Report Overview

Global Bio-organic Fertilizer Market Highlights

Bio-organic Fertilizer Market Size:

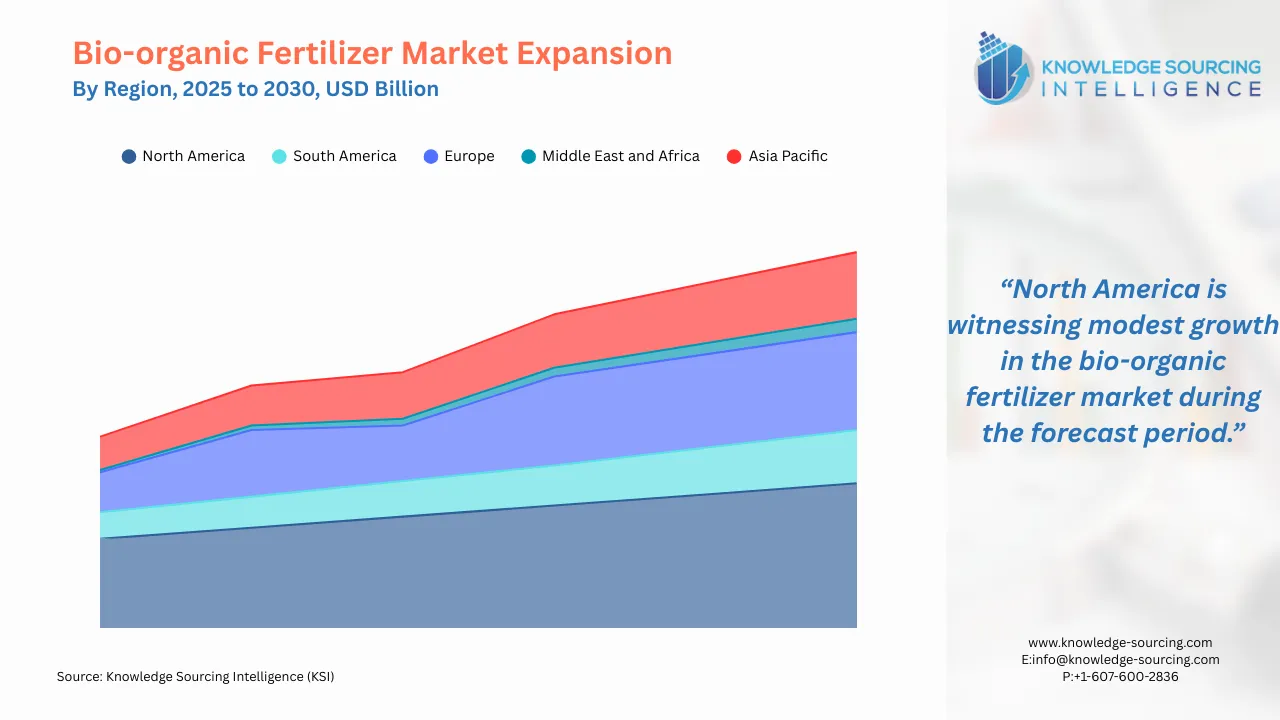

The Global bio-organic fertilizer market is predicted to expand at a CAGR of 16.31% to account for US$6.697 billion by 2030 from US$3.147 billion in 2025.

Bio-organic fertilizers are a category of organic fertilizers that include a diverse range of live microorganisms or dormant cells from effective microbial strains. These fertilizers enhance the quality and functionality of the soil, leading to improved growth, characteristics, and yield of agricultural products.

The bio-organic fertilizers market is experiencing significant growth, driven by increasing demand for sustainable agricultural practices, technological advancements, and rising awareness of environmental issues related to conventional fertilizers. As the global population continues to grow, the need for efficient and eco-friendly agricultural inputs becomes paramount.

Bio-organic fertilizers, which are derived from natural sources such as plant and animal matter, play a crucial role in promoting sustainable agriculture. These fertilizers enhance soil fertility and contribute to ecosystems' health by reducing chemical runoff and improving biodiversity.

Bio-organic Fertilizer Market Drivers:

- Growing adoption of organic farming

The rising adoption of organic farming is one of the significant growth drivers in the bio-organic fertilizer market, which is influenced by a number of interlinked factors. The first is a growing consumer demand for organic products, which has been fueled by increased awareness of health and environmental issues. Consumers are increasingly demanding chemical-free food options, prompting farmers to switch to organic practices to cater to this demand. Government initiatives also play an important role in encouraging organic farming by offering subsidies, grants, and other favorable policies that reduce the barriers for farmers opting for sustainable methods.

The environmental sustainability of organic farming is increasingly being recognized. Organic practices improve soil health and biodiversity and reduce chemical runoff, thus addressing climate change and ecological degradation concerns. As these issues arise, more farmers are turning to organic methods. Hence, there is a need for the use of bio-organic fertilizers to maintain soil fertility and support crop production sustainably.

Technological changes also make this possible. New agricultural technology, such as precision farming and crop management, allows farmers to use bio-organic fertilizers more efficiently, making them apply them according to the specific needs of crops and soil conditions. The health benefits associated with organic produce, including lower exposure to harmful chemicals, are also increasingly recognized by consumers, further encouraging farmers to adopt organic practices.

Furthermore, growing awareness of health and environmental issues drives a rising consumer demand for organic products. The 25th edition of the yearbook "The World of Organic Agriculture," co-published by the Research Institute of Organic Agriculture (FiBL) and IFOAM – Organics International, highlighted a remarkable increase in both the area of land and the number of farms engaged in organic agriculture in 2022. Supported by the Swiss State Secretariat for Economic Affairs (SECO), the Sustainability Fund of Coop Switzerland, and NürnbergMesse, which organizes the BIOFACH trade fair, this annual survey serves as a vital resource for understanding developments in organic agriculture worldwide.

Bio-organic Fertilizer Market Geographical Outlook:

- The United States in the North American region is expected to hold significant market shares.

The bio-organic fertilizer market’s growth in the United States is characterized by a robust increase in demand, driven by consumer preferences, government support, and advancements in agricultural practices.

One of the key factors contributing to this growth is the increasing consumer demand for organic produce. As more consumers prioritize health and sustainability, there has been a notable shift towards organic farming practices. According to the U.S. Department of Agriculture (USDA), over 17,445 certified organic farms are in the country, highlighting a significant commitment to organic agriculture. Farmers are increasingly utilizing bio-organic fertilizers to meet certification requirements and consumer expectations for high-quality, chemical-free products. This trend is particularly evident in states such as California, Vermont, New York, and Maine, where many conventional farms are transitioning to organic methods.

Furthermore, the United States witnessed an increase in its organic farms from 2008. For instance, in 2008, there were 14,540 certified organic farms covering 4.1 million acres, which rose to 17,445 farms and 4.9 million acres in 2021. This expansion reflects a broader trend towards sustainable agricultural practices prioritizing health and environmental stewardship. The increasing number of certified organic farms indicates a growing commitment among U.S. farmers to adopt organic methods, driving the demand for bio-organic fertilizers.

Government initiatives also play a crucial role in promoting the use of bio-organic fertilizers in the U.S. Various federal and state programs provide financial incentives and support for farmers adopting sustainable practices. These initiatives help reduce the economic burden associated with transitioning to organic farming and foster a conducive environment for the bio-organic fertilizer market’s expansion. Additionally, regulatory frameworks promoting organic farming further enhance biofertilizer market opportunities.

Bio-organic Fertilizer Market Company Profiling:

- Rizobacter: The strategic focus of Rizobacter in the bio-organic fertilizer market is the innovation of biological solutions for improved agricultural productivity and sustainability. The company focuses on developing and applying Plant Growth Promoting Rhizobacteria (PGPR) as an important component in increasing phosphorus availability in soil. This strategy corresponds with growing demands for sustainable agriculture and farm practices, minimizing chemical inputs while maximizing yields. One of the key elements of Rizobacter's strategy is the use of PGPR microorganisms, specifically Pseudomonas fluorescens, which have been meticulously selected and researched for their beneficial properties. These microorganisms not only solubilize phosphorus, making it more accessible to plants but also produce antibiotics and siderophores that protect crops from pathogenic fungi. This dual action enhances plant health and resilience, promoting overall growth and productivity. Rhizobacter’s products are improving the efficiency of phosphorus fertilizers and filling one of the most important gaps in the agricultural nutrient supply for staple crops like wheat, corn, and sunflowers.

- Agrinos: Agrinos emphasizes the development of biological fertilizers that enhance soil health and crop productivity. By utilizing beneficial microorganisms and organic materials, Agrinos aims to create products that improve nutrient availability and promote sustainable farming practices. A significant aspect of Agrinos' strategy involves investing in research and development to innovate and improve its product offerings. This includes developing new formulations that combine various biological agents to optimize plant growth and resilience against pests and diseases. Agrinos aligns its business model with the growing demand for sustainable agricultural practices. By promoting bio-organic fertilizers, the company addresses environmental concerns associated with synthetic fertilizers, such as soil degradation and water pollution, thereby appealing to environmentally conscious farmers.

List of Top Bio-organic Fertilizer Companies:

- Agrinos

- Ingress Bio

- NatureSafe

- Tata Chemicals Limited

- Coromandel

Bio-organic Fertilizer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bio-organic Fertilizer Market Size in 2025 | US$3.147 billion |

| Bio-organic Fertilizer Market Size in 2030 | US$6.697 billion |

| Growth Rate | CAGR of 16.31% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Bio-organic Fertilizer Market |

|

| Customization Scope | Free report customization with purchase |

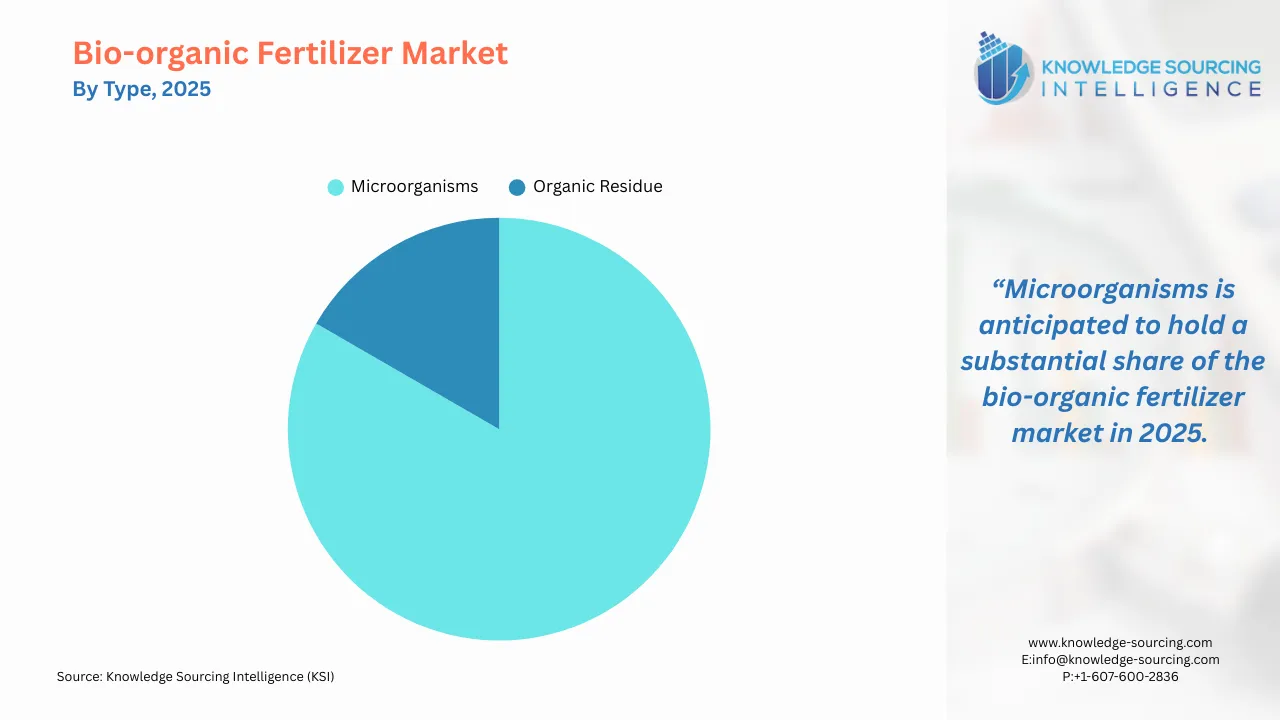

The bio-organic fertilizer market is analyzed into the following segments:

- By Type

-

- Microorganisms

- Organic Residue

- By Crop Type

-

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

- Others

- By Application

-

- Soil Treatment

- Seed Treatment

- Others

- By Geography

-

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Bio-organic Fertilizer Market Size:

- Bio-organic Fertilizer Market Key Highlights:

- Bio-organic Fertilizer Market Drivers:

- Bio-organic Fertilizer Market Geographical Outlook:

- Bio-organic Fertilizer Market Company Profiling:

- List of Top Bio-organic Fertilizer Companies:

- Bio-organic Fertilizer Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: