Report Overview

Next Generation Sequencing Market Highlights

Next Generation Sequencing Market Size:

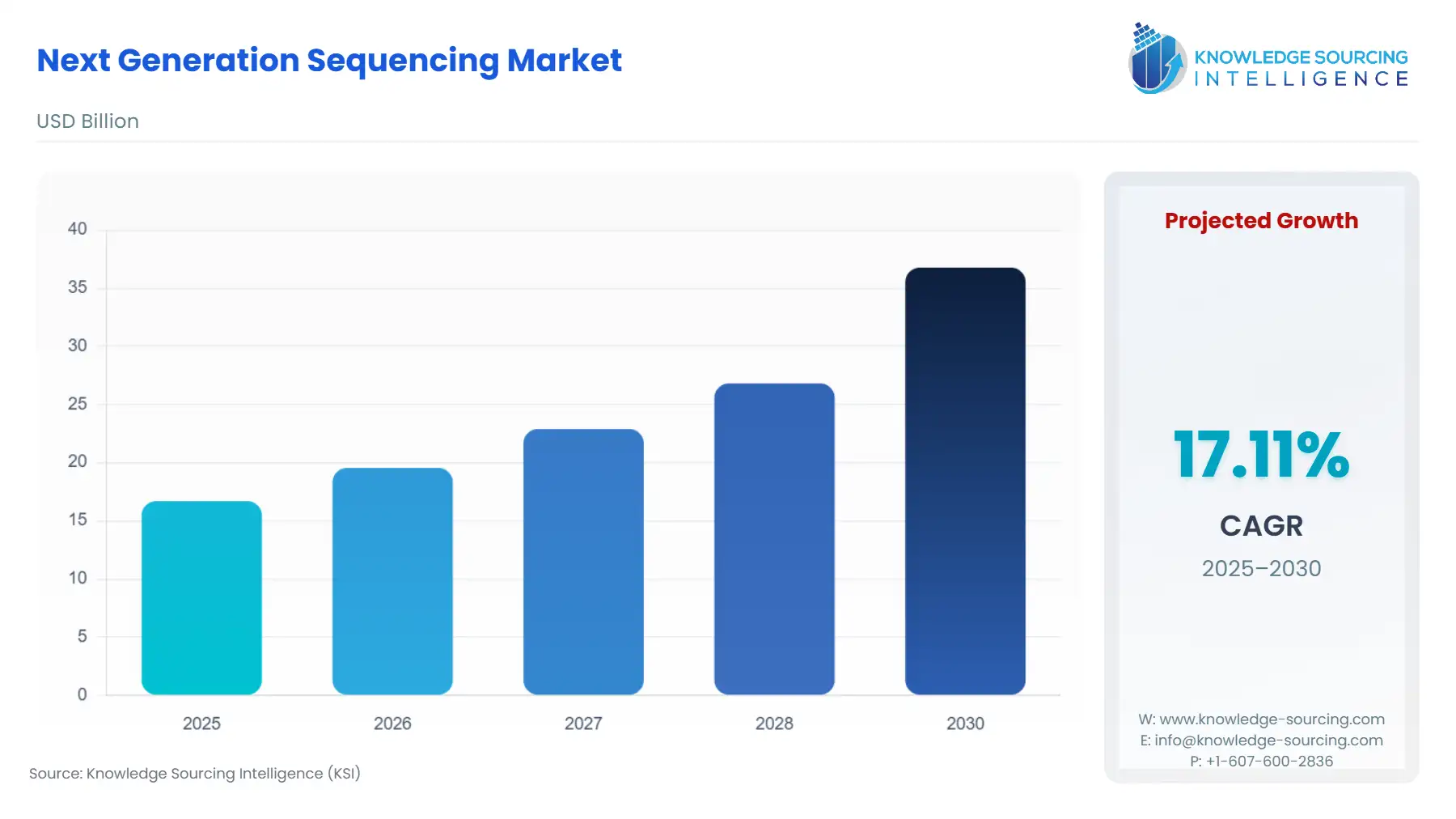

The next generation sequencing market is expected to grow from USD 16.696 billion in 2025 to USD 36.778 billion in 2030, at a CAGR of 17.11%.

