Report Overview

Distributed Temperature Sensing Market Highlights

Distributed Temperature Sensing Market Size:

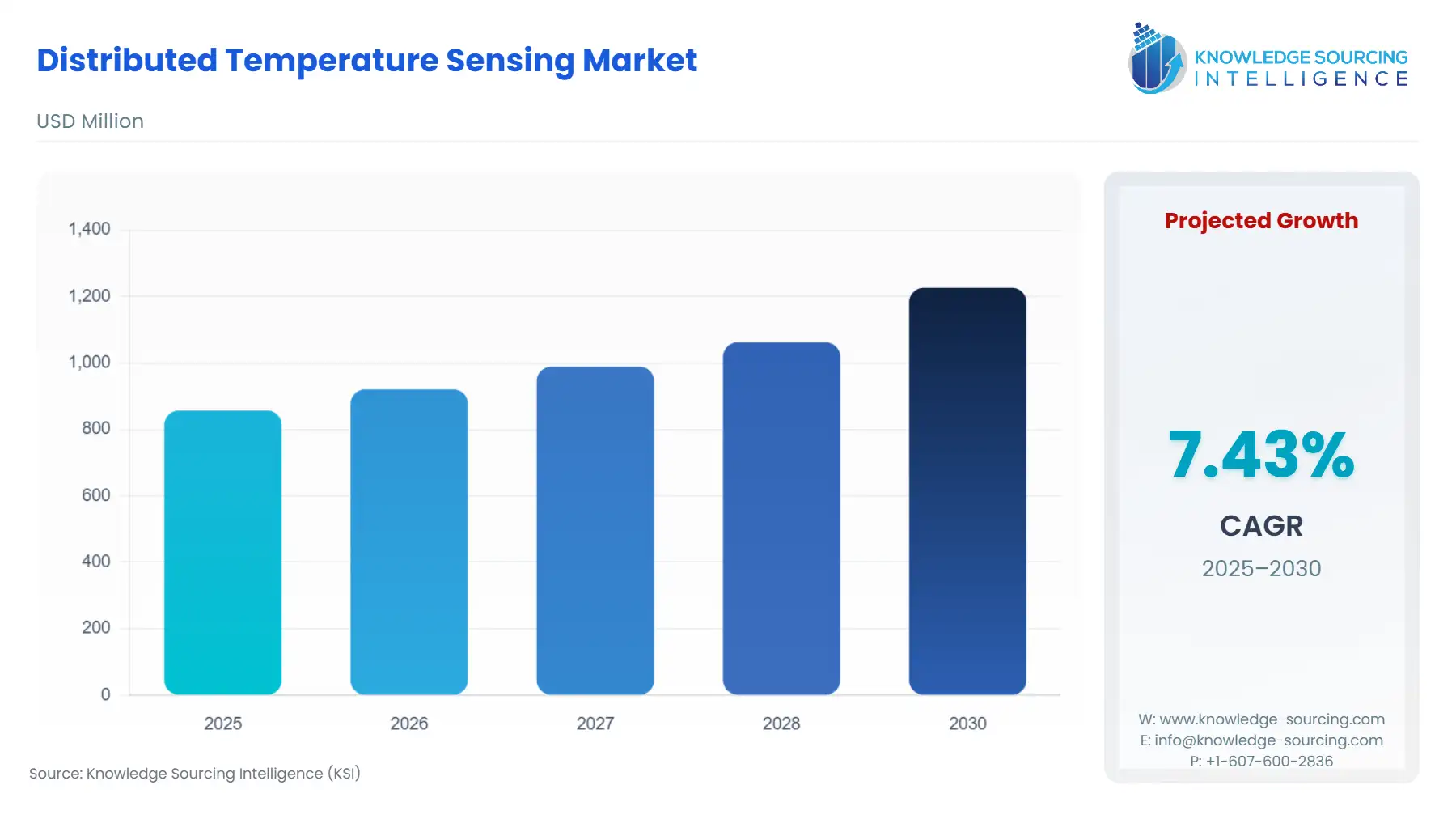

The distributed temperature sensing market, growing at a 7.21% CAGR, is anticipated to reach USD 1301.21 million in 2031 from USD 857.050 million in 2025.

The Distributed Temperature Sensing (DTS) market comprises highly sophisticated optical fiber-based instrumentation that measures temperature continuously over vast distances. Unlike conventional electrical point sensors, a DTS system utilizes the entire length of a standard optical fiber as a linear sensor, providing thousands of spatially accurate temperature measurements in real-time. This capability is foundational to ensuring the integrity, safety, and operational efficiency of large-scale, critical assets, including subterranean power cables, lengthy oil and gas pipelines, and expansive industrial facilities.

