Report Overview

Global Electrostatic Precipitator Market Highlights

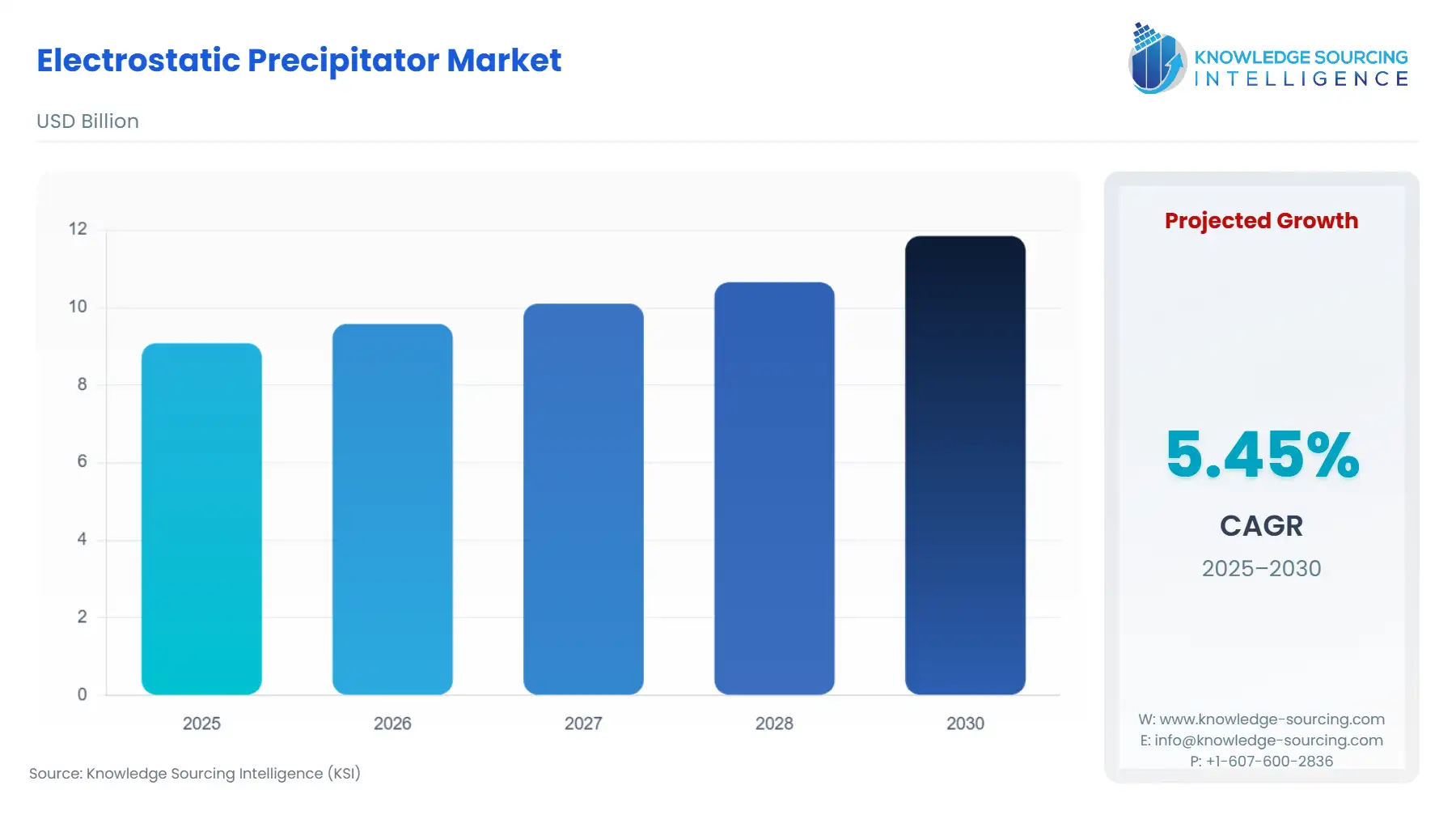

Electrostatic Precipitator Market Size:

The Global Electrostatic Precipitator Market is expected to grow from US$9.086 billion in 2025 to US$11.848 billion in 2030, at a CAGR of 5.45%.