The Next Generation Sequencing (NGS) Market, a convergence of molecular biology, engineering, and advanced informatics, fundamentally reshapes biological research and clinical diagnostics by enabling rapid, high-throughput DNA and RNA analysis. These platforms, which evolved from first-generation Sanger sequencing, deliver sequence information in parallel from millions of fragments, collapsing the cost and time required for genomic analysis.

The market is defined by an intense race for technological differentiation, focusing on accuracy, read length, and accessibility. Its primary trajectory is characterised by the penetration of established sequencing techniques—such as Sequencing By Synthesis (SBS) and Ion Semiconductor Sequencing—into routine clinical settings, while emerging technologies like Nanopore Sequencing drive innovation in portable and real-time analysis. The critical factor governing market expansion is the conversion of massive genomic data sets into actionable clinical or pharmaceutical insights, which is increasingly dependent on the integrated Software & Services segment.

Next Generation Sequencing Market Analysis

Growth Drivers

The most powerful driver is the dramatic reduction in the cost-per-base, transforming NGS from a research tool into a clinical imperative. This financial accessibility directly increases demand for Targeted Sequencing panels in routine diagnostics, making personalised medicine economically feasible for a broader patient demographic. Simultaneously, the escalating prevalence and complexity of chronic diseases, particularly cancer, necessitate comprehensive genetic screening. The mandated shift towards precision oncology creates a sustained and non-discretionary demand pull for NGS-based companion diagnostics, driving adoption within Hospitals & Clinics. The continuous governmental investment, such as the substantial 2025 fiscal year funding provided by the NHGRI to organisations like the European Molecular Biology Laboratory and various US-based institutions for large-scale genomic projects, acts as a bedrock, stabilising research demand for sequencing Hardware and Services globally.

Challenges and Opportunities

The primary constraint facing the market is the bioinformatics bottleneck, defined by the complexity, lack of standardisation, and computational cost associated with storing, analysing, and interpreting the massive data output from high-throughput sequencers. This data analysis challenge acts as a major headwind, especially for smaller Academic & Research Institutes lacking dedicated computational infrastructure. An immense opportunity exists in the shift towards liquid biopsy across the Oncology segment. The non-invasive nature and ability to monitor disease progression and recurrence, validated by FDA approvals for companion diagnostics, create a high-margin, scalable demand trajectory for specialised Targeted Sequencing kits and high-sensitivity, low-error-rate sequencing Reagents. Another pivotal opportunity lies in infectious disease diagnostics, where rapid turnaround time and culture-independent pathogen identification offered by mNGS can significantly propel demand for portable sequencers in public health and acute care settings.

Raw Material and Pricing Analysis

The NGS market is inherently linked to the supply chain of chemical Reagents and specialised Consumables, which constitute the primary recurring revenue stream for NGS platform providers. Key raw materials include high-purity nucleoside triphosphates (dNTPs), specialised polymerases, fluorescently labelled terminators, and flow cell substrates (for SBS). The pricing dynamic is characterised by a "razor-and-blade" model, where the initial Hardware cost is comparatively low compared to the cumulative, long-term cost of proprietary reagents. Competitive pressures, exemplified by Pacific Biosciences' continuous efforts to reduce sequencing costs through new reagents like the SPRQ-Nx, continually force price erosion on the cost-per-gigabase, which, while beneficial for end-users, creates margin pressure on consumables and necessitates volume growth to maintain revenue streams. This cost-per-test reduction is a deliberate strategy to catalyse demand among high-volume users in Academic & Research Institutes and large Pharmaceutical & Biotech Companies.

