Report Overview

Fiber Cement Market - Highlights

Fiber Cement Market Size:

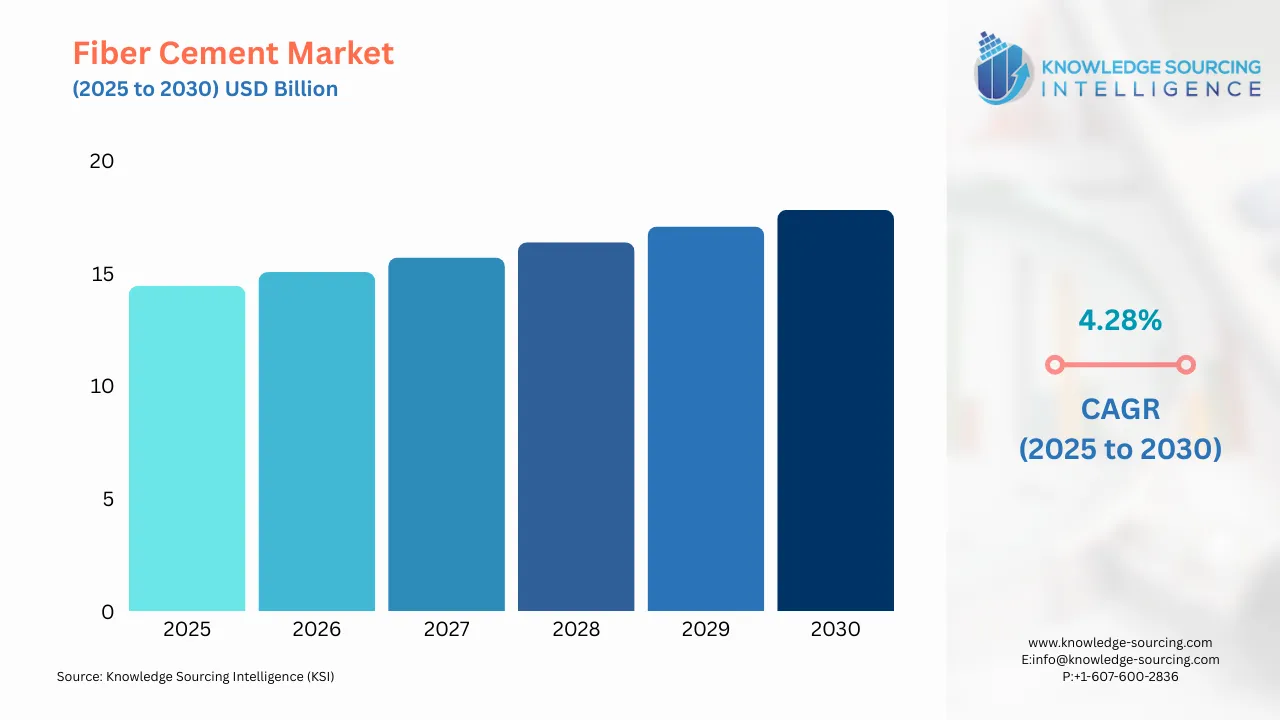

The fiber cement market is evaluated at US$14.437 billion in 2025, is projected to grow at a CAGR of 4.28% to reach US$17.807 billion in 2030.

Fiber cement is essentially a building material made up of cement integrated with cellulose fibers. The cement comes up with several benefits, including high resistance and fireproof properties. The rise in demand for fiber cement is attributed to the rising construction activities, strict government regulations, and demand for environmentally friendly products.

Fiber Cement Market Introduction:

The fiber cement market has emerged as a pivotal segment within the global construction industry, offering a versatile, durable, and sustainable alternative to traditional building materials. Fiber cement, a composite material primarily composed of cement, cellulose fibers, sand, and water, is widely utilized for its exceptional durability, fire resistance, and low maintenance requirements. Its applications span residential and non-residential construction, including siding, roofing, cladding, and interior solutions such as partition walls and tile backer boards. As the construction sector evolves to meet the demands of urbanization, environmental sustainability, and stringent regulatory frameworks, fiber cement has gained significant traction as a preferred material for modern building projects.