Distributed Temperature Sensing Market Analysis

Growth Drivers

Regulatory compliance is a formidable growth driver, directly generating demand as pipeline operators must adhere to stringent safety and leak detection mandates from bodies like the US Pipeline and Hazardous Material Safety Administration (PHMSA). The requirement for continuous, accurate monitoring over tens of kilometers necessitates DTS deployment.

Concurrently, the increasing complexity of high-voltage underground power cable systems and the imperative for grid modernization compel utility providers to adopt DTS for thermal profiling. This monitoring prevents thermal runaway and extends asset life, a critical factor given the substantial capital expenditure associated with cable replacement. The shift towards predictive maintenance across energy and infrastructure sectors further fuels demand, as real-time DTS data facilitates the timely intervention required to minimize costly downtime.

Challenges and Opportunities

A primary market constraint is the high initial capital investment required for DTS systems, encompassing the interrogator unit, specialized fiber optic cable, and complex installation. This financial barrier limits rapid adoption in smaller-scale or less critical applications. Logistical complexity in deploying fiber optic cables, especially in retrofitting existing infrastructure, which demands careful handling to prevent strain-induced signal degradation, represents a consistent challenge. Conversely, a significant opportunity exists in the development of more robust, field-deployable interrogator units. Furthermore, the convergence of DTS with other fiber-optic sensing technologies, such as Distributed Strain Sensing (DSS) and DAS, presents a value-enhancing opportunity, enabling vendors to offer comprehensive, multi-parameter integrity solutions that command premium pricing and broader application scope.

Raw Material and Pricing Analysis

Distributed Temperature Sensing systems are physical products, with core components being the interrogator unit and the specialized optical fiber cable. The raw material analysis primarily centers on the high-purity silica glass used in fiber production and the advanced laser and photodetector components within the interrogator. Pricing stability is heavily influenced by the global fiber optic cable supply chain, which is often subject to fluctuations in silica and germanium feedstock costs. The interrogator unit pricing remains relatively stable but is capital-intensive, reflecting the specialized photonics and signal processing hardware. Tariffs on imported components, particularly sophisticated laser modules and integrated circuits originating from key Asian manufacturing hubs, can increase the final price of the interrogator unit, indirectly impacting demand sensitivity for cost-conscious end-users.

Supply Chain Analysis

The DTS supply chain is a multi-layered ecosystem characterized by significant technical specialization. The chain initiates with high-end component manufacturers supplying laser sources, detectors, and optical switches. These components feed into a select group of Original Equipment Manufacturers (OEMs) who design and assemble the proprietary DTS interrogator unit (the core intelligence of the system). Concurrently, specialized fiber manufacturers supply the sensing cable, which must meet stringent thermal and mechanical specifications. Production hubs for fiber optics are concentrated in Asia-Pacific, while advanced interrogator assembly often occurs in North America and Europe. This geographic split introduces logistical dependencies, and any trade tariffs or geopolitical instability can introduce significant volatility to the cost structure and lead times for the final deployed system.

Distributed Temperature Sensing Market Government Regulations

Government regulations act as a critical demand accelerator, transforming optional monitoring into mandatory compliance, particularly in high-risk industries.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | Pipeline and Hazardous Material Safety Administration (PHMSA) | PHMSA regulations mandate robust leak detection and integrity management for hazardous liquid and gas pipelines. This directly drives demand for DTS, which offers the most effective continuous, long-range thermal monitoring required for leak detection and hot-spot identification along extensive pipeline networks. |

European Union | Construction Products Regulation (CPR) / National Fire Safety Codes | EU-level directives and national implementations for fire detection in large commercial, industrial, and public buildings (e.g., tunnels, metros). DTS is increasingly specified as the definitive solution for reliable, linear heat detection in complex or inaccessible areas, directly increasing its adoption in infrastructure and construction. |

India | Central Electricity Regulatory Commission (CERC) / Grid Regulations | CERC's focus on the reliability and maintenance of communication and power systems within the Inter-State Transmission System (ISTS) encourages the use of advanced monitoring. DTS provides the critical thermal data for long-distance power cables, ensuring system reliability and regulatory compliance against forced outages. |

Distributed Temperature Sensing Market In-Depth Segment Analysis

By Application: Oil and Gas

The oil and gas application segment is the cornerstone of DTS demand, driven by an unyielding regulatory and safety imperative. Oil and gas infrastructure, which includes thousands of kilometers of pipelines, requires continuous, highly accurate thermal monitoring for two primary reasons: leak detection and process control. A major leak poses catastrophic environmental and financial risk, pushing operators to adopt the superior, real-time spatial resolution of DTS over traditional point sensors. The technology is also critical in downhole monitoring for production optimization, where thermal profiling is essential for effective reservoir management and understanding injection fluid behavior.

