Report Overview

FCC Catalyst Market - Highlights

FCC Catalyst Market Size:

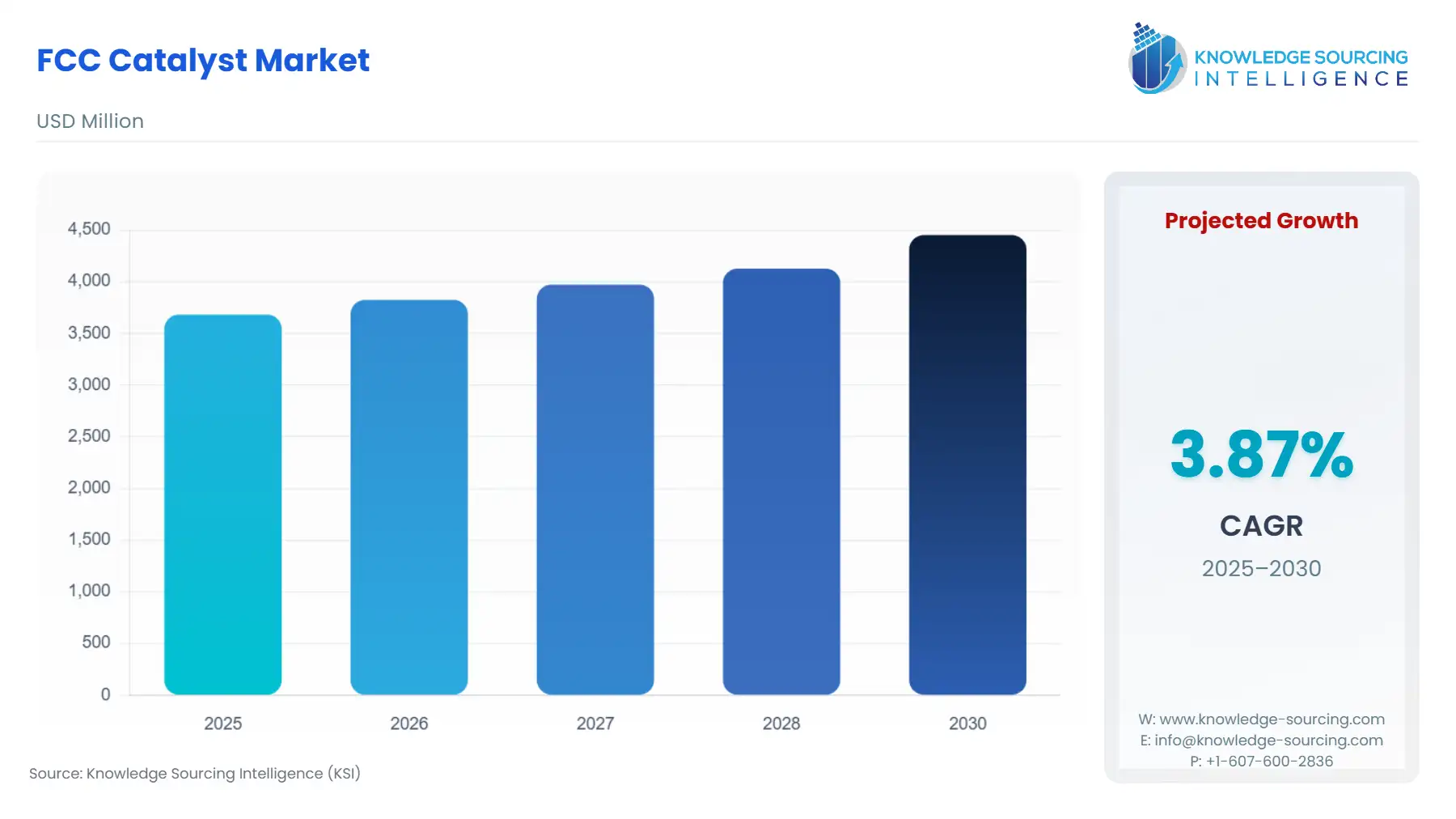

The FCC Catalyst Market is expected to grow at a 3.87% CAGR, attaining USD 4.453 billion by 2030 from USD 3.683 billion in 2025.

