Report Overview

Global B2C E-Commerce Market Highlights

B2C E-Commerce Market Size:

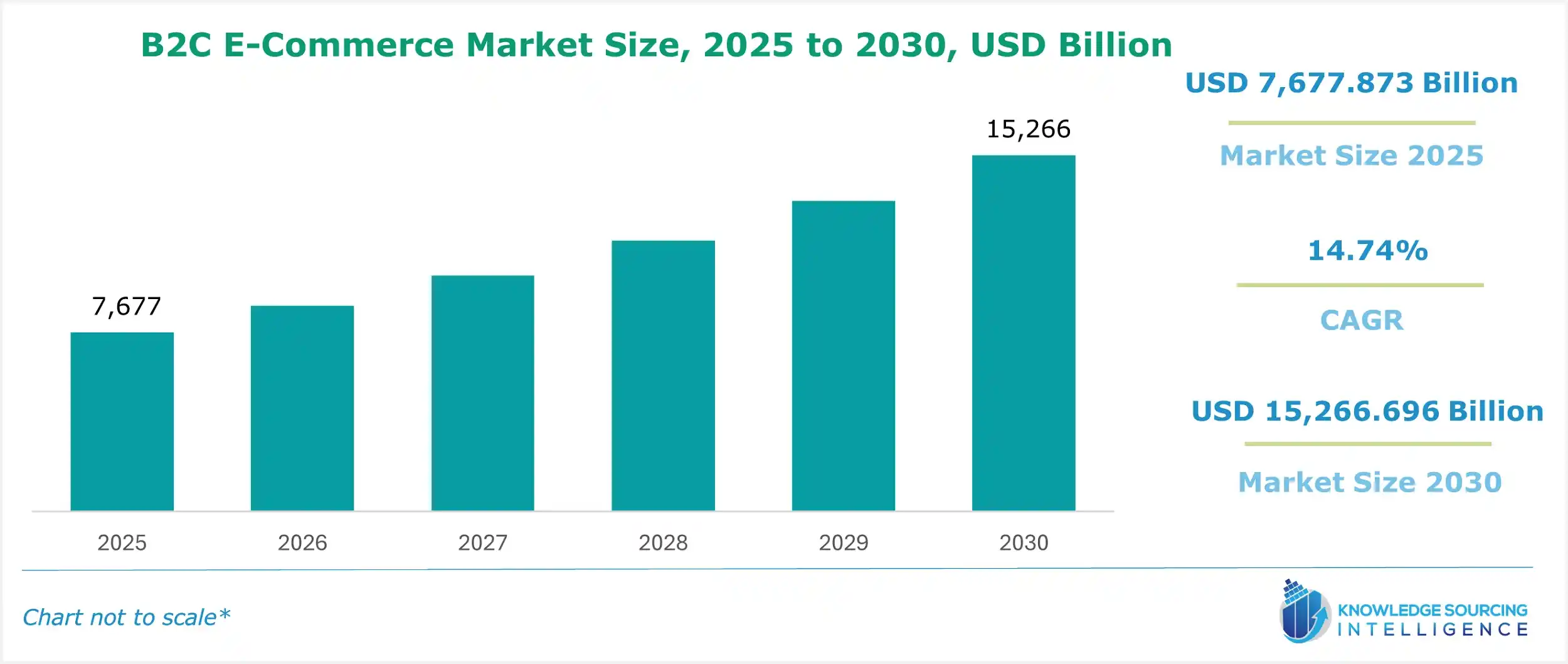

The global B2C E-commerce market will grow from USD 7,677.873 billion in 2025 to USD 15,266.696 billion in 2030 at a CAGR of 14.74%.

Introduction to the B2C E-commerce Market:

The Business-to-Consumer (B2C) e-commerce market represents a dynamic and rapidly evolving sector where businesses sell goods and services directly to individual consumers through digital platforms. This model, encompassing online retail, digital marketplaces, and direct-to-consumer brands, has transformed the way consumers shop, offering unprecedented convenience, variety, and accessibility.

The B2C e-commerce market, a cornerstone of the online retail market, is transforming consumer shopping through e-tailing and digital commerce B2C platforms. Consumer e-commerce trends emphasize seamless, personalized experiences, driving adoption of omnichannel commerce that integrates online, mobile, and physical touchpoints. Direct-to-consumer (D2C) brands are reshaping the landscape by bypassing traditional retail, offering tailored products and enhanced customer engagement. Advanced technologies like AI and data analytics optimize user experiences and supply chain efficiency. As consumer expectations evolve, the B2C e-commerce market empowers businesses to deliver innovative, scalable solutions, redefining retail for industry leaders.

