Report Overview

Extended Reality (XR) In Highlights

Extended Reality (XR) In Construction Market Size:

The Extended Reality (XR) in Construction Market is set to witness robust growth at a CAGR of 23.34% during the forecast period to be worth US$67,348.704 million in 2030 from US$23,598.117 million in 2025.

Extended Reality (XR) In Construction Market Trends:

The Extended Reality (XR) in the Construction market includes technologies like mixed reality, augmented reality (AR), and virtual reality (VR), which are being employed to enhance several construction procedures. This technology has improved immersive visualization, communication, and project management, among other operations in construction.

Further, reducing costs, increasing returns, and easily incorporating training simulations into XR ensure the rapid rise of this technology in construction. This can also be attributed to a rising demand for low-cost and highly effective construction solutions that help improve safety, minimize waste, and reduce errors.

Extended Reality (XR) In Construction Market Growth Drivers:

- Growing technological advancements: The rapid development of AR, VR, and MR technologies are some of the major factors driving the construction industry's adoption of the XR technology. Further, XR technology equipment is included in construction technologies that make the construction processes more accurate. For example, overlaying AR project information onto real-world locations improves installation accuracy and reduces the likelihood of errors, resulting in both labor time and cost savings.

- Increasing accessibility and cost-effectiveness of XR devices: Increased accessibility and affordability of XR equipment and devices have helped propel the market growth for extended reality in the construction industry. Further, most smartphones today have AR capabilities, allowing users to experience AR without the need for additional devices, increasing the market expansion. Moreover, standalone VR headsets are made more accessible and inexpensive, leading to increased experience and market growth.

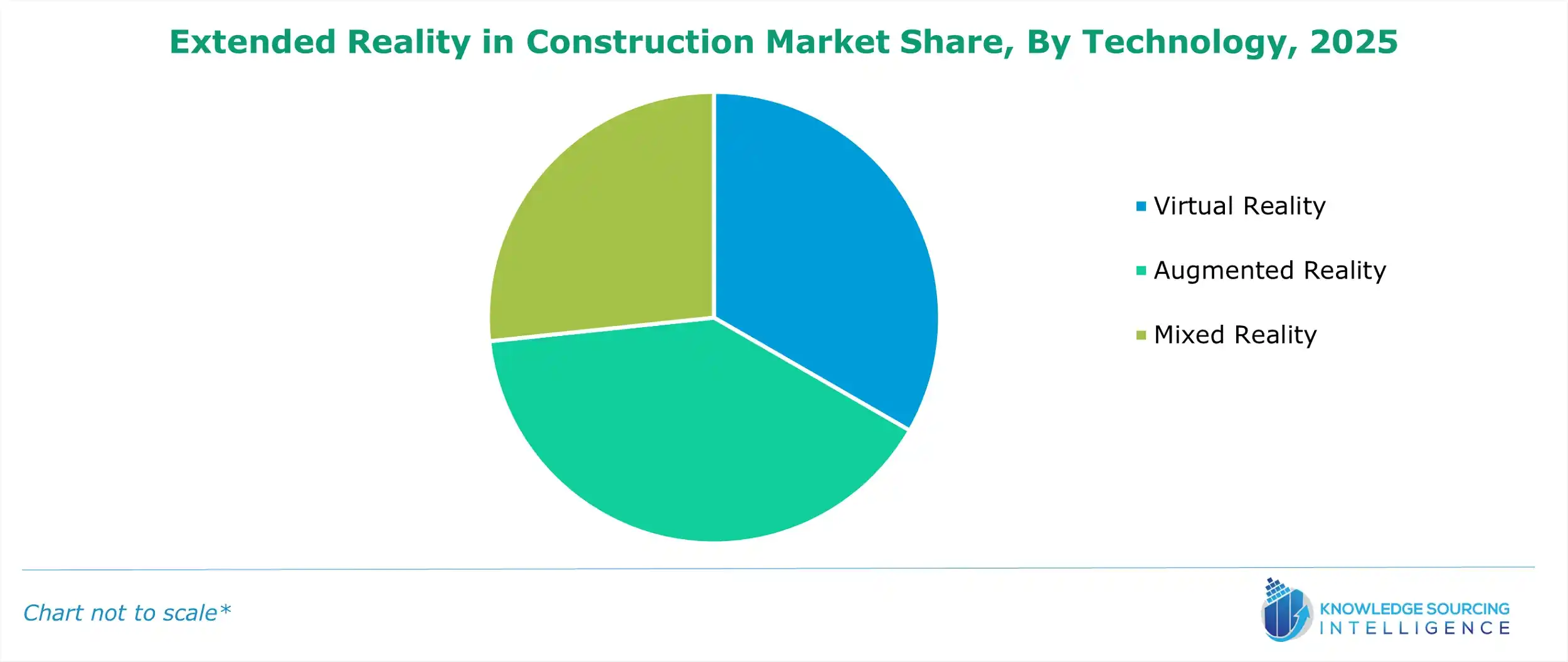

Extended Reality (XR) In Construction Market Segment Analysis by Technology:

- Virtual Reality: The demand for XR in Construction in the virtual reality segment is rising as it lowers costs and enhances design, safety, and communication.

- Augmented Reality: Augmented reality will continue to innovate and create immersive experiences in the gaming and entertainment sectors due to the prominence of AR-enabled mobile gaming and location-based AR experiences.

- Mixed Reality: The demand for mixed reality is rising in the market, creating a highly immersive hybrid reality by combining the virtual and the real worlds.

Extended Reality (XR) In Construction Market Segment Analysis by Component:

- Hardware: The demand for hardware in XR is increasing as it merges virtual and physical environments through devices such as glasses and headsets.

