Report Overview

Global Crowd Analytics Market Highlights

Crowd Analytics Market Size:

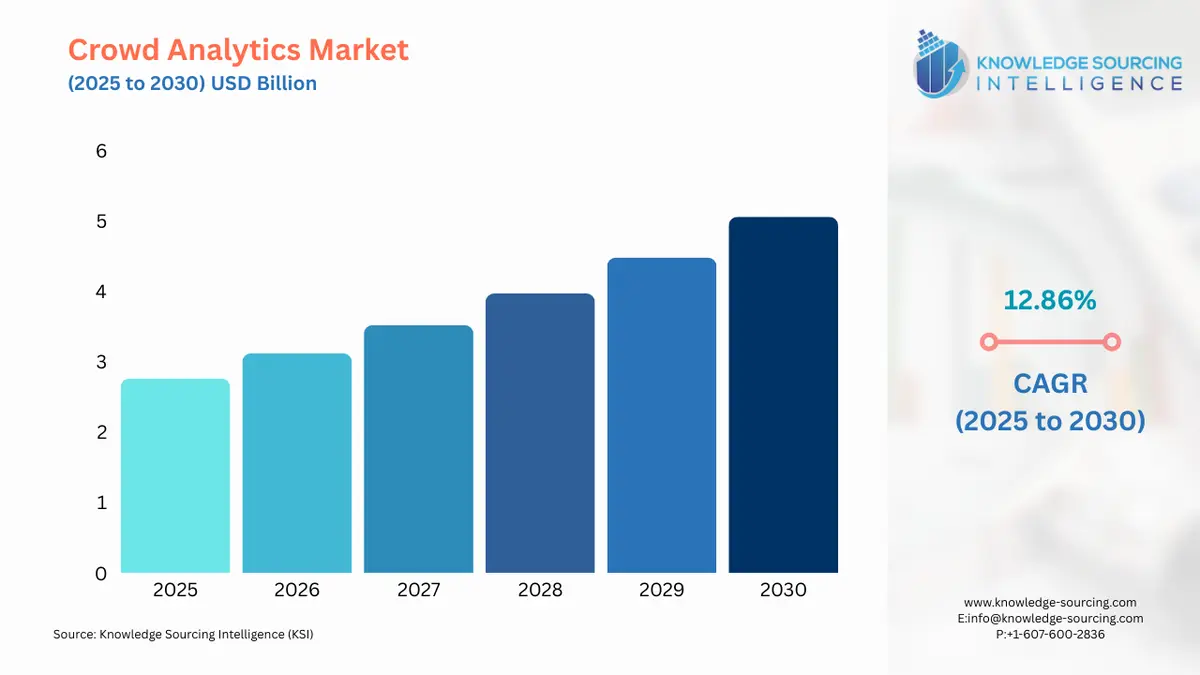

The Global Crowd Analytics Market is expected to grow from USD 2.761 billion in 2025 to USD 5.055 billion in 2030, at a CAGR of 12.86%.

Crowd Analytics Market Introduction:

The growing demand for data-driven insights into human behavior in both public and private settings is propelling the global crowd analytics market's expansion. Crowd analytics involves using cutting-edge technologies, such as artificial intelligence (AI), machine learning (ML), computer vision, and big data analytics to analyze and predict crowd density, movement patterns, and behavior in real time. The growing demand for crowd control, intelligent monitoring, and public safety, particularly in the wake of global issues like pandemics, terrorism, and major public gatherings, is driving this industry.

Governments, urban planners, transportation authorities, event planners, and retail operators are some of the major end customers seeking crowd analytics solutions to improve consumer experiences, security protocols, and operational efficiency. The expansion of IoT-connected devices, the integration of smart city programs worldwide, and the growing use of video surveillance systems are all contributing to the acceleration of crowd analytics adoption.

Potential barriers include challenges such as the difficulty of real-time analytics processing, data privacy concerns, and high implementation costs. However, these obstacles will be removed by further developments in edge computing, cloud-based platforms, and AI algorithms, which will increase the accessibility and scalability of crowd analytics. The market is expected to grow steadily over the next several years as governments and corporations alike realize the strategic importance of comprehending crowd dynamics. This will change the way that human movement is tracked, analyzed, and responded to in numerous industries.

Reflecting the diverse use cases and technological adoption across sectors, the global crowd analytics market is comprehensively categorized by technology, deployment mode, organization size, and industry vertical. Sensor-based, video-based, artificial intelligence, big data analytics, and Wi-Fi-enabled analytics are the technology-based segments of the market. The popularity of CCTV and surveillance cameras, which are combined with AI and computer vision technologies to track and analyze crowd movements in real time, has led to the dominance of video-based analytics.

