Report Overview

Global Automotive Parking Sensor Highlights

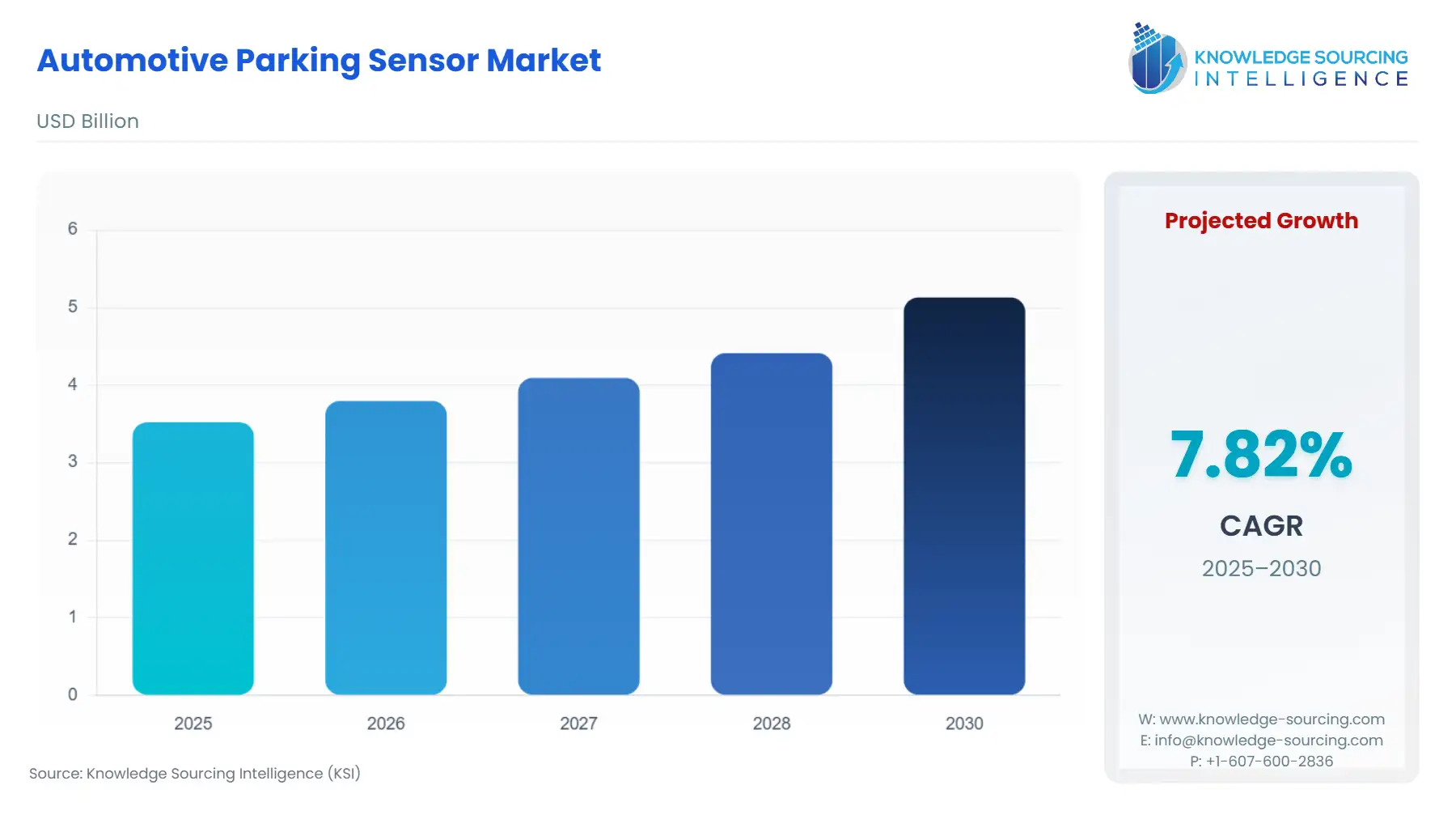

Automotive Parking Sensor Market Size:

The Global Automotive Parking Sensor Market is expected to grow from USD 3.521 billion in 2025 to USD 5.131 billion in 2030, at a CAGR of 7.82%.

Automotive Parking Sensor Market Trends:

An automotive parking sensor is a type of proximity sensor that is used to guide and assist the driver in parking the vehicle. The parking sensor warns the driver of any obstacles in the way while parking the car. The parking sensors are either present in the front of the vehicle, the rear of the vehicle, or both ends of the vehicle. The growing popularity of smarter parking systems and solutions due to the rising number of accidents is significantly fueling the demand for parking sensors across different car model manufacturers. Rising investments in ADAS solutions will continue to bolster the growth of the automotive parking sensor market during the forecast period.

Automotive Parking Sensor Market Segment Analysis:

- By Sensor Type

By sensor type, the global automotive parking sensor market has been segmented into front parking sensors and reverse parking sensors. The most widely used are reverse parking sensors, as they ease the parking process and thus hold a significant share of the market

- By Technology

By technology, the global automotive parking sensor market has been segmented as ultrasonic and electromagnetic. Of these, electromagnetically triggered sensors are used more as they provide a wider view while parking and can be easily mounted inside the bumper of a car.

- By End-User

By end-user, the global automotive parking sensor market has been segmented into OEMs and aftermarkets.

OEMs hold a significant share in the market as most of the major car companies now manufacture cars that have parking sensors already, whereas Aftermarket can grow its share over the coming years.

- By Vehicle Type

By application, the global automotive parking sensor market has been segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles seem to hold a significant share of the market due to the demand for more passenger cars and better parking aids

- By Geography

Geographically, the global automotive parking sensor market is segmented as follows: North America, Europe, the Middle East & Africa, Asia-Pacific, and South America. Currently, the Americas hold a great share of the market and this is expected to increase over the coming years. Europe also holds a significant number of shares, which is said to increase over the coming years

Automotive Parking Sensor Market Competitive Intelligence:

The global automotive parking sensor market is competitive owing to the presence of well-diversified global and regional players. The key players are Robert Bosch GmbH, Valeo, Continental AG, Xvision Ltd, Scorpion Automotive Ltd, Aptiv plc, and Murata Manufacturing Co., Ltd., among others.

Automotive Parking Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.521 billion |

| Total Market Size in 2031 | USD 5.131 billion |

| Growth Rate | 7.82% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Sensor Type, Technology, Sales Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Parking Sensor Market Segmentation:

- By Sensor Type

- Front Parking

- Reverse Parking

- By Technology

- Ultrasonic

- Electromagnetic

- By Sales Channel

- OEMs

- Aftermarket

- By Vehicle Type

- Passenger

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America