Report Overview

Digital Textile Printing Market Highlights

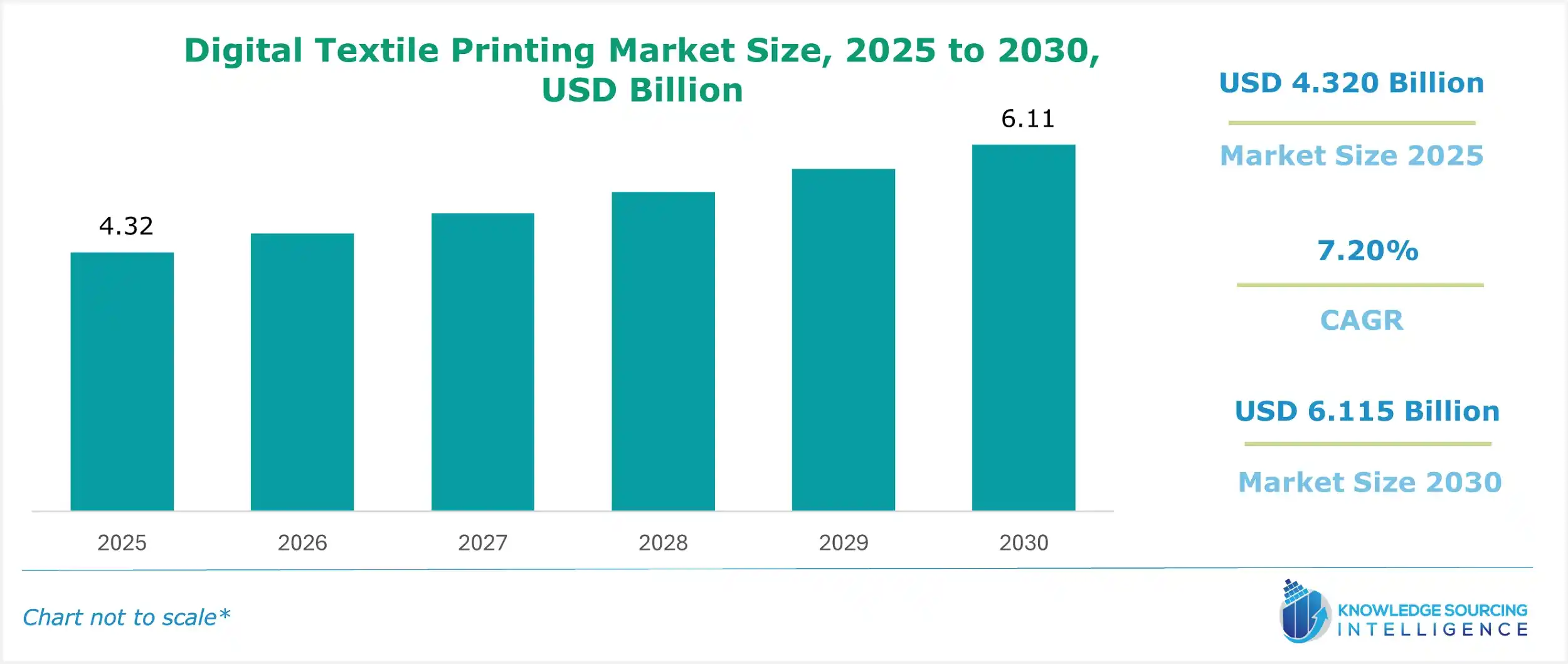

Digital Textile Printing Market Size:

The Digital Textile Printing Market is expected to grow from USD 4.320 billion in 2025 to USD 6.115 billion in 2030, at a CAGR of 7.20%.

Introduction to the Digital Textile Printing Market:

The digital textile printing market is reshaping the global textile industry, offering innovative solutions for fabric design, production, and customization. Unlike conventional methods like screen or rotary printing, digital textile printing employs advanced inkjet technology to apply designs directly onto fabrics, delivering unmatched precision, flexibility, and efficiency. This approach supports intricate, high-resolution patterns while reducing waste, meeting the rising demand for sustainable and personalized textile solutions. Industries such as fashion, home decor, sportswear, and technical textiles increasingly adopt digital printing for its customization, sustainability, and fast production capabilities.