FCC Catalyst Market Analysis:

- Growth Drivers

Three drivers directly elevate demand for FCC catalysts. Emission and fuel-quality regulations compel refiners to adopt advanced catalysts with superior sulfur reduction, octane stability, and conversion efficiency. This regulatory pressure increases the frequency of catalyst upgrades. Second, refiners processing heavier and lower-cost crudes require metal-tolerant and high-matrix catalysts, increasing unit consumption due to faster deactivation rates in harsh feed environments. Third, shifts toward petrochemical integration particularly propylene and butylene maximization drive refiners to procure specialized promotion catalysts. Each driver produces immediate procurement-level demand, as refiners must match catalyst formulations to mandated fuel specifications, feedstock quality variations, and light-olefin margin opportunities.

- Challenges and Opportunities

The FCC catalyst market continues to experience notable cost pressures in the United States as import-dependent refineries and catalyst distributors face persistent tariff-related volatility. Tariffs on critical raw materials such as rare-earth metals, alumina, and specialty zeolites—sourced predominantly from Asia—have increased procurement costs for major FCC catalyst producers, compelling them to reassess sourcing strategies and adjust pricing models. Elevated duties on Chinese chemical intermediates have further tightened margins, particularly for small and mid-sized catalyst formulators that lack vertically integrated supply chains. While some U.S. refineries have responded by accelerating adoption of localized catalyst regeneration and recycling services to reduce exposure, others are negotiating long-term contracts to stabilize input costs.

Margin compression and feedstock price volatility constitute the primary headwinds that suppress near-term catalyst demand, as refiners may delay catalyst changeouts or temporarily switch to economical formulations. Supply-side risks involving zeolite, alumina, and rare-earth inputs raise production costs and complicate inventory planning. However, technological developments create countervailing opportunities. New solutions that reduce coke formation, improve metals tolerance, and optimize olefin selectivity increase the economic return of catalyst upgrades, encouraging refiners to invest in premium formulations. In addition, heavier crude processing and petrochemical-oriented refinery configurations expand the need for specialized catalysts and additive packages, generating sustained replacement and service demand.

- Raw Material and Pricing Analysis

FCC catalysts rely on zeolites, alumina matrices, rare-earth promoters, and binders—each contributing to cost volatility. Rare-earth availability significantly influences promoted zeolite pricing, while alumina and binder supply chains affect manufacturing schedules and inventory levels. Producers mitigate cost fluctuations by optimizing formulations to lower rare-earth intensity and by offering regeneration or additive blending programs that reduce total catalyst consumption per cycle. These material dynamics directly influence catalyst list prices and refiners’ total cost of ownership calculations. Long-term supply agreements increasingly replace spot purchases as refiners seek pricing stability amid uncertain raw material markets.

- Supply Chain Analysis

FCC catalyst supply chains depend on globally distributed production facilities located across North America, Europe, China, Japan, and Brazil, supported by catalyst regeneration hubs. These operations require precise logistics due to hazardous-material handling and refinery turnaround synchronization. Technical service teams play a critical role, as refiners often rely on on-site or near-site specialists to optimize trials and dosing strategies. Disruptions in any part of the chain—such as zeolite output constraints or transportation delays—can push refiners to secure interim additive volumes or extend catalyst life cycles. Major producers maintain multi-region manufacturing footprints to minimize single-point bottlenecks and ensure supply continuity.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Tier 3 gasoline sulfur standard (EPA) |

Imposes a 10-ppm sulfur requirement, increasing demand for FCC catalysts that enhance sulfur removal and maintain octane. |

|

European Union |

Fuel Quality and Euro Standards (European Commission) |

Tight specifications elevate the need for catalysts with improved coke control, gasoline quality enhancement, and consistency across refineries. |

|

China |

China National VI (Ministry of Ecology & Environment) |

Strict fuel and emissions limits require refiners to adopt upgraded FCC catalysts and additives that manage sulfur and improve conversion efficiency. |

FCC Catalyst Market Segment Analysis:

- Residue (By Application)

Residue processing applications create one of the highest demand concentrations for advanced FCC catalysts because heavy feeds introduce severe metal contamination, higher Conradson carbon levels, and more complex reaction pathways. To manage these challenges, refiners require catalysts engineered with robust matrices, high surface-area components, enhanced vanadium and iron traps, and strong hydrothermal stability. When refiners expand residue processing to monetize lower-cost heavy crude, they significantly increase purchases of such specialized catalysts because resid feed accelerates deactivation and necessitates more frequent catalyst replacement. The introduction of iron-tolerance technology by leading suppliers in 2024 illustrates the market’s response to refiners’ need for longer cycle lengths and consistent product yields under metal-stressed conditions. Demand is further amplified by the need for accompanying additives, deactivation-management protocols, and continuous technical support. As a result, residue applications generate higher per-ton catalyst spending, making them a core demand pillar for advanced FCC catalyst manufacturers.

