Report Overview

Digital Media Adapters Market Highlights

Digital Media Adapters Market Size:

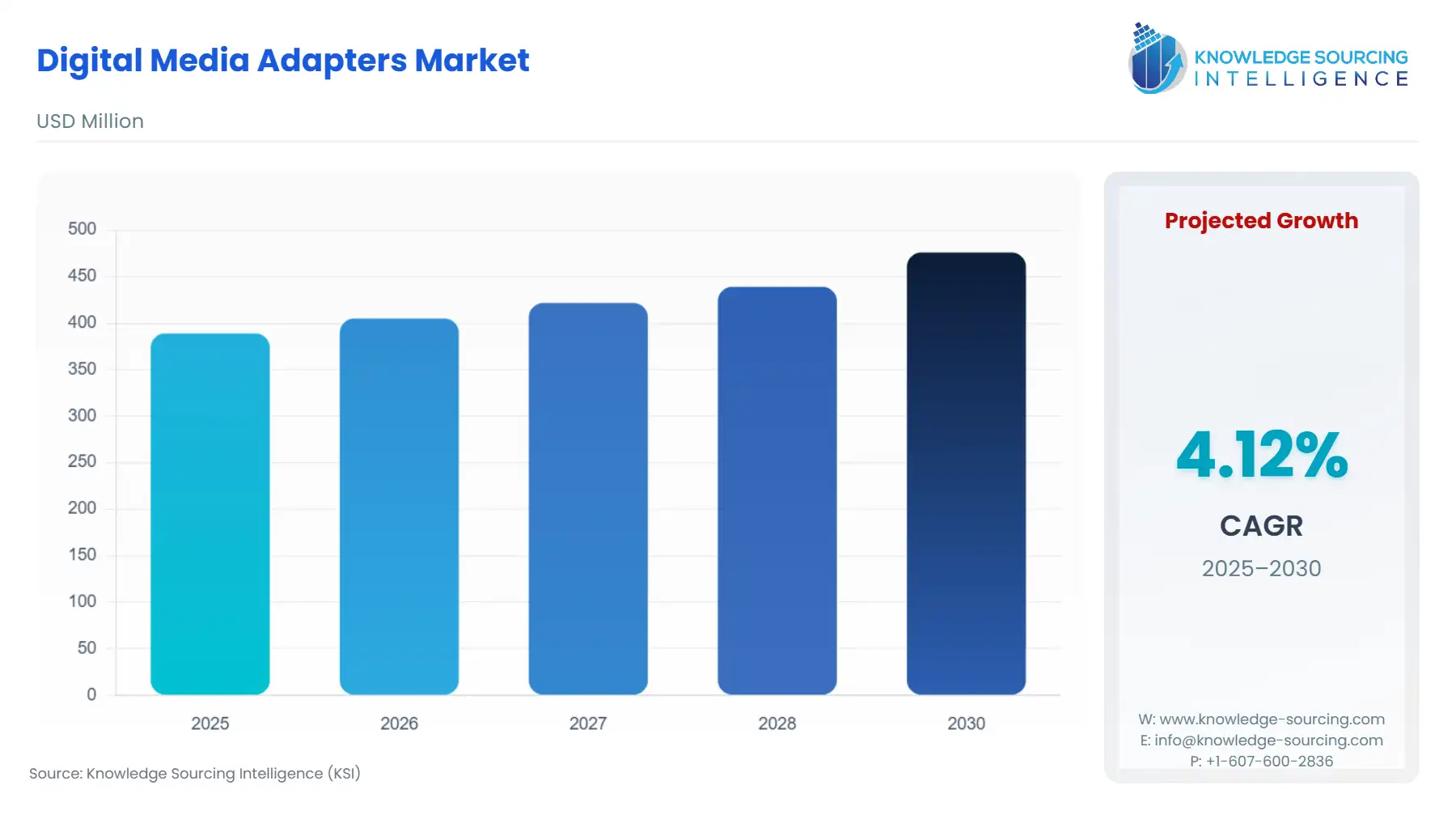

The digital media adapters market is set to expand at a modest CAGR of 4.11% to be worth US$4.76 billion in 2030 from US$3.89 billion in 2025.

- US Tariffs on Electronics Impose Cost Headwinds and Supply Chain Pressure: Proposed and enacted US tariffs targeting high-volume consumer electronics, specifically components like semiconductors used in DMAs, exert upward pressure on the landed cost of final products imported into the US market. This regulatory environment acts as a structural demand constraint by raising consumer prices and simultaneously accelerates industry efforts to diversify manufacturing and assembly operations to regions outside of key tariff-affected zones in Asia.

