Report Overview

Digital Twin in Construction Highlights

Digital Twin in Construction Market Size:

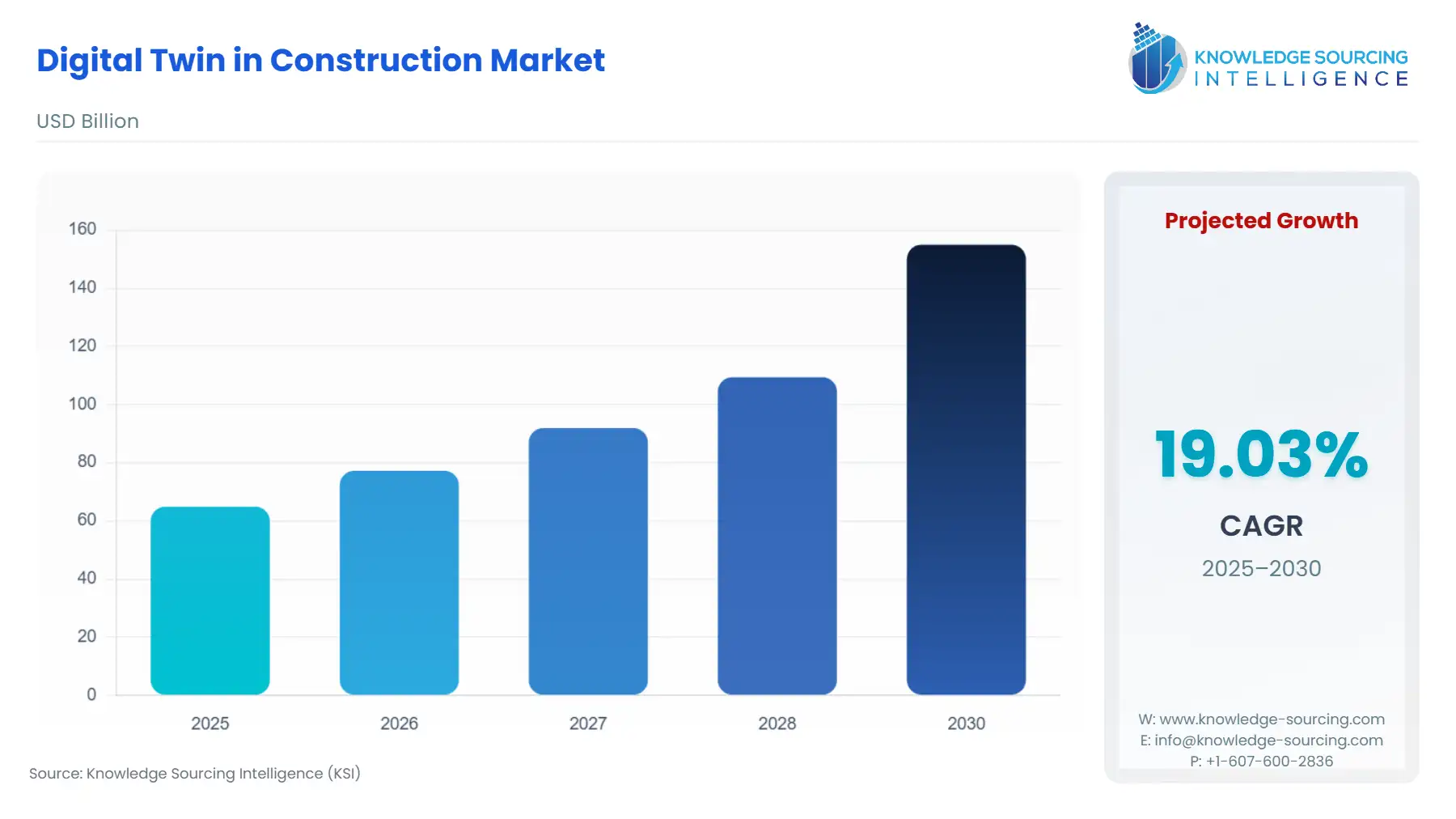

The Digital Twin in Construction Market is projected to grow at a CAGR of 19.02% over the forecast period, increasing from US$64.865 billion in 2025 to US$155.01 billion by 2030.

Digital Twin in Construction Market Trends:

The digital twins market in the construction sector is growing at a significant rate as it enhances design planning, predicts maintenance needs before failures, improves project efficiency, and helps in lifecycle management and resource optimization, revolutionizing the sector and boosting the market. The growing adoption of cloud-based platforms and the growing adoption of building information modelling with digital twins are the key factors driving demand in architecture, engineering, and construction. The market is witnessing increasing integration of artificial intelligence and machine learning in digital twin platforms. The growing smart cities projects will be the high-growth areas.