- Maximum Light Olefins (By Process)

Refiners aiming to maximize production of propylene and butylene from FCC units procure catalysts optimized for olefin selectivity over gasoline yield. These catalysts incorporate specialized zeolite configurations, tuned acidity profiles, and pore architectures that promote β-scission pathways and suppress coke and dry-gas formation. The commercial launch of new high-selectivity catalysts in 2024, such as BASF’s Fourtiva™, reflects the increasing sophistication of olefin-oriented designs. Demand for this process segment is driven by economic arbitrage: petrochemical margins for C3/C4 olefins often exceed traditional gasoline margins, prompting refiners to reconfigure FCC units around olefin optimization strategies. This shift generates stable demand for promotion-focused catalysts, performance additives, and trial optimization services. Suppliers with demonstrated incremental olefin yield improvements secure long-term contracts, reinforcing the segment’s role as a major driver of premium catalyst procurement.

FCC Catalyst Market Geographical Analysis:

- United States

Tier 3 fuel sulfur requirements, combined with ongoing refinery modernization programs, sustain high demand for FCC catalysts with optimized sulfur handling and octane preservation. Domestic suppliers’ extensive technical service networks support refiners during major turnarounds, reinforcing recurring procurement patterns.

- Brazil

Processing of heavier regional crude grades by national refiners increases reliance on residue-tolerant catalysts. Localized production and service infrastructure support logistics and turnaround schedules, driving consistent catalyst consumption.

- Germany (Europe)

EU fuel-quality compliance obligations and refinery integration strategies increase demand for catalysts that reduce sulfur while preserving octane. Proximity to major European catalyst R&D centers supports early commercial adoption.

- Saudi Arabia (Middle East & Africa)

Large-scale refineries processing high-metal, heavy crudes require high-matrix, metals-tolerant FCC catalysts. Long-term supply agreements and technical service partnerships strongly influence demand patterns.

- China

National VI implementation and petrochemical expansion projects elevate demand for catalysts that combine sulfur reduction with olefin selectivity. Domestic and international producers compete through technical performance and local delivery capabilities.

FCC Catalyst Market Competitive Environment and Analysis:

The FCC catalyst landscape includes Haldor Topsoe, Albemarle/Ketjen, BASF, W. R. Grace, Clariant, JGC Catalysts & Chemicals, Sinocata, Anten Chemical, ReZel, and Johnson Matthey. Competition centers on specialized formulations, metals-management capabilities, residue-based processing solutions, and technical services.

- W. R. Grace & Co.

Grace remains a global leader in FCC catalysts through its portfolio of resid, gasoline, and olefins-oriented products. Its 2024 iron-tolerance innovation enhances its positioning in heavy-feed applications, where refiners seek longer cycle lengths and stable conversion under metal stress.

- BASF SE

BASF strengthened its competitive position with its 2024 Fourtiva™ launch, targeting refiners seeking improved olefin yields and reduced coke formation across gasoil-to-resid feeds. BASF leverages strong R&D integration and commercial demonstration capability to secure global contracts.

- Albemarle / Ketjen

Albemarle’s catalyst division, operating under the Ketjen brand, maintains a broad international manufacturing and service footprint. Its capabilities in FCC catalyst formulation and refinery technical support underpin long-term customer relationships.

FCC Catalyst Market Developments:

- May 2025 — Johnson Matthey: Signed a formal agreement to sell its Catalyst Technologies business, reshaping its catalyst portfolio and future strategic focus.

- August 2024 — BASF: Commercially launched the Fourtiva™ FCC catalyst, targeting enhanced mild-resid processing performance and olefin yield.

- August 2024 — W. R. Grace: Announced a new iron-tolerance FCC catalyst solution and related iron-deactivation protocols.

FCC Catalyst Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.683 billion |

| Total Market Size in 2031 | USD 4.453 billion |

| Growth Rate | 3.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Process, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

FCC Catalyst Market Segmentation:

- FCC CATALYST MARKET BY APPLICATION

- Vacuum Gas Oil

- Residue

- Others

- FCC CATALYST MARKET BY PROCESS

- Gasoline Sulfur Reduction

- Maximum Light Olefins

- Maximum Middle Distillates

- Maximum Bottoms Conversion

- Others (low coke production)

- FCC CATALYST MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America