Report Overview

Filter Capacitor Market - Highlights

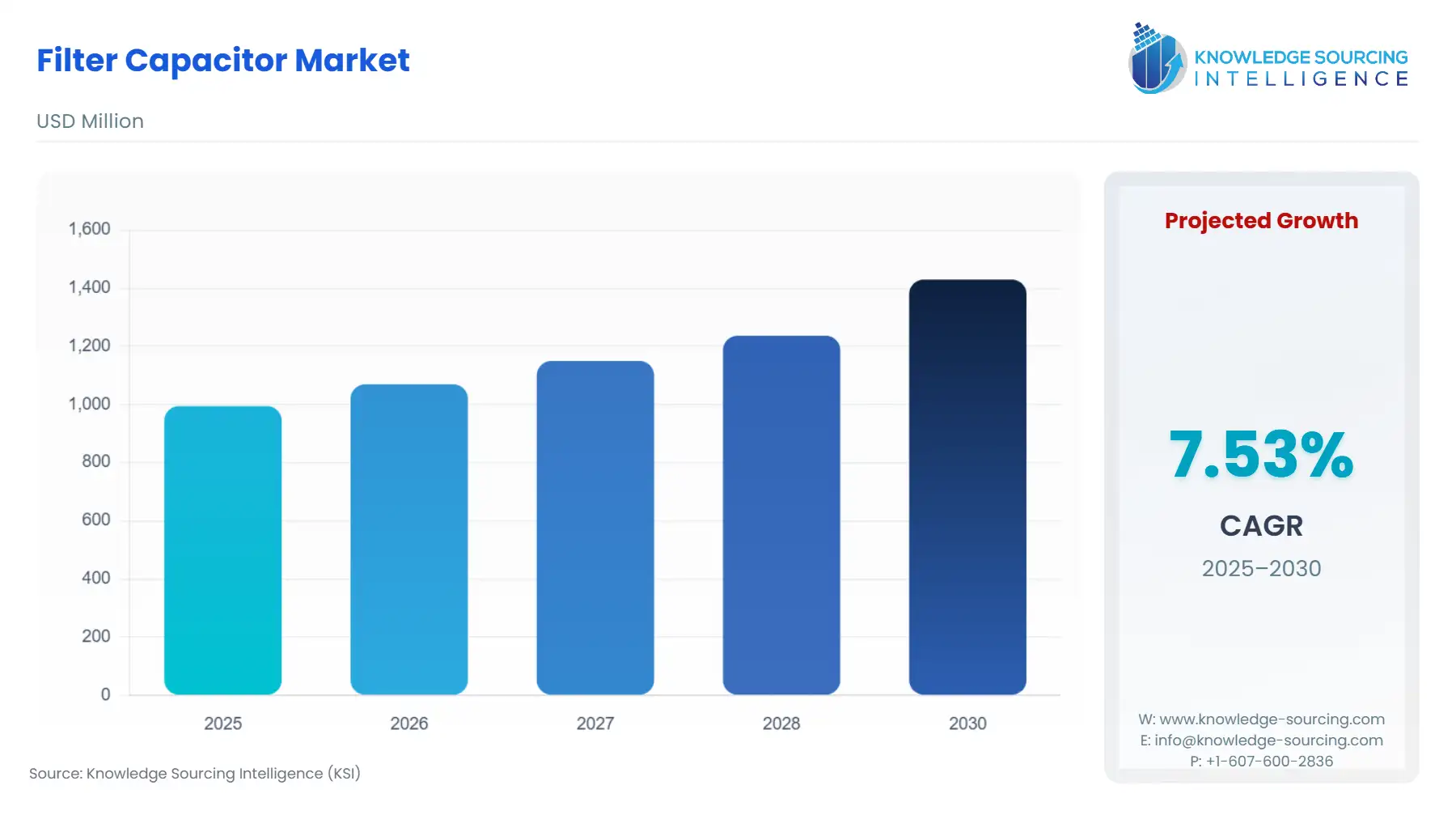

Filter Capacitor Market Size:

Filter Capacitor Market, with a 7.3% CAGR, is projected to grow from USD 994.583 million in 2025 to USD 1518.235 million in 2031.

