Report Overview

France Additive Manufacturing Market Highlights

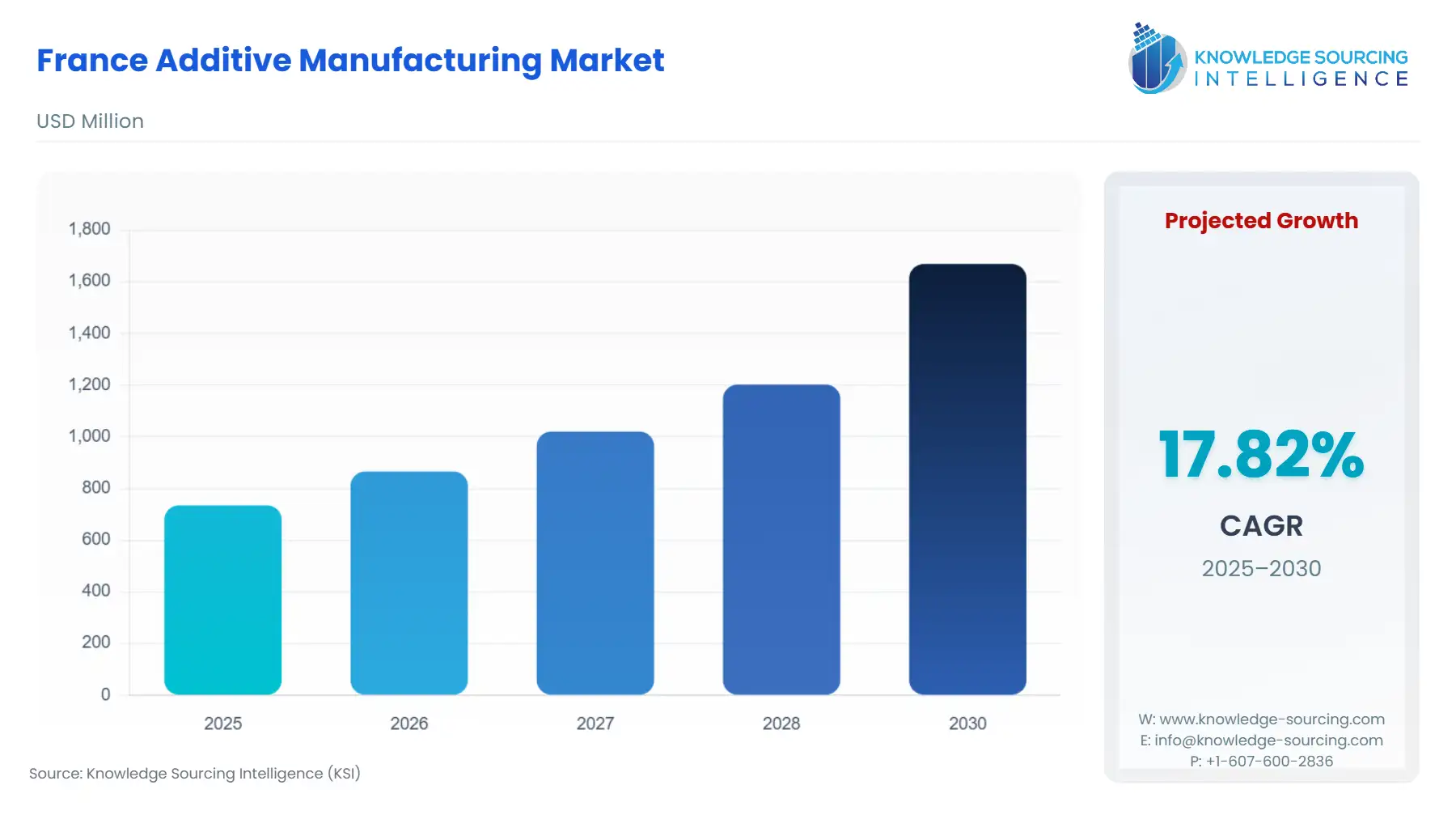

France Additive Manufacturing Market Size:

The France Additive Manufacturing Market is projected to expand at a CAGR of 17.82%, attaining USD 1.669 billion in 2030 from USD 0.735 billion in 2025.