By Fiber Type: Single-Mode Fiber

Single-Mode Fiber (SMF) dominates the market share within the fiber type segmentation due to its fundamental technical superiority for long-distance Distributed Temperature Sensing. The core diameter of single-mode fiber is significantly smaller than that of multi-mode fiber, which eliminates modal dispersion. This characteristic allows a single light pulse to travel much farther before signal degradation compromises the measurement's accuracy and spatial resolution. For applications requiring monitoring over vast distances—such as cross-country pipelines, large perimeter surveillance, or long power cable runs—SMF is the only viable commercial solution.

Distributed Temperature Sensing Market Geographical Analysis

US Market Analysis (North America)

Demand in the US market is profoundly shaped by the stringent regulatory landscape established by federal agencies, most notably the PHMSA within the DOT. The US has an expansive, aging pipeline network, making integrity management an immediate safety and compliance mandate. This creates a non-discretionary demand for DTS systems to ensure leak detection and identify external corrosion hot spots.

Furthermore, the massive investment in grid modernization by utilities necessitates DTS adoption for monitoring high-voltage underground transmission cables, especially in densely populated or constrained urban areas where cable failure is prohibitively expensive. The market is mature, favoring advanced technology integration and high-end, reliable vendors.

Brazil Market Analysis (South America)

The Brazilian market is characterized by significant demand from the deep-sea and offshore oil and gas sector. DTS demand is driven by the complex, high-pressure, high-temperature (HPHT) environments of pre-salt exploration, where downhole monitoring is vital for production efficiency and equipment integrity. Regulatory bodies like the National Agency of Petroleum, Natural Gas and Biofuels (ANP) oversee these operations, creating a need for verifiable, continuous monitoring systems.

Germany Market Analysis (Europe)

The German market for DTS is primarily driven by its vast, sophisticated industrial base and a rigorous focus on fire detection in complex infrastructure. German fire codes and standards, often stricter than general EU directives, require highly reliable, linear heat detection systems in tunnels, automotive facilities, and logistics centers.

Saudi Arabia Market Analysis (Middle East & Africa)

Saudi Arabia's market is intrinsically linked to the immense infrastructure of its national oil and gas producer, Saudi Aramco. Demand is colossal and concentrated in pipeline monitoring, wellbore sensing, and the protection of large-scale refining and processing facilities. The scale of the assets necessitates the ultra-long-range capability of DTS.

China Market Analysis (Asia-Pacific)

The Chinese market is experiencing explosive demand, propelled by rapid urbanization, massive infrastructure development, and substantial state-led investment in industrial and energy projects. This includes constructing extensive new oil and gas pipelines, expanding high-speed rail networks (which require tunnel monitoring), and building out smart grids.

Distributed Temperature Sensing Market Competitive Environment and Analysis

The DTS market is characterized by a moderate level of concentration, with a few established global players leveraging decades of fiber-optic and oilfield experience. Competition centers on product performance metrics—specifically, maximum measurement distance, spatial resolution, temperature accuracy, and integration capability with broader industrial control and management systems (e.g., SCADA). Strategic differentiation is increasingly achieved through the offering of multi-parameter solutions, integrating DTS with DAS and DSS to provide a single fiber-based integrity platform.

Halliburton: Halliburton, a global leader in the oil and gas services sector, strategically positions its DTS offerings, such as the FiberLine products, as integrated components of its comprehensive wellbore and reservoir monitoring solutions.

Baker Hughes: Baker Hughes focuses its DTS strategy on the Subsea Integrity Management segment, offering DTS technology embedded directly into its flexible pipe systems. This strategic placement ensures real-time temperature monitoring for flow assurance and outer sheath integrity, critical for deepwater and subsea operations.

Distributed Temperature Sensing Market Recent Developments

In April 2025, Tekscan launched the Temperature Mapping Solution and offers real-time, spatial temperature mapping for industrial use. It's built on the I-Scan 9.5 platform and integrates pressure and temperature data. The system aids battery, electronics, and packaging applications.

In July 2024, VIAVI introduced the NITRO Fiber Sensing solution, which uses fiber optic sensing for real-time monitoring of infrastructure. The system detects and locates temperature, strain, and acoustic changes and supports pipelines, power lines, and data centers. It is designed for proactive maintenance and reduced downtime.

Distributed Temperature Sensing Market Segmentation

By Technology

Optical Time Domain Reflectometry (OTDR)

Optical Frequency Domain Reflectometry (OFD)

By Fiber Type

Single-Mode Fiber

Multi-Mode Fiber

By Application

Oil and Gas

Power Cable

Fire Detection

Pipeline Monitoring

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Indonesia

Others