Supply Chain Analysis

The global NGS supply chain is heavily centralised, creating a high dependency on a few key global platform manufacturers, notably Illumina and Thermo Fisher Scientific, which operate integrated vertical supply chains for their proprietary Hardware, Reagents, and Software. The major production hubs for high-throughput sequencing instruments and specialised flow cells are primarily located in the United States and Europe, with assembly and consumables manufacturing also strategically placed to service core markets. The logistical complexity centres on the cold-chain requirement for many proprietary reagents, which must be shipped and stored at ultra-low temperatures to maintain stability, imposing significant logistical overhead and cost on global distribution. This concentration and proprietary nature make the supply chain highly vulnerable to geopolitical trade friction or facility disruptions, which could immediately constrain the supply and adoption pace of NGS in key emerging markets.

Next Generation Sequencing Market Government Regulations:

Governmental and regulatory bodies play a direct and increasingly complex role in shaping the NGS market, especially in clinical and diagnostic applications.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | Food and Drug Administration (FDA) Approval of Companion Diagnostics | The FDA’s approval pathway for NGS-based liquid biopsy companion diagnostics (e.g., FoundationOne Liquid CDx) legitimizes the technology for clinical use. This regulatory validation formally creates a demand imperative for oncologists to adopt NGS testing to guide therapeutic selection, primarily accelerating the Oncology segment and driving Hardware sales into diagnostic laboratories. |

Europe | In Vitro Diagnostic Regulation (IVDR) | The IVDR mandates stricter requirements for the clinical evidence and performance of in vitro diagnostic devices, including NGS-based tests. This regulation introduces significant compliance overheads for NGS test developers, which may temporarily constrain the pace of new assay launches but ultimately increases demand for high-quality, fully validated, and CE-marked Software & Services solutions that ensure regulatory conformity. |

China | National Medical Products Administration (NMPA) Regulation of Medical Devices | China's NMPA has established specific, rigorous registration pathways for NGS devices and assays intended for clinical use. The localization requirements and stringent approval process create an advantage for domestic suppliers and may slow the market penetration of foreign-made clinical systems, thereby structuring demand toward regionally-compliant or domestically manufactured Hardware and Reagents. |

United Kingdom | Genomics England/NHS Genomic Medicine Service (GMS) | Genomics England's initiatives to integrate sequencing into routine clinical care for rare diseases and cancer through the GMS institutionalizes the demand for NGS. This centralized, national procurement model ensures a large, stable demand for high-throughput sequencers, primarily driving the adoption of Whole Genome Sequencing and establishing public health standards that influence procurement decisions across the Hospitals & Clinics segment. |

Next Generation Sequencing Market Segment Analysis

By Application: Oncology

The Oncology application segment is the cornerstone of clinical NGS demand, driven by the shift from population-based treatments to precision medicine tailored to an individual’s tumour characteristics. The fundamental demand driver is the therapeutic necessity of molecular stratification. NGS provides the high-multiplexing capability required to simultaneously screen for numerous known cancer biomarkers (e.g., mutations in $BRCA1$, $EGFR$, $ALK$ fusions) and identify novel targets that determine a patient’s eligibility for specific targeted therapies or immunotherapy trials. This direct link between molecular diagnosis and therapeutic choice, formalised by FDA-approved companion diagnostics, ensures that every new oncology drug approved with a genetic selection criterion immediately augments the demand for the corresponding Targeted Sequencing assays and high-sensitivity NGS Reagents. Furthermore, the rise of minimal residual disease (MRD) testing and liquid biopsy non-invasively expands the market demand beyond the initial diagnosis phase to include continuous monitoring of treatment efficacy and recurrence, necessitating high-depth sequencing capacity. The increasing volume of complex data generated necessitates specialised bioinformatics Software & Services to facilitate rapid, clinically actionable report generation.

