Report Overview

Global Biobetters Market - Highlights

Biobetters Market Size:

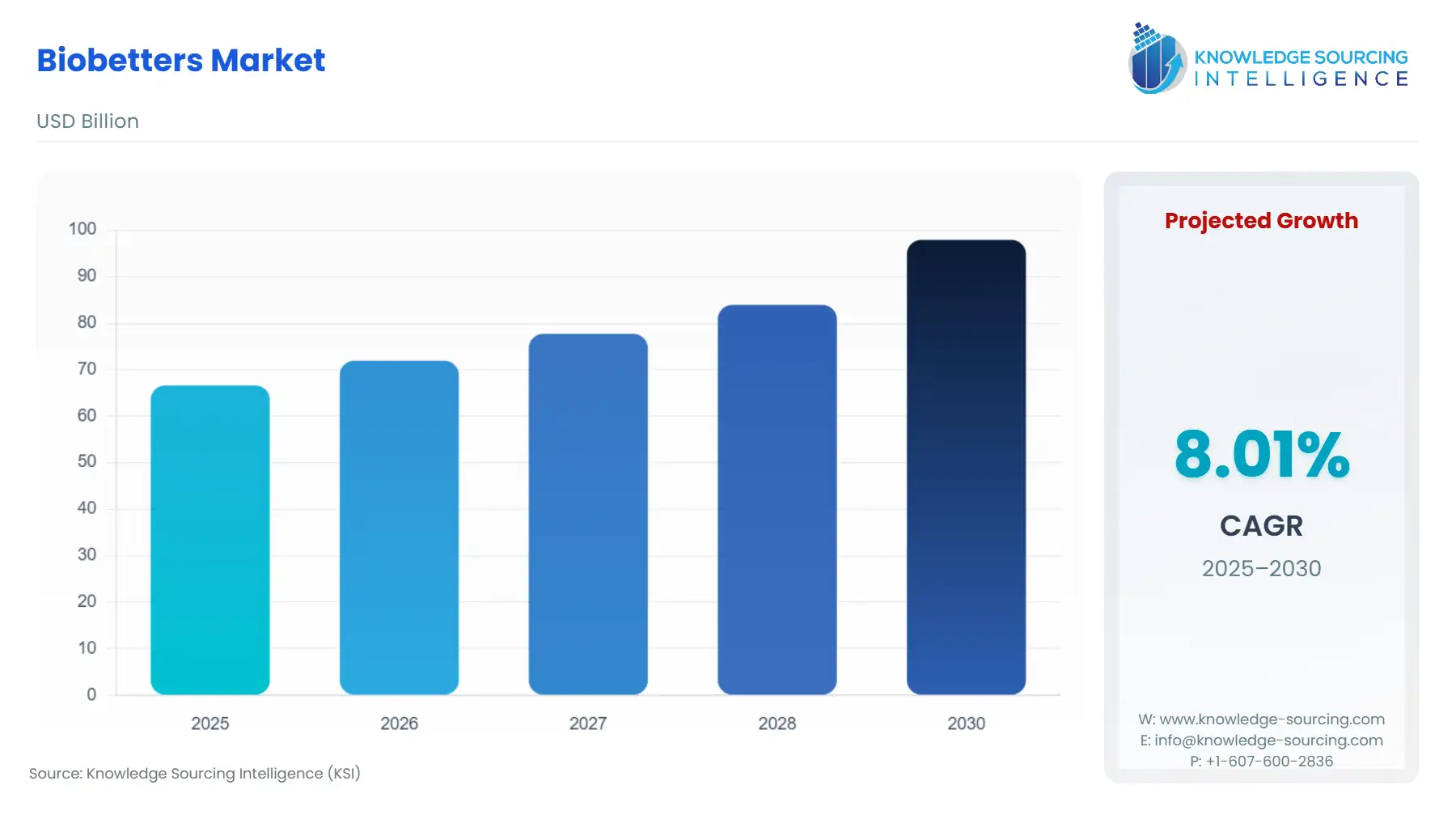

The Biobetters Market is anticipated to expand from USD 66.603 billion in 2025 to USD 97.907 billion in 2030, registering an 8.01% CAGR.

