Report Overview

Global Automotive Intercooler Market Highlights

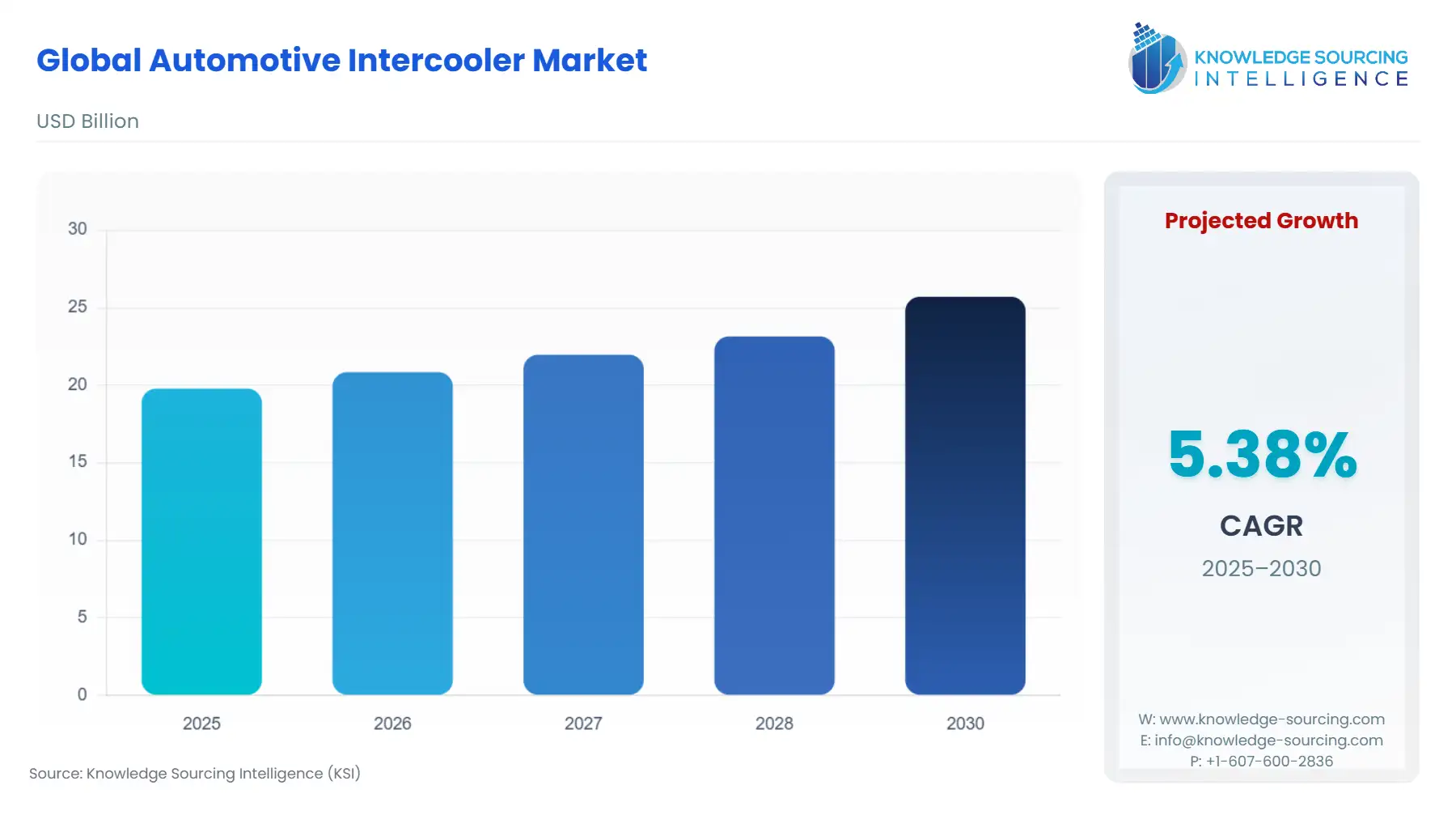

Automotive Intercooler Market Size:

The Global Automotive Intercooler Market is expected to grow from USD 19.777 billion in 2025 to USD 25.702 billion in 2030, at a CAGR of 5.38%.