Crowd Analytics Market Overview

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

Crowd analytics is an emerging niche of the analytics technology domain that focuses primarily on crowd metrics, including the interpretation of crowd movements, detecting abnormalities, and other parameters that enable the betterment of designing areas and better crowd management. The increasing adoption of artificial intelligence in multiple spaces, including retail surveillance and related domains, is primarily the potential reason for pushing the market for crowd analytics on a global scale.

Increasing urbanisation, rising public safety concerns, and the rapid development of smart cities worldwide are driving market growth. The increasing adoption of artificial intelligence in various spaces, such as video surveillance, Wi-Fi/Bluetooth tracking, sensors, AI, and big data analytics, including retail surveillance and related domains, is propelling market expansion. The Global Expansion of AI Surveillance paper of the Carnegie Endowment for International Peace, the AI surveillance technology has been growing rapidly globally, with at least 74 out of the 176 countries actively adopting the same for multiple use cases, including smart/city platforms, smart policing, and facial recognition systems.

The increasing use of AI in surveillance is anticipated to create abundant opportunities for crowd analytics technology, thereby increasing the market potential in the forecasted period. Moreover, market developments and increasing consumer gatherings are also expected to drive the growth of the same.

Another key market driver in the private space is its growing demand in several high-opportunity commercial and operational sectors. For instance, in retail and shopping malls, retailers are using crowd analytics for footfall analysis, customer dwell time, and in-store movement patterns to enhance store layouts and optimize staff activities. According to Verizon's insights, while 62% of retailers were satisfied with their store’s overall physical experience, only 39% expressed satisfaction with their digital experience. This disparity highlights a growing demand for integrated, data-driven tools like crowd analytics, which, as per Verizon they help retailers with this, highlighting the growing adoption of crowd analytics by retailers. Other examples are Blickfield uses 11 LiDAR sensors at Virginia Tech’s Creativity and Innovation District, to anonymously track people flow in shared areas. Others, such as the transportation, hospitality, and tourism industries, also use it for operational efficiency.

Thus, the increasing demand for crowd analysis for public safety and business is driving market growth. In terms of technologies, the market leverages some core technologies, like 5G Edge computing, such as that of Verizon, which provides ultra-low latency and high bandwidth connectivity. LiDAR (Light Detection and Ranging) is also widely used to anonymously map crowd density and movement patterns. For example, Blickfield uses LiDAR-based solutions to enable real-time people counting, heat mapping, and queue management across retail spaces, airports, and event venues. Additionally, AI-driven deep learning models, such as Convolutional Neural Networks (CNN) for body and facial recognition and Recurrent Neural Networks (RNN) with Long Short-Term Memory (LSTM) for predictive crowd movement, are also used for enhancing accuracy and offering insights.

The global market for crowd analytics is extremely competitive and has a wide range of participants, from well-known IT behemoths to niche solution suppliers, all of which are advancing behavioral analytics and crowd intelligence technologies. For instance, CrowdANALYTIX, well-known for its AI-powered data science platform, provides customizable analytics based on consumer movement and behavior. Face analysis and real-time audience monitoring technologies are the areas of expertise for Sightcorp (Radiant), which smoothly integrates into retail settings and digital signs. As a leader in digital infrastructure and telecommunications worldwide, Nokia Corporation offers robust analytics solutions through its public safety and smart city platforms that integrate real-time data processing and video surveillance.

Another major player, NEC Corporation, provides cutting-edge biometric and video analytics systems that are extensively used in Asia and Europe's transportation and public safety infrastructure. A UK-based business called Wavestore offers scalable video management software (VMS) that integrates with analytics technologies driven by artificial intelligence to facilitate crowd monitoring. As a component of STRATACACHE, Walkbase provides location-based analytics for physical retail settings, giving marketers knowledge about how customers move through and interact with their establishments.

Crowd Analytics Market Trends

The crowd analytics market is experiencing transformative growth, driven by advanced technologies that enhance real-time crowd management and safety. Behavioral analytics is a key trend, leveraging AI and machine learning to interpret crowd movements and interactions. Recently, IBM introduced a cloud-based tool for retail and transportation, analyzing crowd patterns to optimize operations. Predictive crowd analytics is advancing, using historical and real-time data to forecast crowd behavior, as seen in Huawei’s 5G-integrated airport solutions for passenger flow. Crowd sentiment analysis is gaining traction, with tools like Crowd Analyzer’s AI platform achieving 91% accuracy in gauging audience emotions across social media. Privacy-by-design crowd analytics addresses data concerns by embedding anonymization, as implemented in Germany’s smart city initiatives. Edge computing crowd analysis reduces latency, with Cisco’s Splunk acquisition enhancing real-time processing. Multi-source data fusion integrates cameras, sensors, and social media, as demonstrated by Siemens’ urban mobility solutions. These trends underscore the market’s focus on efficiency, safety, and ethical data use.

Crowd Analytics Market Growth Drivers:

- Increasing foot traffic and associated market developments are expected to fuel the market growth

Foot Traffic Indicators Towards Global Fast-Fashion Expansion publication by the global commercial real estate services provider Colliers, global retail fashion companies across Europe and other major regions have been witnessing an increasing trend in foot traffic at their store locations.

Consequently, Primark, in its September 2022 news release, announced expansions across the US locations for the next 5 years, targeting the addition of 60 stores during the same period.

Furthermore, as per the Retail Trends- 2022 Forecast by Placer.ai, a location intelligence and foot traffic data software company, offline market visits have been increasing post the peak COVID period and have also surpassed 2019 levels for some retail chains. For example, Target witnessed significant positive changes in customer visits in 2019, which is expected to raise the scope of the crowd analytics market in both the short and medium term of the timeline.

In addition, strategic market steps by major crowd analytics players are also expected to boost the market growth rate. For instance, as per the January 2022 blog by digital analytics company Raydiant, the company announced the acquisition of a crowd monitoring and analytics company, Sightcorp, whose operations are powered by the capabilities of artificial intelligence.

- Retail Sector’s Push for Enhanced Customer Experiences

One of the key factors driving the crowd analytics market is the growing emphasis on delivering seamless, personalized, and data-driven customer experiences. Retailers are increasingly leveraging real-time insights by adopting crowd analytics software for footfall analysis, customer movement patterns, stay duration, returning visitors, activity time, and dwell times to optimize store layouts, manage queues, and personalize in-store promotions. Various technologies such as LiDAR, Wi-Fi tracking, and AI-powered video analytics are being deployed to understand consumer behavior at a granular level, which helps them in managing their staff and for targeted advertising.

Brands are investing in understanding how and where consumers engage with retail spaces, many using crowd analytics technologies for doing so. According to the June 2023 Foot Traffic Indicators Towards Global Fast-Fashion Expansion publication by the global commercial real estate services provider Colliers, global retail fashion companies across Europe and other major regions have been witnessing an increasing trend in foot traffic at their store locations. For example, Uniqlo saw a 14.4% increase in foot traffic in 2022, had planned to open stores at 200 U.S. locations. Additionally, other fashion retailers like Primark, Inditex, and H&M witnessed an average 0.3% increase in foot traffic for the first quarter of 2023, driving strategic expansion plans. For example, Primark, in its September 2022 news release, announced expansions across the US locations for the next 5 years, targeting the addition of 60 stores during the same period. Thus, this growth in offline retail, surpassing pre-COVID levels for some chains, underscores the need for crowd analytics to optimize in-store experiences and drive sales.

Crowd analytics solutions, such as Verizon’s 5G Edge Crowd Analytics IO Platform, V-Count Retail Store Analytics, and Sightcorp’s AI-driven facial analysis, enable retailers to address these challenges by optimizing store experience, personalizing marketing, and enhancing customer journeys. However, challenges like data privacy concerns and high implementation costs for smaller retailers must be addressed to sustain growth.

- Predictive Crowd Analytics for Strategic Planning

Predictive crowd analytics is fueling market growth by forecasting crowd behavior using historical and real-time data. This capability is critical for industries like transportation and event management, where anticipating crowd flow enhances efficiency and safety. Huawei’s 5G-powered analytics platform was implemented in airports to predict passenger movements, reducing congestion and improving operational planning. By integrating IoT and AI, predictive tools provide actionable insights for optimizing infrastructure and staffing. The rise of large-scale events and urban gatherings further amplifies the need for such solutions, as organizations seek to prevent bottlenecks and ensure seamless experiences. This trend drives innovation, with companies developing advanced algorithms to support proactive decision-making, making predictive analytics a cornerstone of the market’s growth trajectory.

- Crowd Sentiment Analysis for Consumer Insights

Crowd sentiment analysis is transforming the market by providing businesses with insights into audience emotions and preferences, particularly in retail and entertainment. By analyzing social media, facial expressions, and crowd interactions, these tools help tailor customer experiences and marketing strategies. Crowd Analyzer’s AI platform achieved 91% accuracy in sentiment analysis, enabling retailers to refine campaigns based on real-time feedback. This technology supports dynamic pricing, customer engagement, and brand reputation management, driving demand in consumer-centric industries. As businesses increasingly rely on data-driven strategies, sentiment analysis enhances their ability to respond to crowd dynamics, boosting market growth by aligning services with consumer expectations and fostering loyalty through personalized experiences.