Digital Twin in Construction Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Digital Twin in Construction Market is segmented by:

- Type: The Digital Twin in Construction Market is segmented by type into informative twin and autonomous twin. Informative twins play an important role in achieving sustainability objectives by simulating energy usage, maximizing building design, enhancing material selection, and increasing market expansion. Autonomous twins can boost project timelines, resource allocation, and possibly solve problems in the construction field without the direct involvement of any human being.

- Component: The Digital Twin in Construction Market, by component, is segmented into software and hardware. The software provides informed business decisions throughout the asset lifecycle, employing real-time data from sensors, IoT devices, and historical data, while the services offered are consulting, integration, and customization services by tech firms and construction technology.

- Application: The Digital Twin in Construction Market, by application, is segmented into resource management and logistics, safety monitoring, product design & optimization, quality management, predictive maintenance, and others.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. The North American market is growing due to the integration of advanced technology, an efficient workforce, and a regulatory environment. In Europe, the market is growing at a significant rate due to the emergence of technologies like big data analytics, IoT, artificial intelligence (AI), and machine learning (ML), combined with Industry 4.0 technologies. Asia-Pacific is also growing at a robust rate due to technological advancements, rising manufacturing output, and expanding digital networks, among others.

Top Trends Shaping the Digital Twin in the Construction Market:

1. Growth in Autonomous Digital Twin in the construction industry

- The autonomous digital twin segment in the construction industry is set for swift growth with the industry's emphasis on automation and real-time decision-making. Autonomous twins are different from conventional digital twins because they are not only able to simulate and replicate physical assets but also make decisions and perform tasks autonomously without human intervention. In building, this means smart systems that can track structural performance, identify anomalies, and automatically initiate corrective measures, like adjusting equipment parameters or redirecting workflows on a building site. This kind of autonomy enhances project results by minimizing delays, eliminating human mistakes, and increasing overall site effectiveness.

- Another significant growth driver is the convergence of AI, machine learning, and IoT with construction technology, which renders autonomous digital twins ever more feasible. High-end sensors placed across the site provide real-time data into the digital twin, while historical and real-time inputs are used by AI models to forecast equipment breakdowns, hazard potential, or design defects. These systems can optimize workflows on their own, redistribute resources, or model the effect of design modifications, all while minimizing the need for human oversight.

- In January 2025, SPX FLOW, a leading global fluid technology company, collaborated with Siemens to highlight innovative digital twin technology in the MxD (Manufacturing x Digital) center in Chicago. A leading innovation center for manufacturing, MxD is fueling innovation in industries like food and beverage, chemicals, and batteries.

2. Increasing Integration of AI and Machine Learning

- The increasing integration of AI and machine learning is enabling enhanced decision-making by analysing vast amounts of data and allowing digital twins to predict maintenance needs, optimize schedules, and detect risks, driving further adoption.

- For example, in January 2025, Siemens AG introduced Industrial Copilot for Operations, bringing AI-driven decision-making for construction site logistics, equipment monitoring, and infrastructure maintenance.

Digital Twin in Construction Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing adoption of Building Information Modelling: The growing adoption of building information modelling is the key factor driving the adoption of digital twins, as it offers seamless integration of digital twins in the construction sector. For instance, the widespread adoption of BIM across major large-scale projects globally helps in the integration of real-time data with digital twins

- Increasing Safety Concerns: Safety is also a critical driver behind the adoption of digital twin technology, which enhances safety monitoring, hazard prediction, and real-time risk mitigation. According to the National Safety Council (NSC) of the US, the construction industry experienced the largest number of preventable fatal injuries between 2021 and 2022. There were 2,055 fatalities and 144,480 injuries resulting in days away from work. The Country’s Bureau of Labor Statistics reported 2.8 million work injuries and illnesses, 5,486 workplace fatalities, and one worker died every 96 minutes from a work-related injury. Also, the demand for worker safety and risk mitigation has increased the adoption of IoT-enabled wearables and sensors to monitor worker vitals. This has driven easy integration of digital twins in the construction sector for progress monitoring, as digital twin uses this sensor data to identify risks. The use of IoT sensors in construction monitoring helps in monitoring performance and thus helps the digital twin in reducing downtime and efficiently utilising the resources.

In addition to this, regulatory pressure and corporate ESG (Environmental, Social, and Governance) commitments are driving construction companies to embrace digital solutions that enhance safety performance. Governments and industry associations are raising safety compliance expectations, and digital twins create a traceable, real-time audit history of safety performance. Further, firms are under pressure from stakeholders to enhance worker well-being and reveal responsible behaviour. By integrating safety monitoring into their digital twin plans, companies not only improve safety but also lower insurance premiums, project downtime, and legal exposure, enabling it to be a strategic investment with sustainable returns.

