Report Overview

France Advanced Battery Market Highlights

France Advanced Battery Market Size:

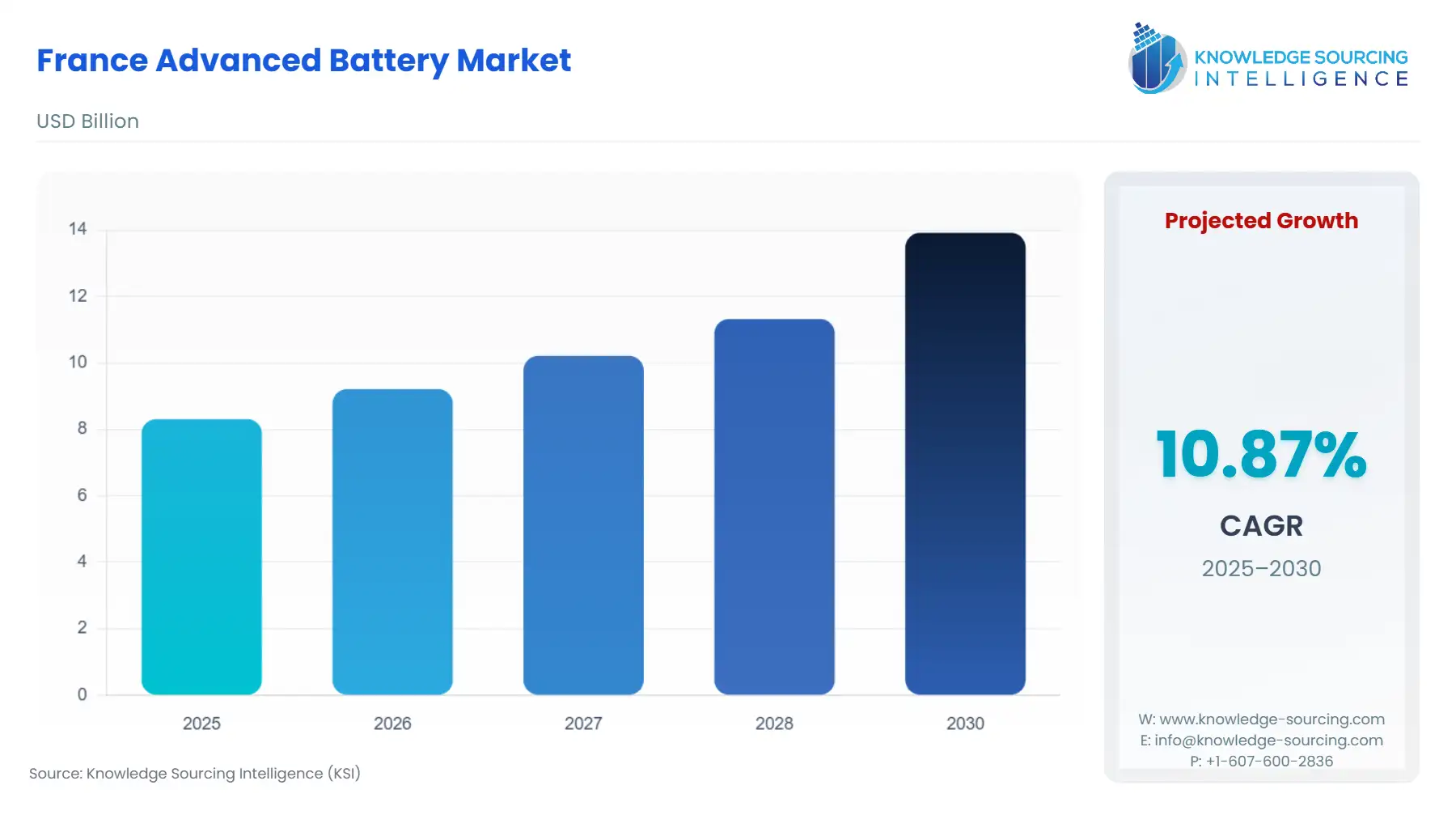

The France Advanced Battery Market is expected to grow at a CAGR of 10.87%, attaining USD 13.92 billion in 2030 from USD 8.31 billion in 2025.

France's advanced battery market stands at a pivotal juncture, propelled by the nation's aggressive pivot toward electrification amid broader European decarbonization mandates. As the second-largest automotive hub in the EU, France registered over 2 million rechargeable vehicles by late 2024, underscoring batteries' role in bridging intermittent renewables with reliable mobility. This surge reflects not just policy imperatives but a tangible shift in consumer behavior, where falling battery costs—down nearly 30% in 2024—make electric options viable for urban fleets and households alike. Yet, beneath this momentum lies a web of supply vulnerabilities and technological imperatives that demand strategic navigation to sustain growth.

