Report Overview

Ethyl Formate Market Size, Highlights

Ethyl Formate Market Size:

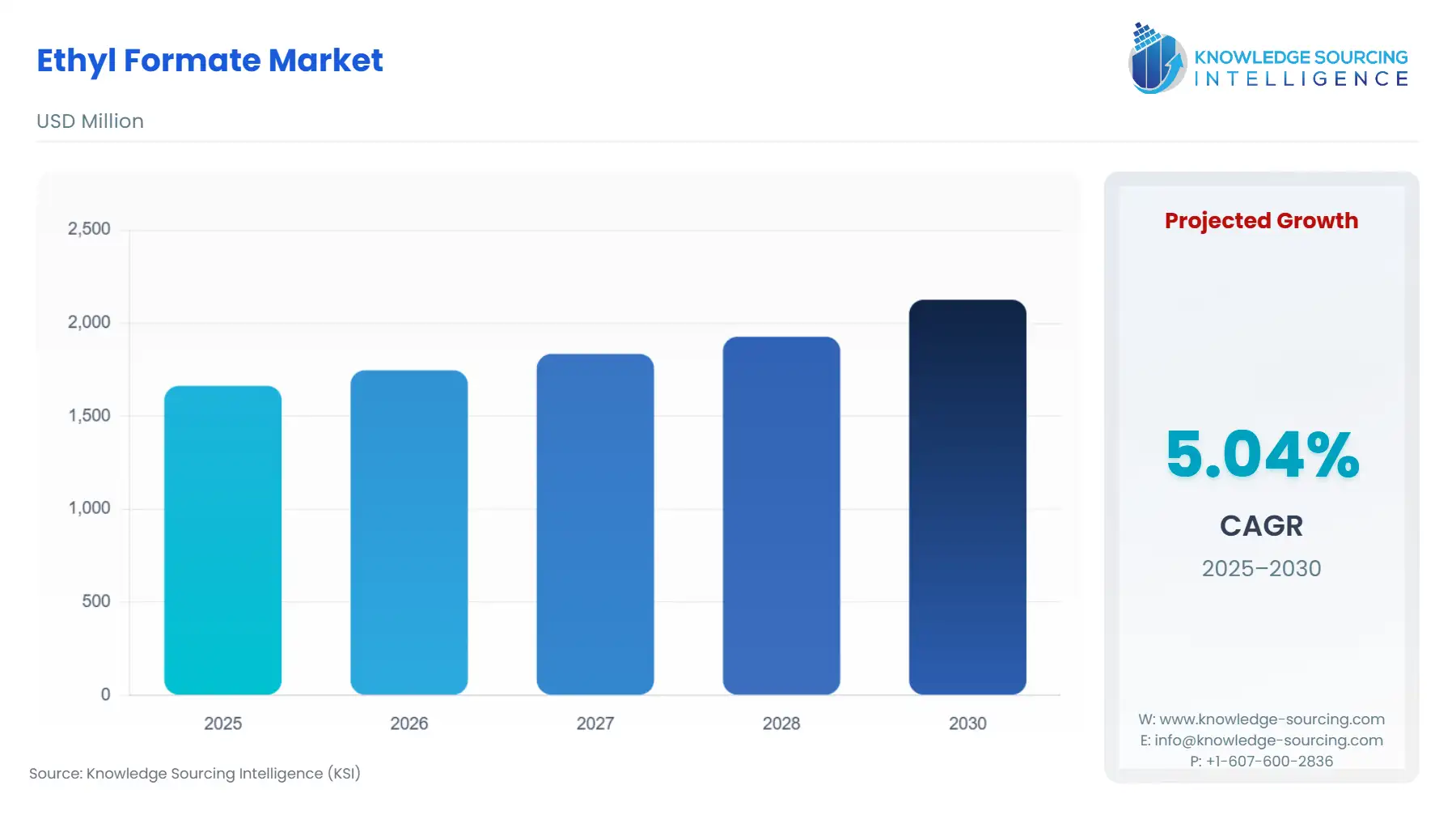

The ethyl formate market is projected to grow at a CAGR of 5.04% over the forecast period, increasing from US$1.663 billion in 2025 to US$2.126 billion by 2030.

Ethyl Formate Market Trends:

The growing drivers of the ethyl formate market include expanding demand for the global paint and coating industry. The market drivers include developing and expanding new housing projects, rising infrastructure projects, growth in the automotive, aerospace, and shipping industries, etc. Further, the automotive industry uses coating additives for various reasons, including improved pigment effect and coating performance. With the increasing demand for automobiles, the need for ethyl formate is expanding.