The global automotive intercooler market currently operates at the critical intersection of regulatory compliance and performance engineering. Intercoolers, as non-optional components in forced induction systems, are intrinsically linked to the efficacy of engine downsizing strategies employed by Original Equipment Manufacturers (OEMs) worldwide. This analysis focuses on how macroeconomic and regulatory dynamics directly mandate or incentivize the integration of these heat-exchange components to meet twin objectives: enhanced power density and reduced tailpipe emissions. The component's function—to cool compressed air before it enters the engine, thereby increasing charge density and volumetric efficiency—translates directly into a quantifiable improvement in combustion, directly driving OEM procurement and, secondarily, stimulating aftermarket upgrade cycles.

Global Automotive Intercooler Market Analysis

- Growth Drivers

The transition to engine downsizing represents the foundational driver of intercooler demand across all vehicle classes. Facing regulatory pressure to reduce fleet-wide average fuel consumption and carbon dioxide emissions, OEMs globally have embraced engine downsizing—reducing the engine's displacement (volume)—while simultaneously integrating forced induction via turbochargers or superchargers. This strategy maintains or even increases power output relative to larger, naturally aspirated engines. Turbochargers compress the intake air, generating significant heat. This thermal energy must be managed, as hotter air is less dense, leading to reduced power and, crucially, a higher propensity for engine knock or pre-ignition, which can cause catastrophic engine damage.

Furthermore, stringent emission regulations globally act as a powerful, non-negotiable demand catalyst. In the United States, the Corporate Average Fuel Economy (CAFE) standards mandate a continually increasing average fuel economy for a manufacturer’s fleet. Automakers utilize the efficiency gains provided by turbocharged, intercooled engines to achieve the necessary fleet-wide average, thereby avoiding substantial financial penalties.

The rising consumer demand for performance and fuel efficiency in a single package provides a tertiary, consumer-pull demand driver. Modern buyers of passenger vehicles, particularly in the rapidly growing SUV and crossover segments, seek the responsive, high-torque driving characteristics associated with forced induction engines, alongside the lower running costs afforded by better fuel economy. The intercooler is an inseparable enabler of this performance-efficiency duality. The performance car segment, in particular, drives demand for advanced and often larger, custom-engineered intercoolers in the OEM space, which then filters into the aftermarket segment for performance upgrades. The enthusiasm for vehicle tuning and modification directly fuels the aftermarket for high-efficiency, often Air-to-Liquid (ATL) or large-capacity Air-to-Air (ATA) units that replace standard OEM components, thereby increasing overall intercooler unit demand.

Finally, advancements in intercooler technology, specifically the transition from Air-to-Air (ATA) to Air-to-Liquid (ATL) systems, are reshaping and intensifying demand. ATL systems, which use an auxiliary liquid coolant loop to cool the charge air, offer superior thermal regulation, greater packaging flexibility, and a shorter air charge path. This short path significantly reduces "turbo lag" and improves engine responsiveness, a critical performance metric for both OEMs and consumers. OEMs designing new high-performance and hybrid powertrains are increasingly specifying ATL intercoolers due to their packaging advantages in compact engine bays and their ability to integrate seamlessly with the engine's overall thermal management system, thus creating an accelerated demand for this more complex, higher-value product type.

- Challenges and Opportunities

The primary market challenge is the long-term, secular transition toward Battery Electric Vehicles (BEVs), which fundamentally do not require the traditional charge-air cooling provided by intercoolers. This shift creates an existential headwind for the conventional market, although its full impact remains a longer-term concern. An immediate challenge involves supply chain instability and trade tariffs, particularly the uncertainty surrounding cross-border tariffs on automotive components manufactured in key production hubs like China. Such tariffs increase component costs for OEMs, potentially incentivizing basic, lower-cost intercooler designs in mass-market vehicles to protect profit margins, which slows the adoption of premium technologies like ATL systems.

Opportunities primarily revolve around hybrid vehicle integration and advanced thermal management systems. Hybrid powertrains still employ intercooled ICEs but require optimized cooling components that operate efficiently across a wider range of engine loads and temperatures. This creates a specific, high-value demand for robust, highly-efficient intercoolers. Furthermore, the push for lighter vehicles to improve fuel economy offers an opportunity for manufacturers to innovate with advanced, lightweight materials such as aluminum alloys and specialized polymers in the core and end-tank construction, driving up the average selling price and value proposition of advanced intercooler units.

- Raw Material and Pricing Analysis

The automotive intercooler is a physical product, primarily a heat exchanger, making the cost and supply of its raw materials critical to market pricing dynamics. Aluminum dominates the production landscape due to its favorable strength-to-weight ratio, excellent thermal conductivity, and corrosion resistance, constituting the majority of the intercooler core and end-tank mass. The price volatility of primary aluminum, driven by global energy costs and geopolitical stability in major producing regions, directly impacts the manufacturing cost base for intercooler suppliers. This is especially true for high-performance units that utilize denser fin structures and thicker core materials. Any sustained increase in aluminum prices directly compresses the profit margins of Tier 1 suppliers, who often operate under long-term, fixed-price contracts with OEMs, leading to pressure to optimize component design for material reduction without compromising thermal performance.

- Supply Chain Analysis

The global automotive intercooler supply chain is highly complex and geographically concentrated. Production is dominated by key manufacturing hubs in Asia-Pacific (China, South Korea) and Europe (Germany, Poland, Czech Republic). This structure creates a significant dependency on efficient cross-continental logistics, specifically in the transport of finished components to major assembly plants in North America and Western Europe. Logistical complexities stem from the bulky nature of the finished component—which is difficult to ship efficiently—and the need for just-in-time (JIT) delivery to OEM assembly lines. The reliance on single-source suppliers for specialized aluminum extruded tubes and complex brazing processes represents a key point of vulnerability in the event of manufacturing disruptions or geopolitical trade conflicts.

The impact of potential tariffs on key components or raw materials, particularly those originating from large Asian production centers, introduces significant instability. If a major assembly region, such as North America or Europe, imposes or raises tariffs on these imported components, the immediate effect is a direct escalation of the intercooler unit cost for the local OEM. This cost increase is generally absorbed or passed on, but it can also force a strategic shift in the supply chain, compelling OEMs and Tier 1 suppliers to accelerate regionalization of manufacturing by establishing new, costly production lines within the tariff-imposing jurisdiction (e.g., Mexico for the U.S. market, or Eastern Europe for Western European OEMs). This supply chain diversification, while increasing resilience, requires substantial capital investment and does not offer an immediate solution to the tariff-driven cost spike.

Automotive Intercooler Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

CAFE Standards (NHTSA, EPA) |

Mandates the continuous improvement of fleet-wide fuel economy. The intercooler is an essential enabler for engine downsizing (turbocharging), which is a primary method for OEMs to achieve compliance and avoid civil penalties. This directly increases the installation rate. |

|

European Union |

Euro 6 / Euro 7 Emission Standards |

Imposes stringent limits on tailpipe emissions (e.g., $\text{NO}_x$, PM). By delivering cooler, denser air, the intercooler optimizes combustion efficiency, which is vital for engine calibration to meet the challenging Euro 6/7 limits, securing high demand for high-efficiency units. |

|

China |

China 6 Emission Standards |

Aligns exhaust emission limits closer to Euro 6 standards. The regulation's severity forces domestic and international OEMs operating in the world's largest automotive market to adopt sophisticated forced induction and cooling technologies, leading to a massive increase in demand volume. |

Global Automotive Intercooler Market In-Depth Segment Analysis

- By Type: Air-to-Liquid (ATL) Intercoolers

Demand for Air-to-Liquid intercoolers is structurally superior in high-performance and high-efficiency hybrid vehicle applications. The ATL system utilizes an auxiliary fluid medium to transfer heat, which, due to water's higher specific heat capacity compared to air, provides a more efficient cooling mechanism, especially during periods of high engine load. This enhanced thermal management is the core demand driver for OEMs producing vehicles where maximum power extraction and consistent performance under stress are imperatives. Furthermore, the ATL system is significantly smaller and more flexible in packaging, as its primary cooling element (the low-temperature radiator) can be placed remotely. This packaging flexibility is critical for modern engine bays that are increasingly constrained by the inclusion of complex emissions control equipment and hybrid battery components.

- By Engine Type: Turbocharged

The Turbocharged engine segment overwhelmingly dominates intercooler demand. A turbocharger operates by using exhaust gas energy to drive a turbine, which spins a compressor, forcing more air into the engine cylinders. This compression inherently generates high heat. The primary, non-negotiable demand driver for an intercooler in this segment is the fundamental law of thermodynamics, which dictates that without cooling, the high-temperature compressed air would severely limit engine performance and pose a serious risk of pre-ignition. OEMs are therefore compelled to install an intercooler in every turbocharged vehicle sold. As the global automotive industry continues its aggressive strategy of engine downsizing—replacing larger naturally aspirated engines with smaller, turbocharged counterparts to meet emission and fuel efficiency standards—the installation rate of intercoolers in this segment sees a corresponding, directly proportional rise in volume.

