Report Overview

EV Battery Recycling Market Highlights

EV Battery Recycling Market Size:

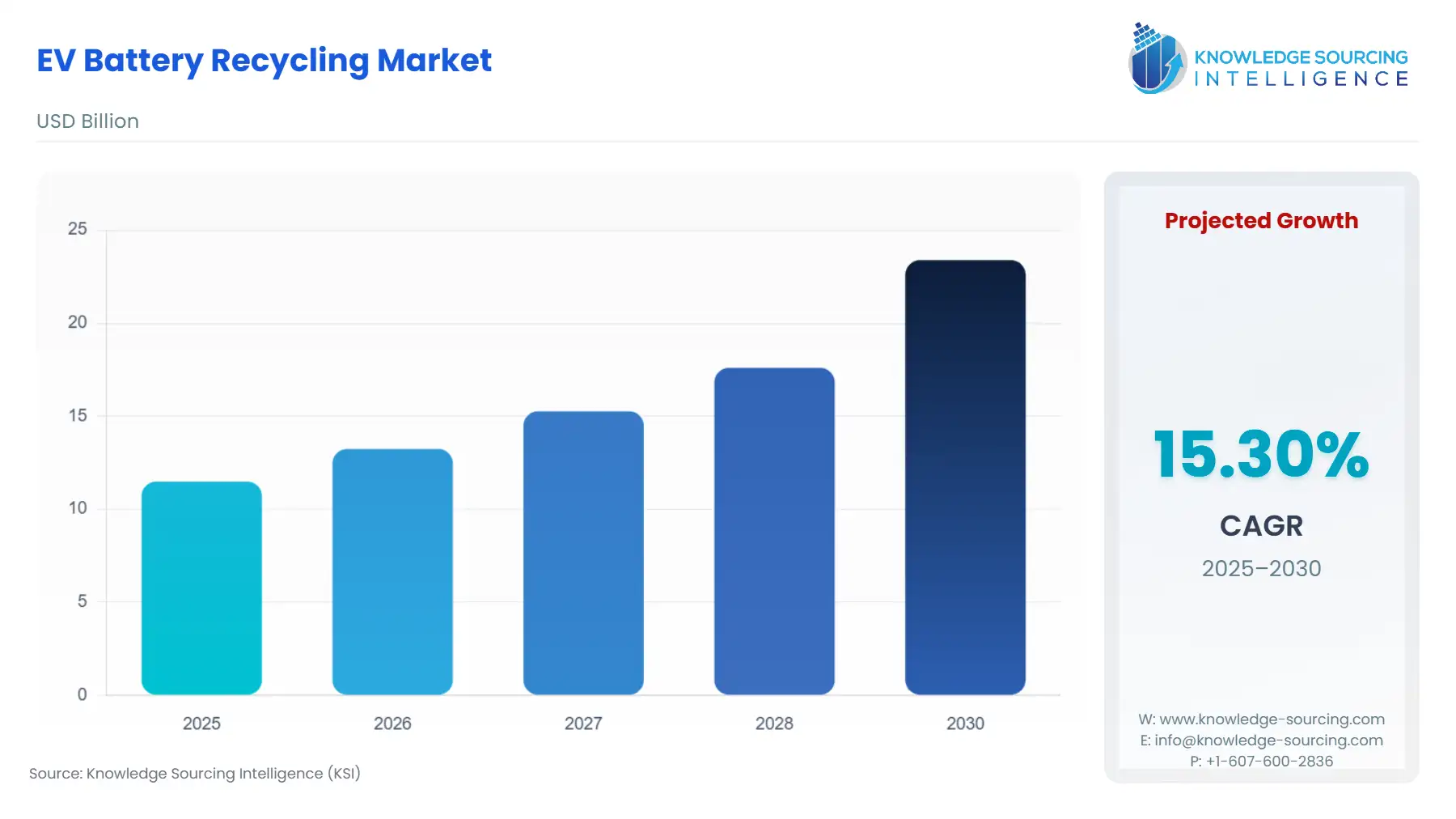

The EV battery recycling market is set to witness robust growth at a CAGR of 15.30% during the forecast period, to be worth USD 23.393 billion in 2030 from USD 11.482 billion in 2025.

