Report Overview

Specialty Chemicals Market Report, Highlights

Specialty Chemicals Market Size:

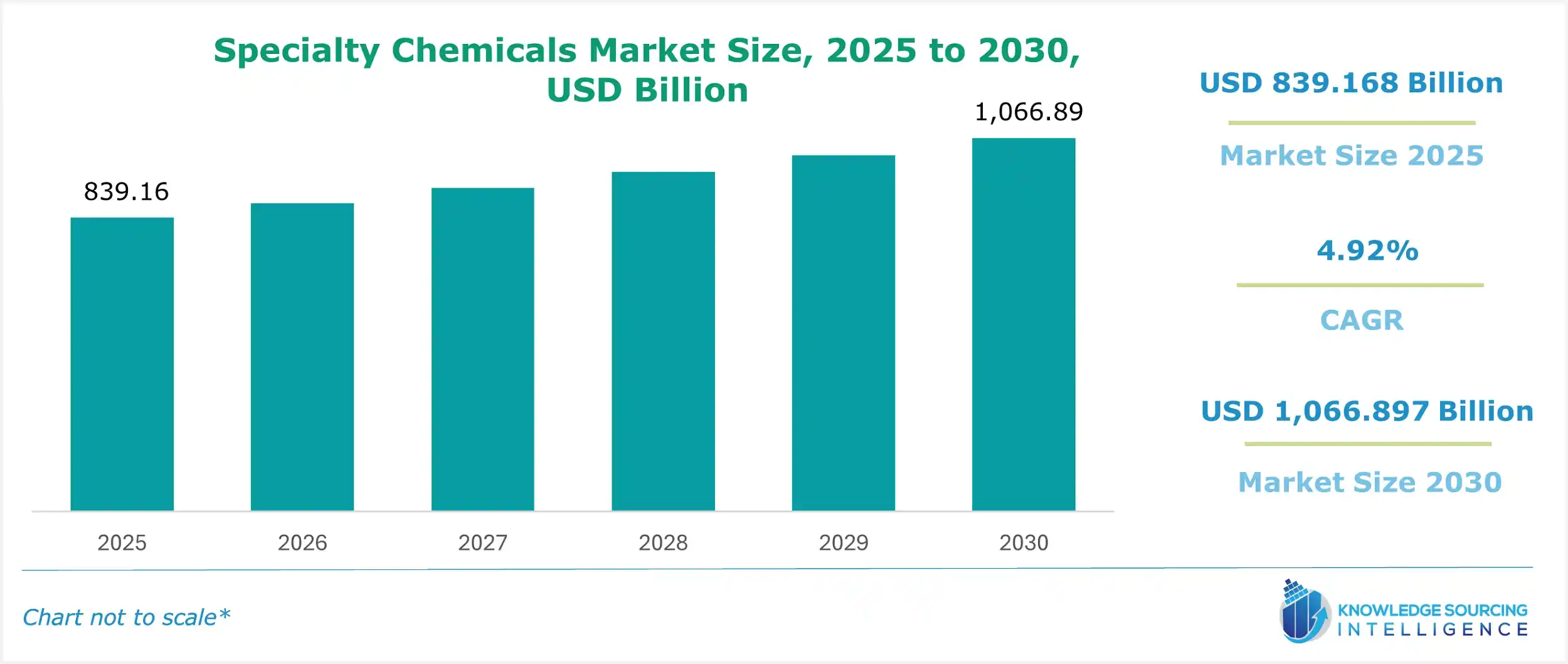

The Specialty Chemicals market will grow at a CAGR of 4.92% from USD 839.168 billion in 2025 to USD 1,066.897 billion in 2030.

Specialty Chemicals Market Overview:

The specialty chemicals market, a vital segment of the industrial chemicals industry, focuses on high-performance chemicals tailored for specific applications. These advanced materials, including chemical additives, formulation chemicals, adhesives, agrochemicals, paints, polymers, surfactants, lubricants, flavors, fragrances, and textile auxiliaries, enhance functionality in sectors like automotive, electronics, agriculture, construction, and pharmaceuticals. Offering properties such as durability, conductivity, and corrosion resistance, specialty chemicals meet stringent performance needs, driving innovation and customization to optimize manufacturing and improve end-product quality. Their role in delivering sustainable solutions aligns with global environmental goals.

Key growth drivers include booming construction and infrastructure development in Asia and Africa, spurred by rising demand for affordable housing. In Europe, initiatives like Italy’s National Recovery and Resilience Plan (2021–2026), with a €242 billion investment in transport infrastructure (roads, railways, ports), boost demand for specialty chemicals in coatings and adhesives. The UK reported 32,000 homes completed and land allocated for 26,000 more in 2023/24, further driving market growth.