The French Additive Manufacturing (AM) market is transitioning from a predominantly prototyping-focused environment toward an industrial production paradigm, fundamentally reshaping the country’s manufacturing sector. This shift is deeply rooted in the strong French industrial base, particularly in the high-value sectors of aerospace, defense, and healthcare. The market's evolution is heavily influenced by national strategic investment programs designed to accelerate the adoption of Industry 4.0 technologies. As firms seek greater design complexity and supply chain resilience, the demand for AM hardware, software, and specialized services has become a strategic imperative rather than a simple operational upgrade.

France Additive Manufacturing Market Analysis:

- Growth Drivers

The aerospace and defense sector's stringent requirements for low part weight and enhanced performance act as a critical growth catalyst for the French AM market. Large French original equipment manufacturers (OEMs) mandate the use of AM technologies like Selective Laser Melting (SLM) for parts such as fuel nozzles and structural components. This directly increases demand for industrial-grade metal AM systems and high-specification metal powders (e.g., titanium alloys) to achieve component weight reductions of up to 15%, which subsequently lowers fuel consumption and operational costs. Furthermore, the push for product customization in the medical and dental fields, particularly for hearing aids and dental prosthetics, drives direct demand for Stereolithography (SLA) and Digital Light Processing (DLP) technologies and specialized photopolymer resins.

- Challenges and Opportunities

A primary challenge constraining widespread adoption and limiting growth is the high initial capital investment required for industrial AM hardware, along with the associated costs for specialized post-processing and certification. This financial barrier limits rapid AM integration among the numerous small and medium-sized enterprises (SMEs) that form the backbone of French manufacturing. Conversely, significant opportunity exists in the shift towards on-demand manufacturing services. Companies offering outsourced AM services and digital manufacturing expertise directly capture demand from firms hesitant to commit to high capital expenditure, accelerating AM adoption without the full financial risk to the end-user. The increasing maturity of the supply chain for thermoplastics and polymer powders also presents an opportunity, reducing material cost volatility and stabilizing production expenses, which in turn stimulates greater demand for polymer-based AM systems like Selective Laser Sintering (SLS).

- Raw Material and Pricing Analysis

Additive Manufacturing involves physical hardware and materials. The pricing and supply chain of key materials significantly influence downstream AM requirements. Plastics, including polymers and resins, constitute the majority (88%) of raw materials used in the French AM sector. While plastics are relatively accessible, metal powders—which are necessary for the high-value aerospace and automotive segments—face a more complex supply chain. The cost and certification of high-performance metal powders (e.g., titanium and nickel-based superalloys) remain a considerable factor in the final part cost, leading to elevated prices for AM-produced end-use parts. This cost structure limits metal AM demand primarily to mission-critical, low-volume applications where the performance benefits decisively outweigh the cost premium.

- Supply Chain Analysis

The French AM supply chain exhibits a strategic dependency on global sourcing for industrial-grade AM hardware, with US and German firms holding dominant market shares. French companies largely focus on high-value segments, including software development, specialized material production (e.g., Sartomer Arkema for polymers), and application-specific AM services. The supply chain for materials is concentrated, with French firms like Arkema and Exceltec playing niche roles in thermoplastic powder production for SLS. Logistical complexities primarily revolve around the specialized handling, safety, and inventory management of reactive metal powders. The domestic presence of R&D centers, clusters, and specialized labs (e.g., Additive Factory Hub initiative) is critical, as these entities serve as production hubs for advanced prototyping and functional component development, reducing time-to-market for domestic OEMs.

Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

France |

France 2030 Investment Program / General Secretariat for Investment (SGPI) |

Provides direct financial subsidies and grants for AM R&D and industrialization projects, specifically boosting demand for metal AM (e.g., Metal Binder Jetting) technology in the aerospace sector. |

|

Europe |

European Union Aviation Safety Agency (EASA) Certification |

Creates a high barrier to entry by requiring complex, lengthy certification processes for flight-critical AM parts, constraining demand to non-critical and cabin parts until broader certification standards are adopted. |

|

France |

French Industrial Property Office (INPI) & Existing IP Laws |

Existing liability and Intellectual Property (IP) laws are deemed sufficient to address AM issues like copyright infringement and product liability, providing a predictable (stable) legal framework that facilitates business investment in the sector. |

France Additive Manufacturing Market Segment Analysis:

- By Technology: Selective Laser Sintering (SLS)

The Selective Laser Sintering (SLS) technology segment in France is driven by its capacity for producing highly complex, durable polymer parts without the need for support structures, allowing for greater design freedom and material utilization efficiency. The technology's ability to efficiently produce small-to-medium batches of end-use parts, tooling, and jigs directly caters to the automotive and industrial machinery sectors' demand for production flexibility and low-volume customized components. Furthermore, the strong domestic French material science capabilities, notably in thermoplastic powder production, ensure a stable and innovative material supply chain, which subsequently supports and catalyzes higher demand for compatible SLS systems and services from local manufacturers seeking reliable domestic sources.

- By End-User Industry: Aerospace & Defense

The Aerospace & Defense industry in France is a dominant source of growth for the AM market, driven by the critical need for weight reduction and simplified assembly. Major French aerospace OEMs leverage AM to consolidate multiple complex parts into single, lightweight components, directly reducing assembly time and inventory costs. These structural imperatives drive high demand for specialized, industrial-grade metal AM systems (SLM, EBM) and certified metal powders. The focus extends beyond prototyping to serial production of high-performance parts, such as engine components and structural brackets. Government initiatives, exemplified by the "France 2030" program supporting technologies like Metal Binder Jetting for aerospace, further institutionalize this demand, ensuring continued high-level investment and adoption.

France Additive Manufacturing Market Competitive Analysis:

The French AM competitive landscape is characterized by a mix of powerful global software providers and highly specialized domestic hardware and service firms. Competition centers on integrated platform solutions, material-specific expertise, and rapid service delivery.

- Dassault Systèmes: The company's strategic positioning leverages its core strength in sophisticated Product Lifecycle Management (PLM) and Computer-Aided Design (CAD) software. Through its 3DEXPERIENCE platform, Dassault Systèmes positions itself as the digital backbone for the entire AM workflow, from design simulation (CATIA, SIMULIA) to manufacturing operations. This approach directly captures demand for an integrated, virtual twin environment, crucial for aerospace and automotive clients to simulate and certify AM parts prior to physical production. The platform's ability to manage complex Bills of Material (BOM) for additive and subtractive processes ensures its software remains an indispensable element for major manufacturers industrializing AM.

- Prodways Group: As the largest French 3D printer manufacturer, Prodways focuses on developing and commercializing proprietary AM processes, notably the MOVINGLight® technology for high-speed, high-precision polymer and ceramic applications. The company’s strategy centers on process speed and material versatility, directly appealing to industrial customers in sectors like audiology and ceramics that require both precision and high throughput. By vertically integrating hardware and materials, Prodways mitigates supply chain risk and captures specialized industrial demand, evidenced by recent sales of its ceramic models to major aerospace firms.

France Additive Manufacturing Market Developments:

- September 2025: The French multinational software corporation Dassault Systèmes, whose platforms like CATIA are critical for AM design and simulation, continually rolls out major updates to its 3DEXPERIENCE Platform, including the R2025x release. These updates focus heavily on integrating advanced simulation tools, generative design capabilities, and seamless workflows for additive manufacturing. These new features allow French aerospace and automotive companies, key users of the platform, to optimize complex parts for metal and polymer AM, enhancing design-to-manufacture efficiency within the local industrial ecosystem.

- March 2025: Prodways Group, a major French industrial 3D printing player, unveiled its DENTAL PRO Automated Line, a key industrialization solution for dental laboratories. This automated workflow builds on the company's MOVINGLight® DLP technology, integrating an automated loader and job management system. The line is designed for high-throughput, continuous production, capable of efficiently printing a large volume of aligner models and other dental applications. This product launch directly targets the rapidly expanding digital dentistry market in France and Europe, promising increased productivity and minimized human intervention for dental lab scale-up.

France Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.735 billion |

| Total Market Size in 2031 | USD 1.669 billion |

| Growth Rate | 17.82% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-User |

| Companies |

|

France Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modeling

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others