Digital Media Adapters (DMAs) represent the crucial hardware segment facilitating the pervasive global shift toward on-demand digital entertainment. These devices, including streaming players and sticks, are essential components that connect standard high-definition televisions to the internet, enabling the playback of streaming Video and Audio content from a vast array of global and regional services. The market functions at the intersection of consumer demand for personalized entertainment and the technology industry's drive to establish proprietary content and advertising ecosystems. The competitive landscape is characterized by constant innovation in processing power and connectivity to meet escalating content quality standards, making rapid product iteration an imperative for market leaders.

Global Digital Media Adapters Market Analysis

- Growth Drivers (Global Titles)

The fundamental catalyst is the intensifying global adoption and competition among OTT service providers. As major studios and networks transition to direct-to-consumer models, the resulting fragmentation of exclusive content necessitates a DMA to aggregate all services, which directly and fundamentally increases demand for the device itself. A secondary driver is the escalation of video fidelity requirements, specifically the shift to 4K and 8K streaming, which mandates hardware capable of handling immense data throughput and sophisticated decoding. This structural demand for performance accelerates replacement cycles. While US tariffs on electronics manufacturing create cost headwinds, the underlying consumer demand for high-quality, easily accessible content sustains the market's velocity, forcing manufacturers to absorb some tariff impact to protect market share.

- Challenges and Opportunities (Global Titles)

A primary challenge is the near-ubiquitous integration of streaming functionality into modern Smart TVs. This saturation dilutes primary demand for low-end, stand-alone adapters. However, this constraint simultaneously creates an opportunity for specialized, premium DMAs. The opportunity lies in leveraging advanced gaming and cloud services by designing adapters with superior processors, extensive storage, and Wi-Fi 6/6E connectivity for ultra-low-latency streaming. This focus drives new demand by appealing to the Residential user's need for a dedicated, high-performance gaming hub that consistently outperforms embedded Smart TV chipsets. Expanding the Commercial segment with robust, secure, Wired adapters for digital signage or hotel entertainment systems also presents a critical path for diversification.

- Raw Material and Pricing Analysis (Global Titles)

The Digital Media Adapters Market, being a physical product category, is inextricably linked to the cost and availability of key electronic components. Pricing is acutely sensitive to the supply of System-on-Chip (SoC) microprocessors (which handle video decoding and operating system functions) and specialized memory modules (DRAM/NAND). These components are commodities sourced from global semiconductor fabrication hubs. The verifiable US regulatory actions, specifically the threat and enactment of tariffs on electronics, introduce a significant and non-negotiable cost element for products assembled in high-tariff jurisdictions. This structural cost increase exerts immediate upward pressure on wholesale and retail pricing in the vital North American market, requiring strategic inventory management and the accelerated exploration of manufacturing alternatives in low-tariff countries to maintain competitive retail price points.

- Supply Chain Analysis (Global Titles)

The DMA supply chain exhibits pronounced centralization, with key manufacturing and final assembly hubs situated predominantly across East Asia (China, Vietnam, and Malaysia). This concentration facilitates efficient scaling but creates significant logistical vulnerabilities. Key complexities include the just-in-time procurement of application processors and memory chips, which subjects the production schedule to global semiconductor allocation and lead times. The geopolitical dimension is critical: high-volume production dependency on a few regions makes the global supply of DMAs susceptible to trade disputes and US tariff uncertainty, which constrains the smooth flow of finished goods and necessitates substantial capital expenditure for diversifying assembly lines or strategically stockpiling crucial components to maintain market momentum.

Digital Media Adapters Market Government Regulations

Government and regulatory agencies primarily influence the Digital Media Adapters market through trade policy, spectrum allocation, and consumer protection mandates.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FCC (Federal Communications Commission) & Trade Representative Tariffs |

FCC certifies that Wireless adapters operate within licensed or unlicensed radio spectrum bands (e.g., Wi-Fi frequencies). This mandate ensures devices function without interference, creating a standard barrier to entry. US tariffs on goods from key manufacturing regions directly increase import costs, causing price inflation for US consumers and encouraging manufacturers to re-evaluate their production footprints. |

|

European Union |

General Data Protection Regulation (GDPR) |

GDPR mandates stringent privacy and data security standards for all electronic devices handling user data, including DMAs. This compels manufacturers to invest in secure operating systems and privacy-focused software design, thereby increasing the development cost but establishing a competitive advantage for companies that offer demonstrably higher levels of user privacy assurance. |

|

China (Mainland) |

CCC (China Compulsory Certification) & Content Control |

The CCC mark is mandatory for market entry, ensuring product safety and quality, which adds verification time and cost to the supply chain. Furthermore, the government's strict regulation of internet content directly constrains the content demand accessible through DMAs sold within the jurisdiction, often requiring specialized, locally compliant operating system variants. |

