Report Overview

Automotive Air Filter Market Highlights

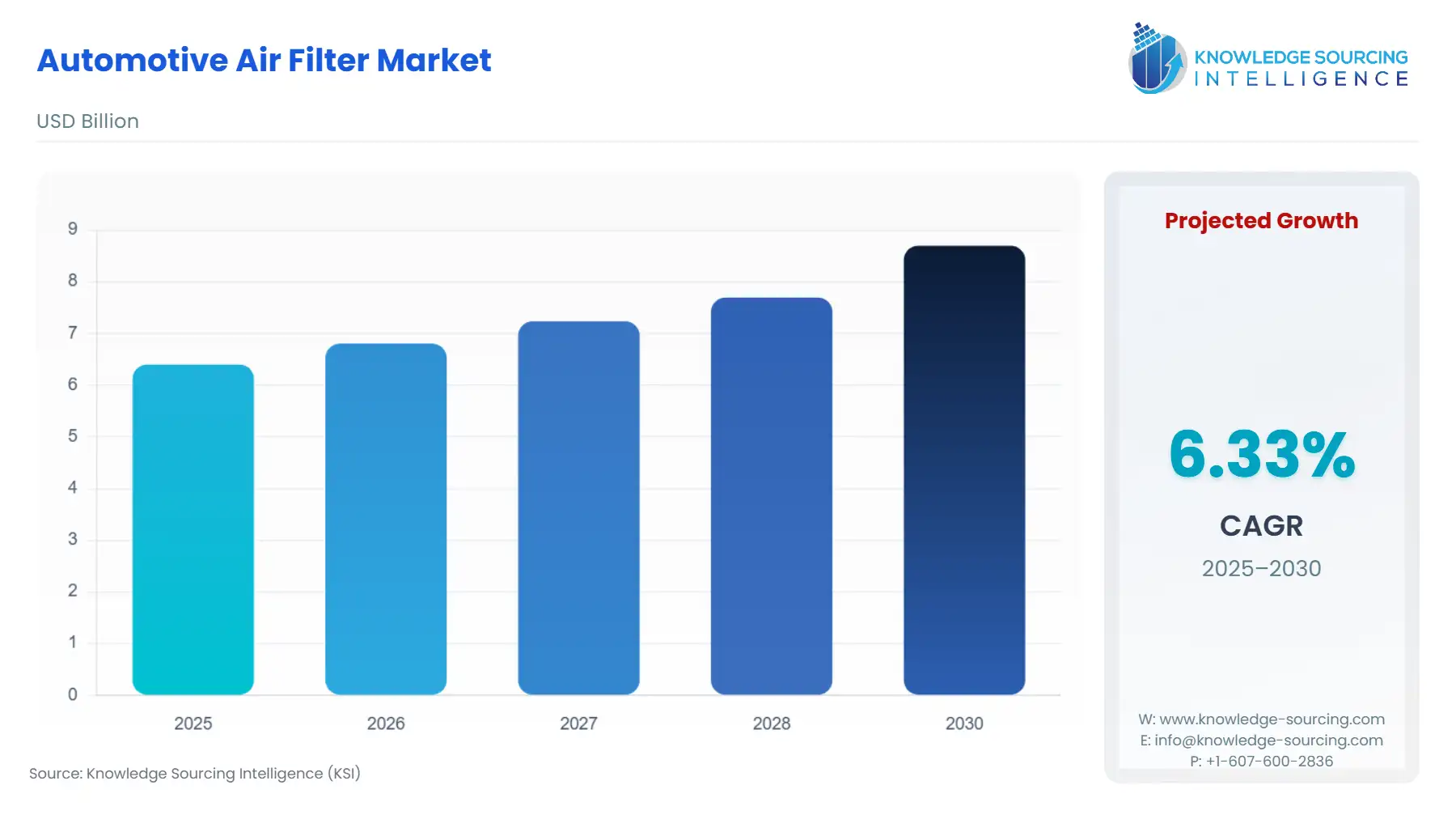

The automotive air filter market is expected to grow at a CAGR of 6.34% from US$6.40 billion in 2025 to US$8.70 billion in 2030.

