Report Overview

Europe Baby Food Market Highlights

Europe Baby Food Market Size:

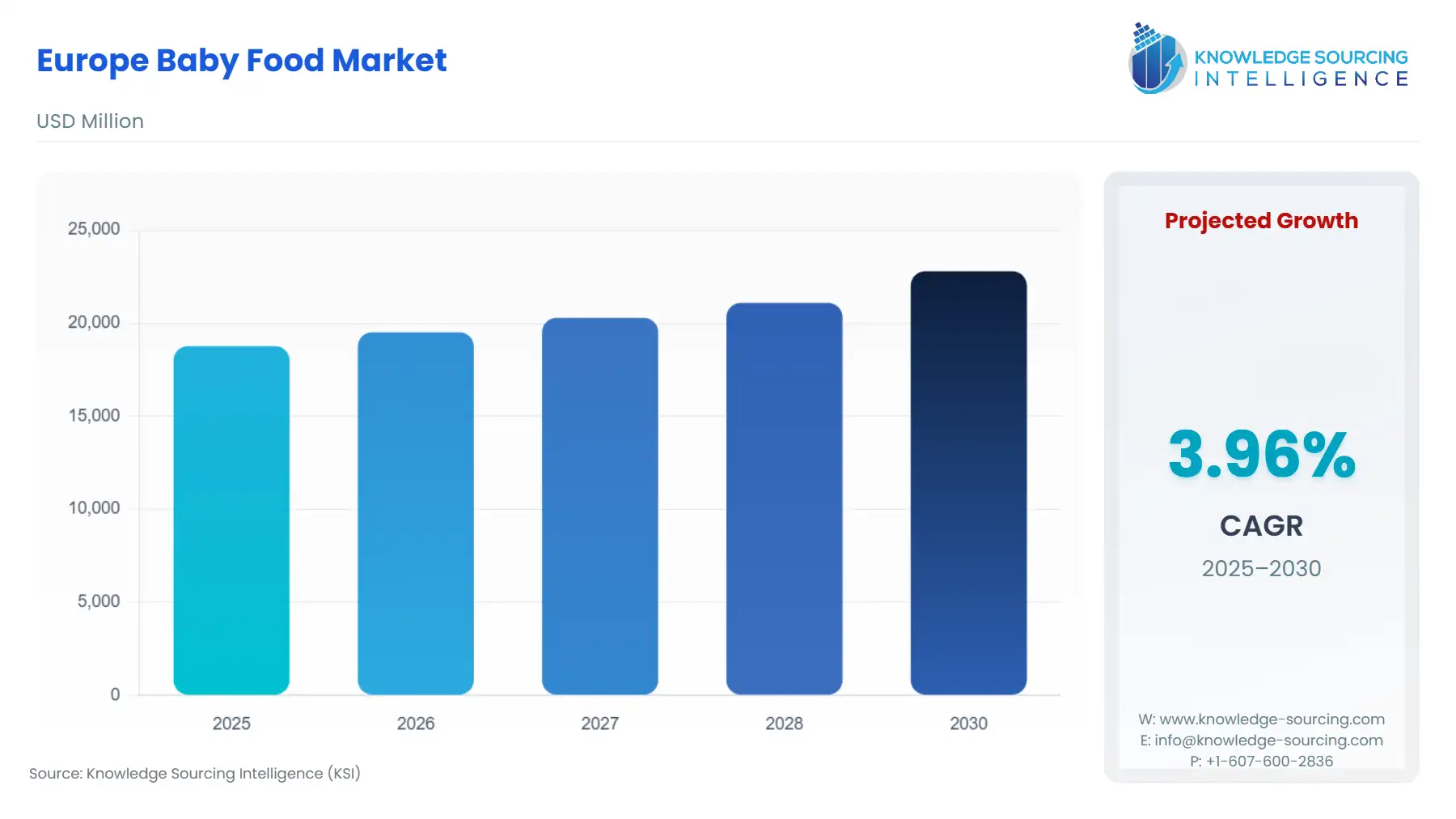

The European baby food market is expected to attain a market size of USD 22,795.347 million by 2030, growing at a 3.96% CAGR from a valuation of USD 18,770.362 million in 2025.