- Growing Adoption of Cloud-Based Platforms: The increasing proliferation of IoT in the construction sector, such as in equipment, materials, and others, helps in driving data-driven decision-making for digital twins. The rapid innovations in IoT and sensor technologies, and the growing adoption of IoT-enabled devices such as drones or the integration of IoT in equipment and materials, are helping in the seamless integration of data from these IoT devices and sensor technologies, helping digital twins in real-time data collecting, monitoring for site progress tracking, and environmental monitoring. According to a study, “PwC’s Construction Industry Vision 2025” by PwC, 32% of the businesses in the construction industry are implementing IoT solutions specifically for resource tracking and enhancing the safety monitoring on construction sites. The data highlights the growing implementation of IoT, which will drive the digital twin in the construction industry. For instance, as per Dassault Systèmes SE, its integration of the 3DEXPERIENCE platform in China's Central-South Architectural Design Institute (CSADI) reduces the construction error by 60%, and has completed construction at a 30% faster rate, highlighting the benefit of the implementation of the digital twin.

Challenges:

- High Implementation Cost: Implementing a digital twin involves integration of various technologies such as IoT, sensors, BIM, artificial intelligence, and cloud computing. This makes the significant upfront costs. Additionally, there are software and hardware expenses, such as on tools used for collecting real-time data, and also requires a skilled workforce, driving the implementation cost. This becomes a key challenge for its adoption, more particularly in small and medium construction firms, which form the majority, significantly restating the market growth.

Digital Twin in Construction Market Regional Analysis:

- North America: The North American region has a significant share of the market. It is driven by increasing adoption in the USA, Canada and Mexico. For instance, the United States' digital twin in the construction market is experiencing robust growth, driven by technological advancements and increasing demand for efficiency and sustainability. Several drivers are responsible for driving the growth of the market, such as the growing adoption of cloud-based platforms. Expansion in IoT and cloud-based platforms forms the largest growth base of the digital twin market, mainly due to establishing a robust foundation for real-time data collection and analysis. In this regard, as per Edge Delta, cloud computing has resulted in becoming a significant factor in streamlining business operations, and over 90% of companies worldwide use cloud computing in their operation. Forbes, on the other hand, generated an EBITDA value of over $3 trillion. Furthermore, in 2023, corporate data garnered 60% of data stored in the cloud, which reveals how most businesses use the cloud for storage and half trust its security and reliability.

Digital Twin in Construction Market Competitive Landscape:

The Digital Twin in Construction Market is moderately fragmented, with some of the major companies including ANSYS Inc., IBM Corporation, Microsoft Corporation, Siemens AG, Bentley Systems Incorporated, Oracle Corporation, Dassault Systèmes SE, Autodesk Inc., PTC Inc., and Hexagon AB.

- Dassault Systèmes SE: Dassault Systèmes SE is widely recognized for its role in the construction industry. It offers a comprehensive platform for creating digital twins for buildings and infrastructure, such as 3DEXPERIENCE and others.

- Siemens AG: Siemens AG is a leading player in the digital twin in the construction market. It offers solutions like MindSphere, PlantSight, Simcenter 3D, and SIMIT.

- Bentley Systems Incorporated: Bentley Systems holds a strong presence in the digital twin in the construction market. It offers platforms like iTwin, AssetWise, and SYNCHRO in the market.

Digital Twin in Construction Market Key Developments:

- In May 2025, India’s Sangam Digital Twin Initiative will help with Infrastructure Planning. The Government of India unveiled its ambitious Sangam: Digital Twin initiative, which is an AI-native, federated digital twin platform created to help facilitate scenario-driven infrastructure planning and real-time governance.

- In April 2025, Autodesk’s Tandem Cloud Digital Twin Platform will keep evolving. Autodesk is steadily improving its cloud-based digital twin platform (Autodesk Tandem). Recent enhancements include IoT, timeline events, and visualisation, all intended to improve project lifecycle management.

- In July 2025, McKinsey discusses the Public Digital Twin for demonstrating ROI. McKinsey published an industry briefing on how digital twins can effectively improve return on investment (ROI) on public infrastructure investments through better modelling, scenario planning, and ultimately better decision-making.

Digital Twin in Construction Market Scope:

| Report Metric | Details |

| Contact Image Sensor Market Size in 2025 | US$397.798 million |

| Contact Image Sensor Market Size in 2030 | US$570.371 million |

| Growth Rate | CAGR of 7.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Contact Image Sensor Market |

|

| Customization Scope | Free report customization with purchase |

Digital Twin in Construction Market Segmentation:

By Sensor Type

- Informative Twin

- Autonomous Twin

By Component

- Software

- Hardware

By Application

- Resource Management and Logistics

- Safety Monitoring

- Product Design & Optimization

- Quality Management

- Predictive Maintenance

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others