Market Key Highlights

The automotive air filter market is a foundational component of both internal combustion engine (ICE) and emerging electric vehicle (EV) ecosystems, essential for optimizing engine combustion efficiency and safeguarding occupant health. This market operates on an inherent replacement cycle, establishing strong recurring revenue streams across the original equipment manufacturer (OEM) and aftermarket sales channels. The critical function of air filters, preventing abrasive particles from entering the engine's intake system and filtering pollutants from the cabin air, positions the industry as a direct beneficiary of global regulatory mandates concerning air quality and emissions. The current market dynamic reflects a dual-pronged driver: regulatory compliance demanding advanced engine filtration, and heightened consumer health consciousness driving premium cabin filter adoption.

Automotive Air Filter Market Analysis

Growth Drivers

The primary catalyst for market expansion is the global push for reduced vehicular emissions. Strict environmental legislation, notably the implementation of standards like the US Environmental Protection Agency's (EPA) mobile source regulations and the European Union’s Euro 6 framework, directly necessitates the integration of more sophisticated air filtration systems. Compliance with these rules, which limit particulate matter (PM) and nitrogen oxide emissions, compels vehicle manufacturers to use higher-efficiency air intake filters to ensure optimal air-fuel mixture and prevent engine degradation. This regulatory pressure directly increases the complexity and per-unit value of filters in the OEM channel. Furthermore, the mandatory inspection and maintenance schedules linked to these regulations ensure a predictable, high-volume demand in the aftermarket for compliant replacement parts.

The increasing average age and lifespan of the global vehicle fleet also directly amplify demand. As vehicles operate for longer periods and accumulate higher mileage, the requirement for routine air filter replacement intensifies to maintain fuel efficiency and avoid costly engine damage. In regions with high vehicle density and severe air quality issues, consumer awareness of respiratory health risks has surged. This social shift directly propels the demand for premium cabin air filters, specifically those incorporating activated carbon or high-efficiency particulate air (HEPA) media, which filter out smoke, pollen, and ultra-fine particles, thereby shifting demand toward higher-margin, advanced filter technologies.

Challenges and Opportunities

A significant challenge confronting the market is the automotive industry's accelerating shift toward electrification. Battery-electric vehicles (BEVs) eliminate the need for traditional engine intake air filters, a key product segment. This trend acts as a long-term structural headwind against the intake filter segment. However, this same trend presents a clear opportunity; BEVs require highly efficient cabin air filtration for their Heating, Ventilation, and Air Conditioning (HVAC) systems. Since BEV cabins are often sealed tighter and rely more heavily on robust climate control, the demand is shifting from standard particle filters to advanced, high-performance cabin air filters to protect both the battery system's cooling and the occupants' health. This transition opens a path for suppliers to capitalize on higher-value filtration products. A secondary challenge involves the proliferation of counterfeit filters in the aftermarket, particularly in emerging economies, which undercuts legitimate suppliers on price and poses risks to engine health.

Raw Material and Pricing Analysis

As a physical product, the cost structure of automotive air filters is intrinsically linked to the supply chain of key raw materials, primarily filter media, plastic/polyurethane, and metal. Filter media, consisting predominantly of cellulose, synthetic fibers (polyester, polypropylene), and glass fiber, experiences price volatility driven by pulp market dynamics, petrochemical costs, and energy-intensive manufacturing processes. The shift toward high-performance synthetic and nanofiber media, necessitated by tighter filtration requirements, introduces higher material costs and complex manufacturing steps compared to traditional cellulose paper. Manufacturers manage pricing dynamics by leveraging multi-layer designs that optimize material usage and increase the effective filtration surface area, thereby extending service life and justifying a higher price point in the aftermarket. Supply chain dependencies on specialized fiber producers and resin manufacturers mean that any geopolitical or logistical constraint on these commodities directly influences finished product pricing and overall gross margins.

Supply Chain Analysis

The global automotive air filter supply chain is complex, characterized by concentrated production hubs, particularly in Asia-Pacific and Central Europe. Production is vertically integrated to some extent, with major players manufacturing their own filter media, while others rely on specialized non-woven fabric producers. The OEM channel is highly dependent on Just-In-Time (JIT) logistics to supply vehicle assembly plants, making it sensitive to transportation bottlenecks. The aftermarket segment, which accounts for the lion's share of revenue, relies on complex global distribution networks, including master distributors, regional wholesalers, and vast retail chains. The logistical complexity is compounded by the need to stock a wide variety of Stock Keeping Units (SKUs) to cover the diverse global vehicle parc. Key production dependencies exist in China, Southeast Asia, and Eastern Europe, areas that offer economies of scale for non-woven media and finished filter assembly.