Moreover, the food industry worldwide is accommodating ethyl formate in its growing functions, such as a solvent for fungicides and larvicides. The increasing demand for food processing has impacted the demand for food preservatives.

Ethyl Formate Market Overview & Scope:

The Ethyl Formate Market is segmented by:

- Application: By application, the ethyl formate market is segmented into solvents, flavoring agents, fumigants, intermediaries, and others. The food and beverage industry is driving the demand for flavoring agents.

- Grade: The pharmaceutical grade segment is expected to witness prominent demand as there is a growing number of noncommunicable disease (NCD) cases worldwide, and a related surge in medicines. According to the World Health Organization, NCDs cause the deaths of 41 million people each year.

- Distribution Channel: The online segment is expected to witness prominent demand as there is a growing number of internet users and the penetration of 5G services in many regions worldwide.

- End-use Industry: The Paints and Coatings segment will have significant demand during the forecast period. In Great Britain, the value of construction output of new work for the public and private sectors has risen by 15.82% from the previous year and reached £132,989 million in 2022. This increased spending suggests the overall demand for the construction industry in the country.

- Region: By geography, the Ethyl Formate Market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the Ethyl Formate Market:

1. Advancement in technologies

- Advancements in technology are poised to significantly increase the market growth of ethyl formate. In March 2024, the government of Australia collaborated with Murdoch University to explore the use of ethyl formate as an alternative to methyl bromide for controlling and eradicating the khapra beetle at the Australian border. The ethyl formate is being tested as an alternative for safer use and doesn’t damage products.

Ethyl Formate Market: Growth Drivers vs. Challenges

Drivers:

- Expanding use of the food and beverages industry: Ethyl formate is a chemical used in the food industry as a flavoring agent and fumigant. The growing demand for processed food created an immense opportunity. The European Union exports processed F&B products for about €116.0 billion in 2022 while importing crop products and related raw food materials. The processed food is the primary profit driver for the European Union. This suggests the expanding food and beverage application in the market

- Rising pharmaceutical demand: People of almost all ages, regions, and demographics are affected by NCDs. This resulted in increased healthcare spending for the purchase of pharmaceuticals. The demand for pharmaceuticals is also increasing due to the rising geriatric population worldwide. Ethyl formate is the major chemical used in the manufacturing of many pharmaceuticals.

- Growing demand for eco-friendly chemicals: The ban on toxic solvents drives the demand for ethyl formate. It is regarded as safe (GRAS) by the American Food and Drug Administration (FDA). It has low toxicity and kills insect pests. It is approved in several countries for the control of insect pests. Efume by Intreso Group is developed for various applications, from post-harvest fumigation of household pests to equipment disinfection. It is suited to a wide variety of fruits, vegetables, grains, and cut flowers. Efume is a non-residual way to protect post-harvest produce, packaged and stored foods, and processing equipment.

Challenges:

- Price volatility: The price volatility due to the supply-chain constraint is a serious challenge in the industry.

Ethyl Formate Market Regional Analysis:

- Asia-Pacific: The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries. India is poised to be a significant player in the chemical industry. India’s chemical industry is extremely diversified, with 80,000 commercial products. Ethyl formate is mainly used in specialty chemicals, solvents, fungicides, and larvicides. India is the 6th largest producer of chemicals in the world and 3rd in Asia, contributing 7% to the country’s GDP.

Ethyl Formate Market Competitive Landscape:

The market is fragmented, with many notable players including Otto Chemie Pvt. Ltd., Spectrum Chemical Manufacturing Corp., Loba Chemie Pvt. Ltd., Beetachem Industries Pvt. Ltd., Vigon International, LLC., Kushan Odowell Co., Ltd., Sisco Research Laboratories Pvt. Ltd., Tokyo Chemical Industry (India) Pvt. Ltd., BASF SE, and Merck KGaA, among others.

Ethyl Formate Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ethyl Formate Market Size in 2025 | US$1.663 billion |

| Ethyl Formate Market Size in 2030 | US$2.126 billion |

| Growth Rate | CAGR of 5.04% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Ethyl Formate Market |

|

| Customization Scope | Free report customization with purchase |

Ethyl Formate Market Segmentation:

By Application

- Solvents

- Flavoring Agents

- Fumigants

- Intermediaries

- Others

By End-Use Industry

- Food and Beverage

- Pharmaceuticals

- Agriculture

- Paints and Coatings

- Others

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Distribution Channel

- Direct Sales

- Wholesalers

- Online Retail

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others