Report Overview

Global Electronic Brake Force Highlights

Electronic Brake Force Distribution System Market Size:

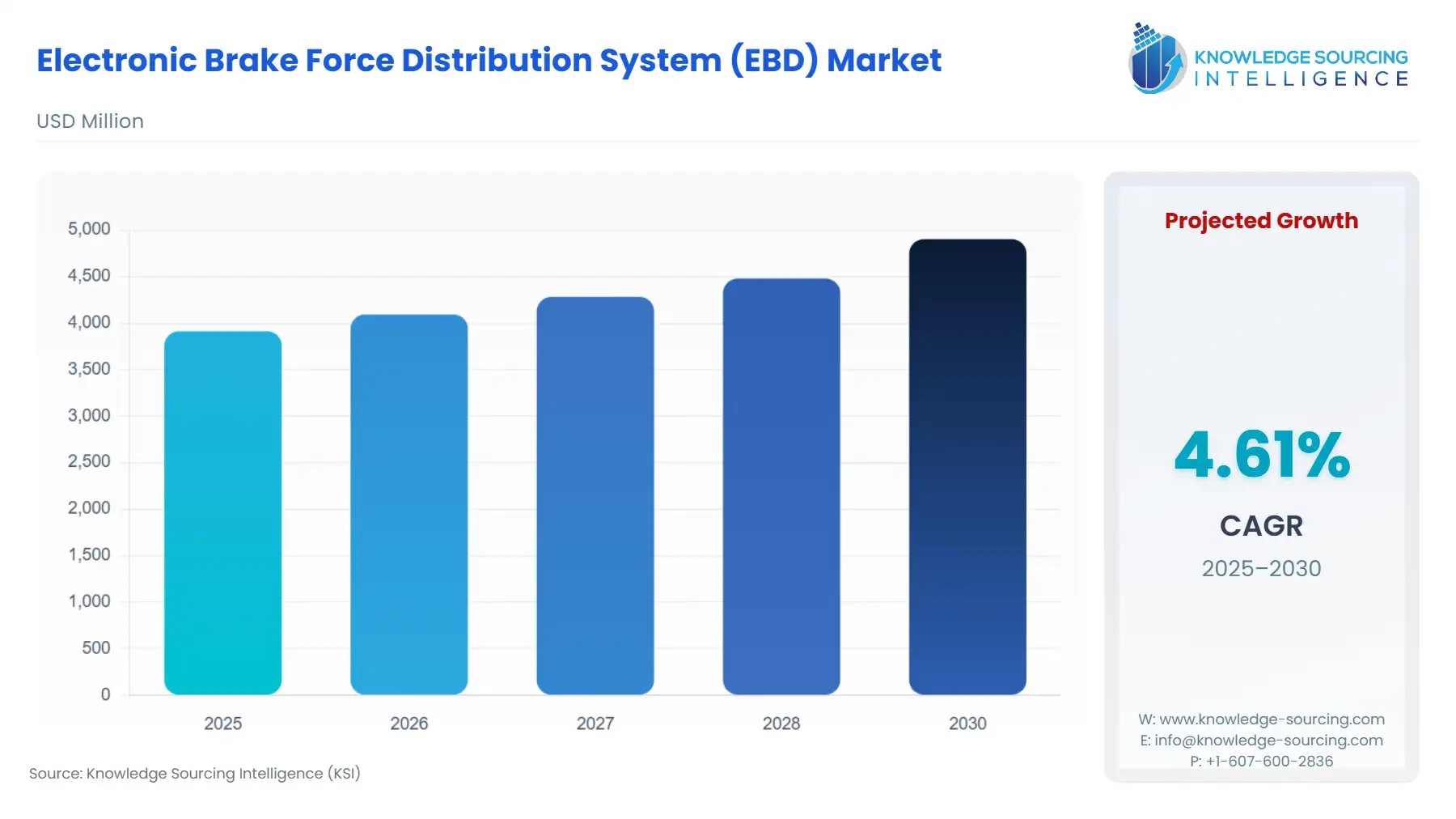

The Global Electronic Brake Force Distribution System (EBD) Market is expected to grow from USD 3.913 billion in 2025 to USD 4.903 billion in 2030, at a CAGR of 4.62%.

Electronic Brake Force Distribution System Market Trends:

This growth is attributed to the increasing requirement for a safer vehicle driving experience and vehicle safety systems.

EBD, or electronic brake force distribution, also known as electronic brakeforce limitation, is an automobile brake technology that varies the amount of force being applied to the wheels of the vehicle based on different conditions such as road conditions, speed loading, etc. Basically, EBD is based on the principle that not all wheels carry the same weight and every wheel requires a different brake force to bring it to a stop without the car going out of control. Also, the amount of weight being carried by the vehicle shifts during the braking process, and so the amount of braking force required by the wheel may also change. EBD is always coupled with anti-lock braking systems (ABS) and electronic stability control (ESC), EBD regulates the amount of brake force applied on each wheel to maximize stopping power while maintaining vehicle control. Most of the weight is carried by the front wheels, so the EBD applies less pressure on the rear wheels so that they don’t skid or lock.

EBD basically acts as a subsystem of ABS and ESC, where ABS, which is an anti-lock braking system, works by applying braking force gradually on the wheel so that the vehicle slows down without the wheels of the vehicle locking and causing a skid whereas the ESC works by maintaining the vehicles stability and balance during turning operations and removing the possibility of understeer or oversteer. The EBD module consists of wheel speed sensors, brake force accumulators, and electronic control module. EBD works when the wheel speed sensors read the speed of the wheel and calculate the slip ratio. This information is then sent to the ECU, which in turn gives the signal to the brake force accumulators, telling the amount of force that needs to be applied to the wheel.

The global automotive electronic brake force distribution system (EBD) market has been segmented on the basis of vehicle type, sales channel, and geography. There have been key developments and investments by various key players and governments in the electronic brakeforce distribution system market. For example, the company Toyota, which is headquartered in Japan, announced in 2016 that the company’s all-new vehicle variants will come with ABS and EBD safety features . Further, the NHTSA (National Highway Traffic Safety Administration), a segment of the US transportation department, planned to make the ABS (automatic emergency braking system) mandatory in vehicles, starting from 2022.

Electronic Brake Force Distribution System Market Segment Analysis:

- By Vehicle Type

On the basis of vehicle type, the global automotive electronic brake force distribution system (EBD) market is segmented as passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles hold a significant amount of market share due to the increasing production and demand for passenger vehicles.

- By Sales Channel

On the basis of the sales channel, the global automotive electronic brake force distribution system (EBD) market is segmented as OEMs and aftermarket. OEMs hold a notable amount of share in the market due to the fact that most of the vehicles produced come with an EBD module fitted in conjunction with the ABS module.

- By Geography

By geography, the global automotive electronic brake force distribution system (EBD) market is segmented into North America, Europe, Middle East & Africa, Asia-Pacific, and South America. North America holds a significant share of the market owing to the increasing demand and production of automobiles in the region coupled with the increase in the need for safe and convenient driving systems.

Electronic Brake Force Distribution System Market Competitive Landscape:

The global automotive electronic brake force distribution system (EBD) market is competitive owing to the presence of well-diversified international, regional, and local players. The competitive landscape details strategies, products, and investments being made by key players in different technologies and companies to boost their market presence.

Electronic Brake Force Distribution System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.913 billion |

| Total Market Size in 2031 | USD 4.903 billion |

| Growth Rate | 4.62% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Vehicle Type, Sales Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electronic Brake Force Distribution System Market Segmentation:

- By Component

- Hardware

- Software

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Sales Channel

- OEMs

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America