Crowd Analytics Market Restraints

- Privacy-by-Design Crowd Analytics Challenges

Implementing privacy-by-design crowd analytics poses a significant restraint due to stringent data protection regulations and consumer concerns. While anonymized data collection is critical for ethical analytics, ensuring compliance with laws like GDPR and CCPA increases development complexity and costs. Recently, Germany’s smart city projects emphasized privacy-compliant analytics, requiring advanced encryption and anonymization techniques, which slowed deployment. Businesses must invest heavily in secure systems to avoid legal repercussions and public backlash, which can deter smaller firms with limited resources. This restraint limits market scalability, as companies struggle to balance robust analytics with privacy safeguards, potentially slowing adoption in regions with strict regulatory frameworks.

- Edge Computing Crowd Analysis Infrastructure Limitations

The adoption of edge computing crowd analysis is hindered by inadequate IT infrastructure, particularly in developing regions. Edge computing requires high-speed internet, robust hardware, and technical expertise to process data locally, reducing latency for real-time analytics. However, regions with limited connectivity or outdated systems face challenges in deploying these solutions. Cisco noted that infrastructure gaps in emerging markets restricted the scalability of edge-based analytics, despite its potential for real-time crowd management. This restraint slows market growth, as organizations in these regions cannot fully leverage advanced analytics, limiting their ability to capitalize on crowd management technologies and creating disparities in market adoption globally.

Crowd Analytics Market Segmentation Analysis

- By Technology: Artificial Intelligence (AI)

Artificial Intelligence (AI) dominates the crowd analytics market due to its ability to process vast datasets, deliver real-time insights, and enable predictive and behavioral analytics. AI-powered solutions analyze data from cameras, sensors, and social media to interpret crowd movements, sentiments, and patterns, enhancing safety and operational efficiency. In 2024, IBM’s Watson-powered analytics system was deployed in Croatia’s national parks to track visitor movements and environmental impacts, showcasing AI’s role in dynamic crowd management. AI’s integration with machine learning and natural language processing enables applications like crowd sentiment analysis and predictive modeling, critical for retail, transportation, and smart cities. For instance, Crowd Analyzer’s AI platform achieved high accuracy in sentiment analysis for retail campaigns. The scalability and adaptability of AI make it the leading technology, driving innovation across industries by providing actionable insights for crowd management.

- By Industry Vertical: Retail

The Retail sector leads the crowd analytics market, leveraging analytics to optimize store layouts, enhance customer experiences, and boost sales. Retailers use crowd analytics to track foot traffic, analyze consumer behavior, and tailor marketing strategies, driven by technologies like AI and video-based analytics. For instance, Cisco’s Splunk platform enhanced retail analytics by providing real-time insights into shopper movements, improving store operations, and customer engagement. Retailers like Target have adopted crowd analytics to identify peak shopping hours and optimize product placements, enhancing customer satisfaction and revenue. The segment’s dominance is fueled by the need for data-driven decisions in competitive retail environments, where understanding consumer patterns is critical. As retail continues to prioritize personalized experiences and operational efficiency, crowd analytics remains essential, solidifying the sector’s leadership in market adoption.

Crowd Analytics Market Geographical Outlook:

- North America is predicted to hold the largest market share

The use of crowd analytics solutions is being driven by growing security concerns, with an emphasis on improving public safety in various contexts, which is anticipated to drive the regional market. The use of these technologies is given top priority by smart city projects throughout the region to maximize urban management and raise overall municipal efficiency.

Concerns about public safety and security are driving the crowd analytics business in the United States, with applications for tracking crowd behavior in many contexts. Crowd analytics is integrated into smart city programs for effective public services, traffic control, and urban planning. In addition, crowd analytics is used by retailers to improve consumer experiences, and it is also used by the events industry to organize large-scale gatherings. The need for data-driven decision-making and ongoing technology improvements drive the broad adoption of crowd analytics solutions across industries.

The high level of technological maturity, strong surveillance infrastructure, and growing need for data-driven decision-making in both public and corporate sectors have made the US market for crowd analytics one of the most developed and fastest-growing in the world.

Massive crowd behavior monitoring in airports, stadiums, transit stations, shopping malls, smart city hubs, and major public events has been made possible by the country's extensive use of AI-powered video surveillance, real-time foot traffic tracking, IoT sensors, and sophisticated data analytics platforms. Strong demand is being created in the public sector by the U.S. government's active promotion of crowd analytics technologies for public safety, event security, and disaster response, especially through organizations like the Department of Homeland Security and urban planning authorities.