Europe Baby Food Market Introduction:

The European baby food market is growing moderately, fueled by the increasing awareness of infant nutrition among parents, leading to a boost in demand for nutrition-rich and high-quality baby food. The growth in urbanization, the shifting lifestyle, and a rise in disposable income among middle-class families are also boosting the demand for convenient and diverse varieties of baby food regionwide. According to U.S. Energy Information Administration data, the disposable income per capita in Western Europe was reported to grow from $24,232 in 2025 to $25,371 by 2030, further growing to $28,199 by 2040, which will promote the purchase of baby food products in Europe.

The growth of the baby food products market in the region is being driven by several key factors, including rising consumer purchasing power and the increasing prevalence of online shopping. Additionally, the growing number of working mothers is contributing significantly to this trend. Due to time constraints and a reduced inclination toward breastfeeding, many working women are opting for convenient, ready-to-eat baby food options. According to official statistics from Germany, approximately 65.4% of parents in the country were employed in 2023. Among mothers aged 20 to 49 with children under the age of six, 27% were employed full-time, while 73% were engaged in part-time work.

Packaged baby food is gaining popularity among urban parents. In addition, since there are more working women in the area and more women are taking leadership roles, they are finding baby food a convenient option. As a result, the market is expected to grow during the forecast period due to the rising popularity of prepared baby food and milk formula.

The World Health Organisation (WHO) has demanded that guidelines for the promotion of commercial baby meals be established to conform to recommendations for newborn feeding best practices. Additionally, to promote healthy eating among kids, the UK government has enacted new laws that limit the promotion of foods and beverages that are high in fat, salt, and sugar online making players focus on manufacturing such products. However, despite soaring sales, there are no legally enforceable norms or regulations for the content and advertising of produced infant meals in the UK or the EU.

Further, DMK follows the best production standards in the preparation of its baby food, which is made only in Germany with an emphasis on humane manufacturing techniques. Ensuring the requisite safety of products, from raw materials to the final product, is ensured by consistent and efficient hygiene and quality standards, as well as official monitoring of the manufacturing facilities.

Europe Baby Food Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

Numerous lifestyle and socioeconomic reasons are driving the constant rise of the baby food market in Europe. A major factor driving market expansion is the growing awareness among European parents of the value of early nutrition and the long-term health advantages of balanced diets for babies. The demand for ready-to-eat, convenient, and nutritionally balanced infant food items has increased due to urbanization and the growth in the number of working women.

The strict food safety laws in Europe and the strong consumer preference for clean-label products are driving parents to seek premium, organic, and minimally processed solutions that guarantee sustainability, safety, and traceability. The market is also experiencing a sharp increase in demand for plant-based and allergy-free baby food substitutes because of a larger trend toward ecologically friendly and health-conscious consumption. Furthermore, the swift growth of online grocery delivery services and e-commerce platforms has made it easier for parents to get a variety of infant food products, including high-end and international brands.

The strict food safety regulations and standards in Europe have increased consumer confidence in packaged infant food items, leading to their broader use. Consumers can now more easily acquire a wide variety of items thanks to the quick growth of e-commerce platforms and the increasing availability of baby food through contemporary retail formats. In addition, the growing popularity of plant-based and allergy-free baby food is opening new market opportunities due to a larger movement towards sustainable and health-conscious consumption.

The European market has been greatly impacted by the continent's increasing urbanization. Because of their hectic schedules and time restrictions, urban parents are seeking easy, ready-to-eat infant food solutions. The market for commercial infant food items has grown because of smaller families in metropolitan areas and an increase in the percentage of dual-income households. France has 82%, Germany and Italy have 78% and 72% of urban population, respectively, according to the data from World Bank.

Product packaging innovations that increase convenience for working parents include single-serving containers and resealable pouches. The market is dominated by nations with strong brand loyalty to reputable infant food makers and significant purchasing power, such as Germany, France, the UK, and Italy. Furthermore, product awareness and customer reach are being increased by aggressive marketing methods, celebrity endorsements, and the expanding use of contemporary retail formats. Overall, the European baby food market is expected to expand further as producers concentrate on creating easy-to-use, organic, and nutritionally sophisticated products that satisfy the changing dietary requirements and lifestyle preferences of contemporary European families.