Fiber cement’s appeal lies in its ability to combine the strength and durability of cement with the flexibility and workability provided by cellulose fibers. It is resistant to fire, moisture, pests, and rot, making it an ideal choice for exterior and interior applications in diverse climatic conditions. The material is commonly used for siding, which dominates its application segment due to its cost-effectiveness and ability to withstand extreme weather conditions compared to alternatives like vinyl or wood. Other key applications include roofing (slats and corrugated sheets), cladding (flat sheets and planks), and interior uses such as partition walls, ceilings, and window sills. The versatility of fiber cement allows it to cater to both aesthetic and functional requirements, enhancing the longevity and value of buildings.

The global construction industry’s growth, particularly in rapidly urbanizing regions, has fueled demand for fiber cement. For instance, in the Asia-Pacific, countries like China and India are witnessing significant infrastructure investments. In 2023, China’s transport infrastructure investment was reported at USD 165.6 billion, underscoring the scale of construction activity driving demand for durable materials like fiber cement. Similarly, India’s housing sector is projected to see investments of approximately USD 1.3 trillion over the next seven years, with plans to construct 60 million new homes by 2030. These developments highlight the critical role of fiber cement in addressing the construction needs of emerging economies.

Fiber Cement Market Trends:

The fiber cement market is experiencing robust growth, primarily driven by the expanding construction industry worldwide. As developing nations undergo rapid urbanization and industrialization, demand for fiber cement products continues to rise. This trend is further supported by increasing global infrastructure investments, particularly in residential construction projects. However, the market faces significant challenges, including high manufacturing costs due to the complex production process, substantial maintenance expenses, and rising labor costs associated with the need for skilled workers to operate advanced technologies.

Geographically, the market spans North America, South America, Europe, the Middle East and Africa, and the Asia Pacific, with the Asia Pacific region expected to grow at the fastest pace. This exceptional growth is attributed to accelerating urbanization, a booming construction sector, heightened infrastructure investments, and growing awareness of fiber cement's benefits. Government initiatives promoting sustainable construction materials, such as India's 'Housing for All by 2024' program, along with the region's competitive advantages in raw material and labor costs, position the Asia Pacific as the most promising market for fiber cement expansion in the coming years.

Some of the major players covered in this report include James Hardie Industries PLC, Etex Group, Nichiha Corporation, CSR Limited, Gyproc, Everest Industries Limited, Swisspearl Group, Shera, and Ramco Industries, among others.

Fiber Cement Market Drivers:

Rapid Urbanization and Infrastructure Development

The global surge in urbanization is a primary driver of the fiber cement market, as it fuels demand for durable and versatile construction materials. With urban populations projected to reach 68% of the global total by 2050, according to the United Nations, the need for robust building solutions in densely populated areas is intensifying. Fiber cement’s strength, weather resistance, and adaptability make it ideal for high-rise buildings, residential complexes, and infrastructure projects such as bridges and public facilities. In the Asia-Pacific, rapid urban growth in countries like India and China has spurred significant construction activity. For instance, India’s infrastructure sector is witnessing substantial investments, with the government allocating USD 130 billion for infrastructure projects in 2024-2025, including roads, railways, and urban housing. This creates a robust demand for fiber cement products, particularly for siding and cladding applications in urban developments, as they offer longevity and low maintenance in high-density environments.