EV Battery Recycling Market Overview:

The market growth is driven by increased suppliers of electric vehicle (EV) batteries. These suppliers are focusing on recycling batteries to reduce costs associated with rising material prices and to protect the environment. This trend is contributing to the greater adoption of EVs. Batteries require two new uses after their first life: updated recycling facilities and recovered materials for feedstock. Adding batteries to stationary energy storage systems helps them last longer and generates income. There has been a rise in the setting up of recycling infrastructure across many collection points, allowing consumers to convert a wider range of recycling materials.

The EV battery recycling market is pivotal in supporting sustainable EV adoption through lithium-ion battery recycling and EV battery lifecycle management. Focused on critical raw material recovery, such as lithium, cobalt, and nickel, it reduces dependency on mining and mitigates supply chain risks. The circular economy for EV batteries drives efficient end-of-life battery treatment, transforming battery waste management into resource recovery opportunities. Advanced recycling processes, including hydrometallurgy and pyrometallurgy, enable high-purity material extraction for reuse in new batteries. This market addresses environmental concerns and regulatory pressures, ensuring sustainable, scalable solutions for the growing global EV ecosystem.

As demand for electric vehicles (EVs) grows worldwide, volumes of battery production scrap and end-of-life batteries will increase exponentially. With growing EV adoption, more batteries are reaching end-of-life, increasing the need for efficient recycling solutions to manage battery waste and recover valuable materials. According to the data by the International Energy Agency (IEA), the total number of EVs is expected to grow from 30 million in 2022 to 240 million in 2030 when the State Policies are taken into consideration (excluding two- and three-wheeler vehicles). EV car sales reached 17 million in 2024 and are expected to surpass 20 million in 2025. Thus, the growing adoption of EVs is the key factor driving the EV battery recycling market.

The growing focus on the circular economy and increasing demand for recovering critical raw materials from EV batteries, such as lithium, cobalt, and nickel, are further giving a major boost to the market.

Another significant driver for the market is the rising environmental regulations by the governments that enforce strict rules for battery disposal and recycling. Moreover, advancements in recycling technology, such as hydrometallurgy, are improving the efficiency and recovery rate, driving market growth. For instance, in 2022, Umicore launched a new business unit, Battery Recycling Solutions, with a plan for a significant capacity, with a 150,000-tonne battery recycling plant by 2026. It uses a combination of pyro- and hydro-metallurgy, making claims that it is 20-30% more cost-efficient and has high recovery yields of over 95% for nickel, copper, and cobalt, and over 70% for lithium from a wide variety of battery production scraps and end-of-life batteries.

Key players in the EV battery recycling market are increasingly investing in cost-effective solutions, with a strong emphasis on research and development (R&D) and technological innovation. The market is also witnessing capacity expansion and increasing adoption of advanced and efficient recycling methods. Additionally, the market is aligning its operations with compliance requirements.

EV Battery Recycling Market Trends:

The EV battery recycling market is advancing with hydrometallurgy EV batteries and pyrometallurgy battery recycling, enhancing material recovery efficiency. Direct recycling of lithium-ion preserves battery structures, reducing processing costs. Black mass processing optimizes the extraction of valuable metals like lithium and cobalt. Battery dismantling automation streamlines end-of-life processing, improving scalability and safety. Cathode-to-cathode recycling enables direct reuse of cathode materials, supporting circularity and minimizing waste. These trends focus on sustainable, cost-effective solutions to meet rising EV battery waste volumes, aligning with regulatory demands and circular economy goals while reducing reliance on virgin materials in battery production.

EV Battery Recycling Market Growth Drivers:

Increase in EV Sales: EV adoption drives most battery recycling activity because people worldwide are choosing electric transportation. As more consumers and commercial fleets are increasingly transitioning to electric vehicles, there is a growing demand for EV batteries, particularly lithium-ion batteries. According to the International Energy Agency (IEA)[1], EV production will jump to 240 million units in 2030, starting with 30 million EVs in 2022. As per the same source, electric vehicle sales could reach around 17 million in 2024, accounting for more than one in five cars sold worldwide. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. This is up from 14% in 2022, indicating robust EV adoption.

Thus, this rapid surge in electric vehicle adoption has created the need for their proper disposal and recycling to prevent environmental hazards and to recover critical raw materials like lithium, cobalt, and nickel. Electric vehicles will represent more than 10% of road vehicle usage in 2030. Manufacturers are expected to sell 20 million EVs in 2025 and 40 million models in 2030 when these vehicles achieve 20% and 30% of all vehicle demand.