Europe Baby Food Market Drivers:

- Rise in urbanization in Europe

The European market has been greatly impacted by the continent's increasing urbanization, because of their hectic schedules and time restrictions, urban parents are looking for easy, ready-to-eat infant food solutions. The market for commercial infant food items has grown as a result of smaller families in metropolitan areas and an increase in the percentage of dual-income households. Furthermore, urban parents are looking for better and organic baby food options since they are frequently more nutrition savvy and health-conscious. Baby food choices have also been influenced by access to a variety of cuisines and heightened knowledge of environmental issues. As a result, there is a growing desire for sustainable, environmentally friendly, and culturally inspired products. Businesses in urban regions are using targeted marketing techniques, focusing on quality and convenience, to meet the demands of urban parents.

As per the European Investment Bank, although 72% of people in the EU reside in cities or other metropolitan regions in 2020, there are significant regional variations hidden. Urbanization rates range from around 50% in Luxembourg, Romania, and Croatia to more than 80% in Italy, the Netherlands, and the United Kingdom.

According to the European Commission, by 2050, Europe is predicted to be around 83.7% more urbanized. The proportion of people living in rural regions as a percentage of the total population decreased between 1961 and 2018, while the population of towns and cities increased steadily and smoothly. These trends apply to the combined populations of the EU27 and the UK. While the population of all European Functional Urban Areas (FUAs) is expected to grow by 4% on average by 2050, the population of almost half of these areas will decrease, with 10% of cities seeing a population decline of more than 25% between 2015 and 2050.

- Increasing Number of Working Mothers

A key driver of the European baby food market is the consistent expansion in the continent's growing working mother population. There is an increasing need for infant food options that are quick, easy, and nutritious as more women enter the workforce. Working women now have less time to cook homemade baby meals due to hectic schedules and the difficulties of juggling work and family obligations. As a result, they are seeking baby food options that are portable, ready to eat, and simple to prepare. These items guarantee that the child gets the vital nutrients for normal growth and development while providing a convenient option for feeding while on the road.

Furthermore, the growing number of dual-income homes in Europe has increased purchasing power, allowing parents to spend more on customized, high-end, organic baby food items that suit their health-conscious tastes. As working moms frequently depend on trustworthy brands that adhere to strict European food safety regulations and offer clear labeling, allergen information, and organic certifications, their demand for confidence and safety in baby nourishment is further heightened. Baby food makers are developing new ways to satisfy this increasing need by creating products that are high in nutrients, made with natural ingredients, and come in handy, with suitable packaging like single-serving containers, resealable jars, and squeezable pads.

According to the data from the World Bank, the female labor force was 47.5 percent in the United Kingdom, while in Germany, the percentage share of the total workforce was 46.5 percent in 2024. Moreover, France reported 48.5%, while in Spain and Italy, it was 47% and 42.5% of females in the total workforce, respectively, in 2024.

Modern retail channels, online grocery platforms, and subscription-based delivery systems have made it simpler for working mothers to swiftly and effectively acquire a variety of infant food options. Furthermore, the demand for organic, plant-based, and clean-label baby food has increased due to European parents' growing health consciousness and emphasis on sustainability; working mothers have welcomed this trend. In general, the growing number of working women is evolving the European baby food market by hastening the transition to quick, high-quality, and health-conscious feeding options.

Europe Baby Food Market Geographical Outlook:

- The UK in Europe is predicted to hold the largest market share

As one of the major European economies, the United Kingdom holds high growth potential for the baby food market, fuelled by the improved prevalence of live births in the country, which has increased the parents’ concern to provide high-quality nutrition to their baby. According to the data provided by the Office for National Statistics, in 2024, the number of live births (England and Wales combined) reached 594,677, marking an increase of 3,605, as shown in the figure below, compared to the preceding year.

The United Kingdom's baby food market is a dynamic and evolving sector within the broader food and beverage industry. It encompasses a wide range of products specially designed and formulated to meet the nutritional needs of infants and toddlers. The market has been influenced by changing societal trends, including shifting demographics, increased awareness of health and nutrition, and evolving parental preferences.

