Report Overview

Infrared Refrigerant Sensor Market Highlights

Infrared Refrigerant Sensor Market Size:

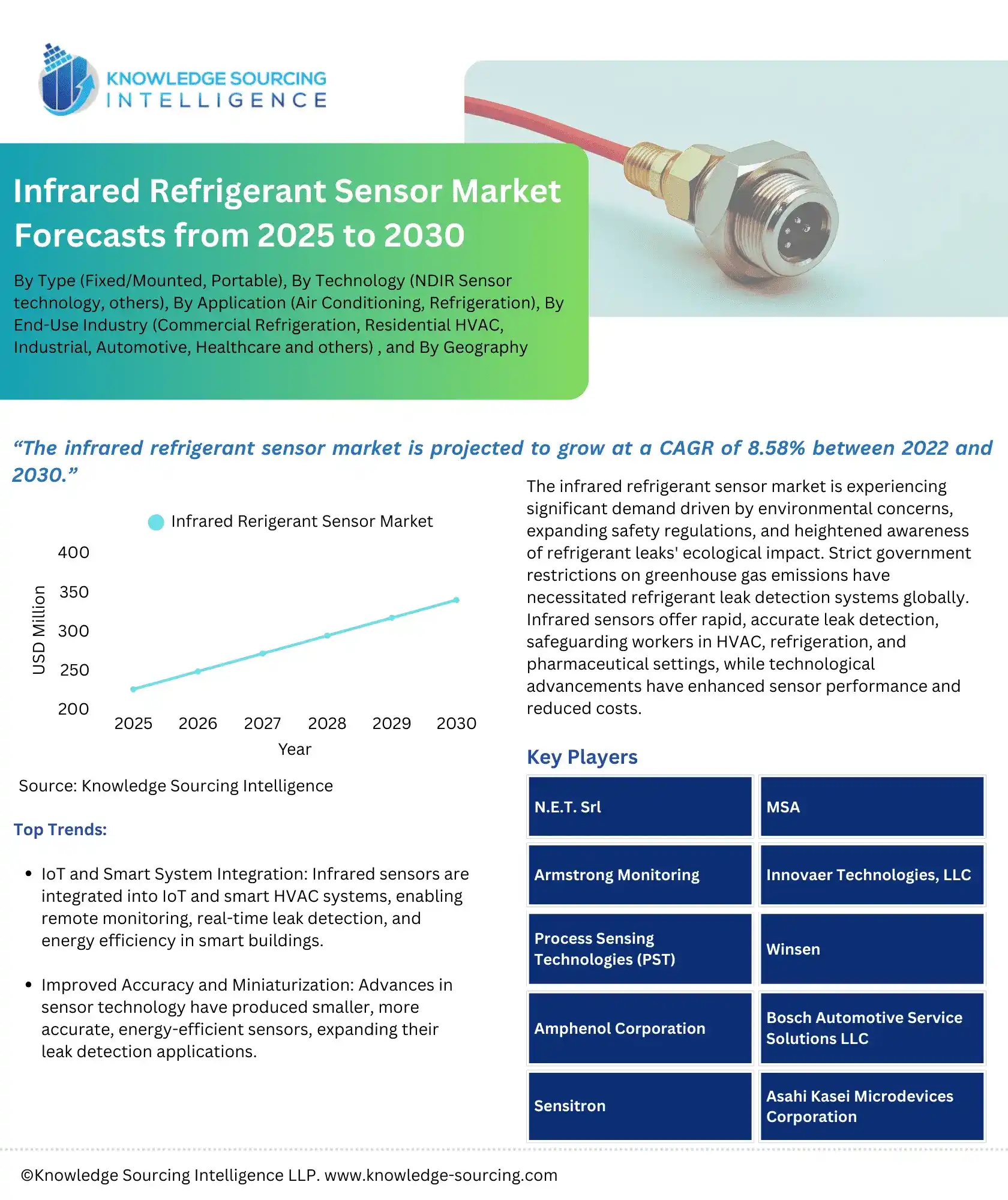

The infrared refrigerant sensor market is projected to grow at a CAGR of 8.58% between 2025 and 2030.

The infrared refrigerant sensor market is experiencing significant growth due to environmental concerns, expanding safety regulations beyond heating and cooling systems, and an increasing awareness of the ecological effects of refrigerant leaks. Government-implemented strict restrictions on greenhouse gas emissions have created a market necessity for refrigerant leak detection sensor systems worldwide.

Infrared Refrigerant Sensor Market Overview & Scope:

The infrared refrigerant sensor market is segmented by:

- Type: Portable infrared refrigerant sensors will grow significantly because they offer users versatility alongside user-friendly operation and economic benefits. Due to tightening regulations, these sensors are important in safeguarding operations and protecting the environment.