B2C e-commerce involves transactions between businesses and end consumers, typically conducted through websites, mobile apps, or online marketplaces like Amazon, eBay, or regional platforms such as Shopee and Mercado Libre. Unlike Business-to-Business (B2B) or Consumer-to-Consumer (C2C) models, B2C focuses on delivering products or services directly to individuals for personal use. The market spans diverse sectors, including retail (clothing, electronics, groceries), digital services (streaming, software subscriptions), and experiential offerings (travel, event tickets). Its significance lies in its ability to bridge geographical barriers, enabling businesses to reach global audiences while offering consumers personalized and seamless shopping experiences.

In 2024, global retail e-commerce sales reached an estimated $6 trillion, with projections indicating a 31% growth over the coming years, driven largely by B2C transactions. This growth reflects the increasing reliance on online shopping, particularly in emerging markets where rising internet access and smartphone adoption are fueling demand. For instance, regions like Southeast Asia and Latin America have seen significant e-commerce uptake due to expanding middle-class populations and improved digital infrastructure.

B2C E-commerce Market Trends:

The B2C e-commerce market is changing with sustainable practices, focusing on eco-friendly packaging to satisfy conscious consumer demands. Ethical shopping drives brands to align with values like transparency and sustainability, boosting customer loyalty programs that reward responsible purchases. Instant delivery and click-and-collect services enhance convenience, catering to fast-paced consumer lifestyles. Efficient return management systems streamline operations, improving customer trust and retention. Innovations in AI-driven logistics and data analytics optimize these processes, enabling personalized experiences. As consumer priorities shift toward sustainability and convenience, these trends are reshaping the e-commerce landscape, offering scalable, value-driven solutions for industry experts.

B2C E-commerce Market Drivers:

- Widespread Internet and Smartphone Penetration

The global expansion of internet access and smartphone adoption is a cornerstone of B2C e-commerce growth. By 2025, over 80% of the global population is expected to own a smartphone, with developing regions like Africa and Southeast Asia driving significant increases. High-speed internet, particularly 5G, has enhanced mobile commerce, enabling faster load times and seamless user experiences. For example, in India, the rollout of 5G networks has led to a 20% surge in mobile-based e-commerce sales on platforms like Flipkart, as consumers leverage faster connectivity for browsing and purchasing. This accessibility empowers consumers to shop on the go, boosting impulse purchases and increasing transaction volumes. Additionally, affordable smartphones and data plans have expanded e-commerce access to rural and underserved areas, creating new consumer bases for businesses.

- Advancements in Technology and AI

Artificial intelligence (AI), machine learning, and related technologies are transforming B2C e-commerce by personalizing customer experiences, optimizing operations, and enhancing scalability. AI-powered tools like recommendation engines, chatbots, and predictive analytics improve customer engagement and conversion rates. In 2024, Amazon’s AI-driven product recommendations increased average order values by 15%, demonstrating the impact of tailored suggestions. Similarly, headless commerce architectures, which separate front-end and back-end systems, enable businesses to deliver flexible, omnichannel experiences across devices, a trend highlighted as a key market growth driver. Augmented Reality (AR) is another innovation, allowing consumers to visualize products in real-world settings. IKEA’s Place app, for instance, boosted conversion rates by 30% in 2024 by enabling customers to preview furniture in their homes. These technologies enhance user experience and streamline inventory management and logistics, reducing operational costs.

- Shifting Consumer Expectations

Modern consumers demand convenience, speed, and personalization, reshaping how e-commerce businesses operate. The rise of same-day delivery, seamless payment systems, and tailored product offerings has become a competitive necessity. In 2024, Walmart expanded its drone delivery service to 1.8 million U.S. households, reducing delivery times and increasing customer satisfaction by 25%. Social commerce, where purchases occur directly on platforms like Instagram and TikTok, is also gaining momentum, with global sales projected to reach a substantial figure by 2027. Consumers also value sustainability, prompting platforms like Zalando to launch a “Pre-Owned” clothing category in 2024, appealing to eco-conscious shoppers and reducing waste. These shifts compel businesses to invest in faster logistics, intuitive interfaces, and sustainable practices to meet evolving demands.

- Growth of Emerging Markets

Emerging markets, particularly in Asia, Africa, and Latin America, are fueling B2C e-commerce growth due to rising disposable incomes, urbanization, and digital infrastructure improvements. In Nigeria, Jumia reported a 25% increase in active users in 2024, driven by a growing middle class and demand for electronics and fashion. Cross-border e-commerce is also thriving, with platforms like AliExpress reporting a 15% increase in international sales in 2024, driven by demand for affordable goods. Government initiatives, such as India’s Digital India program, have bolstered e-commerce by improving internet connectivity and financial inclusion, enabling millions to access online marketplaces. These markets represent significant growth opportunities as they integrate into the global digital economy.

B2C E-commerce Market Restraints:

- Logistical and Supply Chain Challenges

Efficient logistics are critical to e-commerce success, but high shipping costs, last-mile delivery inefficiencies, and supply chain disruptions remain significant barriers. In 2024, global shipping delays caused by geopolitical tensions increased logistics costs for e-commerce platforms by 10-15%, impacting profitability. Rural areas in emerging markets often lack reliable delivery infrastructure, limiting market penetration. For example, in Africa, only 30% of rural areas have access to reliable last-mile delivery services, constraining e-commerce growth. Businesses must invest in localized warehousing and alternative delivery methods, such as drones or partnerships with local couriers, to overcome these hurdles.

- Data Privacy and Security Concerns

Growing consumer awareness of data privacy and increasing cyber threats pose significant challenges. High-profile data breaches, such as the 2024 Shopify incident affecting 200,000 customers, have eroded consumer trust and prompted stricter regulatory scrutiny. Compliance with regulations like the EU’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act (CCPA) adds operational complexity and costs, particularly for smaller retailers. In 2024, GDPR fines for non-compliance in the e-commerce sector reached €1.2 billion, deterring some businesses from expanding into Europe. Robust cybersecurity measures and transparent data practices are essential to maintain consumer confidence.

- Intense Competition and Market Saturation

The B2C e-commerce market is highly competitive, with global giants like Amazon and Alibaba dominating alongside regional players. Small and medium-sized businesses struggle to compete with the pricing power, logistics networks, and brand recognition of these giants. In 2024, Amazon’s dominance in the U.S. led to a 20% revenue decline for small e-commerce retailers, as consumers favored its fast delivery and vast product range. Market saturation in mature regions like North America and Western Europe also limits growth opportunities, pushing businesses to differentiate through niche offerings or superior customer experiences.

- Economic Uncertainty

Macroeconomic factors, such as inflation and fluctuating consumer spending, can dampen e-commerce growth. In 2025, economic slowdowns in the Eurozone have reduced discretionary spending on non-essential goods like luxury items and electronics, impacting e-commerce sales. In the U.S., inflation rates hovering around 3% in early 2025 have prompted consumers to prioritize essential purchases, affecting categories like fashion and consumer electronics. Businesses must adapt by offering competitive pricing, flexible payment options, or loyalty programs to sustain demand.

B2C E-commerce Market Segmentation Analysis:

- By Product, the apparel and accessories segment is rising significantly

Apparel and Accessories is a leading product segment in B2C e-commerce, encompassing clothing, footwear, jewelry, and related items. This segment thrives due to its broad consumer appeal, frequent purchase cycles, and the influence of social media and fast fashion trends. In 2024, apparel and accessories accounted for a substantial portion of global e-commerce sales, driven by the rise of online-only brands, sustainability initiatives, and the growing demand for personalized shopping experiences.

The segment benefits from high consumer demand for variety, affordability, and convenience, particularly among younger demographics like Gen Z and Millennials. Social commerce platforms, such as Instagram and TikTok, have amplified sales, with influencers and shoppable posts driving impulse purchases. For instance, in 2024, Shein reported a 30% increase in global sales, attributed to its trend-driven, affordable clothing and robust social media marketing. Additionally, sustainability trends have boosted demand for second-hand and eco-friendly apparel, with platforms like Zalando launching a “Pre-Owned” category in 2024, which increased customer engagement by 20%.

The segment is propelled by technological innovations like augmented reality (AR) for virtual try-ons, which enhance customer confidence in online purchases. For example, ASOS introduced an AR fitting tool in 2024, reducing return rates by 15%. Fast fashion’s rapid inventory turnover and competitive pricing continue to attract price-sensitive consumers, while direct-to-consumer (DTC) brands leverage data analytics to offer personalized styles. However, challenges like high return rates (often 30-40% for apparel) and environmental concerns over fast fashion’s waste are prompting businesses to adopt circular economy models, such as rental and resale platforms.