Global Automotive Intercooler Market Geographical Analysis

- US Market Analysis (North America)

The demand dynamic in the US market is predominantly dictated by the regulatory push from federal CAFE standards. This pressure drives OEMs to increase the penetration of small-displacement, turbocharged engines in the traditionally large-volume light truck and SUV segments. The local factor impacting demand is the strong consumer preference for large vehicles and high horsepower, which necessitates the installation of larger, more robust intercooler units to support sustained high-output performance in turbocharged V6 and V8 engines. Furthermore, the robust aftermarket customization culture drives a significant secondary market for high-performance intercooler upgrades across the entire North American region.

- Brazil Market Analysis (South America)

Brazil's automotive market is characterized by a high proportion of flex-fuel vehicles and a cost-sensitive consumer base. The demand for intercoolers is emerging primarily through the adoption of 1.0L to 1.6L turbocharged engines, a strategy OEMs employ to maximize power from small engines while adhering to local efficiency standards. Local factors, such as high taxation and regulatory compliance costs, pressure OEMs to utilize locally sourced, cost-effective ATA intercooler designs in mass-market vehicles, although the increasing sales of premium, imported models introduce demand for higher-end ATL technology.

- Germany Market Analysis (Europe)

The German market, as the hub of Europe's premium and performance automotive sector, exhibits a high-value demand for intercoolers. This is driven less by volume and more by the necessity of compliance with stringent Euro 6/7 emission standards and the market's entrenched demand for high-speed, high-performance vehicles. The local factor is the density of high-performance vehicle manufacturers who are early adopters of advanced ATL systems, valuing their superior thermal efficiency and compact packaging for integration with complex, sophisticated engine architectures and high-end thermal management loops.

- UAE Market Analysis (Middle East & Africa)

Demand in the UAE is heavily influenced by challenging climatic conditions and high consumer affluence. The extreme ambient temperatures necessitate intercoolers to prevent significant power loss due to heat soak, making them a non-negotiable component for performance retention. The preference for large SUVs and high-end performance vehicles, often running high boost pressures, drives an accelerated demand for high-efficiency, oversized aftermarket and OEM-performance intercoolers that can maintain charge-air temperatures effectively under desert conditions.

- China Market Analysis (Asia-Pacific)

China's market is the global volume engine for intercooler demand, driven by its unparalleled domestic passenger vehicle production scale and the universal application of the China 6 emission standards. The local factors impacting demand include a strong, regulatory-enforced push for the adoption of small-displacement turbocharged engines in mass-market sedans and SUVs, paired with increasing consumer demand for technologically advanced features. This scale necessitates massive, localized production and supply chains, leading to high-volume demand for both basic and advanced intercooler units across multiple vehicle segments.

Global Automotive Intercooler Market Competitive Environment and Analysis

The global automotive intercooler market features a moderately concentrated structure, dominated by established Tier 1 automotive suppliers. Competition centers on technological sophistication, particularly in heat-exchanger core design and material science, and the ability to maintain a global, low-cost manufacturing footprint. Major players leverage long-standing relationships with OEMs, securing supply contracts that lock in large-volume production. The primary competitive differentiator is the ability to miniaturize components while simultaneously increasing thermal dissipation efficiency, a necessity for the constrained packaging environments of modern engine bays.

- Denso Corporation

Denso Corporation, one of the world's largest automotive component manufacturers, leverages its scale and deep systems integration expertise. Their intercooler offering is a part of their broader thermal management and engine control portfolio. Denso’s strategic positioning emphasizes high-volume, quality-assured OEM supply, particularly in the Asia-Pacific region.

- Valeo SA

Valeo positions itself as a technological partner for CO2 emission reduction and electrification components. Their intercooler strategy is centered on providing integrated thermal modules, combining the intercooler with the main engine radiator and often the low-temperature auxiliary radiator for ATL systems.

Automotive Intercooler Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 19.777 billion |

| Total Market Size in 2031 | USD 25.702 billion |

| Growth Rate | 5.38% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Vehicle Type, Engine Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Intercooler Market Segmentation:

- By Type

- Air-to-liquid

- Air-to-Air

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Engine Type

- Supercharged

- Turbocharged

- By Design Type

- Top Mounted

- Front Mounted

- Side Mounted

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others