Report Overview

Display Panel Market - Highlights

Display Panel Market Size:

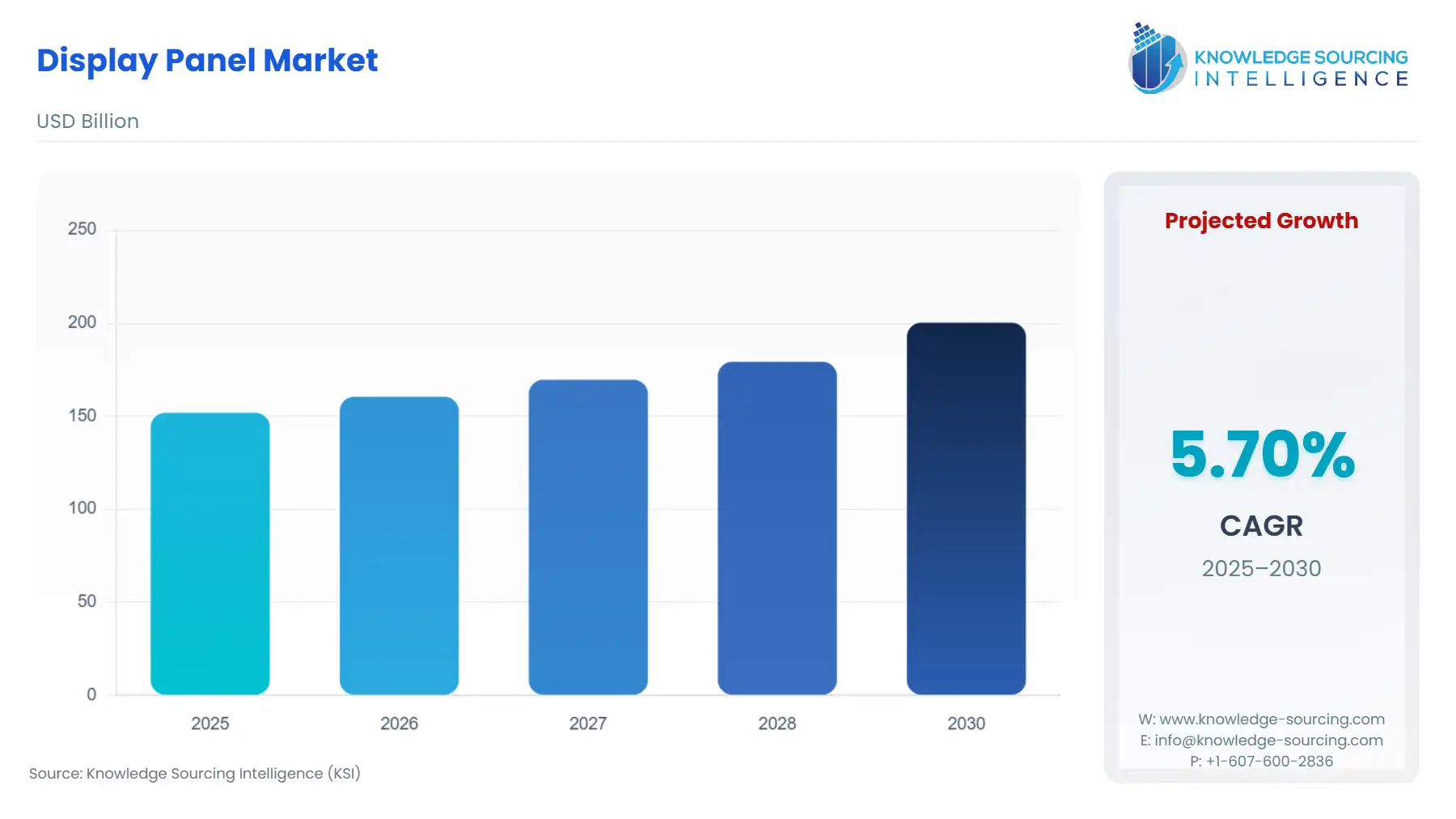

The Display Panel Market is expected to grow from USD 151.792 billion in 2025 to USD 200.282 billion in 2030, at a CAGR of 5.70%.

The Display Panel Market is a cornerstone of the global electronics industry, underpinning the visual interfaces that drive modern technology across consumer, commercial, and industrial applications. Display panels, the core components of screens in devices like televisions, smartphones, digital signage, and automotive dashboards, leverage advanced technologies to deliver high-quality visuals, energy efficiency, and interactive capabilities. The market is fueled by rising consumer demand for high-resolution displays, advancements in display technologies, and the proliferation of smart devices. The market is poised for robust growth.

The Display Panel Market is a vital driver of the electronics industry, propelled by rising demand for high-resolution displays, technological advancements, smart device proliferation, and growth in digital signage and automotive applications. Despite challenges like high manufacturing costs, supply chain vulnerabilities, and environmental concerns, the market is experiencing robust growth, supported by innovations in LED, OLED, and 4K technologies.

Asia-Pacific leads with television and smartphone production, North America excels in automotive and digital signage, and Europe prioritizes premium and sustainable displays. The LED, 4K, and television segments are pivotal, addressing diverse consumer and industrial needs. Industry experts should focus on technological innovation, supply chain resilience, and regional market dynamics to leverage the market’s growth potential.

Display Panel Market Overview:

Display panels are integral to modern electronics, enabling vibrant, responsive, and energy-efficient visual interfaces. LCD panels, using liquid crystals to modulate light, dominate cost-sensitive applications like televisions and monitors. LED panels, including Organic LED (OLED) and MicroLED, offer superior contrast, color accuracy, and flexibility, driving premium applications in smartphones and automotive displays. Other technologies, such as Quantum Dot (QD) and E-Ink, cater to niche markets like e-readers and high-end TVs. Resolutions range from HD (720p) and FHD (1080p) for budget devices to 4K (2160p) and 8K (4320p) for immersive experiences in TVs and digital signage. Applications include televisions for home entertainment, digital signage for advertising, automotive for infotainment and dashboards, smartphones for personal devices, and others like wearables and medical displays.

In June 2025, the global Display Panel Market is experiencing significant demand, driven by the proliferation of smart devices, advancements in OLED and MicroLED technologies, and the expansion of digital signage in retail and public spaces. Leading companies, such as Samsung Display, LG Display, BOE Technology, and AU Optronics, are advancing the market with innovations in flexible displays, energy-efficient panels, and high-resolution technologies. The market’s growth reflects its critical role in enabling immersive user experiences, enhancing operational efficiencies, and supporting digital transformation across industries.

Display Panel Market Growth Drivers:

Several factors are propelling the Display Panel Market:

Rising Demand for High-Resolution Displays: Consumer preference for immersive visuals drives 4K and 8K adoption, with global 4K TV shipments reaching 150 million units in 2024 (Consumer Technology Association, 2024).

Advancements in Display Technologies: Innovations in OLED, MicroLED, and QD enhance color accuracy and energy efficiency. In 2023, Samsung introduced a 77-inch QD-OLED panel with 30% brighter output (Samsung Press Release, September 2023).

Proliferation of Smart Devices: The global smartphone market, with 1.5 billion units shipped in 2024, fuels demand for compact, high-quality displays (International Data Corporation, 2024).

Growth in Digital Signage and Automotive Applications: Retail and transportation sectors invest in displays, with global digital signage spending reaching $20 billion in 2024 (International Sign Association, 2024).

Display Panel Market Restraints:

The market faces several challenges:

High Manufacturing Costs: Producing advanced panels like OLED and MicroLED requires significant investment, limiting scalability for smaller manufacturers.

Supply Chain Vulnerabilities: Semiconductor shortages and reliance on rare earth materials disrupt production, with 20% of panel output affected in 2024 (U.S. Department of Commerce, 2024).

Environmental Concerns: Display production consumes substantial energy and generates e-waste, raising sustainability issues under EU regulations (European Commission, 2023).

Display Panel Market Geographical Analysis:

Asia Pacific

Asia Pacific dominates the Display Panel Market, driven by its role as the global hub for electronics manufacturing, robust consumer demand, and technological innovation. China leads with its massive production capacity, accounting for 60% of global display panel output in 2024 (China National Bureau of Statistics, 2024). The television segment is dominant, with China shipping 90 million TV panels in 2024, fueled by domestic brands like TCL and Hisense (Consumer Electronics Association of China, 2024). Japan contributes through advanced OLED and MicroLED technologies, with Sony launching an 8K MicroLED TV in 2023 (Sony Press Release, October 2023). India’s smartphone market, with 200 million units sold in 2024, drives demand for FHD and 4K displays (Ministry of Electronics and Information Technology, 2024). The LED type segment, particularly OLED, prevails due to its adoption in premium smartphones and TVs. The region’s growth is fueled by government support for semiconductor industries, rising middle-class spending, and 5G-driven device upgrades.

China’s dominance stems from its vertically integrated supply chain, with companies like BOE and TCL leading LCD and OLED production. Japan’s focus on high-end displays supports MicroLED adoption in professional and consumer markets. India’s growing digital economy and “Make in India” initiative boost local manufacturing, with Samsung expanding its Noida display plant in 2024 (Samsung India Press Release, March 2024). Australia contributes through digital signage in retail and public spaces. Asia Pacific’s competitive edge lies in its scale, cost efficiencies, and rapid adoption of next-generation technologies, positioning it as the market’s epicenter.

North America

North America holds a significant market share, driven by its advanced consumer electronics market, automotive innovation, and leadership in digital signage. The U.S. leads with a robust television segment, with 50 million 4K TVs sold in 2024, supported by streaming platforms like Netflix (Consumer Technology Association, 2024). The automotive application is prominent, with 80% of new U.S. vehicles featuring infotainment displays in 2024 (U.S. Department of Transportation, 2024). Canada contributes through digital signage, with $500 million invested in public displays in 2024 (Canadian Digital Signage Association, 2024). Mexico’s electronics manufacturing sector, with $100 billion in exports in 2024, drives demand for LCD panels (Mexican Ministry of Economy, 2024). The 4K resolution segment dominates, reflecting consumer demand for high-quality visuals.

The U.S. benefits from a strong innovation ecosystem, with companies like Apple and Tesla integrating OLED and MicroLED in smartphones and vehicles. Regulatory incentives, such as the CHIPS Act, support domestic semiconductor production, indirectly boosting display manufacturing (U.S. Department of Commerce, 2023). Canada’s focus on smart cities drives digital signage adoption, while Mexico’s proximity to the U.S. enhances its role in supply chains. North America’s growth is underpinned by high consumer spending, technological leadership, and diverse application areas.

Europe

Europe maintains a strong market presence, driven by sustainability initiatives, premium consumer electronics, and automotive advancements. Germany and the UK lead due to their focus on Industry 4.0, with Germany’s automotive sector investing €3 billion in display-equipped vehicles in 2024 (German Federal Ministry for Economic Affairs, 2024). The automotive segment is significant, with 70% of European cars featuring advanced displays under EU safety regulations (European Commission, 2024). France contributes through its television market, with 10 million 4K TVs sold in 2024 (French Ministry of Culture, 2024). Spain’s digital signage sector, supported by €500 million in retail investments, boosts LED adoption (Spanish Ministry of Industry, 2024). The OLED segment within LED dominates, driven by premium applications and energy efficiency requirements.

The UK’s consumer electronics market supports 8K TV adoption, with retailers like Currys promoting immersive displays. Germany’s leadership in automotive innovation, led by BMW and Volkswagen, drives demand for curved and flexible displays. The EU’s Green Deal, aiming for carbon-neutral manufacturing by 2050, promotes energy-efficient LCD and LED panels (European Commission, 2023). Europe’s growth is bolstered by regulatory frameworks, a focus on sustainability, and investments in high-value applications.

Display Panel Market Segment Analysis:

LED Technology

The LED technology segment is a major driver, driven by the superior performance of OLED and MicroLED displays in terms of contrast, brightness, and flexibility. OLED panels, with self-emissive pixels, offer deep blacks and vibrant colors, while MicroLED provides unmatched brightness and longevity, ideal for premium smartphones, TVs, and automotive displays. In September 2023, Samsung launched a 77-inch QD-OLED panel with 30% higher brightness, targeting high-end TVs (Samsung Press Release, September 2023). The segment’s growth is fueled by demand from television and smartphone applications, with 70% of premium smartphones using OLED in 2024 (International Data Corporation, 2024). Asia Pacific dominates, with China and Japan leading OLED production and South Korea leading LED development. Growth is driven by advancements in flexible displays, foldable devices, and energy-efficient technologies.

OLED displays are ideal for smartphones due to their thin profiles and flexibility, enabling devices like foldable phones. MicroLED, though costlier, is gaining traction in large-format TVs and automotive dashboards for its durability and brightness. The segment benefits from innovations like tandem OLED, which stacks two OLED layers for improved efficiency. Challenges include high production costs and complex manufacturing, but the segment’s premium appeal ensures sustained demand. The rise of augmented reality (AR) and virtual reality (VR) applications further supports LED growth.

4K Resolution

The 4K resolution segment is the largest, driven by consumer demand for high-quality visuals and widespread adoption across applications. 4K displays, with 3840x2160 pixels, offer four times the detail of FHD, making them ideal for immersive experiences in televisions, gaming monitors, and digital signage. In 2024, LG Display expanded its 4K OLED production capacity by 20% to meet TV demand (LG Display Press Release, February 2024). The segment’s growth is fueled by the television industry and digital signage applications, with 150 million 4K TVs shipped globally in 2024 (Consumer Technology Association, 2024). North America and the Asia-Pacific region lead 4K adoption, with the U.S. and China driving consumer electronics sales.

4K displays are now standard in mid-range TVs and premium smartphones, supported by streaming platforms offering 4K content. Digital signage uses signage that leverages 4K for high-impact advertising, while automotive applications incorporate 4K displays for detailed navigation. The segment benefits from cost reductions in LCD and OLED production, making 4K more accessible. Challenges include competition from higher resolutions like 8K, but 4K’s balance of quality and affordability ensures its dominance. The rise of 5G and cloud gaming further boosts 4K demand.

Television Applications

The television application segment is a significant driver, driven by consumer demand for larger screens, higher resolutions, and smart features enhancing entertainment. Modern TVs, increasingly equipped with 4K and OLED panels, cater to the demand for immersive viewing experiences. In January 2024, TCL introduced its 2024 QLED 8K TV lineup, featuring a 30% improved color gamut (TCL Press Release, January 2024). The segment’s growth is supported by global TV sales reaching 250 million units in 2024, with 60% being 4K or OLED-based (Consumer Electronics Association, 2024). Asia-Pacific leads, with China and India driving volume, while Europe prioritizes premium models.

Televisions account for a significant portion of display panel demand due to household penetration and frequent upgrade cycles. The shift to smart TVs, integrated with streaming and IoT platforms, drives demand for advanced panels like. OLED for premium models and LCD for budget options. The segment benefits from consumer trends like cord-cutting and premium content services like Disney+. Disney+. Challenges include market saturation in developed regions, but growth in emerging markets and innovations in 8K and MicroLED sustain momentum. The segment’s importance is underscored by its role in home entertainment and media consumption.

Display Panel Market Key Developments:

Nov 2025: Universal Display Corp (UDC) announced it will acquire OLED-related patents from Merck KGaA (Germany), a move in preparation for closing Q1 2026.

Oct 2025: Chinese mainland display-panel manufacturers (led by TCL CSOT and BOE Technology Group) crossed 50% of global revenue share in the first half of 2025, highlighting major consolidation and investment shifts in the industry.

Sept 2025: TCL CSOT unveiled its latest display technologies at IFA 2025, including premium QD-Mini LED TV panels under its “C9K” flagship model.

Aug 2025: LG Display introduced its 27-inch QHD 540 Hz OLED monitor panel (under its fourth-generation OLED tech) and a 45-inch 5K2K OLED panel at K-Display 2025 in Seoul.

May 2025: LG Display announced at SID Display Week that its new fourth-generation OLED TV panels include AI up-scaling and deliver ~20% better energy efficiency compared with the previous generation.

Display Panel Market Future Outlook:

The Display Panel Market is set for sustained growth through 2030, driven by consumer demand for high-resolution displays, advancements in OLED and MicroLED, and expanding applications in automotive and digital signage. The adoption of 5G, AR/VR, and IoT will further increase demand for compact, high-performance displays. Asia-Pacific will continue to lead, fueled by China’s production capacity and India’s consumer market growth. North America and Europe will see steady growth, driven by television and automotive applications. Emerging sectors like wearables and smart homes will diversify the market. Addressing cost barriers, supply chain disruptions, and environmental concerns will be critical for broader adoption. Industry experts should monitor technological innovations, regulatory shifts, and regional consumer trends to capitalize on opportunities.

List of Top Display Panel Companies:

Japan Display Inc.

SAMSUNG

Panasonic

LG Display Co., Ltd

Sharp Corporation

Display Panel Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 151.792 billion |

| Total Market Size in 2028 | USD 200.282 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.70% |

| Study Period | 2020 to 2028 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2028 |

| Segmentation | Technology, Resolution, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Display Panel Market Segmentation:

By Technology

LCD

LED

Others

By Resolution

HD

Full-HD

Ultra HD

By Application

Smartphones & Tablets

PCs & Laptops

Television & Digital Signage

AR/VR Devices

Automotive Displays

Others

By End-User

Consumer Electronics

Medical & Healthcare

Automotive

Media & Entertainment

Military & Defense

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others