- Technology: The market is divided into two main technological sections: NDIR sensor technology and other sensor technologies. NDIR sensors represent the industry's standard infrared technology for detecting refrigerant gas escapes. An infrared beam passes through an air sample within this sensor technology, which detects the amount of light absorption performed by varying gases.

- Application: The refrigeration application segment leads the infrared refrigerant sensor market because commercial and industrial refrigeration systems require strict safety standards for leak prevention alongside their large refrigerant use.

- End-User Industry: The infrared refrigerant sensor market is based on the end-use industry and is divided into the following categories: commercial refrigeration, residential HVAC, industrial, automotive, and healthcare industries.

- Region: The North American market sector will dominate the market as its primary market segment in the forecast duration. The strong environmental regulations and major HVAC & Refrigeration industry, combined with compliance requirements for environmental influence, stand as the main factors behind this regional market expansion. The Energy Information Agency anticipates that the USA industrial sector demand for energy will rise 30% by 2050, causing a 17% increase in greenhouse gas emissions, leading to a rise in the requirement for these sensors.

Top Trends Shaping the Infrared Refrigerant Sensor Market:

1. Integration with IoT and Smart Systems

- These infrared refrigerant sensors are being utilized in the IoT and smart HVAC refrigeration systems for diverse applications, including remote monitoring of the devices with real-time data on leak detection and refrigerant levels. These benefits provide energy efficiency and safety to smart buildings and homes.

2. Improved Sensor Accuracy with Miniaturization

- The advancement of sensor technology leads to miniature-sized, accurate, and energy-conserving infrared sensors that enhance their application range, including leak detection.

Infrared Refrigerant Sensor Market Growth Drivers vs. Challenges:

Opportunities:

- Stringent Environmental Regulations: Global environmental regulations enforce severe requirements to reduce emissions of high-GWP refrigerants because international regulatory bodies and domestic governments maintain strict regulatory standards. Instead of relying on standard sensors, using infrared refrigerant sensors serves to locate harmful refrigerant leaks and helps organizations fulfill their environmental regulatory requirements. This includes the F-Gas Regulation in Europe and the EPA Section 608 requirements in the United States.

- Growing Demand for Energy Efficiency: The prior detection of refrigerant leaks through infrared sensors leads to higher energy efficiency in HVAC and refrigeration systems as they prevent premature system failure, reducing the carbon footprint and driving the energy efficiency framework globally. The EU plans to reach climate neutrality by 2050, according to EEA statistics from November 2024, through building energy efficiency improvements and product marking initiatives, as well as financing schemes for energy efficiency investments and heating and cooling system advancements.

Challenges:

- High Initial Cost: Implementing infrared refrigerant sensors becomes less attractive due to their elevated initial installation costs, surpassing electrochemical or semiconductor options.

Infrared Refrigerant Sensor Market Regional Analysis:

- Asia-Pacific: Industrialization and urbanization throughout the Asia-Pacific region drive the market to require more HVAC systems alongside solutions for infrared refrigerant sensors. According to data collected by UNICEF, it is projected that by 2030, urban residents will make up 55 percent of the entire population in this region.

Infrared Refrigerant Sensor Market Competitive Landscape:

The market is fragmented, with many notable players, including SGX Sensortech, Asahi Kasei Microdevices Corporation, Armstrong Monitoring, and Process Sensing Technologies (PST), among others:

- New Product: In August 2024, Asahi Kasei Microdevices developed the "Sunlight R290" gas sensor for highly flammable refrigerant (R290) operation safety in HVAC systems during August 2024. The sensor provides precise measurement capability and extended operational parameters and requires minimal power and small physical size, alongside low heat emission.

- Collaboration: In June 2024, Cubic Sensor & Instrument Co., Ltd, partnered with Innovaer Technologies to achieve UL 60335-2-40 and IEC 60335-2-40 certification for Dual Channel NDIR AM4205, AM4203, and AM4203DR, which determine A2L and A3L refrigeration gas leak detection sensitivity.

List of Top Infrared Refrigerant Sensor Companies:

- Armstrong Monitoring

- Process Sensing Technologies (PST)

- Amphenol Corporation

- Sensitron

- MSA

Infrared Refrigerant Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Growth Rate | CAGR of 8.58% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Infrared Refrigerant Sensor Market |

|

| Customization Scope | Free report customization with purchase |

The Infrared Refrigerant Sensor Market is analyzed into the following segments:

By Type

- Fixed/Mounted

- Portable

By Technology

- NDIR Sensor technology

- Others

By Application

- Air Conditioning

- Refrigeration

By End-Use Industry

- Commercial Refrigeration

- Residential HVAC

- Industrial

- Automotive

- Healthcare

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific