Report Overview

Emission Control Catalyst Market Highlights

Emission Control Catalyst Market Size:

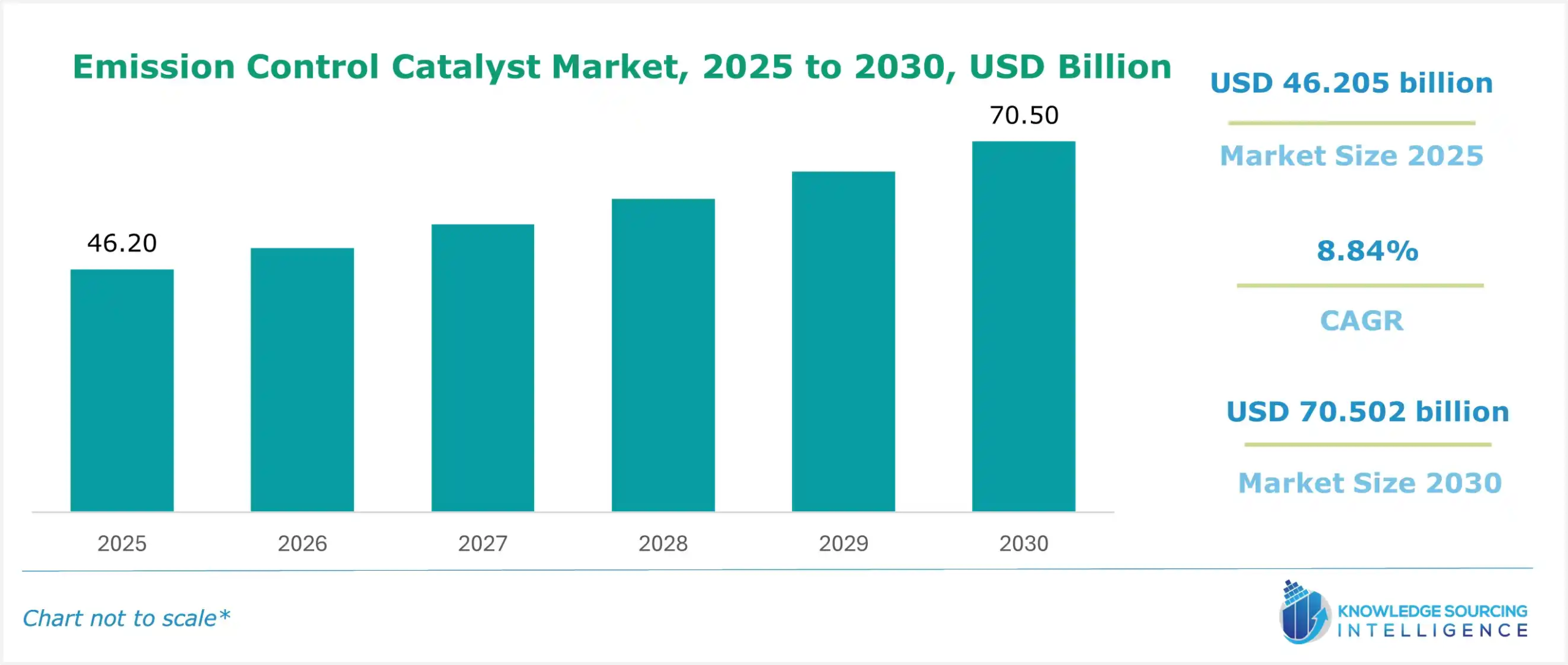

The emission control catalyst market is expected to grow at a CAGR of 8.84%, reaching a market size of US$70.502 billion in 2030 from US$46.205 billion in 2025.

The global market size for emission control catalysts will grow substantially throughout the forecast duration. Catalytic converters use emission control catalysts to reduce harmful emissions into the atmosphere. As environmental worries develop, industry individuals undertake new substances, techniques, approaches, and technologies. The number one purpose of the economic, industrial, and governmental sectors is to lessen the amount of emissions. To lower the damaging carbon emissions, catalytic converters use catalysts for pollutant management. Leaders in the enterprise are pushing new technology, systems, strategies, and merchandise in response to developing environmental worries. States, organizations, and industry sectors prioritize regulating a variety of pollution.

In addition, the market is being driven by urbanization and industrialization. The industrial sector is growing due to the increased demand for industrial goods and services brought about by more people living in cities. The expansion of the industrial sector releases dangerous gases into the atmosphere. ECCs are widely used in this sector to cut harmful gas emissions. The ECC market is expanding due to the rising demand for industrial goods and services brought on by industrialization and urbanization. For instance, in 2023, CO2 emissions linked to energy increased by 1.1% globally, rising by 410 million tonnes (Mt) to a new record high of 37.4 billion tonnes (Gt).

Emission Control Catalyst Market Drivers:

- Strict fuel economy regulations are expected to boost the demand for the emission control catalyst market globally.

Strict standard emission and fuel economy regulations have been imposed by several governments worldwide on fuel-powered passenger cars. The industry for emission control catalysts is predicted to grow as a result of these standard regulations, which have forced automakers to use more of them in their vehicles to lower their carbon footprints, reduce air pollution, and maintain performance and safety.