Growing Emphasis on Sustainable Construction Practices

Sustainability has become a cornerstone of modern construction, driven by environmental awareness and the need to reduce carbon footprints. Fiber cement is increasingly favored for its eco-friendly attributes, such as the use of recyclable cellulose fibers and its lower environmental impact compared to asbestos-based materials, which have been phased out in many regions due to health concerns. The World Green Building Council emphasizes the importance of materials that align with green building standards, noting that sustainable construction can reduce a building’s lifecycle emissions by up to 50%. Fiber cement’s durability reduces the need for frequent replacements, and innovations like Nuvoco Vistas’ Duraguard Microfiber Cement, launched in September 2023, highlight the industry’s focus on high-strength, eco-friendly formulations. Additionally, fiber cement’s recyclability and energy-efficient production processes align with global sustainability goals, making it a preferred choice for green-certified projects.

Stringent Fire Safety and Building Regulations

Governments worldwide are enforcing stricter building codes, particularly concerning fire safety, which significantly boosts the adoption of fiber cement. Its non-combustible nature makes it an ideal material for regions prone to wildfires or urban areas requiring enhanced safety standards. For example, in Australia, where bushfires pose a significant risk, fiber cement siding is widely used for its fire-resistant properties, as highlighted in a 2023 construction report. In the U.S., the National Fire Protection Association’s updated codes emphasize non-combustible materials for exterior applications, further driving fiber cement’s use in residential and commercial projects. Recent developments, such as James Hardie Industries’ introduction of fire-resistant fiber cement products in 2023, underscore the material’s alignment with regulatory demands, ensuring compliance while enhancing building safety.

Fiber Cement Market Restraints:

High Initial Costs and Installation Complexity

One of the primary restraints in the fiber cement market is the relatively high initial cost and installation complexity compared to alternatives like vinyl or wood. Fiber cement products require specialized tools and skilled labor for proper installation, which increases overall project costs. A 2023 survey by the National Association of Home Builders indicated that installation challenges deter approximately 20% of contractors from using fiber cement, citing the need for trained installers and higher labor expenses. For instance, cutting fiber cement panels generates silica dust, necessitating safety measures that add to labor costs. This restraint is particularly pronounced in cost-sensitive markets, where builders may opt for cheaper, less labor-intensive materials despite fiber cement’s long-term benefits.

Competition from Alternative Materials

The fiber cement market faces stiff competition from alternative materials such as vinyl, wood, and metal, which often offer lower upfront costs or easier installation. Vinyl siding, for example, is popular in budget-conscious markets due to its affordability and simpler installation process, despite being less durable. In 2023, a U.S. construction industry report noted that vinyl siding captured a significant share of the residential market due to its cost-effectiveness, posing a challenge to fiber cement adoption. Additionally, wood and engineered wood products appeal to consumers seeking natural aesthetics, further limiting fiber cement’s market penetration in certain regions. This competition requires manufacturers to innovate and differentiate their products to highlight fiber cement’s superior durability and sustainability.

Fiber Cement Market Segment Analysis:

By product type, the Fiber Cement Siding segment is gaining traction

Fiber cement siding dominates the product type segment due to its widespread use in exterior applications, offering a combination of durability, aesthetic versatility, and low maintenance. It is favored for its ability to withstand extreme weather conditions, including heavy rain, high winds, and UV exposure, making it a preferred choice over alternatives like vinyl or wood. Siding is used in residential, commercial, and industrial buildings, with applications ranging from single-family homes to large-scale infrastructure projects. Its popularity is driven by its fire resistance, pest resistance, and ability to mimic the appearance of traditional materials like wood or stone, enhancing both functionality and curb appeal. In the U.S., fiber cement siding has gained significant traction, with a 2023 construction report highlighting its use in over 25% of new residential projects due to its longevity and compliance with stringent building codes. Innovations, such as James Hardie Industries’ partnership with Magnolia Home in August 2022 to launch an exclusive line of aesthetically versatile fiber cement siding, further underscore its market dominance. The segment’s growth is also supported by increasing demand in emerging markets, where urbanization drives the need for durable exterior solutions.