Digital textile printing utilizes inkjet printers to transfer digital designs onto fabrics using specialized inks, such as dye-sublimation, pigment, reactive, and acid inks, tailored for materials like cotton, polyester, or silk. By eliminating physical screens or plates, it reduces setup times and enables on-demand production. This technology excels in short-run printing, rapid prototyping, and customization, making it ideal for fast-fashion brands, bespoke designers, and niche markets. Recent advancements, such as high-speed single-pass printers and enhanced ink formulations, have improved production efficiency and print quality. For instance, in 2025, Epson’s Monna Lisa series introduced enhanced precision and speed, achieving resolutions up to 1200 dpi, catering to high-end fashion and home decor.

On-demand textile printing supports rapid, cost-effective production, addressing the growing demand for custom apparel printing. Sustainable textile printing practices, such as waterless printing and eco-friendly inks, reduce water and energy use, aligning with environmental goals. Industrial textile printing enables high-volume production with vibrant, precise designs. As brands prioritize eco-friendly and flexible solutions, innovations in ink formulations and printing systems continue to drive market growth, empowering manufacturers to meet consumer preferences for sustainable, personalized textiles.

The market is also advancing through software integration, with artificial intelligence (AI) and machine learning (ML) optimizing design workflows and color management. Companies like Adobe have integrated AI-driven tools into textile design software, improving color accuracy across diverse fabrics. Waterless printing technologies and eco-friendly inks are gaining traction, with Kornit Digital’s Atlas MAX Poly printer, launched in 2025, reducing water consumption by up to 95% compared to traditional dyeing.

The digital textile printing market is set for sustained growth, fueled by ongoing innovations and market dynamics. In 2025, HP’s Indigo digital press series for textiles introduced advanced automation, boosting production efficiency. Collaborations, such as a 2025 partnership between Brother Industries and a major sportswear brand, have led to digitally printed performance fabrics with moisture-wicking properties. The rise of circular economy principles is also influential, with initiatives like the Textile Exchange’s 2025 push for closed-loop production using digital printing on recycled fibers. Additionally, blockchain technology is enhancing supply chain transparency, enabling brands to trace digitally printed textiles from design to delivery.

Digital Textile Printing Market Trends:

The digital textile printing market is constantly evolving, driven by the influence of fast fashion and rising demand for e-commerce textile customization. Personalized textile products are gaining traction, enabled by on-demand printing technologies that offer flexibility and speed. Innovations in reduced water consumption printing align with sustainability goals, minimizing environmental impact. Zero-waste textile production is a key trend, as digital methods optimize material use and reduce excess inventory. Advancements in inkjet systems and eco-friendly inks enhance efficiency and design precision. As consumer preferences shift toward customization and sustainability, digital textile printing is influencing the industry toward agile, eco-conscious production.

Digital Textile Printing Market Drivers:

- Demand for Customization and Personalization: The surge in e-commerce and social media platforms has significantly increased consumer demand for unique, personalized textile products. Digital textile printing allows brands to provide customized apparel, home decor, and accessories, like personalized T-shirts, tailored curtains, and monogrammed upholstery, without the high setup costs of traditional screen printing. This flexibility enables manufacturers to target niche markets and meet individual preferences, ultimately improving customer satisfaction and fostering brand loyalty. A 2024 report by WTiN indicated that 68% of fashion brands now incorporate personalization into their product offerings, with digital printing being the preferred method due to its ability to produce small batches efficiently. Platforms such as Etsy and Printful reported a 25% year-on-year increase in demand for custom-printed textiles in 2024, highlighting the market’s shift toward personalized products.

- Sustainability and Environmental Concerns: The textile industry is under increasing scrutiny regarding its environmental impact, particularly in terms of water and energy consumption. Digital textile printing presents a sustainable alternative to traditional methods, which often involve water-intensive dyeing processes and generate considerable fabric waste. By enabling on-demand production, digital printing minimizes overproduction and excess inventory, while eco-friendly inks, such as water-based pigment inks, reduce chemical runoff. For instance, Kornit Digital’s Atlas MAX Poly printer uses water-based inks that reduce water consumption by up to 95% compared to conventional dyeing. The European Union’s 2025 Textile Strategy further emphasizes sustainable production, incentivizing manufacturers to adopt digital printing to meet regulatory requirements and consumer expectations for eco-conscious products. This alignment with global sustainability goals positions digital printing as a critical technology for the industry’s future.

- Technological Advancements: Continuous innovations in digital textile printing technology are expanding its applications and improving efficiency. High-speed single-pass printers, advanced ink formulations, and AI-driven software have enhanced print quality, durability, and substrate versatility. For example, Mimaki’s 2024 launch of high-speed textile printers enables manufacturers to scale production for large runs while maintaining vibrant colors and fine details. Similarly, Epson’s Monna Lisa series achieves resolutions up to 1200 dpi, catering to high-end fashion and home decor markets. Software advancements, such as Adobe’s AI-integrated textile design tools, allow designers to predict color outcomes across fabrics with greater accuracy, streamlining workflows and reducing errors. These advancements make digital printing viable for both small-scale customization and large-scale production.

- Growth in Fast Fashion and E-Commerce: The fast-fashion industry’s need for rapid design-to-market cycles aligns seamlessly with digital textile printing’s capabilities. Brands like Shein, Zara, and H&M leverage digital printing to produce small batches of trendy designs, minimizing inventory risks and enabling quick responses to changing consumer preferences. The global e-commerce market for apparel is projected to grow by 10% annually through 2030, driven by increased online shopping and demand for trendy, affordable clothing. Digital printing’s ability to support short production runs and rapid prototyping allows fast-fashion retailers to stay competitive in a dynamic market. Additionally, the rise of direct-to-consumer (DTC) brands, which rely heavily on digital printing for custom and limited-edition products, further fuels market growth.

Digital Textile Printing Market Restraints:

- High Initial Investment Costs: The cost of acquiring and maintaining advanced digital textile printing equipment remains a significant barrier, especially for small and medium-sized enterprises (SMEs). High-end single-pass printers, which offer superior speed and quality, can cost upwards of $500,000, making them inaccessible for smaller manufacturers or those in emerging markets. Additional expenses, such as software licenses, maintenance, and specialized inks, further increase the financial burden. A 2024 analysis by Textile World highlighted that these costs limit adoption in regions with developing textile industries, such as parts of Africa and South Asia. While prices for entry-level printers have decreased, the gap between affordable and high-performance systems remains a challenge.

- Technical Limitations: Digital textile printing faces challenges with certain fabrics, particularly natural fibers like wool, linen, or complex blends, where ink adhesion and color vibrancy can be inconsistent. Unlike synthetic fabrics like polyester, which are well-suited for dye-sublimation printing, natural fibers often require specialized pre-treatments or inks, increasing complexity and cost. Ongoing research is addressing these issues, but limitations persist for specific applications, such as high-end woolen garments or intricate blended fabrics. These technical challenges restrict the versatility of digital printing in certain luxury and technical textile segments.

- Skilled Workforce Shortage: Operating digital textile printers and managing sophisticated design software requires specialized skills, including knowledge of color management, fabric handling, and printer maintenance. The shortage of trained professionals, particularly in developing economies, hinders market growth. For instance, a 2024 report by Textile Today highlighted that regions like South Asia and Latin America face a skills gap, with insufficient training programs to support the adoption of digital printing technologies. This lack of expertise can lead to operational inefficiencies and higher error rates, discouraging investment in digital printing systems.

Digital Textile Printing Market Segmentation Analysis:

- By Type, the Pigment Print segments will gain robust market growth

Among the various printing types in digital textile printing, pigment print stands out as the dominant segment due to its versatility, sustainability, and compatibility with a wide range of fabrics. Pigment printing involves applying water-based or eco-friendly inks that adhere to the fabric surface without requiring extensive pre- or post-treatment, unlike reactive or dye-sublimation methods. This method is particularly valued for its ability to produce vibrant, durable prints on both natural and synthetic fibers, making it ideal for applications in fashion, home decor, and technical textiles. The simplicity of pigment printing reduces water and energy consumption, aligning with global sustainability trends. Additionally, pigment printing’s ability to support short-run production and rapid design changes has made it a preferred choice for fast-fashion brands and DTC models. Innovations in pigment ink formulations, such as improved colorfastness and softer hand-feel, are further solidifying its market leadership.

- By Fabric Type, polyester is expected to grow significantly

Polyester dominates this market due to its widespread use, compatibility with digital printing technologies, and growing demand in fashion, sportswear, and home textiles. Polyester’s smooth surface and synthetic composition make it ideal for dye-sublimation printing, a popular digital printing method that ensures vibrant, high-resolution designs with excellent durability. The fabric’s affordability, durability, and versatility have made it a staple in fast-fashion and performance apparel, where digital printing enhances design flexibility. In 2024, Mimaki launched high-speed textile printers optimized for polyester, enabling manufacturers to produce large-scale runs for sportswear and outdoor textiles with enhanced efficiency. Polyester’s dominance is further supported by its use in sustainable initiatives, such as recycled polyester derived from PET bottles, aligning with circular economy goals. The global rise in athleisure and outdoor apparel, particularly in markets like the United States and China, continues to fuel polyester’s prominence in digital textile printing.