The market for biobetters—enhanced versions of existing biopharmaceuticals—is transitioning from an opportunistic niche to a strategic pillar within the global pharmaceutical industry. Biobetters are intentionally designed to improve upon a reference product's clinical attributes, such as reduced immunogenicity, greater efficacy, or improved patient compliance through convenient dosing regimens. This class of medicine represents a critical response to two structural market forces: the imperative to replace aging, high-value patent-expired biologics, and the concurrent need to leverage sophisticated engineering techniques to address previously untreatable or difficult-to-treat biological targets. The complexity of these molecules necessitates substantial capital investment in R&D and specialized manufacturing capacity, positioning the sector as a domain for technologically advanced and well-capitalized biopharmaceutical entities.

Global Biobetters Market Analysis

Growth Drivers

Technological innovation in molecular modification is the foremost catalyst propelling demand for the Global Biobetters Market. Sophisticated techniques in protein engineering, such as site-specific PEGylation and glycoengineering, allow developers to fundamentally alter a biologic’s profile. PEGylation, for instance, covalently links polyethylene glycol (PEG) chains to the therapeutic protein. This modification increases the hydrodynamic size of the molecule, which slows its renal clearance and, critically, extends the half-life. The direct market impact is the reduced dosing frequency required for the patient, which significantly increases patient adherence and preference, translating directly into higher demand for the biobetter version over the originator product. Furthermore, reduced dosing lessens the administrative burden on healthcare providers.

The recent infusion of Artificial Intelligence (AI) and Machine Learning (ML) into drug discovery acts as a profound accelerant for biobetter development. Generative AI platforms are capable of de novo design, meaning they can engineer entirely novel protein sequences optimized for specific therapeutic functions, stability, and manufacturability, a process that is often faster and more precise than traditional trial-and-error methods. This accelerates the creation of complex modalities like bispecific antibodies or enhanced Antibody-Drug Conjugates (ADCs) with optimized linker-payload stability. The ability to program superior attributes into a molecule at the design stage effectively creates demand for novel biobetters that can tackle "undruggable" targets or deliver significantly better therapeutic indices than existing treatments.

The unrelenting rise in the global burden of chronic and age-related diseases necessitates a continuous supply of improved therapeutics. Conditions such as various cancers, rheumatoid arthritis, and Crohn's disease, which are often treated with biologics, require long-term management. As the number of patients demanding treatment for these prevalent and complex diseases grows, there is an explicit demand for biobetters that offer better safety profiles, lower immunogenicity risks, and superior efficacy. For instance, in oncology, demand shifts toward biobetters in the form of next-generation ADCs, which are designed to selectively deliver a cytotoxic payload directly to cancer cells, reducing systemic toxicity and improving the therapeutic window compared to earlier versions. This evolution of treatment methodology directly pulls demand away from older, less-targeted therapies and toward engineered alternatives.

Further, the sophistication of analytical and manufacturing technologies now enables the commercial realization of highly complex molecular structures. Advancements in host cell line development (e.g., Chinese Hamster Ovary (CHO) cells) and process chromatography allow manufacturers to consistently produce and purify novel biobetters at a commercial scale, meeting the stringent quality standards of global regulators. This technical capability reduces the fundamental risk associated with scaling complex novel biologics, encouraging more companies to dedicate resources to developing biobetters with high structural complexity, thereby increasing their market availability and subsequent demand.

Challenges and Opportunities

The primary constraint facing the biobetters market is the exceptionally high cost and complexity of the regulatory pathway required for a novel biological license, contrasted with the abbreviated pathway for biosimilars. This financial barrier limits the pool of developing entities, constraining the pace of market entry. An opportunity lies in geographic expansion into emerging markets where the biopharmaceutical landscape is rapidly maturing, and government health systems are increasingly prioritizing higher-efficacy treatments. Furthermore, the development of next-generation Antibody-Drug Conjugates (ADCs) with novel, proprietary payloads and site-specific conjugation technology presents a significant opportunity. Concerning external market factors, while global tariffs on cross-border trade of pharmaceutical components pose a potential headwind by raising raw material and manufacturing costs, leading biopharmaceutical firms with vertically integrated or localized supply chains can mitigate this impact, ensuring consistent supply and stable pricing, thus maintaining end-user demand.

Raw Material and Pricing Analysis

The biobetters market, rooted in recombinant protein and antibody manufacturing, is acutely dependent on the pricing and supply of highly specialized raw materials. Key inputs include mammalian cell culture media (which must be serum-free for cGMP compliance), purification resins (e.g., Protein A for antibody purification), and specialized chromatographic filters. These materials are complex to manufacture and source, creating a dependence on a limited number of specialized vendors. The final drug pricing model is significantly influenced by this raw material cost, coupled with the capital-intensive nature of bioproduction—specifically the cost of operating large-scale bioreactors and the rigorous quality control testing. Any supply chain volatility or pricing escalation for these specialty chemical inputs directly pressures manufacturing costs, ultimately influencing the premium pricing structure of the biobetter.

Supply Chain Analysis

The biobetters supply chain is characterized by a high degree of complexity and reliance on specialized expertise, differentiating it from small-molecule production. Key production hubs are concentrated in regions with robust biomanufacturing infrastructure, primarily North America and Europe, with Asia-Pacific (especially China and South Korea) rapidly expanding capacity, often through Contract Development and Manufacturing Organizations (CDMOs). The most significant logistical complexity is the absolute requirement for a validated cold chain—maintaining precise, continuous temperature control (typically $2^{\circ}\text{C}$ to $8^{\circ}\text{C}$) from the production facility through final clinical distribution. This cold chain dependence creates vulnerabilities at trans-shipment points and elevates distribution costs. The impact of tariffs on the supply chain is generally mitigated by the high-value, specialized nature of the product, but companies must strategically source materials to maintain cost competitiveness. For example, some companies rely on South Korean-based production with established logistical lines to global markets, allowing them to ensure consistent supply and circumvent localized tariff disruptions that could affect drug availability and access.

Biobetters Market Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

USA | U.S. Food and Drug Administration (FDA) / Biologics License Application (BLA) Pathway | The requirement for a full BLA submission (not the abbreviated BLA for biosimilars) mandates comprehensive non-clinical and clinical data, which increases development cost and time. This ensures a high-quality product with demonstrably superior characteristics, supporting the premium price/demand for a proven biobetter. |

Europe | European Medicines Agency (EMA) / Scientific Advice & Guideline for Similar Biological Medicinal Products | EMA provides extensive scientific advice throughout development, which offers regulatory predictability. While guidelines focus on biosimilars, a clear pathway for demonstrating 'significant clinical advantage' is necessary to justify the biobetter designation, influencing R&D targets toward proven novel enhancements. |

International | International Council for Harmonisation (ICH) / Common Technical Document (CTD) | Standardizes the format of regulatory submissions globally, enabling streamlined international filing for companies pursuing simultaneous approvals across multiple major markets (e.g., US, EU, Japan). This reduces administrative overhead, facilitating faster global market entry and supply chain planning. |

Global Biobetters Market Segment Analysis

By Type: Monoclonal Antibodies (mAbs)

The Monoclonal Antibodies (mAbs) segment dominates the biobetters market due to their foundational role in modern biotherapeutics and the applicability of next-generation engineering techniques. Demand is acutely driven by the development of Fragment Crystallizable (Fc) region modifications that specifically enhance the antibody’s half-life by improving binding to the neonatal Fc receptor (FcRn). By increasing the time a therapeutic remains active in the body, these biobetters allow for less frequent subcutaneous or intravenous administration, which is a major convenience for patients with chronic conditions. Furthermore, the advent of Bispecific and Trispecific Antibodies—engineered to bind to two or three distinct targets simultaneously—drives unprecedented demand by creating novel mechanisms of action, particularly in complex immunological and oncological pathways where a single target inhibition is insufficient. The ability to create a single molecule that achieves the effect of a combination therapy simplifies treatment and potentially improves efficacy, thus securing its premium position and market pull.

By Application: Oncology

The Oncology segment exhibits the strongest demand for biobetters, primarily fueled by the imperative for highly targeted and potent cytotoxic therapies that mitigate systemic toxicity. The most significant growth driver here is the rapid evolution of Antibody-Drug Conjugates (ADCs). Biobetter ADCs are characterized by innovations in three core components: the monoclonal antibody for precise tumor targeting, the linker for enhanced stability in circulation and controlled release within the tumor cell, and the cytotoxic payload for increased potency. Next-generation ADCs, featuring novel topoisomerase inhibitors or microtubule inhibitors as payloads and proprietary cleavable linkers, demonstrate improved therapeutic indexes in clinical settings. This translates into a clear patient and physician demand for therapies offering better tumor response rates and reduced off-target adverse effects compared to first-generation treatments and traditional chemotherapy.

Global Biobetters Market Geographical Analysis

US Market Analysis

Demand in the US market is largely driven by a highly advanced healthcare infrastructure and an established value-based pricing system that justifies the premium cost of biobetters, provided they demonstrate superior clinical outcomes. The US benefits from the presence of the FDA, which has a well-defined, though rigorous, BLA pathway for new biological products. The high prevalence of chronic diseases like diabetes and autoimmune disorders, combined with a significant commercial payer system, creates robust market pull for biobetters that improve patient convenience and adherence, such as those enabling self-administration or extended dosing intervals.