The Global Electrostatic Precipitator Market is fundamentally defined by the imperative to control particulate matter emissions generated by heavy industry and energy production. Electrostatic Precipitators (ESPs) are high-efficiency air pollution control devices that utilise an electric field to charge and collect dust particles, serving as indispensable assets in sectors like Power Generation, Cement, Metal, and Chemicals. Market dynamics are almost entirely reactive, driven by the pace and severity of environmental regulations imposed by government and international agencies. The technology's ability to handle high gas volumes and high temperatures, coupled with relatively low operating costs compared to alternatives like fabric filters for specific applications, secures its position as the preferred solution for large-scale, high-particulate-load industrial stacks. Investment in this market is directly correlated with regulatory enforcement cycles, industrial capacity expansions, and the mandatory retrofitting of ageing thermal plants.

Global Electrostatic Precipitator Market Analysis

- Growth Drivers

The stringent global implementation of air quality standards forms the paramount growth driver, compelling industries like Power Generation and Metal processing to acquire or upgrade ESP systems to prevent operational shutdown and ensure regulatory compliance. This legislative mandate creates a non-negotiable demand for high-performance pollution control. Furthermore, rapid industrial expansion in emerging economies, particularly in the Asia-Pacific, directly translates into new, large-scale Power Generation and Cement plant construction. These greenfield projects drive foundational demand for original equipment manufacturer (OEM) ESP installation. The verifiable trend of retrofitting ageing coal-fired power plants with enhanced ESP systems to meet updated emission limits, such as the US EPA's MATS, provides a sustained and profitable stream of Hardware and Services demand.

- Challenges and Opportunities

A key challenge is the significant initial capital expenditure and extensive physical footprint required for large-scale ESP installation, which acts as a deterrent for smaller facilities and postpones purchasing decisions during periods of economic uncertainty. This constraint dampens demand in price-sensitive segments. An opportunity exists in the development and market penetration of Wet ESP (WESP) technology, which is highly effective in removing sub-micron particles, aerosols, and acid gases, thereby creating specific demand in the Chemicals and waste-to-energy sectors where traditional Dry ESPs are less effective. Another critical opportunity is the growing demand for digital optimisation and maintenance Services, driven by the integration of IoT and AI, allowing manufacturers to offer high-margin, long-term service contracts that stabilise recurring revenue.

- Raw Material and Pricing Analysis

Electrostatic Precipitators are capital equipment primarily constructed from High-Strength Steel and specialised metal alloys for the collection plates, discharge electrodes, and structural housing, which must withstand high temperatures and corrosive flue gas environments. Pricing is directly and acutely sensitive to global volatility in steel, nickel, and chromium markets, with price surges in these raw materials directly escalating the final manufacturing cost and purchase price for end-users like the Cement and Power Generation industries. The cost of Advanced Control Systems (Hardware component), including high-voltage power supplies and microprocessors, also contributes significantly to the final price. Geopolitical factors, particularly the US tariffs on imported steel and derivative industrial components, further inflate the cost of installation in North American markets, forcing manufacturers to absorb higher material costs or pass them on to the customer.

- Supply Chain Analysis

The ESP supply chain is characterised by a globalised engineering and regionalised fabrication model due to the size of the final product. Core high-value components, such as high-voltage transformer-rectifiers, proprietary discharge electrodes, and advanced Software for control systems, are typically supplied by specialised manufacturers in North America and Europe. However, the structural steel components (the majority of the weight and bulk) are sourced and fabricated close to the final installation site to mitigate excessive logistics costs and project timelines. This dual structure creates a dependency on stable global commodity prices for steel and a reliance on a network of regional fabrication partners for the large physical structure. Disruption, such as geopolitical trade tensions or shipping constraints, primarily affects the supply and cost of the specialised, high-tolerance internal components.

Electrostatic Precipitator Market Government Regulations

The market for Electrostatic Precipitators is almost entirely regulatory-driven, with governmental bodies dictating emission thresholds that directly determine the replacement and upgrade cycle of the equipment.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

EPA Mercury and Air Toxics Standards (MATS) and New Source Performance Standards (NSPS) |

MATS for coal-fired power plants mandates the retrofit of existing ESPs or the installation of supplemental technology to achieve ultra-low particulate matter and heavy metal emission limits. This rule creates intense demand for high-efficiency ESP upgrades and hybrid ESP-fabric filter systems in the Power Generation sector. |

|

European Union |

Industrial Emissions Directive (IED) |

The IED sets strict, technologically-driven emission limit values (ELVs) across all major industrial sectors, including Cement and Chemicals. The directive's requirement for Best Available Techniques (BAT) forces operators to continuously upgrade their ESP technology to meet increasingly stringent concentration limits, driving demand for modern, highly-efficient models. |

