Report Overview

Glass Cockpit Market Size, Highlights

Glass Cockpit Market Size:

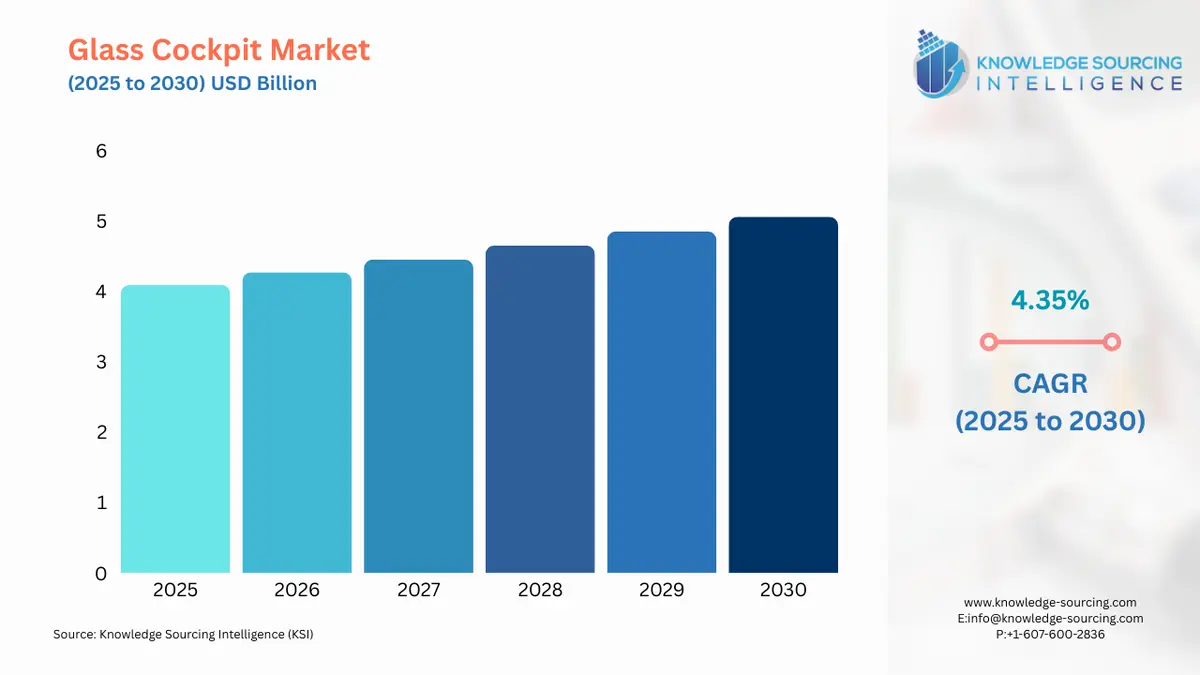

The Glass Cockpit Market is expected to grow from US$4.091 billion in 2025 to US$5.062 billion in 2030, at a CAGR of 4.35%.

Glass Cockpit Market Trends:

With the advancement of technology, the glass cockpit entered the cockpit display market. By using LCD technology, this next-generation cockpit with touchscreen technologies is gaining popularity. With the growing trend of digitization, the market is propelled to grow at a significant pace in the forecast period. These flight decks with efficient flight control systems are providing huge operational benefits where pilots are offered novel ways of interacting with the aircraft system. Additionally, the growing number of air travel passengers, along with the manufacturing of new aircraft, is further propelling the market demand in the forecast period and in the upcoming years. Hence, the growing aerospace and defence industries are fueling the market’s growth in the forecast period.

Glass Cockpit Market Geographical Outlook:

- North America and Europe are to witness considerable growth during the forecast period

Geographically, North America and Europe are projected to hold a significant share of the global glass cockpit market. This is due to the early technology adopters. Additionally, North America has a robust military industry, with the United States as a pioneer in the global aerospace and defense industry. While the Asia Pacific region is expected to witness high market growth prospects. This region is predicted to be the fastest-growing region during the forecast period. This is due to a large consumer base along with the growing number of air passengers, specifically in the emerging countries of India and China. As per the International Air Transport Association (IATA) predictions, the Asia Pacific region is considered to be the biggest driver of air passenger demand during the period 2015 to 2035.