The rise in the number of women in the UK workforce over the past few decades has also had a profound impact on the baby food market. As more women pursue careers and choose to continue working after childbirth, there is a growing demand for convenient and time-saving solutions when it comes to infant nutrition. This shift in societal norms has led to an increased reliance on packaged baby food products that are not only nutritious but also easy to prepare and serve. According to the ONS UK labor market bulletin for October to December 2022, a total of 15.66 million women aged 16 and over were engaged in employment during that period. This figure reflects an increase of 108,000 women in employment compared to the previous year. The female employment rate stood at 72.3%, a slight decrease from the record high of 72.7% recorded between December 2019 and February 2020. Among these employed women, 9.74 million worked full-time, while 5.92 million opted for part-time employment. It's notable that a significant portion of part-time employment, 38%, was undertaken by women, whereas only 14% of men were engaged in part-time work.

Furthermore, one of the key driving factors in the UK baby food market is the changing demographics. The UK, like many developed nations, has experienced a decline in birth rates in recent years. As a result, families with young children are more likely to focus on providing the best nutrition for their babies. Additionally, there is a growing trend towards having children later in life, which often leads to increased disposable income for parents and a willingness to invest in premium and organic baby food options.

Moreover, the steady economic growth in the country, followed by a rapid increase in urban population, has increased the consumer purchasing power in the United Kingdom, which has opened new growth prospects for baby nutrition products. Likewise, the number of marriages registered is also showcasing a positive increase, which will further escalate the demand for baby food in the coming years. According to the General Registrar Office’s quarterly data, in Q1 2024, nearly 388 people were authorised to register their marriages, representing a growth of 23.17% over the number of people authorised in Q1 2023.

The market is also influenced by parents' increasing emphasis on health and nutrition. There is a growing awareness of the importance of providing infants with a balanced and nutritious diet from the early stages of life. Consequently, there is a demand for baby food products that are free from artificial additives, preservatives, and allergens. Organic and natural baby food options are gaining popularity as parents seek out healthier alternatives for their children. The well-established presence of major market players, namely Nestle S.A., Abbott Laboratories, and Danone, which are offering an extensive portfolio that meets the required parents’ demand, followed by emphasis on healthy growth and development of newborns, are additional driving factors for market expansion.

Europe Baby Food Market Key Developments:

- In May 2023, the Queen Mary University of London-based expert group Action on Sugar, in collaboration with sixteen non-governmental organizations, urged Health Secretary Steve Barclay to release the eagerly anticipated Commercial Baby Food and Drink Guidelines. It further indicates that store-bought baby foods, particularly those with fruit and cereal bases, are the primary source of sugars in infants between the ages of four and nine months.

- In July 2022, in response to parents' requests for vegetarian and flexitarian alternatives for their babies, Danone announced the development of the first-ever Dairy and Plants Blend infant formula. Plant-based consumption is rising significantly, about 70% [69%] of parents prefer that their children eat more plant-based meals, and over one-third [37%] of EU consumers choose a vegan, vegetarian, or flexitarian diet.

- Several European brands have introduced plant-based baby food products, such as vegetable-based purees and vegan-friendly formulas, to cater to the growing demand for sustainable and plant-focused diets among parents seeking eco-conscious options for their infants.

- Major baby food companies have introduced recyclable and sustainable packaging solutions, including pouches and pots designed for home recycling, aligning with consumer preferences for environmentally responsible products and stricter regional regulations.

Europe Baby Food Market Scope:

| Report Metric | Details |

| Europe Baby Food Market Size in 2025 | USD 18,770.362 million |

| Europe Baby Food Market Size in 2030 | USD 22,795.347 million |

| Growth Rate | CAGR of 3.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Germany, France, UK, Others |

| List of Major Companies in the Europe Baby Food Market |

|

| Customization Scope | Free report customization with purchase |

Europe Baby Food Market Segmentation:

- By Product Type

- Dried Baby Food

- Milk Formula

- Prepared Baby Food

- Others

- By Age

- Up to 6 months

- 6 to 12 Months

- Greater than 12 months

- By Category

- Organic

- Non- Organic

- By Form

- Solid

- Liquid

- By Distribution Channel

- E-Commerce

- Pharmacies/Drug Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- By Geography

- Germany

- France

- UK

- Others