|

China (Mainland) |

Action Plan for Prevention and Control of Air Pollution |

Central government clean air initiatives and ultra-low emission standards for key industries (e.g., thermal power and steel) create enormous, immediate demand for the installation of new, high-performance ESPs or significant retrofits of existing fleet infrastructure. This regulation drives volume demand for both domestic and international ESP suppliers. |

|

India |

Environmental (Protection) Amendment Rules, Specific Industry Standards |

The mandated emission norms for thermal power plants and other highly polluting industries directly compel compliance through the installation of effective pollution control equipment. The phased implementation of these norms fuels project-based demand for new ESP installations in the vast Indian Power Generation and Manufacturing sectors, often favoring cost-effective, high-volume systems. |

|

Canada |

Federal Industrial Emissions Regulations |

Regulations on coal-fired power generation and stringent provincial standards (e.g., Ontario's air quality regulations) mandate a long-term phase-out or conversion of high-emitting facilities. This regulatory certainty drives demand for strategic, large-scale retrofitting projects over a multi-year horizon, ensuring sustained demand for high-efficiency Hardware and Services from EPC contractors. |

Electrostatic Precipitator Market Segment Analysis

- By Type: Wet Electrostatic Precipitator (WET)

The Wet Electrostatic Precipitator (WET) segment is witnessing an accelerated demand trajectory, primarily driven by its superior capability in handling gas streams containing sub-micron particles, acid mist, and condensable aerosols, which conventional Dry ESPs struggle to capture effectively. The critical demand drivers originate from highly regulated industries such as Chemicals, petroleum refining, and specific waste-to-energy applications. Regulatory mandates targeting not just particulate matter but also acid mist (e.g., sulfuric acid mist) from sulfur-containing fuels and processes force the adoption of WESPs to achieve compliance. Unlike dry systems, the continuous water wash-down prevents particle re-entrainment and handles sticky particulates, thereby creating a necessary and specialised demand where high-efficiency removal of hazardous sub-micron matter is the technical imperative.

- By End-User: Power Generation

The Power Generation sector remains the foundational and largest end-user for ESPs, with demand almost entirely correlated with government energy policy and environmental enforcement. The primary demand driver is the mandatory requirement for particulate matter control in coal- and biomass-fired thermal power plants, which generate immense volumes of flue gas. The verifiable regulatory pressure to meet ultra-low emission standards, particularly in North America and Asia, propels capital expenditure on two fronts: large-scale new installations for greenfield projects and, more significantly, complex retrofitting and modernisation projects for the vast existing fleet. These retrofits often involve installing new, high-frequency power supplies and larger collection areas, directly creating significant Services and Hardware demand to extend the operational life of the asset while meeting modern compliance benchmarks.

Electrostatic Precipitator Market Geographical Analysis

- US Market Analysis (North America)

The US market is a mature, regulation-driven environment where demand is overwhelmingly focused on mandatory retrofitting and modernisation of existing industrial assets rather than greenfield construction. The critical local demand factor is the strict enforcement of the EPA's Clean Air Act regulations, especially the Mercury and Air Toxics Standards (MATS) for coal-fired power plants. This regulatory landscape creates high-value, inelastic demand for advanced, high-efficiency ESP systems and hybrid technologies (ESP-Baghouses). Furthermore, the rising cost of raw materials and the political climate surrounding US tariffs on imported steel and industrial equipment necessitate that suppliers establish strong domestic Hardware and Services capabilities to manage cost predictability and project timelines.

- Brazil Market Analysis (South America)

The Brazilian market exhibits demand driven by both resource exploitation and a growing domestic industrial base. The key local factor is the expansion of the Cement and Metal processing industries, spurred by sustained national infrastructure and construction projects. This industrial growth drives foundational demand for new, standard-duty Dry ESP installations. However, market adoption faces headwinds from inconsistent regulatory enforcement timelines and currency volatility, making investment decisions cautious and often prioritising the lowest initial cost solutions. Suppliers compete primarily on installation and maintenance Services efficiency, offering modular and locally supported units to address the large number of mid-sized industrial facilities.