In agriculture, increased chemical inputs support global food production. The FAO reported 85.5 million tonnes of urea and 16.1 million tonnes of ammonium nitrate produced in 2022, highlighting the reliance on agrochemicals. The pharmaceuticals sector also fuels demand, as chronic diseases drive the need for specialty chemicals in drug formulation.

The Asia-Pacific (APAC) region leads market expansion due to rapid industrialization, while North America and Europe benefit from advanced R&D and regulatory support for sustainable chemicals. However, challenges like volatile raw material costs and stringent environmental regulations may hinder growth. Innovations in green chemistry and bio-based materials are expected to address these, ensuring sustained market growth. The specialty chemicals market remains critical for advancing technological innovation, sustainability, and industrial efficiency across global industries, with strong growth projected in the coming years.

Specialty Chemicals Market Trends:

The specialty chemicals market is changing, emphasizing sustainability and innovation. Green chemistry solutions and sustainable chemical manufacturing prioritize eco-friendly processes, while circular economy chemicals emphasize recycling and waste reduction. Bio-based specialty chemicals gain traction, offering renewable alternatives for high-performance applications. Digitalization in chemicals, driven by Industry 4.0 chemicals, integrates AI and IoT for optimized production and supply chain efficiency. Smart materials and functional chemicals deliver advanced properties like self-healing or conductivity, meeting niche industry demands. These trends reflect a shift toward sustainable, technology-driven solutions, positioning the market for growth in a dynamic, environmentally conscious landscape.

Specialty Chemicals Market Growth Drivers:

Growing consumer demand for personal care supplies is expected to boost the specialty chemicals market growth.

Specialty chemicals are widely used in the cosmetics industry. Cosmetics is a major industry in Europe, having a retail sales value of €96 billion in 2023, according to Cosmetics Europe. This brings an estimated at least €29 billion in added value to the European economy annually. The industry growth will remain significant in the upcoming period, as, according to Cosmetics Europe, 500 million consumers use cosmetic and personal care products in the region. These products included antiperspirants, fragrances, make-up, shampoos, soaps, sunscreens, and toothpaste.

Additionally, in India, according to IBEF (India Brand Equity Foundation), the overall market share is expected to grow to US$20 billion by 2025 with a Compound Annual Growth Rate (CAGR) of 25%. The market in India has seen the personal care and cosmetics market with increasing shelf space in boutiques and retail stores across the country. The growth is also correlated with the growing e-commerce industry in the country. Various companies are launching online platforms to reach out to customers easily.

A substantial rise in the agrochemical industry is anticipated to propel the specialty chemicals market.

The agrochemical industry will see a significant demand for the application of chemicals in the production process, as the demand for food will eventually increase in the coming period. The global human population reached 8.0 billion in November 2022. According to the United Nations, this is expected to reach 9.7 billion in 2050 and reach nearly 10.4 billion in the mid-2080s. According to the Food and Agriculture Organization, fertilizers (n.e.c.) production was 1,239,004.3 tonnes in 2022. Fertilizers are a significant input in agricultural production. The demand for organic-based fertilizers has been significant in recent years due to the demand for organic food. The agrochemical industry would grow along with the rise in food demand.

Specialty Chemicals Market Geographical Outlook:

The Asia Pacific region will dominate the specialty chemicals market during the forecast period.

The specialty chemicals market is poised for significant growth, with the Asia-Pacific region expected to dominate due to rapid economic growth and industrialization. Major countries like China, India, Japan, South Korea, and Australia, alongside ASEAN nations such as Thailand, Vietnam, Cambodia, Singapore, the Philippines, and Indonesia, are driving this expansion through robust infrastructure development and urbanization.

China’s Belt and Road Initiative is a key catalyst, fueling construction projects that increase demand for specialty chemicals used in coatings, adhesives, sealants, and construction materials. In India, the Interim Budget 2024-25 allocated $133.86 billion for infrastructure, a 11.1% increase, representing 3.4% of GDP. The railway sector received $30.72 billion, while foreign direct investment (FDI) in townships, housing, and built-up infrastructure reached $33.91 billion by March 2024 (Government of India, 2024). These investments bolster the construction industry, driving demand for specialty chemicals like polymers and additives.

The Asia-Pacific region’s dominance is further supported by its manufacturing hubs, particularly in chemical production, and growing consumer markets. Technological advancements in green chemistry and sustainable chemicals align with environmental regulations, enhancing market growth. Japan and South Korea lead in innovation, producing high-performance chemicals for electronics and automotive sectors.