By End-Users: Pharmaceutical & Biotech Companies

Pharmaceutical & Biotech Companies constitute a highly demanding and high-value segment, with their primary demand drivers rooted in accelerated drug discovery and development. NGS is indispensable for identifying novel drug targets, understanding disease pathways, and performing toxicity screening. In the discovery phase, Whole-Exome Sequencing and Targeted Sequencing are used to screen patient populations and preclinical models for genetic links to disease, a process that inherently increases demand for high-throughput, research-grade sequencing Hardware. Critically, during clinical trials, companies rely on NGS to select responders (patient stratification) and assess pharmacogenomic biomarkers, which ensures drug safety and efficacy, thereby creating a mandatory demand requirement for regulatory-compliant NGS data generation. The recent launch of Illumina's BioInsight business, specifically focused on accelerating technology and data-driven discovery and expanding pharma access to large omics datasets, directly illustrates how NGS platform providers are strategically positioning their Software & Services offerings to cater to the immense computational and data interpretation needs of this segment, further propelling demand for integrated solutions.

Next Generation Sequencing Market Geographical Analysis

United States Market Analysis (North America)

The U.S. market acts as the global innovation and clinical adoption bellwether. Local factors, including significant government-backed genomic initiatives like the NIH's All of Us Research Program, and the high concentration of Pharmaceutical & Biotech Companies, establish a sustained, high-volume demand base for NGS platforms and Software & Services. The unique element is the reimbursement landscape, where positive coverage decisions by Centres for Medicare & Medicaid Services (CMS) and private payers for NGS-based clinical tests (especially in Oncology) immediately catalyse rapid adoption in Hospitals & Clinics, converting technology validation into commercial viability and solidifying the market's trajectory.

Brazil Market Analysis (South America)

The Brazilian NGS market is characterised by emerging research infrastructure and a growing awareness of personalised medicine, yet it faces challenges related to public healthcare funding and logistical complexities. Local demand is primarily driven by large academic centres and specialised private laboratories focused on Oncology and rare disease diagnostics. The key local factor is the high cost of imported reagents and hardware, exacerbated by import duties and currency volatility. This financial constraint shifts demand toward benchtop, lower-throughput systems and necessitates the strategic adoption of in-house assay development, placing a premium on vendor support and regional pricing flexibility.

Germany Market Analysis (Europe)

Germany, with its robust public healthcare system and strong academic research base, represents a mature European NGS market. Local demand is heavily influenced by the stringent quality and privacy standards established by institutions like the German Federal Institute for Drugs and Medical Devices (BfArM). The market prioritises instruments and assays with a strong track record of analytical validation. The emphasis on data privacy and the implementation of the EU's IVDR mean that local demand is increasingly concentrated on providers who offer fully compliant, end-to-end NGS solutions, particularly sophisticated bioinformatics Software & Services that meet European data security and regulatory requirements.

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is experiencing rapid expansion, principally fueled by ambitious Vision 2030 initiatives that prioritise health sector transformation and genomic research, often through large, state-funded projects. The key local factor driving demand is the national focus on population genomics and inherited disease screening, which creates an immediate and non-price-sensitive demand for high-throughput, production-scale sequencers, primarily Whole Genome Sequencing platforms. Procurement decisions often favour large, integrated solutions from global leaders who can provide comprehensive training, maintenance, and data management infrastructure to quickly establish national genomic capabilities.

China Market Analysis (Asia-Pacific)

China is both a massive consumer and an increasingly capable producer in the NGS market. Local demand is driven by a two-pronged strategy: mass-market clinical adoption in reproductive health (e.g., Non-Invasive Prenatal Testing) and state-supported research. The unique factor is the strong preference and policy support for domestic manufacturers of Hardware and Reagents, creating a highly competitive environment. This policy indirectly constrains the market share of foreign vendors in high-volume, cost-sensitive clinical applications while driving intense demand for Targeted Sequencing and specialised library preparation kits from local labs seeking cost-effective, high-throughput solutions.