Nearly more than 50% of the new air passengers are likely to originate from this region. Also, in the near future, by the end of 2024, China will replace the United States as the major aviation market at the global level. Similarly, India from the APAC region is poised to replace the United Kingdom, to be ranked in third place by 2025. On the other hand, Indonesia and Japan are expected to be placed in the fifth and seventh positions in the global aviation market by the end of 2025. Furthermore, the increasing defence expenditure of Southeast Asian countries is expected to provide an opportunity for the growth of the glass cockpit market over the next five years.

Glass Cockpit Market Growth Analysis:

- The growing aerospace & defense industry is burgeoning the market demand for the installation of glass cockpits, further fueling the market growth in the forecast and the upcoming years.

The aerospace & defense industries worldwide are keeping up pace with the increasing air passenger traffic. In addition, the growing global military spending is surging continuously owing to the increased border security threats, hence, the A&D industry is predicted to experience sustainable growth during the forecast period as well. This is further creating a need where governments are required to raise their defence budgets. Also, with the growing manufacturing and production of commercial aircraft, the market is expected to gain popularity with technological advancements. Hence, in the field of commercial aerospace, there is a high demand for the manufacturing of next-generation aircraft coupled with the installation of next-generation technologies for enhanced communication and navigation, fueling the market demand in the forecast period.

- Defense sector augmenting the market growth

In the defense sector, the heightened global tensions, geopolitical risks, and high defense spending by the regional powers other than the United States, which include China, India, and Japan are further augmenting the demand for advanced avionics in the forecast period and in the upcoming years. The growing defence expenditure will further provide assistance in creating immense opportunities for the contractors and their supply chains to fulfil the demand, resulting in improved production yields. In addition, defence companies are required to be able to adapt to the evolving market demands, which include the introduction of new technologies like digital technology. In the field of commercial space, sustainable investments are being made in new and existing space technologies and services along with significant funding coming up from the government and venture capitalists. With an increased focus on the modernization of military missions, the market is poised to grow at a fast pace in the forecast period and in the upcoming years. Furthermore, with increasing investments in R&D in the A&D, a significant increase in revenues was observed, further burgeoning market demand in the forecast period.

- Mergers and acquisitions propelling the market growth

Strategies such as mergers and acquisitions are being observed in recent years focused on the growth drivers in the field of command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance (C5ISR), commercial aviation, unmanned and autonomous vehicles, and the increasing demand for achieving high sales. Additionally, bigger contractors are utilizing acquisitions as a part of their growth strategies in order to gain access to novel and sophisticated technologies along with the expansion of their global outreach.

With the increasing automation in several industries, the automated flight control systems with touchscreens are further providing an opportunity for the market to grow at a significant pace in the forecast period. The commercial aerospace sector is further aimed toward shifting to a fully-automated flight deck, hence, leading to a reduction in the number of crew members in the cockpit and resulting in lowering airline costs. Also, with the increasing number of pilot shortages, the deployment of an automated cockpit is offering an efficient solution to the increasing demand for air transport and the expansion of low-cost airlines.

Glass Cockpit Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Glass Cockpit Market Size in 2025 | US$4.091 billion |

| Glass Cockpit Market Size in 2030 | US$5.062 billion |

| Growth Rate | CAGR of 4.35% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Glass Cockpit Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Aircraft Type

- Defense Aircraft

- Civil Aircraft

- Cargo Aircraft

- Helicopters

- Trainer Aircraft

- Space Aircraft

- By Screen Size

- Small

- Medium

- Large

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Human Machine Interface (HMI) For Cockpit Displays Market

- Drone Flight Control System Market

- Cockpit Display Market

Navigation:

- Glass Cockpit Market Size:

- Glass Cockpit Market Key Highlights:

- Glass Cockpit Market Trends:

- Glass Cockpit Market Geographical Outlook:

- Glass Cockpit Market Growth Analysis:

- Glass Cockpit Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 16, 2025