|

South Korea |

KC (Korea Certification) Mark & R-R-I Certification |

The KC mark ensures compliance with safety and EMI standards, while the R-R-I (Radio Research Agency) certification governs the use of radio spectrum for Wireless devices. These mandates add specific, localized compliance hurdles to market access, driving demand toward adapters pre-approved for local high-speed Wi-Fi standards favored by South Korean consumers. |

|

India |

BIS (Bureau of Indian Standards) Registration & Mandatory Labeling |

BIS registration is mandatory for electronic products sold in India, ensuring quality and safety. This requirement, coupled with local-content integration mandates for some services, increases the administrative complexity of market entry. Successfully achieving BIS certification unlocks massive demand from the rapidly growing Residential segment. |

Digital Media Adapters Market Segment Analysis

- By Content: Video

The Video content segment is the most significant demand driver, directly correlating with the fundamental utility of a Digital Media Adapter. Demand is primarily driven by the exponential increase in cinematic content fidelity. The mainstream adoption of 4K HDR (High Dynamic Range) and the verified industry push toward 8K resolution in production and distribution creates powerful demand for DMAs that can support high-efficiency codecs (like AV1), higher frame rates, and sophisticated HDR formats (Dolby Vision, HDR10+). This technological necessity accelerates the replacement cycle for functional but non-4K-capable older adapters. Furthermore, the rise of interactive and personalized Video content (e.g., sports feeds with overlays, interactive ads) requires DMAs with faster processors and enhanced graphics capabilities, driving consumer willingness to upgrade to premium, dedicated devices that guarantee a superior, stutter-free viewing experience.

- By End-User: Residential

The Residential end-user segment remains the largest and most dynamic market for Digital Media Adapters. The demand is structurally underpinned by the economic advantage of content aggregation and the high prevalence of multi-device households. Consumers actively seek cost-effective, single-purpose devices to replace expensive cable box rentals and to ensure uniform access to OTT services across multiple screens (main living room, bedrooms, etc.). This creates persistent demand for both high-end flagship devices for the main television and budget-friendly streaming sticks for secondary viewing areas. Additionally, the demand for a unified smart home interface is a potent driver, with consumers increasingly selecting DMAs that double as robust smart home hubs, leveraging voice control to manage lighting, security, and thermostats alongside their media consumption.

Digital Media Adapters Market Geographical Analysis

- US Market Analysis (North America)

The US market for Digital Media Adapters is characterized by high penetration of broadband and a dominant culture of 'cord-cutting.' Local factors propelling demand include the high consumer expectation for premium content delivery, which mandates support for the latest 4K/8K standards and low-latency performance essential for cloud gaming services. The highly competitive landscape among ecosystems (Roku vs. Amazon vs. Google) leads to aggressive pricing and continuous feature iteration, driving perpetual consumer replacement demand. Conversely, the uncertainty and cost impact of verified US trade tariffs on imported electronics introduce significant cost constraints, potentially slowing the adoption rate for higher-end, tariff-affected devices.

- Brazil Market Analysis (South America)

Brazil's DMA market growth is strongly correlated with the rapid expansion of fixed and mobile broadband infrastructure and the population's preference for mobile-first content consumption. The core local demand driver is the low initial penetration of high-end Smart TVs, making the DMA the most accessible and cost-effective method to upgrade existing dumb TVs into smart media centers. This situation creates robust demand for casting-centric and low-cost Wireless streaming sticks. The successful localization of global and regional OTT services, including local language support and payment options, is critical to unlocking demand from the large, price-sensitive Residential segment.

- Germany Market Analysis (Europe)

The German market demonstrates a nuanced demand profile, influenced by high consumer standards for security, privacy, and technical longevity. A key local factor driving demand is the preference for manufacturer-independent, platform-agnostic devices, favoring solutions like Roku which aggregate content without prioritizing a single proprietary service. Furthermore, stringent European regulatory requirements (e.g., GDPR, RED) result in consumer preference for established, compliant brands, which compels demand toward premium adapters designed with robust data protection and technical reliability features, justifying a higher price point compared to generic, non-compliant alternatives.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian DMA market is experiencing accelerated growth driven by massive public and private investment in digital infrastructure and the relatively young population's high consumption of premium entertainment. The key local factor propelling demand is the rapid proliferation of high-end consumer electronics (large screen 4K/8K TVs) and the launch of regionally targeted OTT streaming platforms. This scenario creates intense demand for high-performance DMAs (often top-tier Google or Apple devices) that can fully leverage the display technology and deliver cinematic quality. The integration of DMAs into rapidly expanding smart home developments also serves as a critical, emerging demand driver.