The market's trajectory hinges on lithium-ion dominance, which powered 70% of new electric car sales in 2024, while emerging chemistries like sodium-ion tease pathways to raw material independence. Government-backed gigafactories, such as those in Douai and Dunkirk, signal France's bid to capture 20% of EU battery production by 2030, but execution risks loom large.

France Advanced Battery Market Analysis

Growth Drivers

France's advanced battery market expansion traces directly to surging electric vehicle uptake, which in 2024 accounted for 16.9% of new passenger car registrations—291,143 units—up marginally from 2023 but signalling stabilised demand amid subsidy adjustments. This automotive pull escalates need for high-capacity lithium-ion packs exceeding 200 Ah, as manufacturers like Renault integrate them into models such as the ECHO 5 electric city car. Each vehicle requires 50-70 kWh of storage, translating to an incremental 15-20 GWh annual demand tied to fleet electrification targets of 1.5 million EVs by 2025. Policy anchors this: the French Ecological Transition Ministry's incentives, including tax credits up to €5,000 per vehicle, directly channel consumer spending toward battery-equipped transport, outpacing hybrid alternatives.

Renewable integration further catalyzes uptake, with battery energy storage systems (BESS) addressing grid volatility from wind and solar, which supplied 25% of France's electricity in 2024. Utility-scale deployments, like those in Corsica Sole's 50 MW projects, rely on flow and lithium-ion batteries to store excess generation, curbing curtailment rates that reached 5-15% in high-penetration regions. This necessity spikes medium-capacity (50-200 Ah) demand for stationary applications, as operators procure modular units to balance peak loads—projected to add 10 GW of storage by 2030 per RTE grid operator forecasts. Declining raw material costs amplify accessibility: lithium's 80% price drop to under $15,000 per tonne in 2024 trims pack expenses by 25%, enabling commercial adopters to justify upfront investments through 20-30% lifetime savings on energy arbitrage.

Technological maturation in solid-state prototypes rounds out drivers, with French consortia like the European Battery Alliance piloting cells offering 50% higher energy density than incumbent lithium-ion. These advancements target aerospace and defense end-users, where weight reductions directly cut fuel needs by 10-15% in hybrid propulsion, fostering niche demand for low-capacity (<50 Ah) variants in unmanned systems.

Challenges and Opportunities

Supply chain bottlenecks constrain market confidence, as France imports 85% of cathode materials like nickel and cobalt, exposing the market to Asia-centric disruptions—evident in 2024's 10% lithium surplus that flooded ports yet delayed gigafactory ramps due to quality variances. Geopolitical tensions, including DRC export curbs on cobalt, inflated spot prices by 20% mid-year, forcing OEMs to stockpile and defer 5-10% of planned EV rollouts. This volatility dampens industrial adoption, where motive power applications hesitate on uncertain lead times, potentially stalling 15% of projected growth in commercial fleets.

Recycling infrastructure lags compound hurdles; despite EU mandates for 85% lead recovery by 2027, France processed only 30,000 tonnes of battery waste in 2024 against 600,000 tonnes targeted, limiting second-life availability and inflating virgin material costs by 10-15%. Workforce gaps exacerbate this: the sector requires 800,000 skilled roles by 2025 per the EU Pact for Skills, yet France faces a 20% shortfall in electrochemists, slowing R&D velocity and innovation diffusion.

Opportunities counterbalance these headwinds through circular economy pivots. The EU Battery Regulation's due diligence clauses from 2025 compel 12% lithium recycling by 2035, spurring demand for remanufactured packs in residential storage—where repurposed units cut costs 40% and extend grid stability. France's "Battery Valley" in Hauts-de-France, anchored by six gigafactories, positions the nation to localize 20% of EU cathode production, directly boosting OEM procurement by reducing import duties and transit risks. Sodium-ion breakthroughs, led by domestic pilots, offer a cobalt-free alternative, potentially capturing 10% of low-voltage applications by 2027 and diversifying demand away from price-volatile lithium.

Raw Material and Pricing Analysis

Lithium dominates pricing dynamics, with 2024 spot carbonate prices averaging $12,000 per tonne—an 85% retreat from 2022 highs—stemming from 10% global oversupply as Australian and South American mines ramped 30% output. This deflation eases pack assembly costs in France, where importers like Eramet secure long-term contracts at $10,000-14,000 per tonne, enabling 20% cheaper medium-capacity cells for automotive use. However, supply concentration in China (75% refining) heightens vulnerability; a 5% export levy could rebound prices 15-20%, squeezing margins for gigafactories like Verkor's Dunkirk site, which targets 50 GWh annual output.