- Germany Market Analysis (Europe)

The German market is defined by an absolute focus on achieving the lowest possible emission levels, far beyond basic compliance. The local factor impacting demand is the European Union's Industrial Emissions Directive (IED) and Germany's national energy transition (Energiewende). While the phase-out of coal reduces new installation demand in Power Generation, the IED's stringent Best Available Techniques (BAT) requirements create persistent, high-margin demand for upgrading and optimising existing ESPs in the Cement, Chemicals, and Manufacturing sectors. The market is technologically advanced, prioritising high-efficiency, compact WESPs and digital Software and Services solutions for predictive maintenance and enhanced operational data reporting.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market demand for ESPs is strategically driven by two major local factors: the massive investment in non-oil industrial diversification and the sustained need for power and water desalination. The expansion of the Metal and Chemical sectors, aligned with the Vision 2030 economic plan, fuels demand for new, large-scale ESP installations. Given the harsh, dry operating environments, the primary purchasing criterion is rugged reliability and durability. Suppliers must offer robust Hardware components and proven cooling systems designed to withstand extreme temperatures, with a significant Services component for complex maintenance in remote or specialised industrial parks.

- China Market Analysis (Asia-Pacific)

The Chinese market is the largest consumer of ESP technology, characterised by both enormous scale and aggressive, centrally planned environmental enforcement. The local factor dictating demand is the government’s unwavering commitment to its ultra-low emission standards policy across all major industrial sectors. This policy forces wholesale mandatory upgrades and new installations in the Power Generation, Cement, and Metal industries, which operate on a massive scale. While domestic suppliers dominate the high-volume, standard-duty segment, international players like Mitsubishi Hitachi Power Systems (Mitsubishi Power) and General Electric compete intensely in the high-performance, ultra-low emission retrofit segment by offering specialised, advanced ESP and hybrid Hardware solutions.

Electrostatic Precipitator Market Competitive Environment and Analysis

The competitive landscape is dominated by large, multinational engineering and environmental solutions firms with extensive EPC (Engineering, Procurement, and Construction) capabilities. Competition hinges on technological expertise, particularly for high-sulfur or high-resistivity applications, and the capacity to deliver complex Services and retrofitting projects globally.

- Babcock & Wilcox Enterprises, Inc.

Babcock & Wilcox (B&W) is strategically positioned as a comprehensive provider of advanced power generation and environmental solutions, placing their ESP offerings within a broader portfolio of emission control technologies. The company's strength lies in its extensive legacy and market share in the Power Generation sector, specifically offering proven Dry ESP and Wet ESP (WESP) technologies and, critically, the Services for retrofitting ageing facilities to comply with standards like the US EPA's MATS. B&W actively promotes its environmental segment, which provides the technology to meet stringent particulate limits. A verifiable strategic move includes the November 2025 announcement of the sale of its Allen-Sherman-Hoff (A-S-H) business to ANDRITZ, a move aimed at streamlining operations and increasing focus on core businesses like advanced power generation and environmental solutions, reinforcing their commitment to ESP and air quality technology.

- Hamon Group

Hamon Group maintains a significant global presence, focusing on designing and installing key industrial components related to heat transfer and air pollution control, including ESPs. Their strategic positioning emphasises custom-engineered solutions across diverse industrial sectors, notably Power Generation, Chemicals, and Cement. Hamon's verifiable core products include both Dry and Wet ESP systems, leveraging proprietary technology to optimise collection efficiency for varying gas conditions and dust properties. While their 2025 focus has been on other corporate actions (such as the acquisition by John Cockerill in 2022), their environmental segment continues to drive sustained demand through offering specialised expertise in the design, engineering, and maintenance Services required for complex industrial flue gas treatment projects.

- General Electric (GE)

General Electric's presence in the ESP market is primarily maintained through its Power segment (Mitsubishi Power, formerly Mitsubishi Hitachi Power Systems, is also a major competitor), focusing on large-scale, utility-grade applications. GE's strategy leverages its dominance in the Power Generation industry, offering integrated environmental equipment packages, including ESPs, for new thermal power plants and major retrofits globally. The verifiable strategic imperative is to offer robust, high-volume capacity Hardware and advanced digital Software controls that integrate seamlessly with their extensive turbine and boiler offerings. This bundled approach creates sustained demand by ensuring the ESP's performance is optimised within the overall power plant operation, minimising downtime and guaranteeing long-term regulatory compliance for large utility customers.

Electrostatic Precipitator Market Developments

The following verifiable developments reflect the market’s response to ongoing regulatory pressures and a strategic shift towards core competencies and diversification.

Electrostatic Precipitator Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 9.086 billion |

| Total Market Size in 2031 | USD 11.848 billion |

| Growth Rate | 5.45% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electrostatic Precipitator Market Segmentation:

- By Type

- Plate Wire

- Flat Plate

- Wet

- Two-stage

- By End-Users

- Power Generation

- Chemicals

- Metal

- Cement

- Manufacturing

- Others

- By Component

- Hardware

- Software

- Services

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- North America