Filter Capacitor Market Trends:

A filter capacitor is an electronic component connected in parallel to a power supply or signal source used in electrical circuits to filter out unwanted fluctuations in voltage or current. The filter capacitors include electrolytic capacitors, tantalum capacitors, film capacitors, and ceramic capacitors, which find applicability in the power & energy and electrical & electronics sectors to ensure stable and clean power supply for efficient operation of devices and systems. The surge in electronic device production and the rise in demand for electricity will bolster the demand for filter capacitors, ensuring their market growth.

Filter Capacitor Market Growth Drivers:

The increased production of electronic devices is propelling the filter capacitors market growth.

Filter capacitors play a vital role in consumer electronic devices like laptops, smartphones, televisions, and other home appliances by ensuring a stable and reliable power supply, minimizing electrical noise, and protecting sensitive electronic components. They are commonly used in power supplies, voltage regulators, and DC-DC converters within these devices to smooth out the incoming power, reducing voltage ripples and noise that could disrupt or damage the circuitry. The increase in the production of electrical & electronic devices due to a surge in consumer demand coupled with the launches of smart home devices is expected to accelerate the demand for filter capacitors. According to the National Investment Promotion & Facilitation Agency, in 2022, the domestic production of electronic items in India had increased from 3,17,331 crore (USD 49 billion) in 2016-17 to 6,40,810 crore (USD 87.1 billion) in 2021-22. In 2022, Eve company launched a security camera for smart homes called "Eve Outdoor Cam," which was designed for "Apple HomeKit Secure Video" which had features like 1080p video, a 157-degree field of view, infrared night vision, and infrared motion detection covering 100 degrees at distances of up to 30 feet.

The rise in electricity demand across various sectors is expected to accelerate market growth.

The electricity demand is increasing across various sectors like construction, industrial, etc., and power generation and distribution systems need to operate efficiently and reliably to meet this growing demand. Filter capacitors play a crucial role in power generation plants, substations, and electrical grids by reducing electrical noise, smoothing out voltage fluctuations, and improving power quality. They help to maintain a stable and consistent power supply, ensuring uninterrupted operations and preventing damage to sensitive equipment. Furthermore, the increasing deployment of renewable energy sources, such as solar and wind, adds complexity to the power generation mix. These energy sources often generate power with variable and intermittent characteristics. Filter capacitors are used in power conversion and conditioning systems to smooth out fluctuations and ensure a steady electricity supply. The increase in demand for electricity by end-users, coupled with investments to improve and develop power grids, will boost the demand for filter capacitors. According to the International Energy Agency (IEA) report in 2022, the global electricity demand is expected to grow from 5 900 terawatt-hours (TWh) in 2021 to over 7 000 TWh in 2030. In 2022, Biden-Harris Administration announced an investment of $10.5 billion to enhance the resilience and reliability of America’s electric grid.

Filter Capacitor Market Geographical Outlook:

The Asia-Pacific region is expected to hold a significant market share during the forecast period.

The Asia-Pacific region is anticipated to hold a major share due to the large consumer base of consumer electronics, the rapidly growing energy sector, and the region being a hub for electronics manufacturing. In 2022, the State Grid Corporation of China announced that it would invest over CNY150bn ($22bn) in the second half of 2022 to execute a new batch of ultra-high voltage (UHV) power transmission projects across China. In 2021, in the second round of the production-linked incentives (PLI) scheme for electronics manufacturing by the Indian government, it was mentioned that the companies would get incentives up to 3-5% based on sales of electronics manufacturing in India, and was expected to generate a total production of up to INR 12,432 crore. These positive developments will propel the demand for filter capacitors, thereby increasing their regional market growth.

List of Top Filter Capacitor Companies:

Alcon Electronics Private Limited

ASC Capacitors

Cornell Dubilier Electronics Inc.

Electro Technik Industries, Inc

KEMET Corporation (Yageo Corporation)

Filter Capacitor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Filter Capacitor Market Size in 2025 | USD 994.583 million |

Filter Capacitor Market Size in 2030 | USD 1,429.979 million |

Growth Rate | CAGR of 7.53% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Filter Capacitor Market |

|

Customization Scope | Free report customization with purchase |

Segmentation:

By Type

Tantalum Capacitor

Film Capacitor

Ceramic Capacitor

Electrolytic

Others

By Application

Power Supply

Signal Processing

Motor Control Circuits

Others

By End-User

Electrical & Electronics

Power & Energy

IT & Telecommunication

Automotive

Aerospace

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others