Report Overview

Food Grade Dextrose Market Highlights

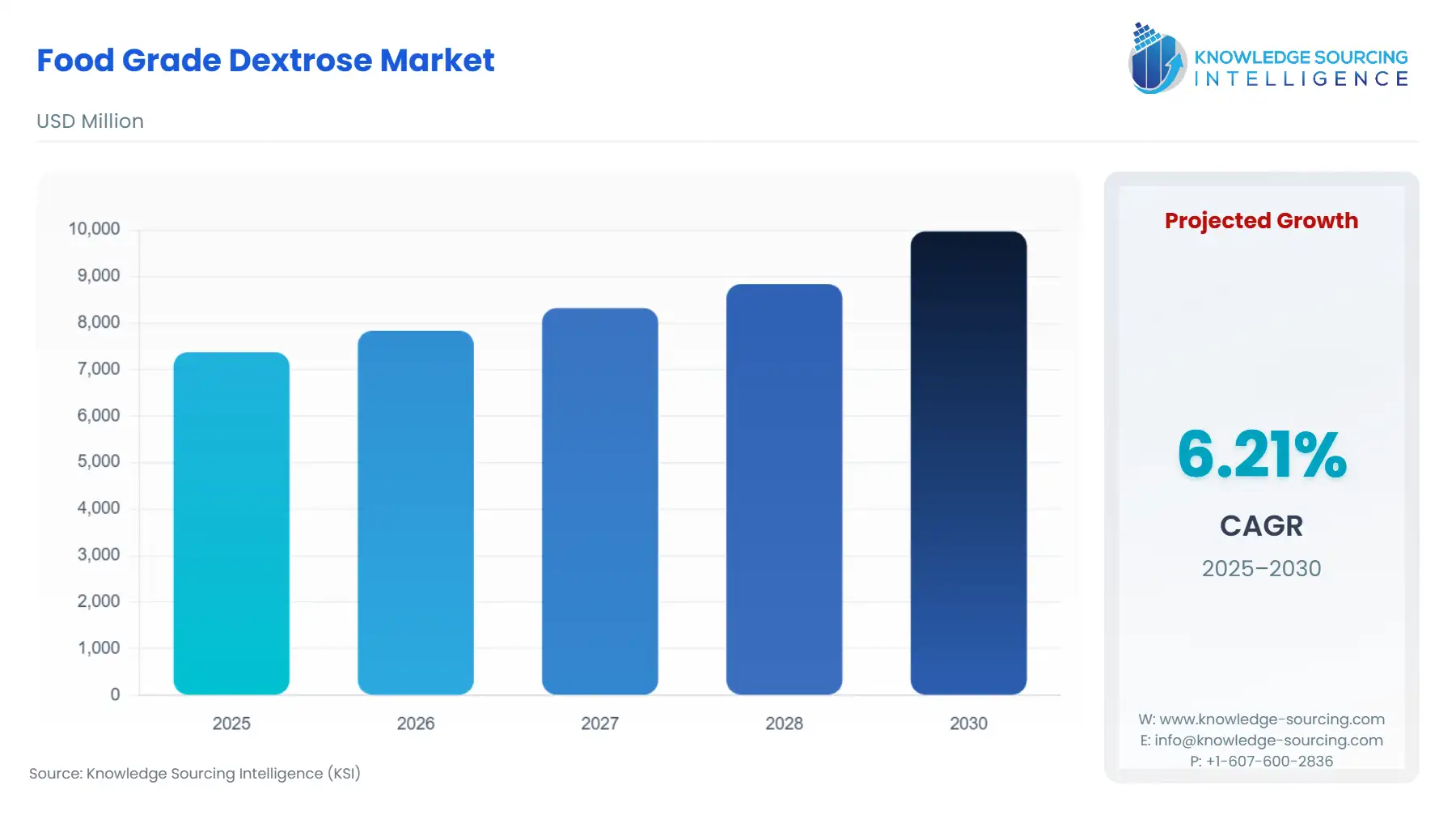

Food Grade Dextrose Market Size:

The food grade dextrose market is expected to grow at a CAGR of 6.22%, reaching a market size of US$9.973 billion in 2030 from US$7.378 billion in 2025.

Dextrose is known to be a simple form of sugar that is commonly produced from corn or wheat. It has a similar chemical identity to that of glucose, or blood sugar. The various applications of dextrose include sweeteners in baking products and processed food products, and it also has medical applications.

Food Grade Dextrose Market Trends:

The global food-grade dextrose market is expected to witness a significant increase in growth during the forecasted period of 2024-2029, due to factors such as the increasing awareness of the benefits of dextrose, coupled with the increasing popularity of convenience and processed food products.