North America and Europe follow, driven by specialty chemical applications in pharmaceuticals and agriculture, but Asia-Pacific remains the leader due to its economic dynamism and infrastructure investments. Challenges like raw material costs persist, but sustainable practices and R&D advancements mitigate these issues. The specialty chemicals market thrives on industrial growth, infrastructure projects, and innovative applications, ensuring continued dominance in Asia-Pacific.

Specialty Chemicals Market Restraints:

Specialty chemicals face stringent environmental standards. This requires significant investments in technology and infrastructure. Compliance with emissions, waste disposal, and hazardous substances is costly. This adds complexity to the expansion of the industry. Many small players face severe fines, penalties, and legal repercussions for noncompliance. This hampers the growth and expansion of small players. Thus, sustainability is becoming more important. The manufacturers must adopt green practices and develop eco-friendly alternatives.

Specialty Chemicals Market Segment Analysis:

Specialty chemicals by end-users are segmented into pharmaceutical, electronics, automotive, construction, and others.

The automotive industry is showing significant growth due to several factors, such as demand from the growing economies of Asia and Africa and the upsurge of electric vehicles. According to OICA (International Organization of Motor Vehicle Manufacturers), car production worldwide increased from 61,553,361 in 2022 to 68,020,265 in 2023, an uptick of 11%.

Additionally, the global consumption of pharmaceuticals has seen an upsurge in the last few years after the COVID-19 pandemic. According to the OECD, the daily doses per 1,000 inhabitants per day for medicines like antidepressants have increased significantly; for Italy, it was 44.6 in 2021 and went to 45.5 in 2022. For Sweden, it went from 108.9 in 2021 to 114.5 in 2022; for Canada, it was 130.1 in 2021 to 134 in 2022. This increased demand for medicine indicates increased chronic ailments and mental health concerns.

Specialty Chemicals Market Key Developments:

November 2025: The Chemours Company Reports Third Quarter 2025 Results. The Chemours Company announced third quarter 2025 net income attributable to Chemours of $60 million, or $0.40 per diluted share, compared to a net loss in the prior year, driven by growth in Thermal & Specialized Solutions and Advanced Performance Materials segments.

November 2025: Solstice Advanced Materials Reports Third Quarter 2025 Results. Solstice Advanced Materials reported net sales of $969 million, up 7% year-over-year, reflecting growth in Refrigerants, Electronic Materials, and Safety & Defense Solutions segments amid strong demand for specialty chemicals.

November 2025: Lanxess CEO Sees Gradual Recovery for Chemical Industry in 2026. Lanxess AG's CEO stated expectations for a gradual recovery in the chemical industry in 2026, supported by stabilizing demand in specialty chemicals for the automotive and electronics sectors.

October 2025: Croda Warns of Tough Trading Amid US Tariffs. Croda International Plc warned of challenging trading conditions due to US tariffs impacting customers, while reaffirming its 2025 outlook, boosted by cost cuts and a 6.5% rise in third-quarter sales at constant currency.

June 2025: Aditya Birla Chemicals Acquires US Facility. Aditya Birla Chemicals expanded its US footprint by acquiring a chemical production facility in Dalton, Georgia, to enhance specialty chemicals production for North American markets.

June 2024, ALTANA AG and UB FIGG invested in the Finnish technology company NORDTREAT. ALTANA division BYK initiated joint development of bio-based flame retardant additives with NORDTREAT. NORDTREAT produces bio-based raw materials. Its products comply with the latest fire protection regulations. These products are needed in the wood-based construction industry in Europe and globally.

List of Top Specialty Chemicals Companies:

BASF SE

Carlyle Group

Evonik

PPG Industries Ltd

Mitsubishi Chemical Corporation

Specialty Chemicals Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 839.168 billion |

| Total Market Size in 2031 | USD 1,066.897 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.92% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

Specialty Chemicals Market Segmentation:

By Type

Specialty Polymers

Construction Chemicals

Specialty Coating

Plastic Additives

Others

By End-User

Pharmaceutical

Electronics

Automotive

Construction

Others

By Application

Rubber Processing Chemicals

Food & Feed Additives

Cosmetic Chemicals

Oilfield Chemicals

Specialty Pulp & Paper Chemicals

Specialty Textile Chemicals

Water Treatment Chemicals

Construction Chemicals

Electronic Chemicals

Mining Chemicals

Pharmaceutical & Nutraceutical Additives

Agrochemicals

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Rest of South America

Europe

United Kingdom

Germany

France

Italy

Spain

Rest of Europe

Middle East and Africa

Saudi Arabia

UAE

Rest of the Middle East and Africa

Asia Pacific

China

India

Japan

South Korea

Taiwan

Thailand

Indonesia

Rest of Asia-Pacific