- By End-User, the textile industry is expanding considerably

The textile industry is emerging as the largest due to its extensive adoption of digital printing across fashion, home decor, and technical textiles. The textile sector encompasses manufacturers, brands, and designers who leverage digital printing to produce apparel, upholstery, curtains, and specialized fabrics for industries like automotive and medical. Digital printing’s ability to support on-demand production, customization, and rapid prototyping has transformed textile manufacturing, enabling brands like Zara and H&M to reduce inventory waste and respond quickly to market trends. In 2024, a partnership between Brother Industries and a leading sportswear brand resulted in a new line of digitally printed performance fabrics with embedded moisture-wicking properties, showcasing the textile industry’s reliance on digital printing for innovation. The textile segment’s dominance is further driven by its alignment with sustainability goals, as digital printing reduces water and chemical usage compared to traditional methods

Digital Textile Printing Market Geographical Outlook:

- The Asia Pacific market is projected to grow substantially

Geographically, the digital textile printing market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific, with the latter being the largest and fastest-growing region. Asia Pacific’s dominance is driven by its robust textile manufacturing base, particularly in countries like China, India, and Bangladesh, which are global hubs for apparel and textile production. The region benefits from a combination of low labor costs, advanced manufacturing infrastructure, and increasing adoption of digital printing technologies. China, in particular, has seen significant investments in digital textile printing, with companies like Epson expanding their presence through new printer launches tailored for the Asian market. India’s growing e-commerce sector and demand for customized apparel further bolster the market, with a 2024 Statista report projecting a 12% annual growth in the region’s apparel e-commerce market through 2030. Additionally, government initiatives, such as India’s “Make in India” campaign, are promoting advanced manufacturing technologies, including digital printing, to enhance export capabilities. The Asia Pacific region’s large consumer base, rapid urbanization, and focus on sustainable production practices position it as the leading market for digital textile printing.

Digital Textile Printing Market Key Developments:

- Kornit Digital’s Atlas MAX Poly Printer Launch (2024): Kornit Digital introduced the Atlas MAX Poly printer, a groundbreaking advancement in digital textile printing specifically designed for polyester and polyester-blend fabrics, which dominate the fabric type segment. This printer leverages advanced pigment-based inks to deliver high-resolution prints with vibrant colors and a soft hand-feel, addressing the growing demand for sustainable and versatile printing solutions in the textile industry.

- Epson’s Monna Lisa Series Update for High-Resolution Printing (2024): Epson unveiled an updated version of its Monna Lisa series, enhancing its capabilities for high-resolution digital textile printing, particularly for the textile industry in the Asia Pacific region. The updated series achieves resolutions up to 1200 dpi, catering to high-end fashion and home decor applications where polyester fabrics are prevalent. This development incorporates improved printhead technology and AI-driven color management systems, enabling precise color reproduction and faster production speeds.

List of Top Digital Textile Printing Companies:

- Mimaki

- Kornit

- SPGPrints

- Dover Corporation

- Robustelli

Digital Textile Printing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Digital Textile Printing Market Size in 2025 | USD 4.320 billion |

| Digital Textile Printing Market Size in 2030 | USD 6.115 billion |

| Growth Rate | CAGR of 7.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Digital Textile Printing Market |

|

| Customization Scope | Free report customization with purchase |

Different segments covered under the digital textile printing market report are as below:

- By Type

-

- Direct Print

- Discharge Print

- Resist Print

- Pigment Print

- Others

- By Fabric Type

-

- Nylon

- Polyester

- Others

- By End-User

-

- Textile

- Enterprise

- Others

- By Geography

-

- North America

-

-

- United States

- Canada

- Mexico

-

-

- South America

-

-

- Brazil

- Argentina

- Others

-

-

- Europe

-

-

- United Kingdom

- Germany

- France

- Spain

- Others

-

-

- Middle East and Africa

-

-

- Saudi Arabia

- UAE

- Israel

- Others

-

-

- Asia Pacific

-

-

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

-