- By Device, Smartphones are expected to hold a larger market share

Smartphones have become the primary device for B2C e-commerce, reflecting their ubiquity, portability, and seamless integration with daily consumer routines. Mobile commerce (m-commerce) has become the preferred shopping channel globally, driven by user-friendly apps, mobile-optimized websites, and widespread 5G adoption.

In 2024, smartphones accounted for over 60% of global e-commerce traffic, with mobile sales contributing significantly to the $6 trillion retail e-commerce market. The rise of 5G networks has enhanced mobile shopping experiences by reducing latency and enabling richer content, such as video-based product demos. In India, Flipkart reported a 20% increase in mobile-based sales following the 5G rollout, as faster connectivity drove higher engagement. Social commerce platforms, accessible primarily via smartphones, have further boosted this segment, with TikTok Shop generating $1.2 billion in U.S. sales in 2024.

Smartphones enable seamless, on-the-go shopping, supported by mobile payment systems like Apple Pay and Google Wallet, which streamline transactions. AI-powered apps enhance personalization, with Amazon’s mobile app using machine learning to tailor product recommendations, increasing order values by 15% in 2024. Progressive Web Apps (PWAs) and improved mobile UX design have reduced cart abandonment rates, while push notifications and location-based marketing drive impulse purchases. The segment’s dominance will likely intensify as 6G networks and foldable smartphones emerge.

B2C E-Commerce Market Geographical Outlook:

- The Asia Pacific market is showing considerable growth

The Asia Pacific region is the largest and fastest-growing B2C e-commerce market, driven by its massive population, rapid digital adoption, and economic growth. Countries like China, India, and Southeast Asian nations, like Indonesia and Thailand, lead the region’s e-commerce surge.

In 2024, Asia Pacific accounted for over 50% of global e-commerce sales, with China alone contributing $2.8 trillion to the market. China’s dominance stems from platforms like Alibaba and JD.com, which leverage advanced logistics and AI to serve millions. India’s e-commerce market grew by 25% in 2024, driven by rising middle-class incomes and government initiatives like Digital India. Cross-border e-commerce is also significant, with AliExpress reporting a 15% increase in international sales in 2024, driven by demand for affordable goods. Southeast Asia, particularly Indonesia and Thailand, is emerging as a hotspot, with Shopee recording a 22% user growth in 2024.

The region benefits from high smartphone penetration (over 75% in 2025), affordable data plans, and a young, tech-savvy population. Social commerce and live-streaming, particularly in China and Southeast Asia, have transformed shopping behaviors, with platforms like Pinduoduo driving group-buying trends. Government support, such as India’s digital infrastructure investments, enhances market access. The region will remain a global leader, with emerging markets like Indonesia and Vietnam contributing significantly.

Products Offered by Key Companies:

- Amazon: Amazon is among the biggest e-commerce platforms in the global market, supplying a wide range of products, from electronics to fashion, and household care. The company generally acts as a platform, allowing retailers to list their products for consumers. Its product range includes smartphones, fashion products, skincare, and sports equipment, among others.

- eBay: eBay aims to enhance the commercial experience of retailers and consumers, along with offering a wide range of products. The company offers products like electronics, automotive, sports, and health & beauty, among others.

Recent Developments in the B2C E-Commerce Market:

- In 2024, Zalando launched a “Pre-Owned” clothing category, reducing waste and appealing to environmentally conscious shoppers.

- In October 2023, the Ministry of Consumer Affairs, Food & Public Distribution of the Indian Government organized a conference for the setting up of an Online Dispute Resolution (ODR) platform to ease the cross-border B2C e-commerce trade.

List of Top B2C E-Commerce Companies:

- Amazon

- E-Bay

- Alibaba Group Holdings Ltd

- Jingdong (JD.com Inc.)

- Flipkart

B2C E-Commerce Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| B2C E-Commerce Market Size in 2025 | USD 7,677.873 billion |

| B2C E-Commerce Market Size in 2030 | USD 15,266.696 billion |

| Growth Rate | CAGR of 14.74% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in B2C E-Commerce Market |

|

| Customization Scope | Free report customization with purchase |

B2C E-commerce Market is analyzed into the following segments:

- By Product

- Apparel and Accessories

- Travel

- Electronics

- Books, Music

- Health

- Others

- By Device

- PCs

- Smart Phone

- Tablet

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America