- India Market Analysis (Asia-Pacific)

India represents a high-volume, hyper-competitive market where demand is uniquely shaped by affordability and linguistic diversity. The central local factor driving demand is the need for cost-effective content casting and aggregation from the massive smartphone user base to a larger screen. The successful launch of the Amazon Fire TV Stick 4K Select in India (October 2025) demonstrates the market's specific need for mid-range, 4K-capable devices that are heavily localized. This need generates high demand for adapters that support regional languages in both voice search and user interfaces, with the Online distribution channel being essential for price transparency and broad geographic reach.

Digital Media Adapters Market Competitive Environment and Analysis

The Digital Media Adapters Market is characterized by intense platform competition, where device sales function as a gateway to recurring service and advertising revenue. The major players leverage their broader technology ecosystems to create user lock-in.

- Roku, Inc.

Roku's strategic positioning revolves around being the leading platform-agnostic operating system for connected TV, prioritizing user-friendly content aggregation over pushing proprietary content. Roku's key products, such as the Roku Ultra 2024 and the Roku Streaming Stick 4K, are verified to feature a new quad-core processor (Roku Ultra 2024), Wi-Fi 6 radio architecture, and support for high-fidelity standards like Dolby Vision and Dolby Atmos. This strategy captures demand from users prioritizing simplicity, affordability, and the broadest possible access to streaming services, making the Roku OS highly popular among Residential users and TV manufacturers. The verifiable launch of the 2024 Roku Ultra, featuring HDMI 2.1 and Quick Media Switching (QMS), directly drives demand by providing a superior, performance-focused option.

- Apple Inc.

Apple positions its Apple TV 4K (3rd generation) as a premium, tightly integrated home entertainment and smart home hub. The company employs a differentiation strategy, focusing on performance, superior aesthetics, and seamless connectivity within its vast ecosystem (e.g., Apple Arcade, Apple Music, AirPlay 2, HomeKit). The verified inclusion of the faster A15 Bionic chip and support for 4K Dolby Vision, HDR10+, and Dolby Atmos drives demand in the affluent Residential segment where users prioritize the highest quality Video and Audio experience and value the device's function as a secure, high-performance HomeKit controller. The company's refusal to prioritize low-cost devices ensures it targets only the premium segment of the market, which is less sensitive to the general price pressure caused by US tariffs.

- Amazon.com, Inc.

Amazon uses its Fire TV line (e.g., Fire TV Stick 4K Max, Fire TV Stick 4K Select) as a primary vehicle to promote its Prime Video content, Alexa voice ecosystem, and broader e-commerce platform. The strategic focus is on delivering high performance at aggressive price points, often leveraging its massive Online distribution network. The verifiable launch of the Amazon Fire TV Stick 4K Select in India (October 2025) demonstrates a targeted, localized product strategy. This device, featuring 4K playback and the new Vega OS, directly drives demand in key international growth markets by offering a feature-rich product optimized for local streaming platforms and consumer budgets.

Digital Media Adapters Market Developments

The following verifiable developments represent significant product launches and capacity additions that impact the market's competitive dynamics and product feature evolution, presented in reverse chronological order.

- September 2024: Roku Unveils the 2024 Roku Ultra with HDMI 2.1 and Wi-Fi 6

Roku officially released the 2024 Roku Ultra, their flagship streaming player. The device features an all-new quad-core processor for 30% faster performance, an upgraded Wi-Fi 6 radio architecture, and is equipped with HDMI 2.1, which includes support for Quick Media Switching (QMS) and 4K HDR. This verifiable product launch directly addresses the demand for premium, low-latency, and high-fidelity streaming experiences, increasing Roku's competitive capacity against Apple TV and high-end Fire TV products in the Residential market.

- August 2024: Google Completes Android Version 14 Update Rollout for Chromecast with Google TV Devices

Google completed the firmware update for its existing Chromecast with Google TV (4K and HD) devices, upgrading the operating system from Android 12 to Android 14. This significant capacity addition, verified in system release notes, enhanced the streaming performance and brought new software features like support for 'Find My Remote' and customizable remote buttons. This update sustains demand for Google's existing hardware by extending its technological relevance and improving the user experience, making current devices more appealing to Residential users without forcing an immediate hardware upgrade.

Digital Media Adapters Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Digital Media Adapters Market Size in 2025 | US$3.89 billion |

| Digital Media Adapters Market Size in 2030 | US$4.76 billion |

| Growth Rate | CAGR of 4.11% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Digital Media Adapters Market |

|

| Customization Scope | Free report customization with purchase |

Digital Asset Management Market Segmentation:

By Connectivity

- Wired

- Wireless

By Content

- Audio

- Video

By Distribution Channel

- Online

- Offline

By End-User

- Residential

- Commercial

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others