth in underserved rural segments. Sustainability pushes create niches for eco-materials, appealing to green-aware consumers and stabilizing supply.

Raw Material and Pricing Analysis

Kids smartwatches depend on semiconductors, lithium-ion batteries, and display panels, with pricing tied to global electronics volatility. Semiconductors, sourced primarily from Taiwan and South Korea, form the core for GPS and LTE chips. USTR's 2024 tariff hikes to 50% on Chinese polysilicon used in wafer production elevated costs thereby amplifying price swing. Likewise, lithium-ion batteries, reliant on cobalt and graphite from the Democratic Republic of Congo and China, face supply constraints from mining regulations and ethical sourcing mandates. Supply chain bottlenecks, exacerbated by 2024 Red Sea disruptions, delay component flows, inflating logistics cost.

Supply Chain Analysis

Global kids smartwatch production hubs center on China for assembly, with batteries and semiconductor components from Taiwan and South Korea. Hence, market players such as Vtech have established their centres in China, Malaysia and Mexico which minimized their exposure to the recent US tariffs under Section 301, however, the global supply chain is still facing friction with economies developing strategies to strike trade deals with the United States.

Government Regulations & Programs

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | Section 301 Tariffs / USTR | Excludes finished smartwatches from duties but taxes components like wafers thereby increasing production costs and prompting diversification; this sustains demand by maintaining affordability while bolstering domestic resilience through diversified sourcing. |

European Union | Digital Services Act (DSA) / European Commission | Requires high privacy/safety for minors on platforms, including wearables with age verification. This drives premium pricing for DSA-aligned products thereby boosting demand in safety-focused households by filtering out risky alternatives and favoring encrypted GPS features. |

Kids Smartwatch Market Segment Analysis:

By Product: Standalone

By product type, the standalone smartwatch is estimated to account for a considerable market share. Standalone kids smartwatches command demand through independent LTE operation, freeing children from phone proximity and appealing to safety-oriented parents. Garmin's Bounce 2, released September 2025, integrates cellular calling and geofencing without Bluetooth, targeting children in independent activities. This autonomy directly spikes uptake, as families avoid smartphone handoffs during school commutes. The segment's appeal lies in subscription models which bundle unlimited texts and tracking, lowering barriers and sustaining annual growth in urban areas.

Privacy regulations amplify this pull, with COPPA compliance ensuring standalone data stays isolated. Parents favor these over tethered variants, citing fewer connectivity drops in active scenarios, per device specs. Company such as Vtech is investing in advancing its smartwatches for instance, VTech's KidiZoom DX4 smartwatch and features dual selfie camera with a home button. Overall, standalone's self-sufficiency reshapes procurement, capturing a significant market share as tariffs spare cellular tech, enabling cost-stable expansion.

By Application: Position Tracking

Based in application, position tracking is projected to account for a significant market share. Position tracking applications surge demand by providing granular location insights, empowering parents to monitor without intrusion. Xplora's X6Play, launched November 2024, deploys award-winning GPS for real-time mapping and safe zones, alerting on deviations. This precision addresses post-pandemic mobility fears, boosting sales among working parents. Features like historical routes integrate with DSA privacy tools, ensuring data encryption and verifiable accuracy, which directly counters trust erosion in basic trackers. Urban density heightens this segment's imperative, with geofencing reducing response times to incidents

Kids Smartwatch Market Geographical Analysis:

The kids smartwatch market analyzes growth factor across following regions

North America: Constant technological advancement in wearable devices followed by growing emphasis on activity tracking is majorly impacting the demand for kids smartwatch in the North America with major regional economies namely the United States, and Canada.

Likewise, the growing parent concern regarding their kid’s whereabouts has further created a technological shift. According to the National Center for Missing & Exploited Children, in 2024, the agency assisted in 29,568 missing children cases including abduction and run away. The well-established presence of major market players such as Garmin Ltd which offers innovative “Bounce” series is further driving the regional market growth.

Europe: The growing children safety concern is majorly driving the demand for kids smartwatch in major regional economies namely Germany, the United Kingdom and France. Likewise, the ongoing efforts to bolster digital literacy in children has further paved the way for future market expansion.

Asia Pacific: Demand for smart connectivity is growing in Asia Pacific with major regional economies namely China implementing policies under its “14th Five Year Plan”. Such policies has further impacted the digital transformation in such nations thereby providing new opportunities to be explored in kid smartwatch. Likewise, the ongoing investment to bolster wearable device development that features advanced security features and GPS tracking has further accelerated product innovations in regional market.

South America & MEA: The digital push in children wearable device is gaining traction with investment that comply with 5G network infrastructure taking place. Such investment has transformed wearable technology in major South American economies such as Brazil which is driving the overall market expansion. The growing family-centric culture has created demand for modest device offering daily activity updates of children which is majorly driving the demand for kids smartwatch in the Middle East and African economies such as Saudi Arabia, and UAE. Likewise, the implementation of future polices such as Saudi Arabia’s “Vision 2030” has also established a framework to bolster technological adoption in wearable devices for kids.

Kids Smartwatch Market Competitive Environment and Analysis:

The landscape features concentrated players leveraging safety niches, with VTech, Garmin, and Xplora holding a considerable share via differentiated positioning.

VTech, headquartered in Hong Kong, emphasis on providing wearable technological innovation for kids that offers real-time activity tracking. The company has emphasized on product advancement to meet the dynamic market trends, for instance, its “KidiZoom DX4” offering dual cameras. Rechargeable lithium ion battery and AR games is designed for children aged 4 to 12 years.

Garmin Ltd. based in the US, targets providing smartwatches for kids which features active monitoring and positioning updates owing to which the company offers diverse product offering featuring its advanced GPS-technology. Its strategies involved constant product development and regional expansion. Its Bounce 2 software update in September 2025 as a $150 LTE gateway with geofencing and sports apps, emphasizing battery life up to 5 days. Official releases highlight Jr. app controls for parental empowerment.

Kids Smartwatch Market Developments:

September 2025: TCL announced the launch of “TCL MOVETIME MT48” kids smartwatch which features DUAL Frequency GPS (L1+L5) online 4G communication, thereby enabling parents to stay connected with kids irrespective of the distances.

November 2024: Xplora formed a strategic partnership with telecommunication & technology service company C Spire which involved providing Xplora’s kids smartwatch “Xplay6” in C Sire’s “Connect and Protect” product line-up that allows kids to have access to technology that safeguards them against online dangers.

Kids Smartwatch Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4,639.8 million |

| Total Market Size in 2031 | USD 6,822.3 million |

| Forecast Unit | Million |

| Growth Rate | 8.0% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product, Compatibility, Connectivity, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Kids’ Smartwatch Market Segmentation:

By Product

Standalone

Non-Standalone

By Compatibility

Android

iOS

Windows

By Connectivity

Bluetooth

Wi-Fi

By Distribution Channel

Online

Offline

By Application

Position Tracking

Audio & Video Calling

Texting & Voice Notes

Fitness Tracking

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others