Furthermore, by combining cutting-edge technology, such as IoT and data analytics, for better public safety, more efficient urban management, and better event planning in urban settings, smart city projects stimulate the expansion of the crowd analytics market. The U.S. DOT has granted millions of dollars in grants to fund community-driven, cutting-edge transportation initiatives to reduce traffic, boost connectivity, and enhance opportunity access, building on the success of the Smart City Challenge. As per the report published by the U.S. DOT, the most common SC&C activities were traffic management, data management, public transportation, and automation or connectivity.

Crowd analytics uses cutting-edge technologies to track and examine crowd behavior in real-time, greatly improving safety and security. These technologies help in the early detection of security concerns by spotting unusual activity and possible threats. By offering real-time monitoring capabilities and optimizing evacuation plans based on anticipated crowd movements during emergencies, they support emergency response activities. Additionally, by using insights into crowd dynamics, crowd flow management is enhanced, reducing stampedes and congestion. Through the identification of persons of interest or possible threats, surveillance and identification technologies like facial recognition and behavioral biometrics improve security measures.

In the meantime, these tools are being used by the commercial and retail sectors to boost marketing efforts, optimize space usage, uncover trends in client movement, and improve the customer experience. Several cities have already integrated crowd analytics into their smart city ecosystems, including New York, Los Angeles, Chicago, and San Francisco. These cities use the data to monitor pedestrian movements, manage emergency evacuations, and streamline urban traffic. Airports and subway systems are progressively implementing AI-powered crowd control technologies in the transportation industry to avoid crowding, reduce wait times, and guarantee passenger safety.

Regarding deployment, there is a notable increase in the use of cloud-based platforms, especially among mid-sized businesses and municipalities seeking agility and scalability. However, many large organizations still favor on-premises solutions due to data security concerns and the requirement for increased customization. The competitive scene is still dominated by U.S.-based businesses and international firms with local operations, who provide specialized, AI-integrated solutions that are suited to different industry demands. Access to highly qualified AI and data science expertise, robust data protection laws, and a well-established IT infrastructure all contribute to the nation's dominant position in crowd analytics innovation and application.

Only an estimated 3.9% of firms employed artificial intelligence (AI) to manufacture goods or services between October 23 and November 5, 2023, according to survey responses from the US Census Bureau[1]. Nonetheless, this utilization differed greatly throughout economic sectors. Information industry organizations reported utilizing AI at higher rates than the national average, with 13.8% of enterprises saying they were employing the technology. Comparing the percentage of AI adopters by industry, companies in the Professional, Scientific, and Technical Services sector similarly reported a high percentage (9.1%).

Comprehensively, the US market for crowd analytics represents a fusion of technology, regulation, and business necessity, making it a key factor for the global market’s growth and a standard for developing nations.

Global Crowd Analytics Market Key Developments:

- In March 2024, Cisco finalized its acquisition of Splunk, a major data analytics company, for an estimated $28 billion. This strategic move was aimed at bolstering Cisco's capabilities in AI and machine learning, particularly for processing large-scale data sets. While Splunk's services are broad, the integration of its data analysis tools with Cisco's networking and security infrastructure is expected to provide enhanced real-time data analysis and predictive insights, strengthening Cisco's position in the crowd analytics market for applications like cybersecurity and network optimization.

- In 2024, NEC Software Solutions (NECSWS) announced the completion of the acquisition of Riven, strengthening its portfolio of cutting-edge technology in support of its digital transformation of services and solutions.

List of Top Crowd Analytics Companies:

- IBM Corporation

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Siemens AG

- Crowd Analyzer Ltd.

Crowd Analytics Market Geographical Outlook:

| Report Metric | Details |

| Polyols Market Size in 2025 | US$33.126 billion |

| Polyols Market Size in 2030 | US$44.873 billion |

| Growth Rate | CAGR of 6.26% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Polyols Market |

|

| Customization Scope | Free report customization with purchase |

Global Crowd Analytics Market Segmentation

- By Technology

- Wi-Fi analytics

- Video-based analytics

- Sensor-based analytics

- Artificial Intelligence (AI)

- Big Data Analytics

- By Deployment

- On-Premise

- Cloud

- By Organization Size

- Small and Medium

- Large

- By Industry Vertical

- Travel & Tourism

- Media & Entertainment

- Retail

- Hospitality

- Transportation & Logistics

- Healthcare

- Sports & Events

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others