Nickel sulfate, critical for NMC cathodes, traded at $6,500 per tonne in 2024, reduced by 15% year-over-year amid Indonesian oversupply flooding Europe via 20% tariff-free quotas. French processors like Umicore in Belgium face 10% higher logistics from Rotterdam hubs, yet this stability supports steady demand in high-nickel packs for Renault's extended-range EVs. Cobalt hydroxide, at $13,000 per tonne, saw 20% volatility from DRC production surges (up 127% at CMOC), but EU traceability rules from 2025 favor premium recycled streams, potentially lifting prices 10% while curbing 30% import dependency.

Supply chains hinge on Asian hubs: China refines 90% of graphite anodes, Indonesia 86% of nickel, and DRC 70% of cobalt, creating bottlenecks for France's 24 billion euro battery output. Logistical strains, including Red Sea rerouting adding 10-15% transit costs, delay 20% of shipments to northern ports like Dunkerque.

Supply Chain Analysis

France's battery supply chain integrates global upstream extraction with nascent European midstream assembly, yet dependencies persist. Key production hubs cluster in Asia: China's 75% share of cathode active materials funnels via Shanghai ports to France's gigafactories, while Indonesia's nickel mines supply 86% of sulfate intermediates through Rotterdam, incurring 12-15 day delays. Upstream, Australian spodumene mines feed 60% of lithium refining in Qinghai, exposing flows to 20% tariff risks under EU carbon border adjustments.

Logistical complexities arise from multimodal routes: 70% of cobalt arrives via Antwerp-DRC shipping, vulnerable to 10% annual disruptions from port congestion, as seen in 2024's 5% delay spike. France mitigates via localized recycling—targeting 70% collection rates—but imports 80% of black mass processing tech from Korea, hindering circularity. Dependencies on single suppliers, like CMOC for 50% of cobalt, amplify price swings, yet opportunities in EU alliances promise 20% domestic refining by 2027.

France Advanced Battery Market Government Regulations:

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union (applicable to France) | EU Battery Regulation (EU) 2023/1542 / European Commission | Mandates 6% recycled lithium content by 2031, directly boosting demand for secondary materials in automotive packs by 15-20% as OEMs like Renault integrate traceable cells, reducing virgin imports by 10% while elevating compliance costs 5-8% for non-EU suppliers. |

France | Extended Producer Responsibility (EPR) Decree / Ministry of Ecological Transition | Requires full lifecycle financing from August 2025, spurring 600,000-tonne waste processing and second-life demand in energy storage, where repurposed units capture 10% of residential market share through 40% cost savings. |

European Union (applicable to France) | Critical Raw Materials Act (2024) / European Commission | Targets 10% domestic extraction and 40% processing by 2030, incentivizing French mining ventures like Imerys' lithium projects to supply 20% local cathodes, stabilizing prices and lifting gigafactory output 25% via reduced external risks. |

France Advanced Battery Market Segment Analysis

By Technology: Lithium-ion Batteries

Lithium-ion batteries command 95% of France's advanced battery demand in 2024, fueled by their 250 Wh/kg energy density that enables 400-500 km ranges in EVs like Renault's Megane E-Tech. Automotive drivers dominate, with 291,143 BEV registrations necessitating 15 GWh of packs, as subsidies under the Advenir program—€1,000 per charger—pair with falling cell prices (down 25% to €100/kWh) to propel fleet conversions. This chemistry's cycle life exceeding 2,000 charges suits hybrid applications, where plug-in models captured 10.1% share in December 2024, driven by corporate quotas avoiding €10,000 penalties.

Energy storage applications amplify uptake, as lithium-ion's 90% round-trip efficiency stabilizes grids amid 25% renewable penetration. Utility-scale projects, like Neoen's 100 MW installations, deploy 50-200 Ah modules to arbitrage peaks, adding 5 GWh demand as curtailment drops 10%. Challenges persist in thermal runaway risks, mitigated by French R&D in silicon anodes boosting density 20%, yet cobalt dependencies (70% imported) inflate costs 15% during DRC volatility. Overall, regulatory pushes for 12% recycled content by 2035 will redirect 30% of end-of-life packs to stationary use, sustaining 18% CAGR through 2030.