In addition, many countries and regions are encouraging as well as setting ambitious targets for EV adoption, further driving the growth in the volume of used batteries. This high volume of end-of-life batteries will require recycling over the next decade, encouraging investments in recycling infrastructure and technology, giving a major boost to the market. For instance, LOHUM and Vecmocon have entered into a strategic partnership in India to accelerate the widespread adoption of EVs. This partnership will ensure the optimal utilization of EV batteries, extending battery life, enabling second-life usage, and facilitating optimal recycling of Li-ion batteries through reduction in EV financing and insurance costs.

Government Regulations and Incentives: Governments worldwide, especially in North America and Europe, support the EV battery recycling industry with investment policies, including EU Battery Regulation standards promoting waste reduction. Official government rules and funding programs from the government promote an increased focus on the EV battery recycling industry, such as Extended Producer Responsibility (EPR). Manufacturers under EPR rules must design complete battery life cycle solutions, including collection and recycling programs. The recycling methods make the process cheaper to run, making it profitable.

EV Battery Recycling Market Segmentation Analysis:

EV Battery Recycling Market Segment Analysis By Battery Type:

Lead-Acid Batteries: Batteries with lead-acid technology remain a considerably growing segment of EV battery recycling because they power many vehicles, including EVs, which maintain stable recycling operations.

Lithium-Based Batteries: The EV battery recycling industry will grow primarily from lithium-ion battery adoption because EVs keep increasing while battery recycling methods at end-of-life need improvement, leading to market expansion.

EV Battery Recycling Market Segmentation Analysis By Recycling Process:

Pyrometallurgical: Pyrometallurgical recycling is a common technique for battery processing that depends on high-temperature treatment. The method achieves high recovery rates for lithium cobalt nickel through its ability to work with many different EV battery chemistries.

Hydrometallurgical: The rising demand for aqueous solution-based hydrometallurgical processes is due to their ability to recover materials with a lower environmental impact while consuming less energy.

EV Battery Recycling Market Geographical Outlook:

The EV battery recycling market report analyzes growth factors across the following five regions:

North America: North America's EV battery recycling market will grow rapidly as investors fund new recycling technology and protect the environment due to supportive government policies. For instance, the Bipartisan Infrastructure Law by the Biden-Harris Administration funded eight projects with $44.8 million that started their work in October 2024 to make recycling batteries and EV components more affordable.

The EV battery recycling market in the United States is expanding significantly due to the growing popularity of EVs, stricter laws pertaining to environmentally friendly waste disposal, and the need to ensure the supply of vital raw materials like nickel, cobalt, and lithium. The increasing number of electric vehicles on American roads has raised the need for efficient battery management systems, a national priority. In addition to reducing the environmental risks associated with inappropriate battery disposal, recycling also lessens the need for mining by recovering valuable elements from used batteries.

Key market participants are making investments in cutting-edge recycling technologies, such as direct and hydrometallurgical recycling techniques, to improve the recycling process's environmental sustainability and efficiency. Automakers, battery producers, and recyclers are forming strategic alliances that are speeding up the development of closed-loop systems, which reprocess used battery materials to produce new batteries. The market landscape is further solidified by industry leaders Redwood Materials, Li-Cycle, and Ascend Elements, who have improved their abilities in battery collecting, disassembly, and material recovery.

The majority of battery recycling activities are driven by EV adoption since more people choose electric vehicles globally. The IEA estimates that after producing 30 million EVs in 2022, EV manufacturing will increase to 240 million units in 2030. This quick expansion necessitates more recycling of end-of-life batteries. By 2030, over 10% of all vehicles on the road will be electric. Manufacturers anticipate selling 20 million EVs in 2025 and 40 million EVs in 2030, accounting for 20% and 30% of the total automobile market, respectively.

A favorable policy environment is also being created to improve recycling volumes and localize battery supply chains via the Inflation Reduction Act and other federal incentives. In line with this, the U.S. EV battery recycling market will grow significantly due to a quickly changing regulatory environment and ongoing technological breakthroughs in recycling, which will be crucial to the country's clean energy transition and circular economy objectives.