Next Generation Sequencing Market Competitive Environment and Analysis

The Next Generation Sequencing market exhibits a competitive structure characterised by a dominant market leader in Sequencing By Synthesis (SBS) and aggressive challengers leveraging differentiated long-read and semiconductor technologies. Competition is centred on sequencer throughput, cost-per-base, and the depth of integrated Software & Services offerings.

Illumina, Inc.

Illumina maintains a foundational strategic position, built on the widespread adoption and standardisation of its SBS technology, offering a comprehensive product portfolio from benchtop to ultra-high-throughput systems (e.g., MiSeq i100 Series, NovaSeq X Series). The company's competitive edge lies in its massive installed base and a closed ecosystem of proprietary Reagents and flow cells, securing a dominant recurring revenue stream. The recent launch of its BioInsight business unit in October 2025 demonstrates a strategic pivot to capture the high-value Software & Services and AI-driven data analysis segment, aiming to deepen integration with Pharmaceutical & Biotech Companies for drug target discovery and development, moving beyond just providing raw sequence data.

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific is strategically positioned as a diversified life science giant, leveraging its Ion Semiconductor Sequencing technology (Ion Torrent) and its vast catalogue of sample preparation and bioinformatics tools. The company’s strength lies in offering integrated end-to-end solutions, particularly appealing to Hospitals & Clinics and clinical research labs that prefer simplified, sample-to-answer workflows. Their competitive approach emphasises rapid turnaround time and ease of use, making their platforms highly relevant for Targeted Sequencing in Oncology and Infectious Disease Diagnostics. The acquisition of key clinical research and CDMO capabilities and strategic collaborations, such as the one with OpenAI in October 2025 to deploy advanced AI within their clinical research business, further solidifies their comprehensive support for Drug Discovery & Development.

Pacific Biosciences of California, Inc. (PacBio)

PacBio occupies a critical niche as the leader in long-read sequencing, utilising its Single Molecule, Real-Time (SMRT) technology. Their strategic positioning directly challenges the short-read dominance by addressing applications that require resolving complex genomic regions, structural variants, and whole-transcriptome analysis, which are particularly relevant for advanced Academic & Research Institutes and complex Drug Discovery & Development projects. PacBio’s introduction of new Reagents and continuous hardware upgrades for its Revio and Vega platforms, aimed at reducing the cost-per-gigabase, is a direct competitive effort to make long-read technology more accessible for high-throughput genomic applications, directly increasing demand from volume users previously constrained by cost.

Next Generation Sequencing Market Developments

October 2025: Illumina Launches BioInsight Business

Illumina, Inc. announced the launch of BioInsight, a new business unit focused on accelerating technology and data-driven discovery. The new business is designed to meet industry demand for deeper biological insights by unifying Illumina's strengths across sequencing, data analysis, Software & Services, and AI. BioInsight is specifically organised to support large national initiatives, collaborate with corporate partners to develop valuable data assets, and provide platforms for private and secure data access for research and Pharmaceutical & Biotech Company partners. This launch signifies a major strategic capacity addition in the high-value bioinformatics and data services segment.

Next Generation Sequencing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 16.696 billion |

| Total Market Size in 2030 | USD 36.778 billion |

| Forecast Unit | Billion |

| Growth Rate | 17.11% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Offerings, Type, Method, Application |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Next Generation Sequencing Market Segmentation:

By Offerings

Hardware

Software & Services

By Type

Genome Sequencing

Exome Sequencing

Targeted Sequencing

By Method

Sequencing By Synthesis (SBS)

Ion Semiconductor Sequencing

Nanopore Sequencing

Others

By Application

Oncology

Infectious Disease Diagnostics

Drug Discovery & Development

Others

By End-Users

Hospitals & Clinics

Academic & Research Institutes

Pharmaceutical & Biotech Companies

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others