Government Regulations

Government and multilateral regulations are the single most powerful non-market driver of product specification and demand in the air filter industry.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | Environmental Protection Agency (EPA): Mobile Source Emissions Regulations (e.g., Tier 3) | Stricter tailpipe emissions limits for PM and compel OEMs to utilize higher-efficiency intake air filters to ensure optimized combustion. This forces technological upgrades and directly drives demand for premium filter media. |

| European Union | Euro 6 and the upcoming Euro 7 standards | Euro 6 mandates significantly reduced PM emissions, requiring specialized, high-particulate-capture intake filters, particularly for diesel vehicles. The proposal for Euro 7 (released November 2022) to regulate non-exhaust emissions (brakes, tires) and apply to a longer vehicle life will further heighten demand for ultra-fine particle filtration media in both engine and cabin filters. |

| India | Bharat Stage (BS) VI Norms | The leap to BS VI aligns India with Euro 6, mandating a complete overhaul of vehicle emission control systems. This regulatory event created a massive, one-time spike in demand for highly specialized, BS VI-compliant air intake filters and established a new baseline for replacement demand in the aftermarket. |

In-Depth Segment Analysis

By Type: Cabin Air Filters

Demand for cabin air filters is experiencing disproportionately high growth, fundamentally decoupled from the engine's power source. This segment's growth is driven by rising consumer awareness of in-car air quality, particularly in highly polluted urban centers across the Asia-Pacific and Latin America. Post-pandemic consumer behavior has solidified the view of the vehicle cabin as a protected, filtered environment. This awareness translates directly into increased replacement frequency and a strong preference for premium products, specifically those containing activated carbon for odor and gas adsorption, and HEPA-grade filtration media capable of capturing ultra-fine particulates. The segment is further catalyzed by the growth of electric vehicles, which require advanced, high-flow cabin filtration for passenger comfort and to protect sensitive electronics, guaranteeing continued demand regardless of the overall powertrain mix.

By Sales Channel: Aftermarket

The aftermarket represents the overwhelming majority of market volume and is the engine of sustained revenue growth. Demand in this channel is non-cyclical, driven purely by the maintenance schedule of the global vehicle parc. The key demand drivers are the mandatory replacement intervals specified by vehicle manufacturers to preserve warranty and optimal performance, combined with consumer decisions to replace filters for improved fuel economy and vehicle longevity. The proliferation of vehicle models and variations requires aftermarket providers to maintain vast inventories, creating complexity but also entrenching established distribution leaders. The aftermarket is also highly influenced by digital retail, as online sales channels provide consumers with greater price transparency and direct access to high-specification, non-OEM replacement options, intensifying competition among established and emerging brands.

Geographical Analysis

China Market Analysis

China represents the single largest market for automotive air filters globally, driven by an immense and rapidly modernizing vehicle fleet and severe urban air pollution challenges. The local government's implementation of strict emission standards and the high rate of new vehicle production continuously fuels OEM demand. Furthermore, the high concentration of atmospheric pollutants in major metropolitan areas directly accelerates the demand for more frequent replacement and the adoption of high-performance cabin air filters, positioning China's aftermarket as particularly robust and technology-receptive.

US Market Analysis

Demand in the US market is characterized by a large and mature vehicle fleet, translating to significant and stable aftermarket revenue. The market is primarily driven by state-level emission regulations, such as those governed by the California Air Resources Board (CARB), which set the technological bar for the rest of the country, pushing for more efficient particulate filtration. A growing consumer focus on DIY maintenance and a shift in demand towards filters that support the needs of the increasingly popular Light Commercial Vehicle (LCV) and pickup truck segments, due to their higher engine capacity and use in dusty environments, shapes the specific product mix.

Germany Market Analysis

The German market, as a major European automotive manufacturing hub, sets the standard for high-quality OEM air filtration, driven by the exacting standards of German premium manufacturers and the strict mandates of the Euro 6/7 framework. The local demand factor is the high-quality expectation from vehicle owners, who prioritize performance and engine protection, leading to a willingness to pay a premium for certified, original-equipment-quality replacement parts in the aftermarket. The dominance of a few large, vertically integrated European suppliers also defines the competitive landscape.

Brazil Market Analysis

Brazil's automotive air filter market is highly dependent on the stability of its domestic new vehicle production and the vast, dispersed nature of its vehicle fleet, which includes a significant proportion of flex-fuel vehicles. Logistical complexities and the often poor-quality road infrastructure in rural areas lead to higher rates of dust and particulate exposure for vehicles. This environmental factor directly increases the wear and tear on air filters, mandating more frequent replacement cycles and boosting the per-vehicle consumption of replacement filters in the aftermarket.