By Installation Type, Residential Construction is expected to lead the market growth

Residential construction represents the largest installation type segment for fiber cement, driven by global housing demand, particularly in urbanizing regions. Fiber cement is extensively used in residential projects for siding, roofing, and cladding due to its durability, cost-effectiveness over time, and alignment with aesthetic and safety requirements. The global push for affordable housing, coupled with rising consumer preference for low-maintenance materials, has solidified fiber cement’s role in this segment. In India, for instance, the government’s plan to construct 60 million new homes by 2030 is boosting demand for fiber cement products in residential developments. Similarly, in the U.S., the National Association of Home Builders reported in 2023 that fiber cement is increasingly adopted in single-family homes for its ability to meet fire safety and environmental standards. The segment benefits from fiber cement’s versatility, allowing homeowners to achieve diverse architectural styles while ensuring long-term resilience, making it a cornerstone of modern residential construction.

Fiber Cement Market Geographical Outlook:

Asia-Pacific is experiencing rapid market growth

The Asia-Pacific region is the largest and fastest-growing market for fiber cement, propelled by rapid urbanization, infrastructure development, and increasing construction investments in countries like China, India, and Indonesia. The region’s dominance is attributed to its large population base, rising urban housing needs, and government-led initiatives for sustainable construction. China, for example, invested USD 165.6 billion in transport infrastructure in 2023, creating significant demand for durable materials like fiber cement for both residential and commercial projects. In India, Visaka Industries’ USD 15.1 million investment in a new fiber cement board plant in West Bengal in August 2022 reflects the region’s focus on expanding production capacity to meet growing demand. The region also benefits from favorable regulatory frameworks promoting eco-friendly materials, with fiber cement aligning with green building standards in countries like Japan and South Korea. Asia-Pacific’s robust construction activity, coupled with increasing awareness of fiber cement’s benefits, positions it as the leading regional market.

Fiber Cement Market Key Developments:

January 2025: Nuvoco Vistas Corp Ltd. introduced Duraguard Microfiber Cement, a patented Portland Pozzolana Cement (PPC) variant enhanced with microfibers, in Western Uttar Pradesh. This product improves crack resistance and durability, catering to the region’s growing demand for high-performance, eco-friendly construction materials. The launch, supported by a Haryana-based production facility, strengthens Nuvoco’s market presence in India by ensuring faster supply and addressing the needs of sustainable residential and commercial construction.

March 2024: Everest Industries revealed plans to establish a new manufacturing facility in Chamarajanagar, Karnataka, with an investment of INR 187 crore. The plant, with a capacity of 72,000 metric tons, focuses on producing fiber cement boards and panels to meet the rising demand for eco-friendly construction materials in India. This development aligns with the country’s sustainable construction trends and government initiatives like the Smart Cities Mission, enhancing Everest’s production capabilities.

February 2024: James Hardie Industries introduced an upgraded line of Hardie® Panels with enhanced texture options for fiber cement siding, aimed at improving aesthetic flexibility for residential and commercial applications. The launch emphasizes durability and design versatility, catering to architects and builders seeking sustainable, low-maintenance solutions. This product enhancement strengthens James Hardie’s leadership in the siding segment, particularly in North America.

Fiber Cement Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 14.437 billion |

| Total Market Size in 2030 | USD 17.807 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Companies |

|

Fiber Cement Market Segmentation:

Fiber Cement Market Segmentation by Product Type

The market is analyzed by product type as follows:

Fiber Cement Siding

Fiber Cement Boards

Fiber Cement Roofing

Fiber Cement Panels

Others

Fiber Cement Market Segmentation by Installation Type

The market is segmented by installation type:

Residential Construction

Commercial Construction

Industrial Construction

Fiber Cement Market Segmentation by end-use sector

The report analyzes the market by end-user:

Residential

Commercial

Industrial

Fiber Cement Market Segmentation by regions:

The study also analysed the fiber cement market into the following regions, with country level forecasts and analysis as below:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, Italy, and Others

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)