Food Grade Dextrose Market Growth Drivers:

- Growing awareness of the benefits: Dextrose is known to have a wide range of applications in the market, due to its various benefits. The different applications of dextrose include medicine, sports supplements, bakery and confectionery, processed and convenience food products, and many others. Some of the well-known medicinal applications include products such as Merative and Micromedex, which are Dextrose solutions in the form of injections. The Amino acids in the dextrose injection are commonly used as a dietary supplement for those patients who are unable to get the required protein and calories for their diet, which can be due to certain illnesses or recent surgeries. It is also known to be used to treat negative nitrogen balance in the blood.

Another application of dextrose in the market is in food and beverage products. One of the largest dextrose providers in the market is the Cargill, Incorporated. Their dextrose product is used as a sweetener product and is often referred to as grape sugar or blood sugar. The functional benefits of dextrose as a sweetener include the reduction of sugar, Maillard reaction, coming in crystal form, helping in sweetness control, the heat of solution, improved solubility, freezing point, osmotic pressure, improved fermentability, enhanced flavour, improved stability, and a bulking agent. Furthermore, the nutritional benefits of dextrose include energy management and the enhancement of the mental performance and well-being of people, with a wide range of applications in food and beverage products such as alcoholic beverages, bakery products, confectioneries, convenience foods, dairy and ice cream products, and food ingredients. Therefore, the increasing awareness of such benefits and the increasing consumption of dextrose-related products will drive the global food-grade dextrose market growth during the forecasted period.

- Growing popularity of convenience products: Dextrose is known to be one of the major components in various convenience and processed food products in the market. The growth of global convenience and processed food products will drive the dextrose market growth in the upcoming years. Ready meals are one kind of convenience food product, due to its ease of access and low time requirement for preparation. It is a well-known product in urban areas since the urban population is known for being busy throughout their days without being able to enjoy extended free time, leading to an increase in demand for convenience food products in the market. Dextrose is known to be used as a sweetener in the convenience food market, acting as a growth driver for the global food-grade dextrose market during the forecasted period.

As per the Agriculture and Horticulture Development Board, convenience foods have shown a strong upward trend in the market, with the popular meals being pizzas and ready meals. It has been stated that 11.5% of the meals require little to no preparation time, allowing the consumers to consume the food product without wasting any extra time. Additionally, the Big 4 retailers have displayed an increase in volume growth of 2.5% over the last year (2021-22). Therefore, the increase in demand for convenience food products such as ready meals will provide the necessary growth for the global food-grade dextrose market during the forecasted period.

Food Grade Dextrose Market Key Players:

- Cargill, Incorporated: An American food company known for providing products and services in various industries, which include food, finance, agriculture, industrial, and risk management fields. They are known to provide dextrose in the form of monohydrate and anhydrous in a variety of particle size distributions and granulometry.

- Roquette Frères: A global company known for being one of the leaders in starch production and also providing a wide range of plant-based ingredients worldwide. They are also known for providing a variety of dextrose products, which include the monohydrate form.

Food Grade Dextrose Market Geographical Outlook:

The Asia Pacific region is expected to witness significant growth in the food-grade dextrose market during the forecasted period. The factors that affect the market growth in the region are the growing processed food industry, coupled with the increasing disposable incomes of individuals. Food-grade dextrose is known for being used as a sweetening agent in several food products, which include confectionery products, processed foods, and many other ready-to-eat food products. Due to its properties of natural sweetening, natural flavours would have a higher preference over artificial flavouring by consumers in the market, increasing the demand for dextrose during the forecasted period. For instance, as per Invest India, the Indian Food processing industry is expected to display an increase in growth to reach an estimated $535 billion by 2025 with a CAGR of 15.2%. Furthermore, Indian consumer spending is also expected to increase to reach an estimated $6 trillion by 2030.

The increase in the growth of consumer spending can be linked to the increasing disposable incomes of individuals in the country, leading to an increase in the amount of spending by individuals on various products. This includes processed and convenience foods, further providing the necessary boost for the growth of natural sweetener agents such as dextrose. As per the Ministry of Statistics and Programme Implementation, the Gross National Disposable Income (GNDI) accounted for an increase from ?201.15 lakh crore in 2020-21 to an estimated ?236.07 lakh crore in 2021-22, accounting for a growth rate of 17.4% in 2021-22 when compared to the contraction of 1.6% in 2020-21.

This increase in growth of the gross national disposable income is linked to an increase in consumer spending power, leading to an increase in consumption and sales of processed and convenience foods in the market, further driving the region's food-grade dextrose market growth during the forecasted period.

Food Grade Dextrose Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Food Grade Dextrose Market Size in 2025 | US$7.378 billion |

| Food Grade Dextrose Market Size in 2030 | US$9.973 billion |

| Growth Rate | CAGR of 6.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Food Grade Dextrose Market |

|

| Customization Scope | Free report customization with purchase |

Food Grade Dextrose Market Segmentation:

- By Type:

- Dextrose Monohydrate

- Dextrose Anhydrous

- By Form:

- Solid

- Liquid

- By Application:

- Bakery and Confectionary

- Dairy Products

- Beverages

- Sports Nutrition

- Others

- By Geography:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America