- Software: In the construction sector, XR software is used to enhance teamwork, train employees, and develop immersive models.

Extended Reality (XR) In Construction Market Segment Analysis by Application:

- Design Visualization: Enhanced design visualization in construction can be achieved through extended reality. XR enables construction teams to experience the project's designs in three dimensions before starting the work.

- Safety Training: Extended reality improves safety training in construction by generating realistic models of construction environments.

- Project Management: The project management segment is growing as XR tools are being applied to update and edit projects in real-time.

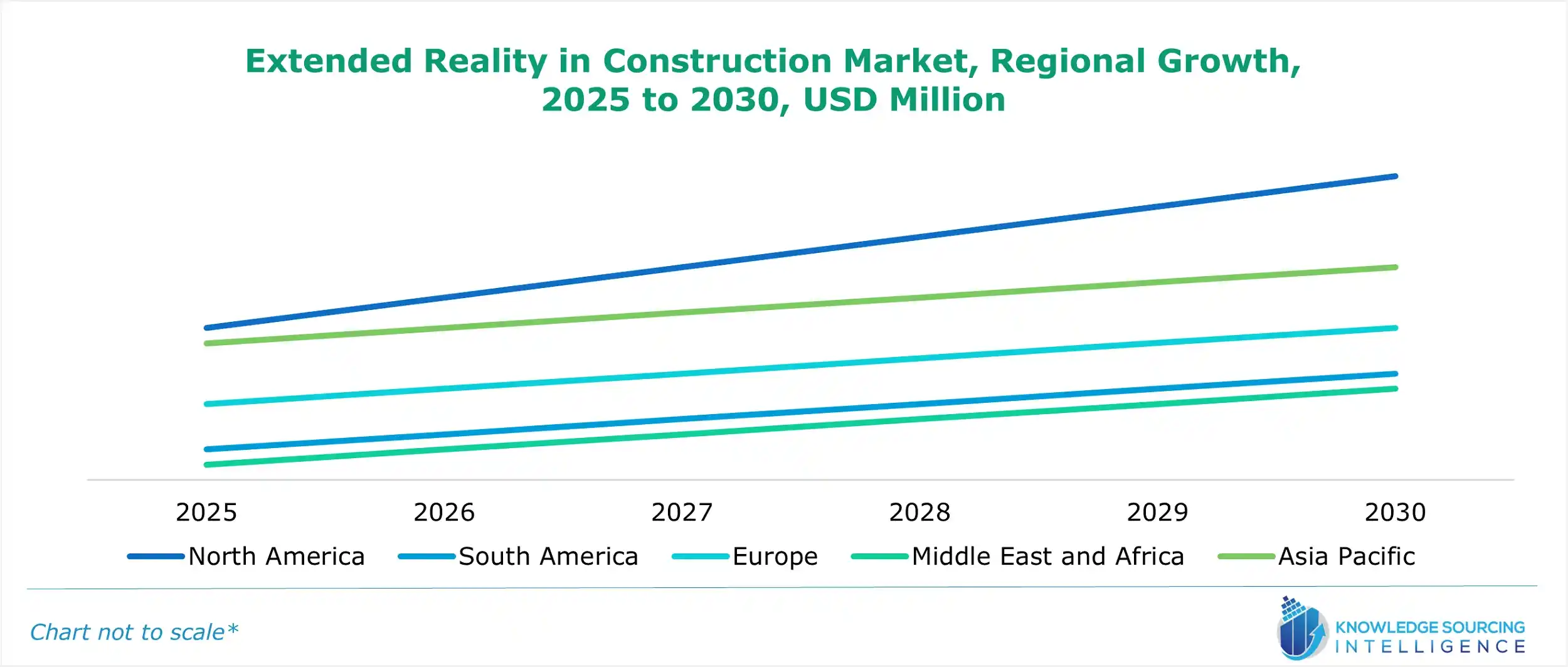

Extended Reality (XR) In Construction Market Geographical Outlook:

The Extended Reality (XR) in Construction market report analyzes growth factors across the following five regions:

Extended Reality (XR) In Construction Market – Competitive Landscape:

- ManageXR – ManageXR is a VR and AR deployment platform. With end-to-end visibility and control, they troubleshoot devices, distribute content, and personalize the user experience.

- Trimble Inc. - Trimble offers construction-related extended reality technologies. For example, they offer Trimble SiteVision, an outdoor augmented reality system that helps users visualize data in the real world by using a GNSS receiver and a mobile app.

- Bentley Systems, Inc. - Bentley Systems' SYNCHRO XR app provides XR tools for the construction industry. These tools assist users in organizing, visualizing, and overseeing construction projects through mixed reality.

The following companies are among the global leaders in the research, development, and advancement of Extended Reality (XR) In the Construction industry.

Extended Reality (XR) In Construction Market: Latest Developments:

- In November 2024, DIG VR introduced a construction VR that replicates the experience of driving an excavator on a fictitious construction site. The game aims to safely and entertainingly introduce young people to the construction industry.

Extended Reality (XR) In Construction Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Extended Reality (XR) In Construction Market Size in 2025 | US$23,598.117 million |

| Extended Reality (XR) In Construction Market Size in 2030 | US$67,348.704 million |

| Growth Rate | CAGR of 23.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Extended Reality (XR) In Construction Market |

|

| Customization Scope | Free report customization with purchase |

Extended Reality (XR) In Construction Market Segmentation:

By Component

- Hardware

- Software

By Application

- Design Visualization

- Safety Training

- Project Management

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others