South Africa Market Analysis

The South African market is defined by a large aftermarket segment due to a high average vehicle age. Demand is critically influenced by the use of vehicles in exceptionally dusty operating environments, particularly on unpaved roads and in mining regions. This creates a specific, acute demand for robust, high-dust-holding capacity intake air filters designed to protect engines from rapid contamination. The market is sensitive to economic factors, with a strong presence of both genuine OEM replacement parts and cost-effective, regionally manufactured alternatives.

Competitive Environment and Analysis

The automotive air filter market is characterized by intense competition among a few globally dominant Tier 1 suppliers and a multitude of regional and local manufacturers. The key competitive differentiator is the ability to develop proprietary filter media that meet increasingly stringent OEM performance and space constraints while maintaining cost competitiveness in the high-volume aftermarket. Strategic positioning is centered on maximizing vehicle parc coverage, optimizing global supply chain logistics, and vertical integration of filter media production.

MANN+HUMMEL

MANN+HUMMEL is a global leader, strategically positioned as an OEM and aftermarket powerhouse with a comprehensive product portfolio spanning air, oil, and fuel filtration. The company’s core strategy centers on continuous innovation in filtration media, particularly in high-performance synthetic and nanofiber technologies, as seen in their MANN-FILTER FreciousPlus cabin air filter designed for enhanced protection against allergens and fine dust. Their positioning as a critical supplier for both ICE and the emerging fuel cell electric vehicle (FCEV) market (developing solutions like test benches for fuel cell humidifiers) demonstrates a strategic move to future-proof their engine-related filtration business.

MAHLE GmbH

MAHLE leverages its extensive global presence and comprehensive thermal management expertise to compete across both the OEM and aftermarket sectors. The company is actively transforming its manufacturing footprint to align with the electrification trend. A key strategic action involves the expansion of its manufacturing operations, such as the announced investment in Morristown, Tennessee, in August 2025, to begin the production of electric compressors for fuel-cell, plug-in hybrid, and full electric vehicles. This strategic capacity addition underscores their commitment to the electric vehicle supply chain, where advanced cabin filtration and thermal management components become central to vehicle performance.

Recent Market Developments

- August 2025: MAHLE GmbH announced a significant investment exceeding $10 million to expand its manufacturing operations in Morristown, Tennessee. The expansion is specifically geared toward the production of electric compressors for fuel-cell electric vehicles, plug-in hybrid vehicles, and full electric vehicles. This development signals a clear shift in investment to support the thermal management and filtration needs of electrified powertrains.

- February 2025: Cummins Inc. announced plans for the full separation of its remaining interest in Atmus Filtration Technologies Inc. (Atmus) through an exchange offer. This corporate action finalizes the strategic move to establish a standalone, publicly traded filtration entity, allowing Cummins to focus on its core power solutions while Atmus (formerly Cummins Filtration) can independently pursue growth strategies within the dedicated filtration market.

- February 2025: MANN+HUMMEL inaugurated a new test bench at its Technology Center in Ludwigsburg. The facility is designed to enable the testing of humidifiers under real conditions to measure and optimize the efficiency and lifetime of fuel cell components. This capital investment targets a critical, specialized filtration and water management need within the rapidly developing hydrogen FCEV market segment.

Automotive Air Filter Market Segmentation

- By Type

- Cabin Air Filters

- Intake Air Filters

- By Vehicles

- HCVs

- LCVs

- Passenger Cars

- Others

- By Sales Channel

- OEM

- Aftermarket

- Online Retail

- By End-User

- On-Road Vehicles

- Off-Road Vehicles

- Industrial/Stationary Engines

- By Geography

- North America (USA, Canada, Mexico)

- South America (Brazil, Argentina, Others)

- Europe (United Kingdom, Germany, France, Italy, Spain, Others)

- Middle East and Africa (Saudi Arabia, UAE, Others)

- Asia Pacific (China, Japan, India, South Korea, Taiwan, Thailand, Indonesia, Others)

Automotive Air Filter Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Air Filter Market Size in 2025 | US$6.40 billion |

| Automotive Air Filter Market Size in 2030 | US$8.70 billion |

| Growth Rate | CAGR of 6.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Air Filter Market |

|

| Customization Scope | Free report customization with purchase |