Report Overview

Emotion Detection and Recognition Highlights

Emotion Detection and Recognition Market Size:

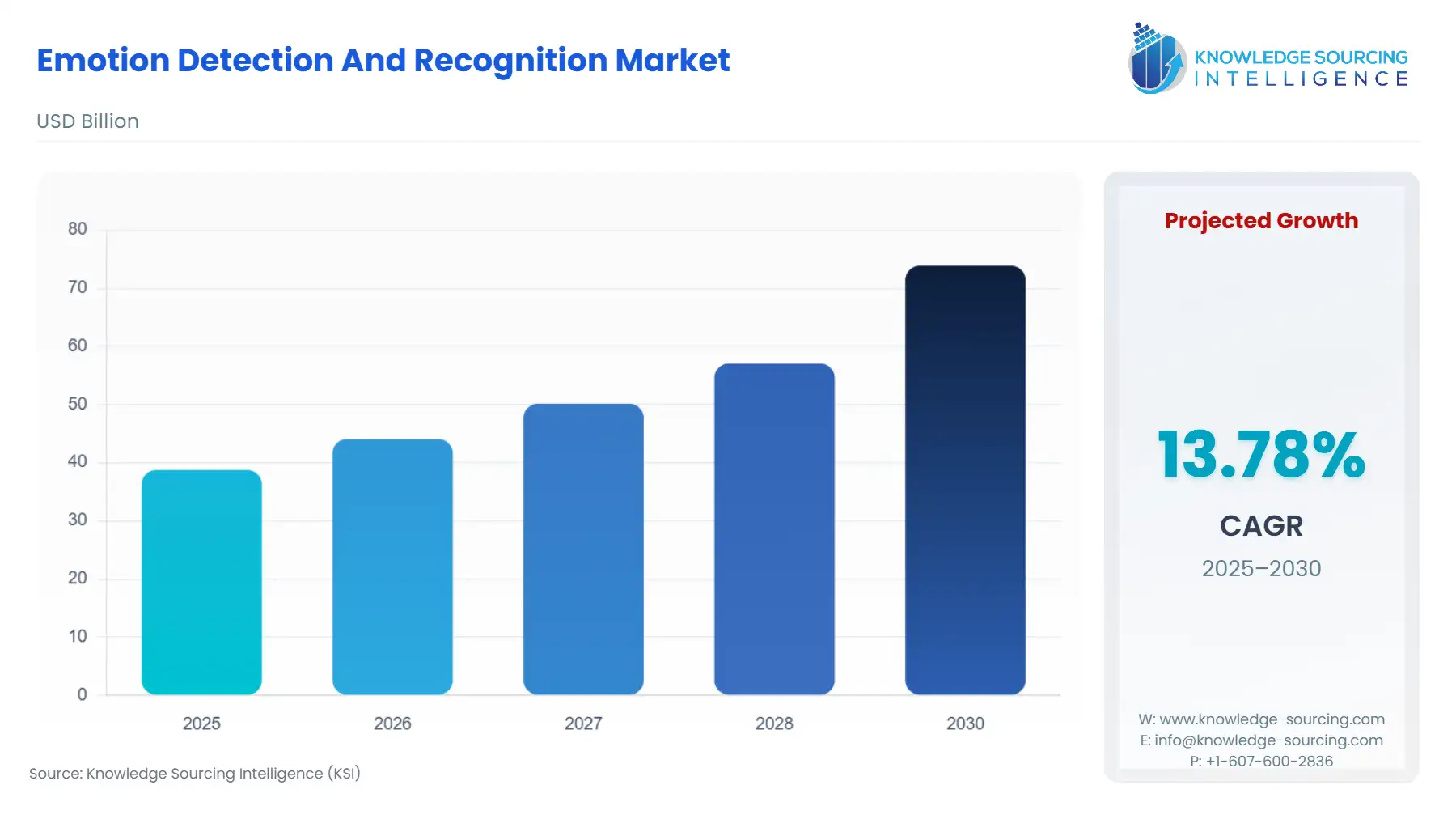

The emotion detection and recognition market is projected to expand at a 13.78% CAGR, attaining USD 73.878 billion by 2030 from USD 38.740 billion in 2025.