Moreover, to meet the demands for battery materials for EV production in the future, battery recycling will be essential. There was sufficient domestic battery recycling capacity in the US as of 2023 to recover 35,500 tons of battery materials, according to the U.S. Department of Energy (DOE). In the next two to four years, other facilities are planned to recover an additional 76,000 tons. Intermediate processing facilities acquire these materials for transforming lithium-ion batteries and battery manufacturing waste into materials that can be reintegrated into the battery supply chain. Plans were made to handle almost 198,000 more tons in the upcoming years, while intermediate processing facilities reclaimed nearly 175,000 tons of material in 2023.

In summary, the USA's market for recycling EV batteries is becoming an essential part of the nation's shift to a sustainable electric transportation environment. The industry is experiencing rapid technological improvements and increasing expenditures due to factors such as a boom in the usage of electric vehicles, increased environmental concerns, and favorable federal and state-level laws. Important players are working together to create a strong infrastructure that guarantees the effective recovery and reuse of vital battery components, including recyclers, automakers, and legislators. The long-term forecast for the U.S. EV battery recycling business is extremely encouraging, positioning it as a vital pillar for both environmental sustainability and domestic resource security, despite the presence of challenges such as safety issues, collection logistics, and recycling efficiency.

South America: The South American EV battery recycling industry is witnessing significant growth due to rising sustainability and environmental concerns, technological advancements, and investment in recycling techniques.

Europe: Europe's EV battery recycling industry is dominant due to its strong environmental laws and affluent citizens. EU regulations demand that companies meet strong battery recycling standards for every type of battery chemistry, driving successful recycling operations.

Middle East and Africa: The Middle East and Africa region is an emerging market that will grow consistently because lithium-ion batteries for EVs keep selling well, whereas unwanted and waste batteries need better recycling systems.

Asia-Pacific: The Asia-Pacific region leads in EV battery recycling because of rising investment to support advanced recycling, while EV adoption grows fast alongside rising worries about metal scarcity, leading to market growth.

List of Top EV Battery Recycling Companies:

Umicore

Bosch

ACCUREC-Recycling GmbH

Li-Cycle Corp.

Terrapure BR Ltd.

Neometals Ltd

Investment in the cost-effective recycling of batteries is a core focus of companies during the projected period. This is combined with aggressive R&D and technological innovation. Manufacturers, recyclers, and technology providers are forming strategic partnerships to increase recycling throughput while maintaining a consistent source of recycled material.

EV Battery Recycling Market Latest Developments:

August 2025: Lyten Inc. to Acquire Remaining Assets of Northvolt AB in Sweden & Germany. Lyten announced a binding agreement to acquire Northvolt’s Swedish plants (including Northvolt Ett and Northvolt Labs) and German assets, along with the company’s intellectual property.

August 2025: Umicore NV Reports Solid H1 Results; Recycling Business Stable. Umicore published its half-year 2025 results: revenues €1.8 billion, adjusted EBITDA up ~10 %, and noted that its Recycling business reported earnings broadly in line with the prior year.

In January 2025, TNO and SusPhos launched an LFP battery recycling process in the Netherlands, achieving cost-effective lithium and phosphate recovery for EV battery production.

In October 2024, the EU and Indian startups attended a matchmaking event dedicated to EV battery recycling as a part of the India–EU Trade AND Technology Council W2G, intending to learn about the new recycling technologies.

In September 2024, AE Elemental launched a commercial EV battery recycling plant in Poland. The facility has the potential to process 12,000 metric tons annually, making it the largest in Poland, prompting many business and community leaders from Europe and North America to take an interest.

EV Battery Recycling Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 11.482 billion |

| Total Market Size in 2030 | USD 23.393 billion |

| Forecast Unit | Billion |

| Growth Rate | 15.30% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Battery Type, Recycling Process, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

EV Battery Recycling Market Segmentation:

By Battery Type

Lead-Acid Batteries

Flooded Lead-Acid Batteries

Valve-Regulated Lead-Acid (VRLA) Batteries

Lithium-Based Batteries

Lithium-Ion Batteries

Lithium Polymer Batteries

Lithium Iron Phosphate (LiFePO4) Batteries

Others

By Recycling Process

Pyrometallurgical

Hydrometallurgical

Others

Mechanical

Others

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Australia

Others