Moreover, fuel consumption standards for light-duty cars are set by emission regulations such as the Greenhouse Gas Emission Standards and Corporate Average Fuel Economy (CAFÉ). Government regulations have ensured that car manufacturers must produce cars that adhere to these standards and reduce the number of dangerous pollutants entering the environment.

- Increased demand by manufacturers to reduce vehicle emissions might impact the emission control catalyst market growth.

ECCs are utilized in a large number of automobiles and industrial processing units to reduce emissions from internal combustion engines and industrial activities. Advances in vehicle engine technologies and catalytic converters, such as SCR systems, two-way catalytic converters, and three-way catalytic converters, are addressing the problem of emissions. A car's engine can eliminate the percentage of the hydrocarbons, carbon monoxide, and nitrogen oxides it produces with a catalytic converter.

Furthermore, manufacturers are developing new and sophisticated systems that use a lot fewer PGMs and enhance the overall performance of the catalytic converters to meet the necessary emission requirements.

- Increased use of platinum as a metal is anticipated to boost the market growth.

The demand for platinum, a crucial component of catalysts used to control emissions, has been rising steadily in recent years. To lower vehicle emissions, platinum-based catalysts are frequently employed in the automotive sector's catalytic converters. Owing to its high activity and stability at high temperatures, platinum is favoured over other metals and is a perfect catalyst for transforming toxic emissions into less toxic ones.

Moreover, the growing global demand for cars and light-duty vehicles has led to a notable increase in the platinum segment. The automotive sector primarily drives the demand for platinum-based catalysts, and in the upcoming years, it is anticipated that this sector's growth will continue to drive platinum demand.

Emission Control Catalyst Market Segment Analysis:

- In terms of application, stationary emission is expected to grow significantly.

The stationary emission segment is anticipated to grow significantly in the upcoming years in terms of applications. Applications in power plants, industrial boilers, and other stationary sources of emissions are included in the stationary emission segment. Moreover, owing to the implementation of stringent emission regulations by governments worldwide and growing awareness of the detrimental effects of air pollution, this segment has seen significant growth in recent years.

Further, the need to lower emissions of nitrogen oxides, carbon monoxide, and other pollutants from stationary sources is what drives the market for stationary emission control catalysts. Because of the growing energy demand and the industrial sector's expansion, the stationary emission segment is predicted to continue growing during the forecast period.

- Increasing demand for diesel oxidation catalysts is predicted to increase the market.

Diesel oxidation catalysts, or DOCs, are primarily utilized in compression-ignition engines, like diesel engines. This device converts hydrocarbons to water and carbon dioxide, and carbon monoxide to carbon dioxide using oxygen found in the exhaust gas stream. These converters are also known to operate at 90% efficiency, eliminating the smell of diesel and lowering observable particulates.

Moreover, during the forecast period, there will be a rise in demand for diesel oxidation catalysts (DOC), as they aid in the breakdown of solid particulates in engine exhaust systems of industrial machinery and vehicles, thereby reducing the number of harmful pollutants released into the environment.

Emission Control Catalyst Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

The emission control catalysts market is expected to grow significantly in the Asia-Pacific region because of the high demand for emission control technologies in this area. Emissions from a variety of sources, including power plants, transportation, and industrial processes, have increased as a result of the region's rapid industrialization and urbanization.

As a result, there has been more emphasis on lowering emissions to enhance air quality and lessen the impact on the environment. This has raised the levels of air pollution. The demand for emission control catalysts has increased as a result of the region's governments enacting stringent emission regulations and encouraging the adoption of emission control technologies.

Emission Control Catalyst Market Developments:

- December 2025: Umicore officially opened its new production plant for emission control catalysts in Nowa Ruda, Poland, to help meet increasing demand driven by tightening European emissions standards.

- November 2025: BASF Environmental Catalyst and Metal Solutions (ECMS) opened a state-of-the-art production facility in Budenheim, Germany, for green hydrogen and fuel cell components, supporting emissions reduction technologies.

- October 2025: Johnson Matthey plc provided a pre-close trading update confirming continued progress on the planned sale of its Catalyst Technologies business to Honeywell, with regulatory approvals and carve-out activity advancing ahead of the projected 2026 completion.

- October 2025: In Q3–Q4 2025, Johnson Matthey’s clean air division (focused on emission control catalysts) was reported to remain a core business area after the announcement of the Catalyst Technologies sale, highlighting strategic focus on emissions-reducing products.

- May 2025: Honeywell announced it agreed to acquire Johnson Matthey’s Catalyst Technologies business (including catalyst tech used in emission control applications) for £1.8 billion, expanding its clean fuels and emission solutions portfolio.

Emission Control Catalyst Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Emission Control Catalyst Market Size in 2025 | US$46.205 billion |

| Emission Control Catalyst Market Size in 2030 | US$70.502 billion |

| Growth Rate | CAGR of 8.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Emission Control Catalyst Market |

|

| Customization Scope | Free report customization with purchase |

Emission Control Catalyst Market Segmentation:

- By Metal

- Palladium

- Platinum

- Rhodium

- Others

- By Type

- Diesel Oxidation Catalyst

- Selective Catalytic Reduction

- Lean Nox Trap

- Three-Way Catalytic Converter

- Four-Way Catalytic Converter

- Others

- By Application

- Automotive industry

- Stationary sources

- Off-road equipment

- Marine industry

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- China

- Japan

- India

- South Korea

- Taiwan

- Indonesia

- Others

- North America