By Application: Automotive

France's automotive segment contributes significantly to the rising need for advanced batteries, with electric and hybrid vehicles requiring 20 GWh in 2024 amid the electrified market share. Electric vehicles lead, as BEV sales stability at 16.9%—bolstered by €4,000 eco-bonuses—drives procurement of NMC lithium-ion packs for 300+ km autonomy in models like the Renault 5 E-Tech. Hybrid electric vehicles follow, capturing 6.9% via business fleets meeting ZFE emission zones, where 50 Ah NiMH variants enable start-stop efficiency gains of 15%.

The necessity surges from urban restrictions: Paris's 2025 low-emission mandates phase out 30% of diesel fleets, channeling €2 billion in subsidies toward battery retrofits. This elevates aftermarket sales 20%, as OEMs like Stellantis integrate modular packs for plug-in hybrids, reducing fuel use 40%. Supply constraints, including 80% Asian cathode reliance, cap scalability, but local assembly at Douai's 9 GWh facility cuts lead times 30%, fostering 14% growth. Solid-state pilots promise 50% density uplift by 2027, targeting defense hybrids and unlocking €1 billion in exports.

France Advanced Battery Market Competitive Analysis:

France's advanced battery landscape features a blend of domestic innovators and global integrators, with Korean firms holding significant gigafactory output. Competition centers on cost, sustainability, and localization, as EU rules favor traceable chains. Key players differentiate via cathode tech and recycling integration, capturing shares in automotive and storage.

Verkor positions as Europe's low-carbon leader with a Dunkirk gigafactory targeting 50 GWh by 2025. Its proprietary NMC cells emphasize 80% recycled inputs, aligning with EPR mandates; the facility, backed by €2 billion in public funds, supplies Renault with 16 GWh packs featuring 300 Wh/kg density for extended-range EVs. Verkor's edge lies in digital twinning for 20% yield gains, per its innovation center reports.

Saft, a TotalEnergies subsidiary, excels in high-reliability nickel-based systems, producing 1 GWh annually across 15 French sites. Its Intensium Max packs, with 2,500-cycle life, dominate industrial stationary applications, powering 50 MW RTE grid projects. Saft's strategic focus on sodium-ion prototypes—cobalt-free and 30% cheaper—targets aerospace, where 2024 contracts with Airbus yield €100 million in low-capacity modules.

Forsee Power leads in modular lithium-ion for buses, with 500 MWh shipped in 2024 via its Paris hub. Its ZEN packs integrate BMS for 95% efficiency, securing 40% of France's e-bus market through €300 million Bolloré partnership; emphasis on IP67-rated cells suits harsh climates, driving 25% demand growth in urban transit.

France Advanced Battery Market Developments:

September 2025: Belgian metals recycler Campine completed its acquisition of Ecobat's French operations, adding two battery recycling plants and a lead products factory in northern France. This bolsters Campine's capacity by 70,000 tons annually, enhancing downstream lead anode production for the zinc and copper industries. The assets generated €100 million in revenue with positive EBITDA in 2024, supporting Europe's circular battery economy and reducing import reliance amid rising EV demand.

December 2024: Automotive Cells Company (ACC), backed by Stellantis, TotalEnergies, and Mercedes-Benz, signed a loan in December 2024 to fund the second production block at its Billy-Berclau-Douvrin gigafactory. This expansion ramps up lithium-ion battery output despite sluggish EV sales, targeting 150,000 car-equivalent units in 2025. It reinforces France's EV supply chain sovereignty, with plans for 2.5 million units by 2030, creating jobs and countering Asian dominance in European battery production.

France Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 8.31 billion |

| Total Market Size in 2031 | USD 13.92 billion |

| Growth Rate | 10.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

France Advanced Battery Market Segmentation:

BY TECHNOLOGY

Lithium-ion Batteries

Lead-acid Batteries

Solid-state Batteries

Nickel-metal Hydride (NiMH) Batteries

Flow Batteries

Sodium-ion Batteries

Others

BY CAPACITY

Low Capacity (<50 Ah)

Medium Capacity (50-200 Ah)

High Capacity (>200 Ah)

BY MATERIAL

Cathode Material

Anode Material

Others

BY APPLICATION

Automotive

Electric Vehicles

Hybrid Electric Vehicles

Plug-in Hybrid Electric Vehicles

Energy Storage Systems

Residential

Commercial & Industrial

Utility-scale

Consumer Electronics

Industrial

Motive Power

Stationary

Medical

Aerospace & Defense

Others

BY SALES CHANNEL

OEM

Aftermarket