Brazil Market Analysis

The Brazilian market is characterized by strong demand for cost-effective, high-efficacy alternatives to high-priced originator biologics. While price is a critical factor, the Ministry of Health's growing emphasis on local production and technology transfer drives demand toward partnerships that enable domestic manufacturing of biobetters. Public tender processes and the reliance of the Unified Health System (SUS) on centralized procurement mean that biobetters that demonstrate superior pharmacoeconomic value—for instance, through reduced hospitalization or simplified treatment—gain favorable market access.

Germany Market Analysis

Germany's biobetters market is driven by the country’s robust, decentralized, and quality-focused statutory health insurance (SHI) system. High demand stems from the willingness of physicians and payers to adopt innovations that improve patients' quality of life. The country’s stringent drug assessment bodies place a premium on new drugs, including biobetters, that offer a demonstrable added benefit (Zusatznutzen) over existing treatments. This regulatory and reimbursement environment directly incentivizes the development and use of biobetters with superior clinical profiles in key therapeutic areas like rheumatology and oncology.

Saudi Arabia Market Analysis

The Saudi Arabian market is shaped by the Vision 2030 initiative, which emphasizes pharmaceutical security, healthcare modernization, and local content development. The demand for biobetters is supported by high government healthcare spending and an increasing prevalence of chronic lifestyle diseases. A key demand driver is the mandatory requirement for local manufacturing or co-manufacturing agreements to gain preferential access to large government tenders, compelling global biobetter companies to establish regional footprints or transfer technology to local partners.

China Market Analysis

The Chinese market is undergoing a fundamental shift toward prioritizing high-quality, innovative medicines. Demand for biobetters is primarily driven by the National Medical Products Administration (NMPA) reform to accelerate novel drug approvals and the growing inclusion of innovative medicines in the National Reimbursement Drug List (NRDL). The vast and expanding patient population, combined with a focus on upgrading domestic biopharmaceutical capabilities, fuels high demand for biobetters, particularly those developed using advanced engineering, which the government actively promotes through policy.

Global Biobetters Market Competitive Environment and Analysis

The competitive landscape for biobetters is concentrated among global biopharmaceutical players that possess deep expertise in protein engineering and substantial financial capacity for complex clinical trials. The market features a strategic dynamic where originator companies leverage biobetters for lifecycle management, while advanced biosimilar firms invest in proprietary engineering to transition toward biobetter development.

Celltrion, Inc.

Celltrion, a South Korean biopharmaceutical company, maintains a strategic position as a pioneer in the global biosimilars sector, which serves as a foundation for its biobetter strategy. The company’s core strength lies in its vertically integrated manufacturing capabilities and its global commercialization network for monoclonal antibodies. Their strategic positioning involves leveraging the success of biosimilars, such as the infliximab biosimilar, a monoclonal antibody (mAb), to fund and launch follow-on enhancements, including its proprietary subcutaneous (SC) formulation, which offers superior patient convenience compared to the original intravenous (IV) administration.

Amgen Inc.

Amgen Inc., founded in 1980 as a pioneering biotechnology company, stands as one of the world's leading independent biotech firms. Committed to transforming scientific breakthroughs into therapies that address unmet medical needs, Amgen focuses on areas like oncology, inflammation, cardiovascular disease, osteoporosis, and rare diseases, boasting a robust portfolio of innovative biologics and biobetters—such as Vectibix for colorectal cancer—and an advancing pipeline.

Global Biobetters Market Key Development

March 2025: Celltrion announced the rebranding of its infliximab biosimilar to Remdantry in Canada, effective April 1, 2025. This strategic move consolidated the intravenous and subcutaneous formulations under a unified brand for direct commercialization. The action is intended to streamline the prescribing experience for healthcare professionals, which indirectly enhances the demand and adoption for the subcutaneous biobetter formulation by reducing clinical complexity.

Global Biobetters Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 66.603 billion |

| Total Market Size in 2030 | USD 97.907 billion |

| Forecast Unit | Billion |

| Growth Rate | 8.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global Biobetters Market Segmentation:

By Type

Monoclonal Antibodies (mAbs)

Vaccines

Recombinant Proteins

Antibody–Drug Conjugates (ADCs)

Others

By Application

Oncology

Neurology

Nephrology

Autoimmune & Inflammatory Diseases

Infectious Diseases

Others

By End-User

Biopharmaceutical Companies

Contract Research Organizations (CROs)

Academic & Research Institutes

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others