The emotion detection and recognition (EDR) market is growing significantly as the sector involves developing and implementing technologies capable of identifying and recognizing human emotions. These EDR systems use various recognition techniques, including facial expression, physiological signals, speech analysis, and natural language processes, which could help in detecting and interpreting emotional states. With the increase of EDR systems in consumer electronic products in the coming years, the emotion detection and recognition market is expected to grow significantly.

Emotion Detection and Recognition Market Driver:

- Increased use of EDR in various applications

The market for EDR is expected to grow as the number of end-use applications of this technology increases. Notably, wearable technology, which includes tracking information such as blood pressure, skin temperature, and heart rate, helps give the device clues about mood. Moreover, with the growing advancement in Internet of Things (IoT) devices and the increasing number of smart devices in the market, EDR systems are anticipated to grow in the projected period. According to the GSMA Association, the demand for the Internet of Things is expected to increase and is expected to generate US$1.1 trillion in revenue for the IoT opportunity. Moreover, as per the GSMA Association, the total number of IoT connections in 2018 was 9.1 billion and is expected to reach 25.2 billion in 2025, with Asia Pacific having the highest number of connections, with 11 billion by 2025.

According to Telefonaktiebolaget LM Ericsson, the market demand for smart wearables and devices is increasing rapidly. The increasing use of these smart devices by consumers in gyms and yoga centers to track their daily activities is one of the major reasons propelling the market for emotion detection and recognition market. The major consumers of this category are people aged from 25 to 34 years, where new users are 32%, followed by a younger generation, with new users being 24%, and the next 35 to 44 years, with a 22% adoption rate for this technology. This increase in growth can be attributed to increasing innovative product launches and increasing interest of consumers in such products. Hence, the market is anticipated to boost as the use cases increase.

Emotion Detection and Recognition Market Geographical Outlook:

- It is projected that the United States emotion detection and recognition market will grow steadily.

The market for emotion detection and recognition in the United States is driven by several factors, including rapid growth in the advancement of AI technology. This is coupled with the increasing adoption of wearable devices, such as smartwatches and virtual reality headsets with additional features, such as trackers and sensors, that aid in emotion detection. This will lead to greater demand for technologies such as speech analysis, facial expression recognition, and psychological signals to detect and interpret the emotional state of the individual.

Moreover, the increasing need for advanced marketing and advertising tools is expected to provide the impetus to market growth. This is because these tools analyze customer emotions and sentiments and thus enable marketers to create personalized campaigns, optimizing advertising efficiency and increasing overall customer experience.

Furthermore, key strategic partnerships among the market players are anticipated to provide a competitive advantage over others. For instance, in 2020, NEC Corporation, a leading biometric authentication and video analytics company in the US market, announced a strategic alliance with Realeyes OÜ (Realeyes) for the development of emotion analysis solutions. Moreover, the emergence of new AI technology startups such as Nuralogix, Cynny, and Mad Street Den, with a focus on emotion recognition software, presents lucrative opportunities in the upcoming years. This will expand the product portfolio for emotional AI solutions supporting the market growth.

Emotion Detection and Recognition Market Key Developments:

- In December 2022, NVISO announced a milestone launch of Neuro SDK for manufacturers building state–of–the–art AI–enabled human-machine interfaces. Additionally, the company has announced support for two new high-performance AI apps, the Human Behavior AI App catalog, Gaze, and Facial ACTION Unit Detection. Therefore, in the coming years, the market for EDR is expected to grow as the end-user industries using EDR accelerate.

Emotion Detection and Recognition Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 38.740 billion |

| Total Market Size in 2031 | USD 73.878 billion |

| Growth Rate | 13.78% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Technology, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Emotion Detection and Recognition Market Segmentation:

- EMOTION DETECTION AND RECOGNITION MARKET BY TYPE

- Facial Recognition

- Gesture Recognition

- Speech Recognition

- EMOTION DETECTION AND RECOGNITION MARKET BY APPLICATION

- Gaming

- Virtual Assistance

- Surveillance

- Recruitment

- Others

- EMOTION DETECTION AND RECOGNITION MARKET BY TECHOLOGY

- Biosensors

- Natural Language Processing

- Machine Learning

- EMOTION DETECTION AND RECOGNITION MARKET BY END-USER

- Automotive

- Consumer Electronics

- Government

- Healthcare

- Education

- Others

- EMOTION DETECTION AND RECOGNITION MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America